Florida sales tax: Rates, exemptions and how to calculate

Florida sales tax affects your pricing, compliance, and cash flow. Learn how to calculate it correctly and stay compliant.

Written by Kari Brummond—Content Writer, Accountant, IRS Enrolled Agent. Read Kari's full bio

Published Monday 26 January 2026

Key takeaways

• Calculate your total Florida sales tax rate by adding the 6% state rate to your county's discretionary surtax (ranging from 0.5% to 2%), and remember that county surtax only applies to the first $5,000 of single tangible items.

• Register for a Florida sales tax permit and collect tax from customers if you exceed $100,000 in retail sales to Florida residents in the previous calendar year, regardless of whether you have a physical presence in the state.

• Apply for common sales tax exemptions on essential items like unprepared groceries for home consumption, prescription medications, and qualifying transactions with government entities or charitable organizations.

• Maintain detailed transaction records for at least five years and file sales tax returns based on your assigned frequency (typically quarterly for most businesses) to avoid penalties of up to 50% of tax due plus interest.

How much is sales tax in Florida?

Florida charges a 6% sales tax on most goods and services. Some purchases have different rates, such as 4.5% for commercial real property rentals and 6.95% for electricity.

- standard rate: 6% for most taxable items

- mobile homes: 3% for new retail sales

- special purchases: rates vary by item (see the Florida Department of Revenue for a full list)

Counties can add a discretionary surtax to the state sales tax rate. The following explains how the surtax works.

Surtax rates:

- Range from 0.5% to 2%

- Some counties impose no additional tax

- Total possible range: 6% to 8%

Surtax limits:

- $5,000 cap: Applies only to first $5,000 of single tangible items

- No cap: Services and real estate rentals have no limit

For example, if you sell a $7,000 refrigerator in a county with a 1% discretionary surtax, you would charge the following tax:

- apply 1% surtax to the first $5,000 of the purchase price (1% x $5,000 = $50)

- apply 6% state sales tax to the total purchase price of $7,000 (6% x $7,000 = $420)

The total tax is $470 ($50 surtax plus $420 state tax).

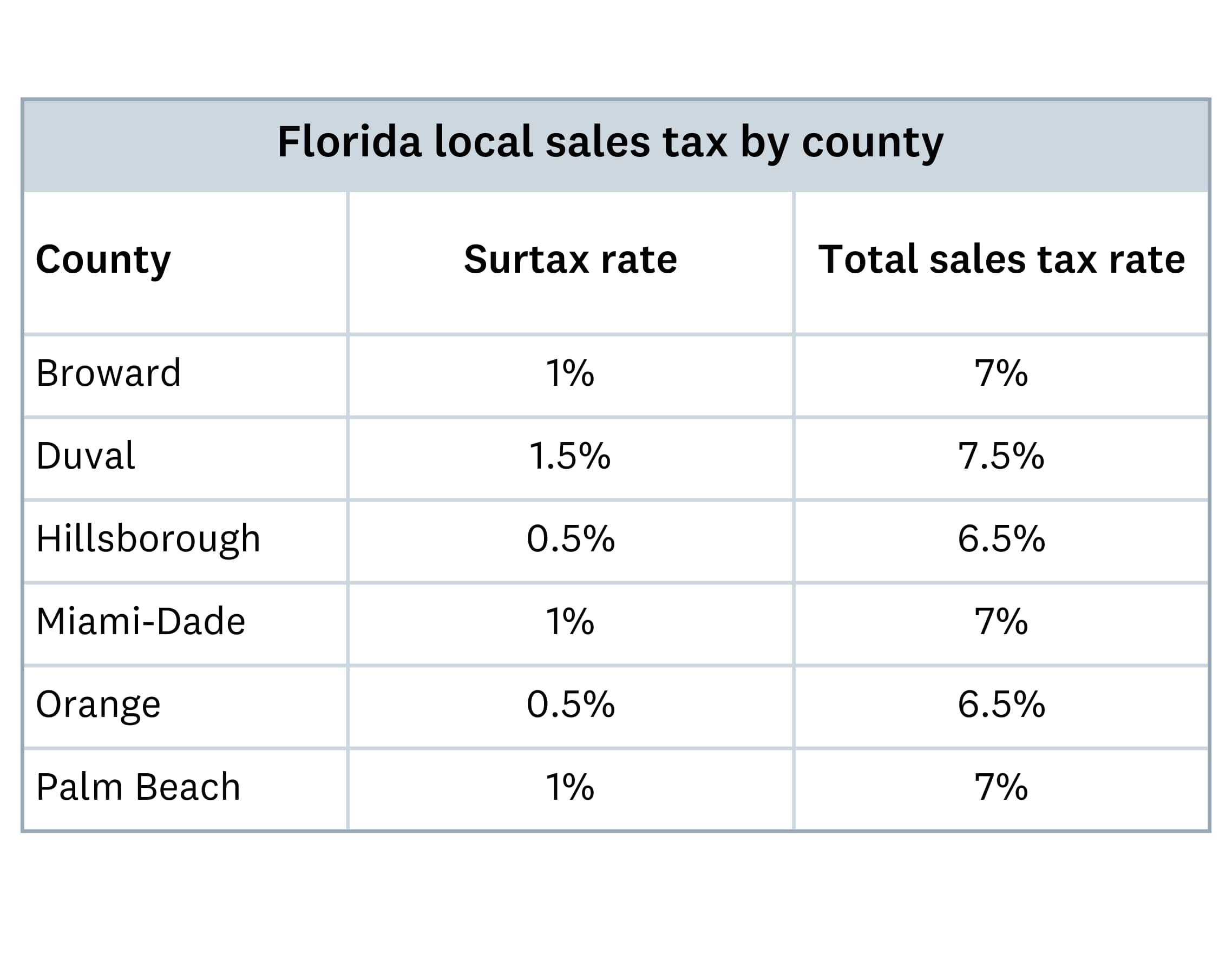

Florida local sales tax by county

Each county in Florida can add a discretionary surtax to the 6% state sales tax. The table below shows local rates for some of the most populated counties.

Discretionary surtax rates change each year. If you operate in more than one county, check the Florida Department of Revenue website for the latest rates.

How to calculate Florida sales tax

You can calculate the exact sales tax to charge your customers by following these steps:

- Calculate tax rate: Add state tax (6%) + county surtax

- Apply formula: Purchase price × total tax rate = sales tax owed

- Final total: Item price + sales tax = customer pays

For example, you sell a $100 handbag in Miami-Dade. The total sales tax charged is 7% – this includes the 6% Florida state tax rate plus the 1% Miami-Dade discretionary surtax.

The tax calculation would be:

$100 (item price) x 0.07 (tax rate) = $7 (sales tax total). Add this to the item price, and the final amount the customer pays is $107.

County surtax rates vary, so the total tax depends on location. Check your local rates or use an online sales tax calculator to apply the correct tax.

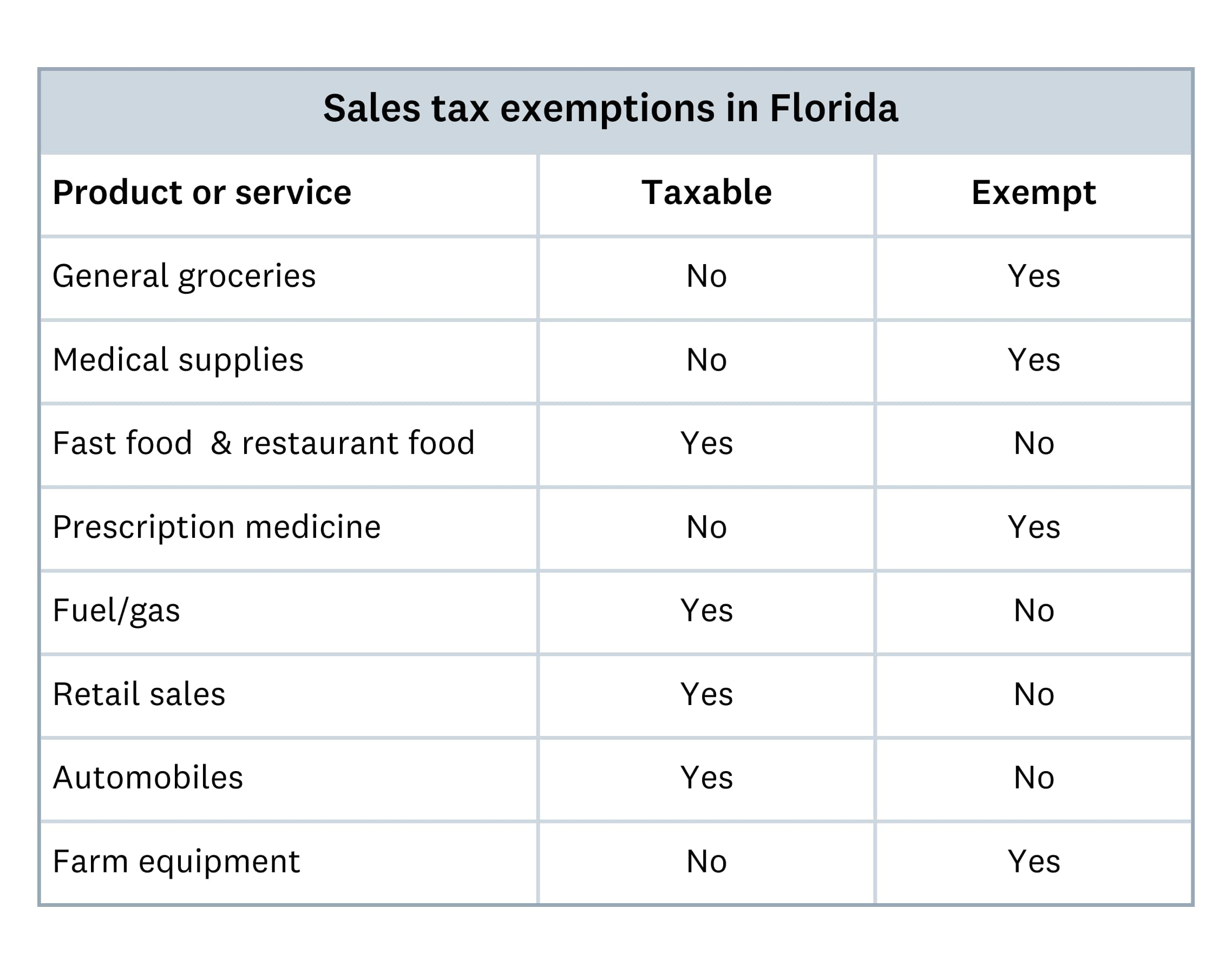

Sales tax exemptions in Florida

Some goods and services are exempt from Florida sales tax. Common exemptions include:

Common exemptions:

- Medical: Prescription medications

- Food: Unprepared groceries for home consumption

- Government: Transactions with government entities

- Nonprofit: Qualifying charitable organization purchases

The table below shows examples of Florida tax exemptions.

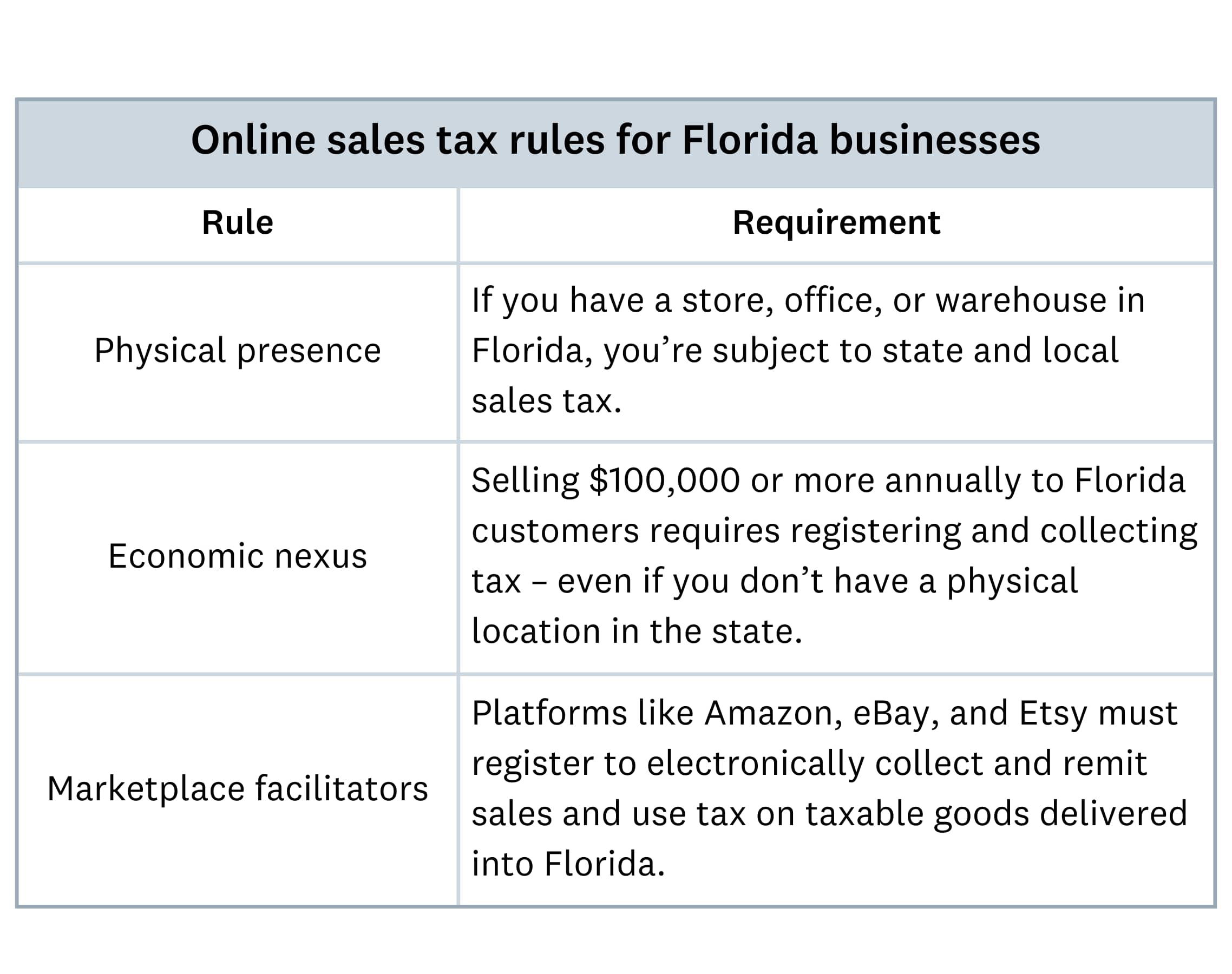

Online sales tax rules for Florida businesses

Florida's Internet Sales Tax Law requires online businesses to collect sales tax if they exceed certain thresholds. For example, you must collect tax if you have more than $100,000 in retail sales to Florida customers in the previous calendar year.

Who must collect:

- Remote sellers: Online businesses without Florida physical presence

- Online marketplaces: Platforms facilitating third-party sales

collection requirement: 6% state tax plus applicable county surtax

If you sell online to Florida residents, you must collect and pay the correct sales tax. Follow these steps to stay compliant:

- Register for a sales tax permit through the Florida Department of Revenue.

- Collect the correct tax rate (state sales tax plus applicable county surtax).

- File and remit taxes regularly based on your assigned filing frequency, such as monthly or quarterly.

- Keep records of all transactions. Florida requires you to keep records for at least five years in case of an audit.

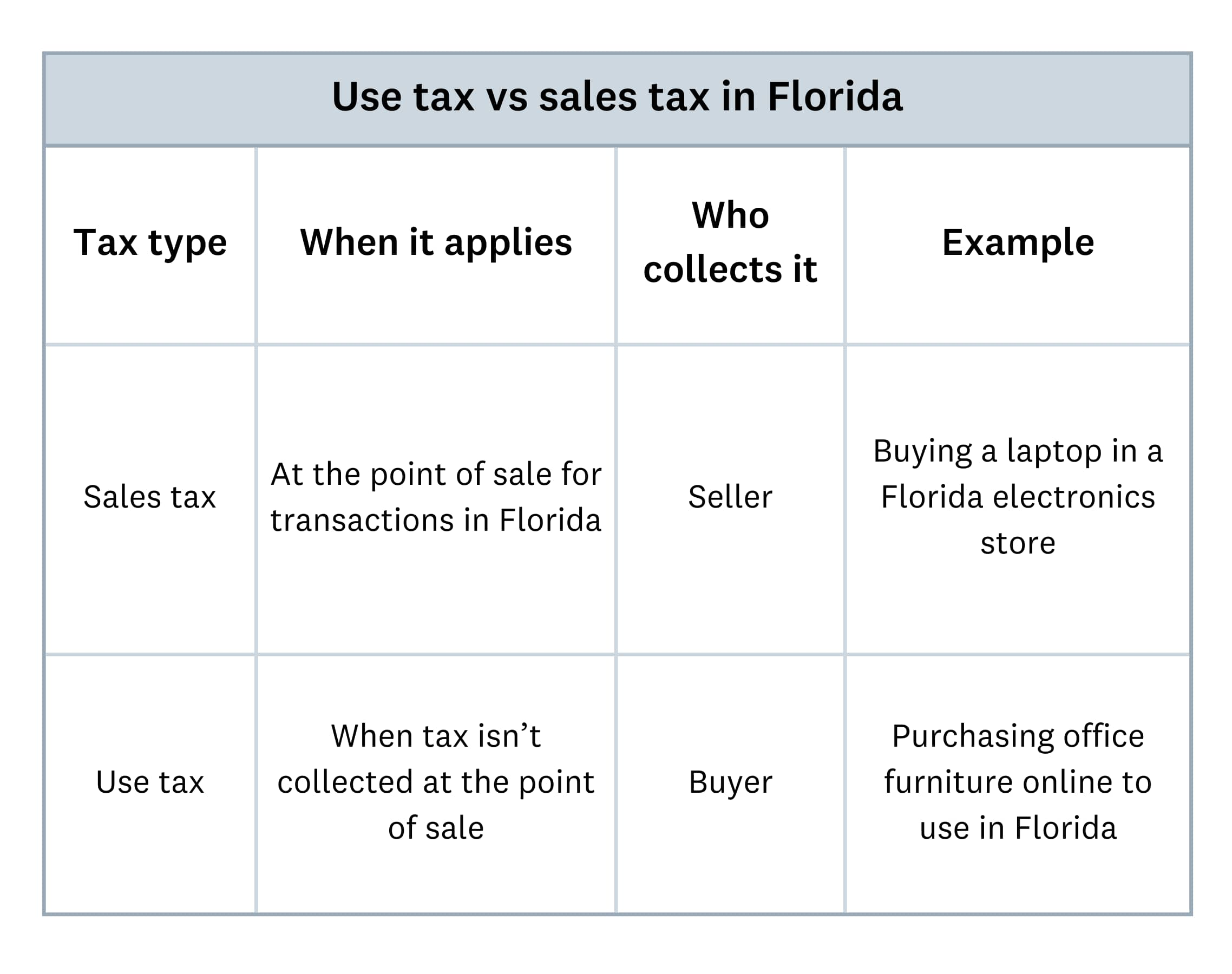

Use tax vs. sales tax in Florida

Use tax and sales tax in Florida apply in different situations:

Sales tax:

- Who pays: Seller collects from customer at purchase

- When: At point of sale in Florida

Use tax:

- Who pays: Buyer pays directly to state

- When: Seller didn't collect sales tax at purchase

Use tax applies when you don't charge sales tax at the point of sale. Common examples of this would be:

- buying furniture online from a seller that doesn't collect Florida sales tax

- purchasing goods tax-free while traveling out of state and bringing them back for use in Florida

- ordering wholesale products for personal use instead of resale

If you owe use tax, report and pay it to the Florida Department of Revenue. This helps keep your business compliant.

Knowing the difference between use tax and sales tax helps you stay compliant. Check your tax obligations when you buy from out-of-state or online retailers.

Streamline your Florida sales tax with Xero

Florida sales tax can be complex, but you do not have to let it slow you down. Xero helps you track sales, manage expenses, and get ready for tax time, so you can focus on running your business.

Real-time financial insights help you make better decisions and focus on your business. Try Xero free for one month.

FAQs on Florida sales tax

Here are some common questions you might have about Florida sales tax for your small business.

Does Florida have 7% sales tax?

Florida's statewide sales tax is 6%. Many counties add a local surtax, so the total rate can be 7% or higher. For example, Miami-Dade County has a 1% surtax, making the total rate 7%.

What items are non taxable in Florida?

Many essential items are exempt from sales tax in Florida. Most groceries for home use, prescription drugs, and medical supplies are not taxed. Services such as healthcare and legal advice are also usually non-taxable. Prepared foods, restaurant meals, and repairs to goods are usually taxable.

Do businesses in Florida need a sales tax permit?

You need a Florida sales tax permit before you sell taxable goods or services.

Who needs permits:

- All businesses selling taxable items

Exemptions:

- Government entities

- Schools and educational institutions

- Qualifying nonprofit organizations

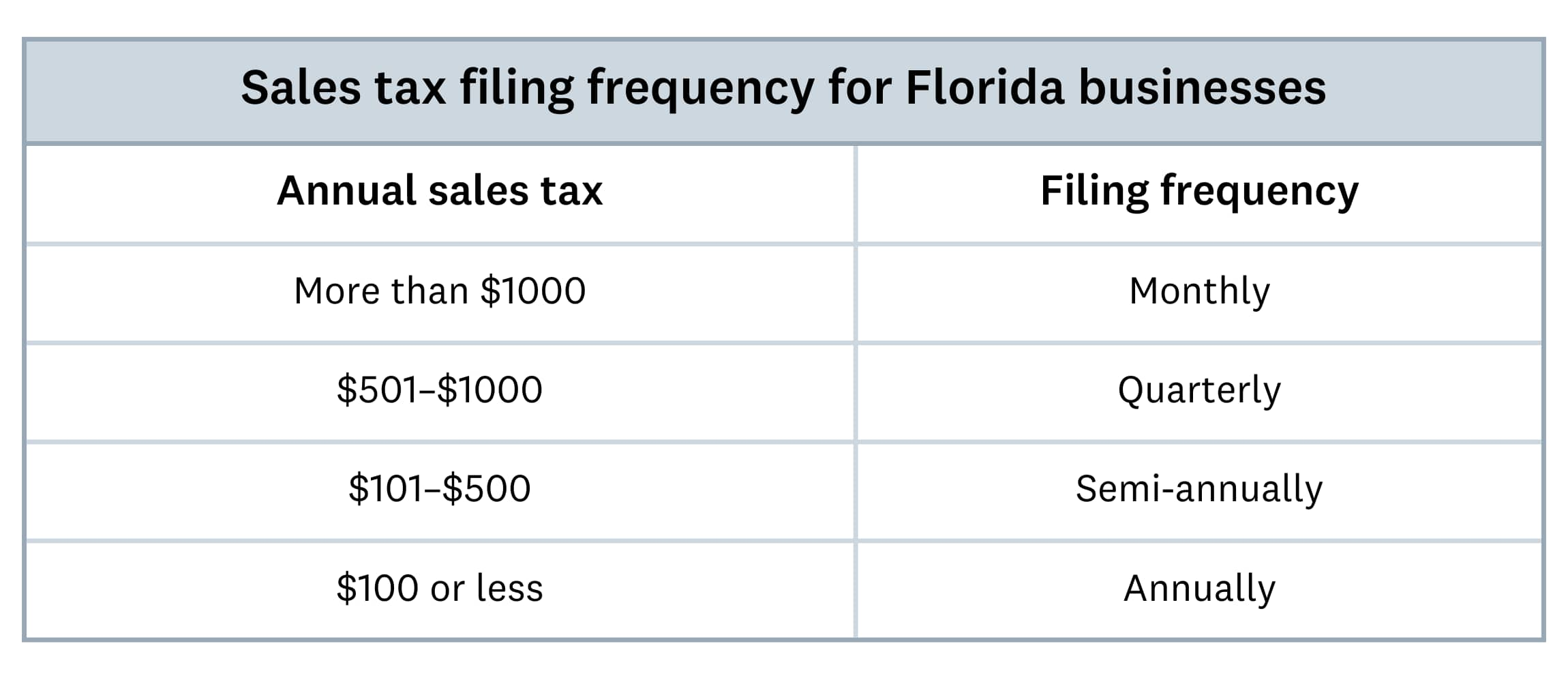

How often do Florida businesses need to file sales tax returns?

Most Florida businesses file sales tax returns quarterly. The state offers a collection allowance of up to $30 per reporting period if you file electronically and on time. Your filing frequency depends on how much tax you collect each year.

Filing schedules:

- Quarterly: Standard for most businesses

- Monthly: Higher tax collection amounts

- Annual: Lower tax collection amounts

If you don't collect or pay sales tax, you may face penalties of up to 50% of the tax due, plus interest. The Florida Department of Revenue can audit your business and assess fines.

Get one month free

Sign up to any Xero plan, and we will give you the first month free.

Disclaimer

Xero does not provide accounting, tax, business or legal advice. This guide has been provided for information purposes only. You should consult your own professional advisors for advice directly relating to your business or before taking action in relation to any of the content provided.