Secure digital document e-signing with Xero

Collate financial reports and tax returns into document packs to share securely with clients for digital signatures.

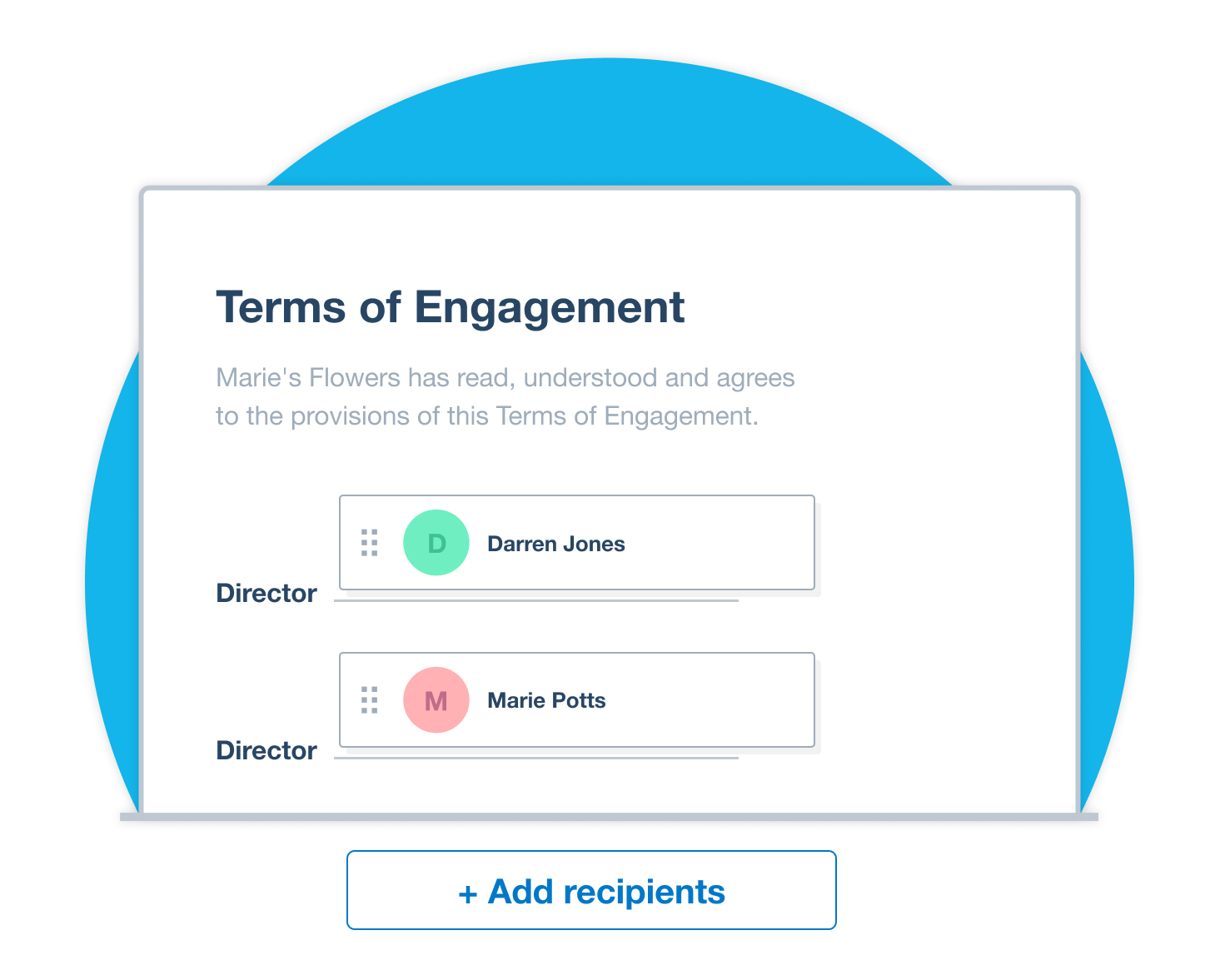

Collate client documents in packs

Combine reports, returns and PDF documents for signing from within Xero to help improve your workflow

- Include published reports from your client’s Xero organisation

- Include tax returns from Xero Tax

- Include PDFs that you upload to Xero HQ from your computer

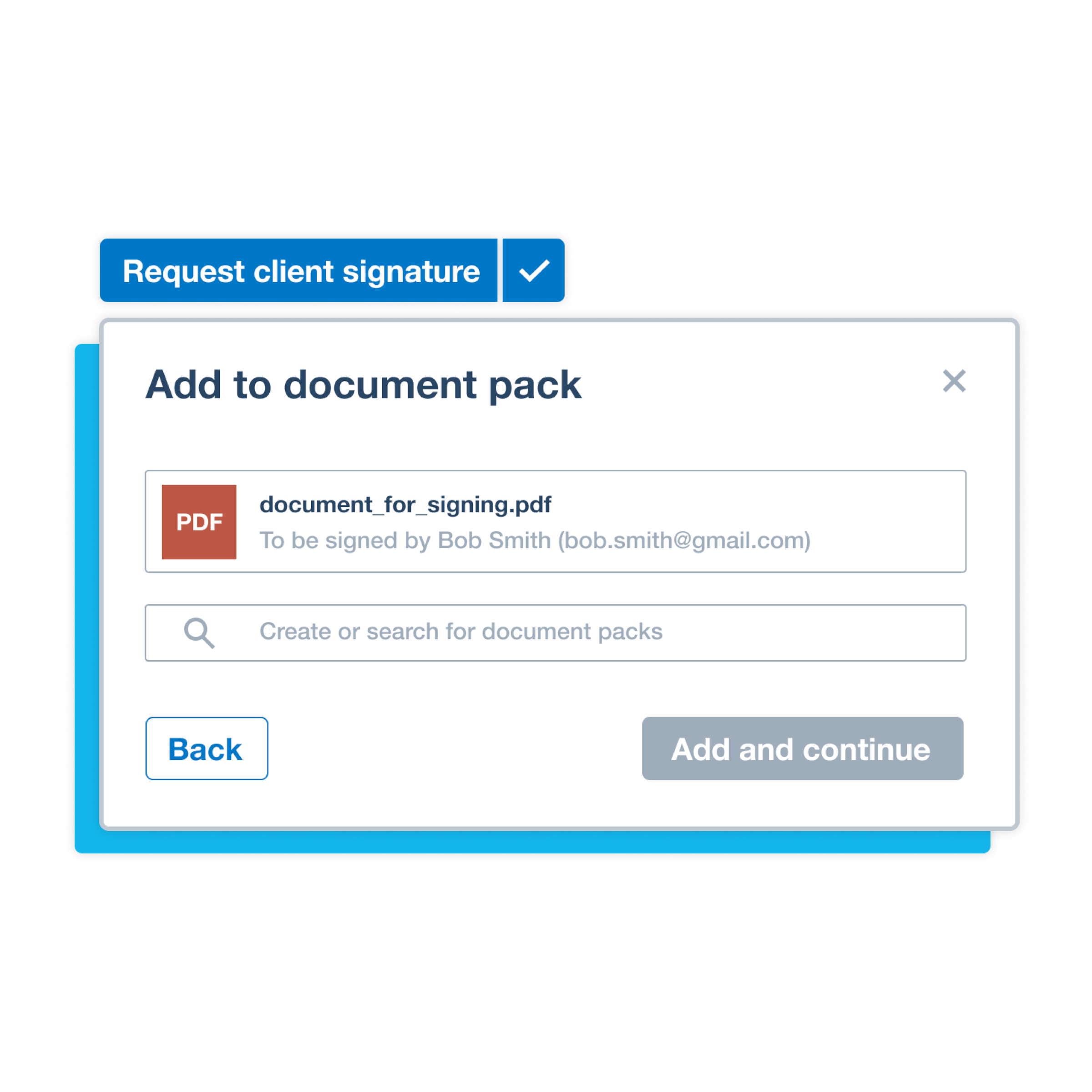

Add tax returns to a pack seamlessly

Prepare your tax returns in Xero Tax, then add them to a document pack all within a simple workflow

- Contact details automatically populated with the signature spot added where possible

- Automatic status updates on the tax return and notification when the returns have been signed

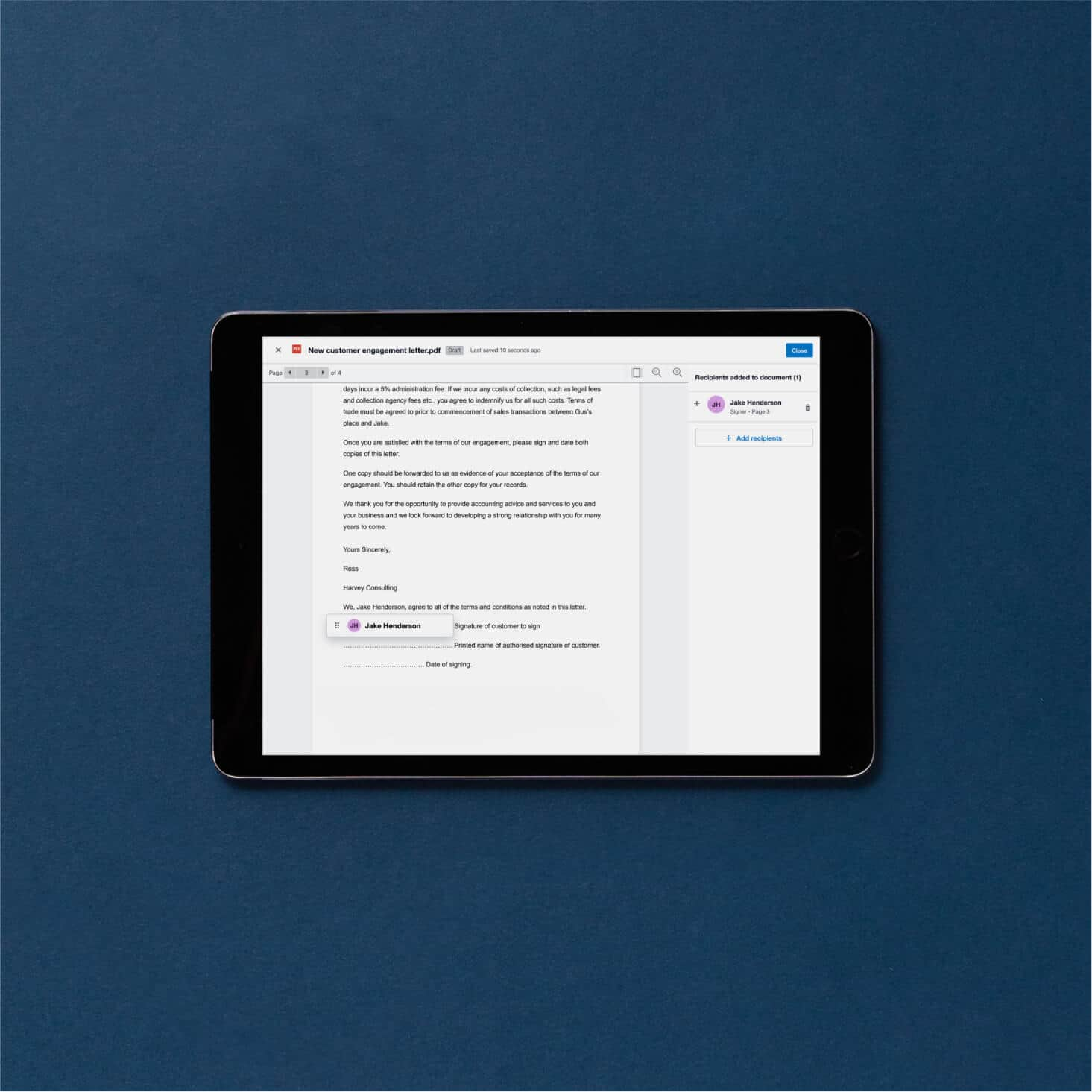

Prepare PDFs for e-signing

Add a signature line to PDFs within your Xero account as well as the names and emails of those who need to sign.

- Add multiple recipients and drag & drop where they need to sign on the page

- Add customised email messages before sending the pack to your clients

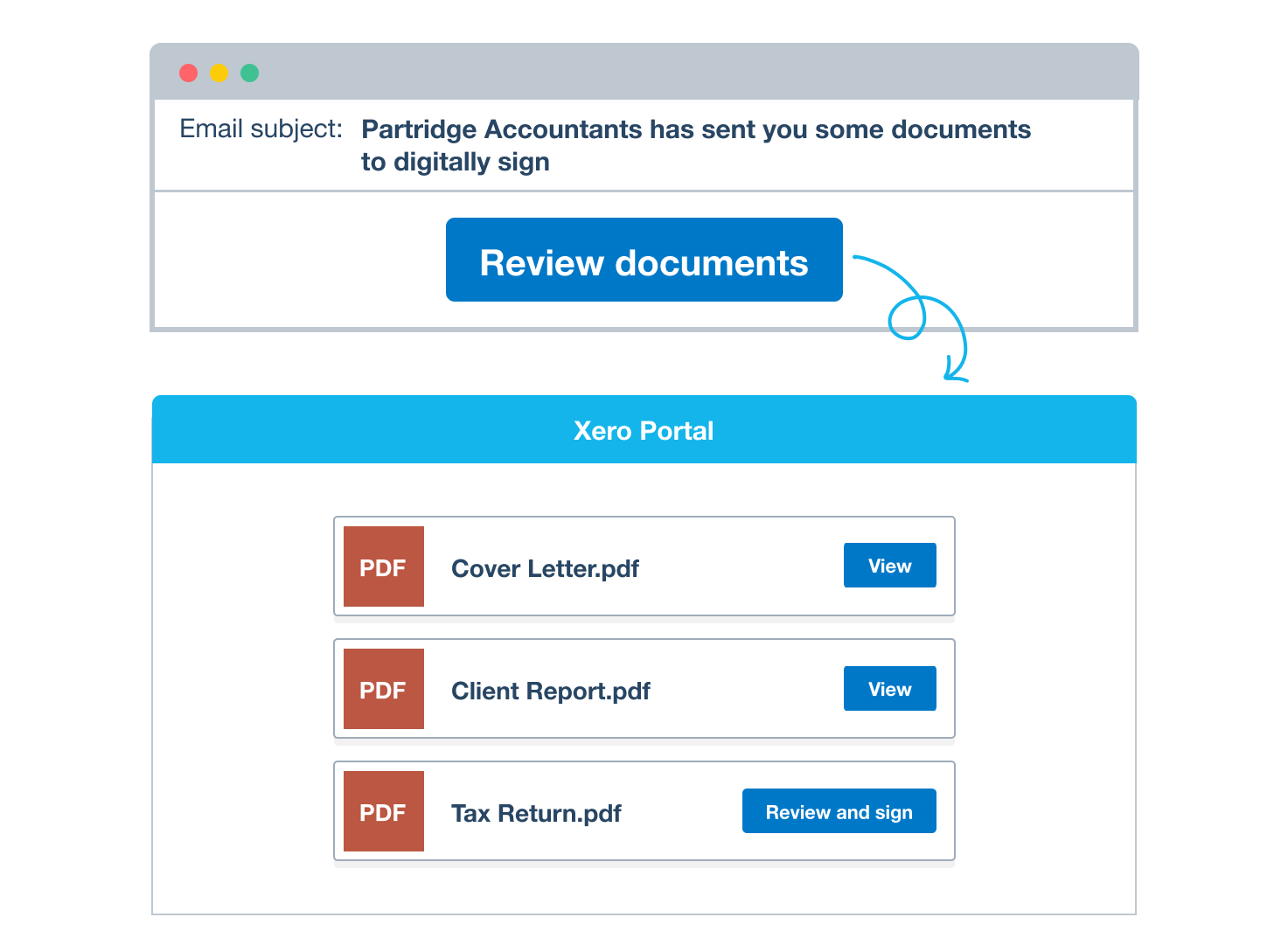

Share documents securely

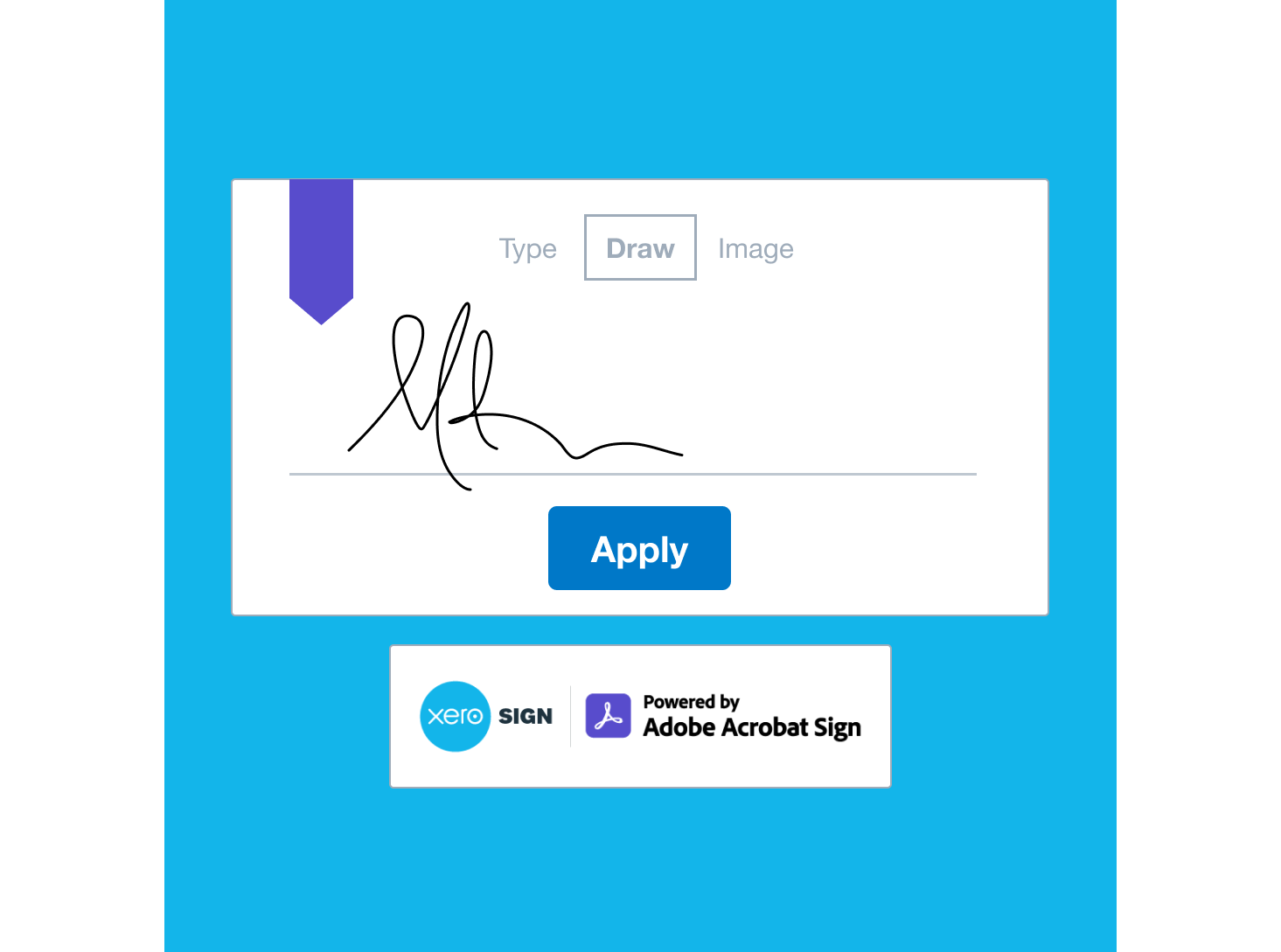

Ask clients to visit a secure Xero portal where they can safely and securely e-sign documents.

- Recipients are notified by email and requested to sign documents

- Clients can sign in with their Xero login or create a free login to access the documents

- Receive notifications updating you on a pack’s status

Receive 25 free transactions

Purchase a Xero Sign powered by Adobe Acrobat Sign bundle. See the bundle pricing and the full Xero Sign T&Cs below.

- New Xero Sign accounts get 25 free transactions to use within 14 days

- Request e-signatures through document packs in Xero HQ or Xero Tax

- Bundles are valid for 12 months from the date of purchase

More about document packs

The current Xero Tax e-signature tool in company accounts and tax is not going away, but if you fancy trying the added benefits of using document packs and Xero Tax, we’ve prepared a side by side comparison.

See how document packs compares to Xero Tax e-signature (PDF)The current Xero Tax e-signature tool in company accounts and tax is not going away, but if you fancy trying the added benefits of using document packs and Xero Tax, we’ve prepared a side by side comparison.

See how document packs compares to Xero Tax e-signature (PDF)To get started, you need to create an Adobe Acrobat Sign account that can only be used with document packs and Xero Tax. Go to Xero HQ, click Ask > Document packs and then follow the prompts to sign up.

See how to set up document packs and Xero SignTo get started, you need to create an Adobe Acrobat Sign account that can only be used with document packs and Xero Tax. Go to Xero HQ, click Ask > Document packs and then follow the prompts to sign up.

See how to set up document packs and Xero SignBring together client documents, tax returns and published reports in Xero HQ, add e-signature requests, then send them out to clients to sign using the secure Xero portal.

See how to prepare and send a document packBring together client documents, tax returns and published reports in Xero HQ, add e-signature requests, then send them out to clients to sign using the secure Xero portal.

See how to prepare and send a document packMicro bundles (100 transactions) are £60, small ones (500 transactions) are £240, medium ones (1000 transactions) are £360 and large ones (2500 transactions) are £600. This pricing is in GBP and excludes VAT. The offer of 25 free transactions automatically applies to new Xero Sign accounts created from 15 February 2023.

Learn more about bundles starting from £60Micro bundles (100 transactions) are £60, small ones (500 transactions) are £240, medium ones (1000 transactions) are £360 and large ones (2500 transactions) are £600. This pricing is in GBP and excludes VAT. The offer of 25 free transactions automatically applies to new Xero Sign accounts created from 15 February 2023.

Learn more about bundles starting from £60‘Transactions’ refers to the number of documents that include at least one electronic signature. Each document can be up to 100 pages or 10 MB. Xero Sign bundles expire 12 months after the purchase date. Unused transactions are not redeemable after that.

See the full Xero Sign terms and conditions that apply (PDF)‘Transactions’ refers to the number of documents that include at least one electronic signature. Each document can be up to 100 pages or 10 MB. Xero Sign bundles expire 12 months after the purchase date. Unused transactions are not redeemable after that.

See the full Xero Sign terms and conditions that apply (PDF)

Become a Xero partner

Join the Xero community of accountants and bookkeepers. Collaborate with your peers, support your clients and boost your practice.