What is cash flow?

Cash flow (definition)

Cash flow determines the ability of a business to pay its suppliers, employees, lenders and owners on time.

Timing is very important to cash flow. The business must have sufficient cash when payments come due or else they risk defaulting. Even profitable businesses can have cash flow issues when faced with badly timed expenses.

A small business with cash flow issues will struggle to make regular payments to its owners. This can, in turn, put their personal finances at risk.

What affects cash flow

The amount of cash in the business is driven by three things:

- Operations – money from selling products and services, minus the expense of delivering those products and services

- Investments – money spent on big assets like real estate or equipment, offset by money received when reselling similar big ticket items

- Finance – money received as loans, offset by money repaid to banks. Shareholder investments are also captured here, and these are offset by dividend payments.

Ideally, cash flow most commonly comes from operations. It isn’t sustainable to keep taking loans or selling chunks of the business.

Read more on how to calculate cash flow.

How to measure cash flow

When assessing cash flow, a business can look forward by doing a cash flow forecast, or backward by doing a cash flow statement.

To see how changes in operations, investments and finance impact your business, try our cash flow calculator.

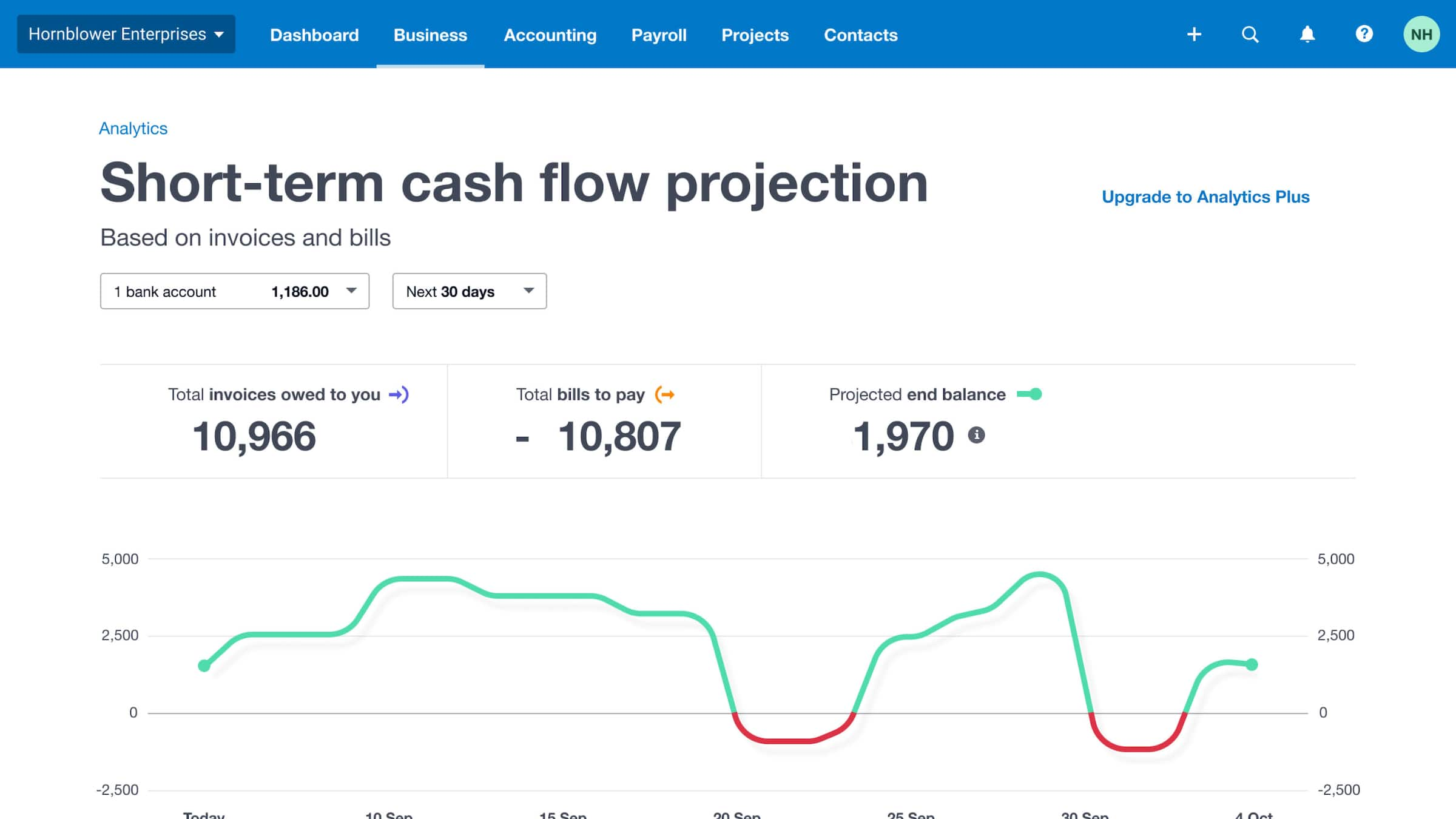

Small businesses can get a picture of future cash flow by accounting for upcoming bills and payments (example from Xero dashboard).

Cash flow forecasts or projections

A cash flow forecast plots upcoming income and expenses on a timeline to predict how much money a business will have in the future.

Cash flow statements

A cash flow statement reviews the past month, quarter, or year to show how cash was generated and how it was spent. At the highest level, it will show which proportion of cash came from:

- selling goods and services (operations)

- taking loans or selling shares in the business (finance)

- selling assets like machinery or real estate (investing)

This can help you check that cash flows are sustainable and not overly reliant on borrowing.

Importance of cash flow

A business needs good cash flow to pay bills and keep trading. Having spare cash also gives a business the opportunity to pursue new opportunities, in line with the adage that you have to spend money to make money. Equally importantly, good cash flow alleviates a lot of financial stress for business owners and managers.

A quick note on the meaning of ‘cash’

Cash is not just money in the till or bank. It includes ‘cash equivalents,’ which is anything that can be sold for a known price, at short notice (usually within about 3 months).

How cash flow differs from free cash flow, working capital, and liquidity

Cash flow is a measure of spending power, similar to free cash flow, working capital, and liquidity. Each of these terms has its own complexities, but here’s roughly how they compare:

- Cash flow refers to the general availability of cash

- Liquidity shows how easily a business can cover upcoming costs (expressed as a ratio)

- Working capital shows how much money will be left after covering those upcoming costs

- Free cash flow is the amount of cash left after making capital investments

See related terms

Handy resources

Advisor directory

You can search for experts in our advisor directory

Cash flow forecast template

Download our free template to help predict cash flow for your business

Business analytics with Xero

See future cash flow, check financial health and track metrics

Disclaimer

This glossary is for small business owners. The definitions are written with their requirements in mind. More detailed definitions can be found in accounting textbooks or from an accounting professional. Xero does not provide accounting, tax, business or legal advice.