Accountant and bookkeeper stories

Xero accountants and bookkeepers share the stories of their careers – the highs, the lows, and everything in between.

Accountant stories

Stephen from Deloitte Private forged an unconventional career path

Stephen Nicholas, Partner at Deloitte Private, shares his unique journey to a career in accounting. (6 min read)

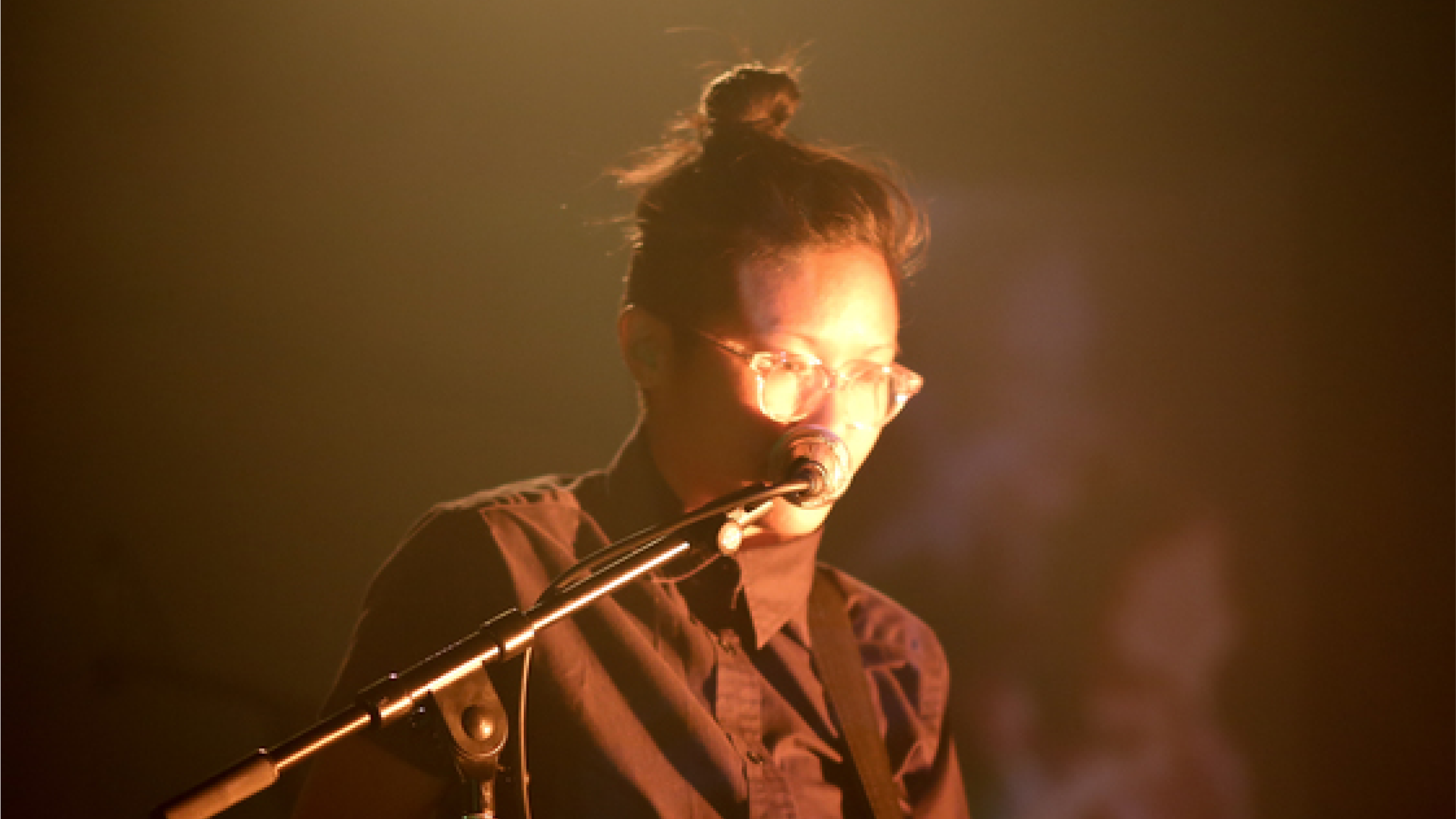

Tate from Polay + Clark merged math and music in an accounting firm

Tate Henshaw found a way to showcase both his math and musical talents as a music industry accountant. (8 min read)

Claire from CV Ledger built a niche accounting firm for creatives

Claire Van Holland had a data career with creative side projects. Now she does accounting for creatives. (6 min read)

Janine from Tax Agent 99 set her entrepreneurial spirit on fire

Read how Janine Gartner’s entrepreneurial spirit paved the way for a career in accounting at her own firm. (5 min read)

Willem from DoughGetters has joined the digital accounting revolution

DoughGetters are taking accountancy in a new direction, making the most of the cloud for South African businesses.

Chad from LiveCa has found freedom with his virtual accounting firm

Chad takes the show on the road: he travels with his family in an RV across Canada and still runs his accounting firm.

Nathan and Peter of Maisey Harris & Co offer enduring relationships

Non-traditional Kiwi accounting firm Maisey Harris offers more than advice: long-lasting relationships are their secret.

Shayne and his team from ease, MNP’s cloud service line, are always on

Cloud accounting has allowed Shayne Dueck and his team to offer real-time insights for real-world business decisions.

Bookkeeper stories

Sally of Balance Books found a passion for a numbers and a new career

After discovering her knack for numbers aged 31, Sally Hams jumped right in and started her own business. (4 min read)

Paco from The Hell Yeah Group gets creative with bookkeeping

Paco de Leon used to hate doing the books. Now her business simplifies bookkeeping for creative clients. (8 min read)

Di from Ontrack Bookkeeping keeps her family priorities on track

Di Crawford-Errington became a bookkeeper so she could spend more time at home with her daughters. (6 min read)

Melanie of Training and Beyond built a strong bookkeeping career

Read how worm farmer Melanie Morris launched her successful bookkeeping career. (7 min read)

Lisa from GoFi8ure is a mobile bookkeeping superhero

Read how Lisa Martin’s mobile bookkeeping business saves clients from evil, time-consuming accounts. (7 min read)

Burton from Sutro Li loves helping great causes through bookkeeping

Burton is a former rocker turned bookkeeper who wants to help good-cause businesses, while living the good life himself.

Nury from San Diego connects with small businesses and her town

Meet Nury Saenz, beach lover and Xero-certified bookkeeper.

Hayley from Cloudmeb is more of a confidante to her clients

Hayley is a Xero-certified accountant who works with business owners and refers to Xero as her automating saving grace.

Become a Xero partner

Join the Xero community of accountants and bookkeepers. Collaborate with your peers, support your clients and boost your practice.