Accounting for reverse charge VAT: what you need to know

Reverse charge VAT is part of accounting in construction and other industries to help prevent fraud. Find out what it is, why it exists, and how to navigate domestic reverse charge with Xero to stay compliant.

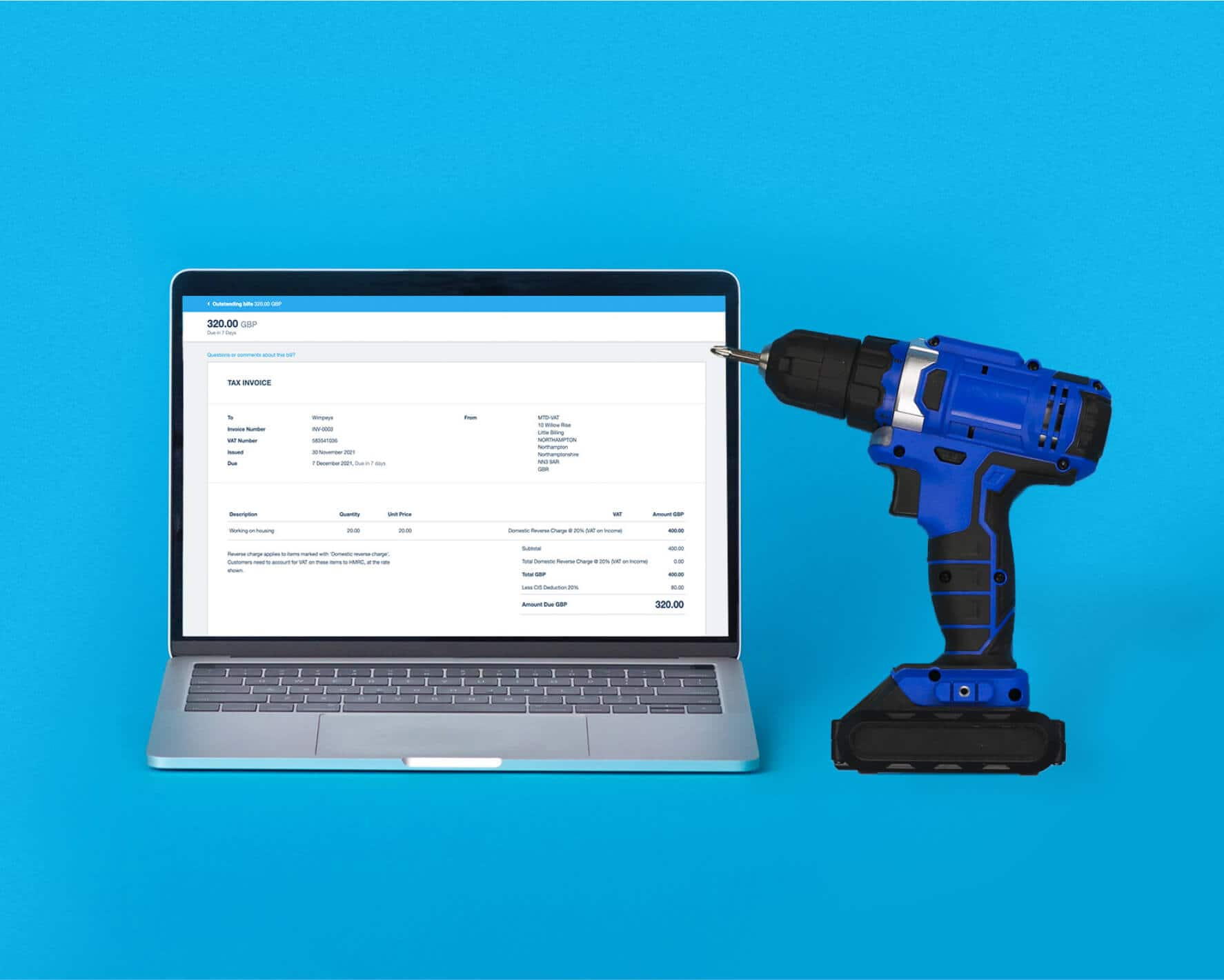

Drill through your DRC VAT calculations with Xero.

What is reverse charge VAT in the UK and why does it exist?

Domestic reverse charge in the UK removes the middleman when it comes to paying VAT - instead of collecting it as a seller, buyers pay the VAT to HMRC when they purchase from you. This reduces VAT-related fraud in some supply chains. It stops companies from charging VAT and avoid paying it to HMRC.

What are reverse charge expenses?

Domestic reverse charge appears as a tax rate on invoices for some services, like construction and building.

Why was reverse charge VAT introduced?

Domestic reverse charge VAT was introduced to reduce opportunities for sophisticated criminal fraud.

How do I prepare my business for reverse VAT?

Update software, monitor finances, communicate with staff, and use correct VAT rates on invoices.

Who is affected by the domestic reverse charge regulations?

Domestic reverse charge affects businesses registered for VAT and the Construction Industry Scheme (CIS) From March 2021, a VAT-registered business providing building and construction services to another VAT-registered business for onward sale must apply the reverse charge VAT to their invoice.

See which goods and services reverse charge applies to

How can Xero help you manage reverse charge VAT?

Xero’s accounting software automates reverse charge VAT calculations, record it when you submit MTD VAT returns, and show the rates to customers. Whether you’re a business owner, contractor or sub-contractor, Xero helps you ensure you’re using the right tax rate and stay compliant with MTD laws.

Automate reverse VAT calculations

Reduce the burden of calculating reverse charge VAT manually – Xero sorts your VAT rate for you.

Submit your VAT returns

Once Xero has created your MTD VAT return, you can submit it directly to HMRC, eliminating stress at tax time.

Show reverse charge rates to customers

Display reverse charge VAT details on invoices, so customers know which items it applies to and what to do.

What is the Construction Industry Scheme (CIS) and how does it work?

The Construction Industry Scheme applies to contractors and subcontractors in the UK construction industry. CIS-registered contractors must make tax deductions on behalf of their subcontractors towards their tax and National Insurance.

Find out more about the CIS scheme in our guide

What goods & services does reverse charge VAT apply to?

Reverse charge VAT applies to goods and services in technology, gas and electricity, telecommunications, renewable energy, emissions and construction industries. Find out about the VAT domestic reverse charge procedure which applies to the buying and selling of certain goods and services.

Find out more about VAT on goods & services from HMRC

Reverse charge VAT: frequently asked questions

Xero allows you comply with the domestic reverse charge (DRC) regulation by adding specific tax rates to your Xero organisation and invoices.

Find out more about adding domestic reverse charge rates in XeroXero allows you comply with the domestic reverse charge (DRC) regulation by adding specific tax rates to your Xero organisation and invoices.

Find out more about adding domestic reverse charge rates in XeroContractors and customers who receive specified services account for VAT in MTD VAT returns. Contractors will receive invoices with the reverse VAT applied to items, and must report the input tax and output tax on that bill in their MTD VAT return.

Contractors and customers who receive specified services account for VAT in MTD VAT returns. Contractors will receive invoices with the reverse VAT applied to items, and must report the input tax and output tax on that bill in their MTD VAT return.

CIS subcontractors and suppliers of specified services show VAT on invoices but don’t account for it in returns. Subcontractors must apply the VAT rate on items in their invoices and state that the customer must pay the reverse charge VAT to HMRC.

See how to send DRC invoices as a subcontractor with XeroCIS subcontractors and suppliers of specified services show VAT on invoices but don’t account for it in returns. Subcontractors must apply the VAT rate on items in their invoices and state that the customer must pay the reverse charge VAT to HMRC.

See how to send DRC invoices as a subcontractor with XeroDomestic reverse charge VAT may impact your cash flow. Affected suppliers and subcontractors no longer get VAT payments from customers, while affected customers and contractors may see short-term cash flow benefits.

Domestic reverse charge VAT may impact your cash flow. Affected suppliers and subcontractors no longer get VAT payments from customers, while affected customers and contractors may see short-term cash flow benefits.

Reverse charge VAT resources for small businesses

Navigating reverse charge VAT can be challenging for small businesses. To stay compliant, here’s a set of resources that can help.

How does reverse charge VAT work?

Reverse charge VAT is when a buyer in the supply chain adds and collects VAT instead of the seller.

Guide to reverse charge VAT for construction

Our free guide explains what reverse charge VAT is and how we can help, plus a reverse charge VAT example.

How can I prepare my business?

Get the right software, consider cash flow impacts, and talk to staff. Need help? Xero’s got you covered.

Use Xero for domestic reverse charge VAT

Access Xero features for 30 days, then decide which plan best suits your business.

Set up for reverse charge VAT with Xero

Xero helps you comply with domestic reverse charge (DRC) regulations when you send invoices and submit VAT returns.

Add preset DRC tax rates to Xero

Activate the DRC tax rates for Xero to use in invoices and tax returns.

Show a DRC disclaimer on invoices

Xero automatically adds a disclaimer to standard invoices. Otherwise, add it manually.

Sign up for MTD for VAT

Sign up with HMRC and connect Xero to HMRC so you can file MTD VAT returns online.

Explore more about domestic reverse charge

Get in-depth information about domestic reverse charge VAT at the UK government website.

Guide to reverse charge procedures

Certain VAT domestic reverse charge procedures apply when you buy or sell specific goods and services.

Find out about VAT procedures for specific goods and services

Reverse charge VAT for construction

Find out about VAT domestic reverse charge for suppliers of building and construction services.

Learn about reverse charge VAT for the construction industry

Reverse charge technical guide

Get technical information about VAT reverse charges if you buy or sell building and construction services.