Free donation receipt template

Create professional receipts for donors that help you manage donations for your nonprofit or charity. Download our free, printable donation receipt to make your donation process fast and simple. Send charitable donation receipts to your donors and keep copies for your records.

Customisable and reusable

Simply add the donation details then print or send a digital copy to donors

Better record-keeping

Make it easier for your donors to claim tax relief with a clear donation receipt

Show appreciation

Say thank you to your donors with a professional donation receipt that recognises their contribution

Download the free donation receipt template

Fill in the form to get a blank receipt template as an editable PDF. We’ll also link you to an example on how to use it.

Got your template? Try Xero for free.

Ready to take control of your business? Xero's got everything you need to succeed, from accounting and invoicing to reporting and payroll.

Benefits of using a donation receipt template

Providing a donation receipt helps you and your donors keep track of contributions. Instead of drafting a new receipt every time, reusing a template will save you precious minutes and make your donation process more consistent. Donor receipt templates help you:

- Maintain clear and trackable donation records

- Simplify your receipt process (use the template again and again)

- Give donors a professional and transparent experience

- Acknowledge donor contributions

What to include in a donation receipt

Including certain details on your donation receipts will help you keep accurate financial records and understand how your organisation raises funds. Donors might also need a donation receipt for tax purposes. Be sure to include the following:

- Charity information including your address and foundation number (if you have one)

- Your donor’s name

- A summary or description of their contribution

- The total of their contribution

- The signature and name of an authorised representative

Types of donation receipts

You might need a different type of donation receipt depending on the contribution. Make sure you customise your donation receipt template to include the right information. Here are some examples:

Charitable donation receipt

Cash, goods, services, and any other kinds of donation to a charity or nonprofit fall under this category.

In-kind donation receipt

Use an in-kind donation receipt when goods or services are donated (instead of cash).

Cash donation receipt

Use this when a donation is in cash.

Stock gift donation receipt

These receipts are for companies that donate shares to your organisation.

Silent auction receipt

Provide these receipts when silent auction attendees purchase items.

End-of-year donation receipt

These statements detail contributions made by donors throughout the financial year.

How to use our free donation receipt template

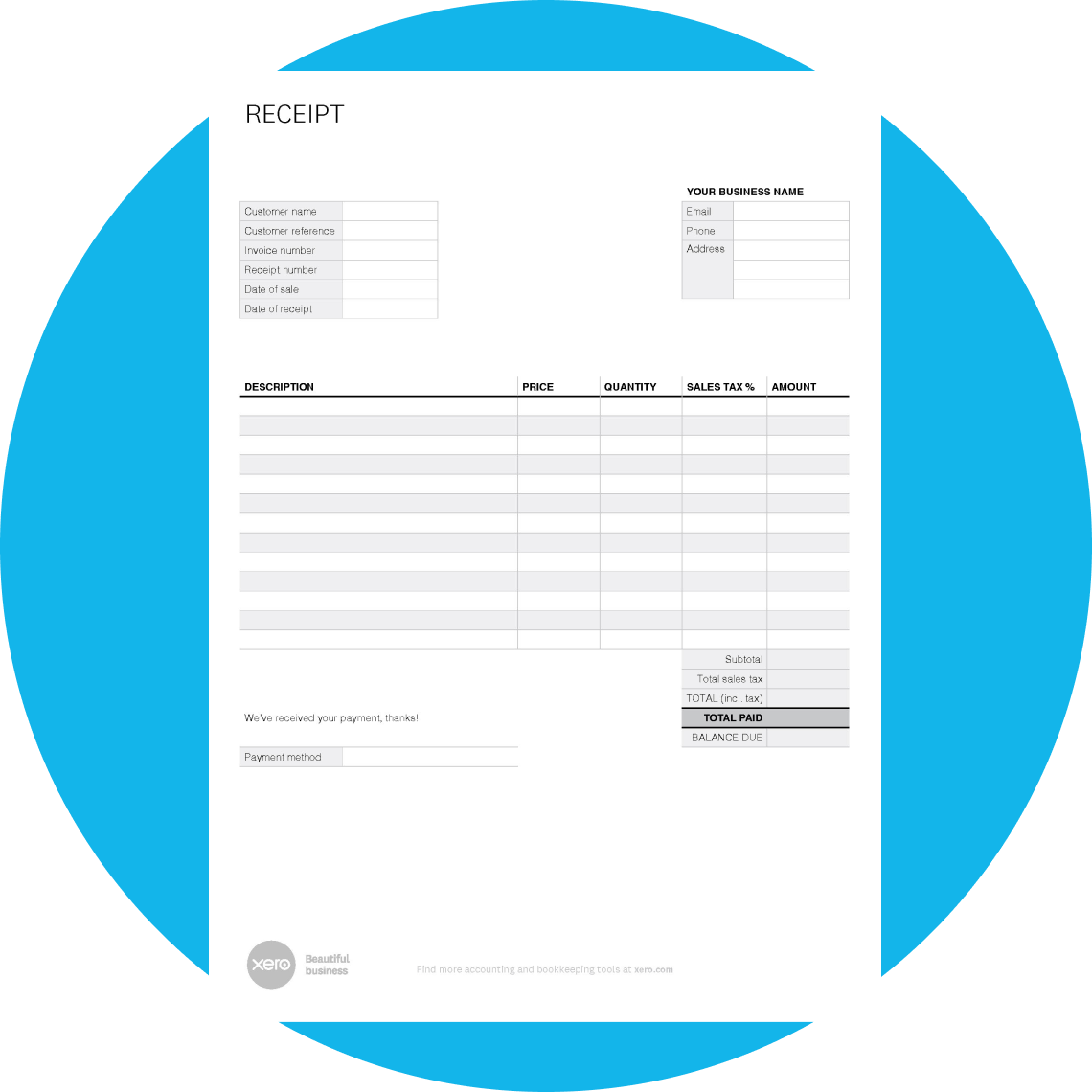

Start sending professional receipts to your donors using our template. Simply follow these steps:

Enter a few details and download the template.

Open the PDF and add information about the donation.

Send the receipt to your donor and save a copy.

FAQs on donation receipts

Donation receipts are about transparency for you and your donors. A detailed donation receipt forms part of your financial record-keeping and helps you track and manage donations. Donors get a record of their donation that can also be used for tax and tax relief purposes. Keeping donation receipts is often a key part of tax requirements. Check out the government guidance for nonprofits and charitable organisations.

Charities and social enterprises in the UKDonation receipts are about transparency for you and your donors. A detailed donation receipt forms part of your financial record-keeping and helps you track and manage donations. Donors get a record of their donation that can also be used for tax and tax relief purposes. Keeping donation receipts is often a key part of tax requirements. Check out the government guidance for nonprofits and charitable organisations.

Charities and social enterprises in the UKProviding receipts for your donors keeps everyone on the same page. There’s a clear record of what’s been donated, you can easily track and manage donations, and your donors have proof of their contributions to claim tax relief. Maintaining accurate written records is important for tax deduction claims and compliance – so you and your donors benefit from clear receipts. And let’s not forget, a donation receipt is a formal ‘thank you’ to the donors who contributed to your organisation.

Providing receipts for your donors keeps everyone on the same page. There’s a clear record of what’s been donated, you can easily track and manage donations, and your donors have proof of their contributions to claim tax relief. Maintaining accurate written records is important for tax deduction claims and compliance – so you and your donors benefit from clear receipts. And let’s not forget, a donation receipt is a formal ‘thank you’ to the donors who contributed to your organisation.

For one-off donations, you should send a receipt as soon as you can. Within 24-48 hours of receiving the donation is ideal. If donors make a regular donation – say, a monthly cash sum – you can also provide an end-of-year donation receipt. This can be helpful for tax and tax relief purposes for your donors.

For one-off donations, you should send a receipt as soon as you can. Within 24-48 hours of receiving the donation is ideal. If donors make a regular donation – say, a monthly cash sum – you can also provide an end-of-year donation receipt. This can be helpful for tax and tax relief purposes for your donors.

There are some differences – for example, you don’t need an invoice number for a nonprofit donation receipt. Our donation receipt template contains everything you need for a legitimate receipt.

Check out our receipt exampleThere are some differences – for example, you don’t need an invoice number for a nonprofit donation receipt. Our donation receipt template contains everything you need for a legitimate receipt.

Check out our receipt exampleDigital receipts can be easier to organise than paper ones, and saving them doesn't take up any space. But paper receipts are ideal for landlords who keep physical files for their tenants. It comes down to personal preference. And with a rent receipt PDF, you can meet your tenants' preferences for paper or digital receipts.

Digital receipts can be easier to organise than paper ones, and saving them doesn't take up any space. But paper receipts are ideal for landlords who keep physical files for their tenants. It comes down to personal preference. And with a rent receipt PDF, you can meet your tenants' preferences for paper or digital receipts.

You should give your tenant a receipt every time they pay the rent. Usually, that means giving them a receipt once a month.

You should give your tenant a receipt every time they pay the rent. Usually, that means giving them a receipt once a month.

Looking for more information on using the receipt template?

Check out our receipt exampleLooking for more information on using the receipt template?

Check out our receipt example

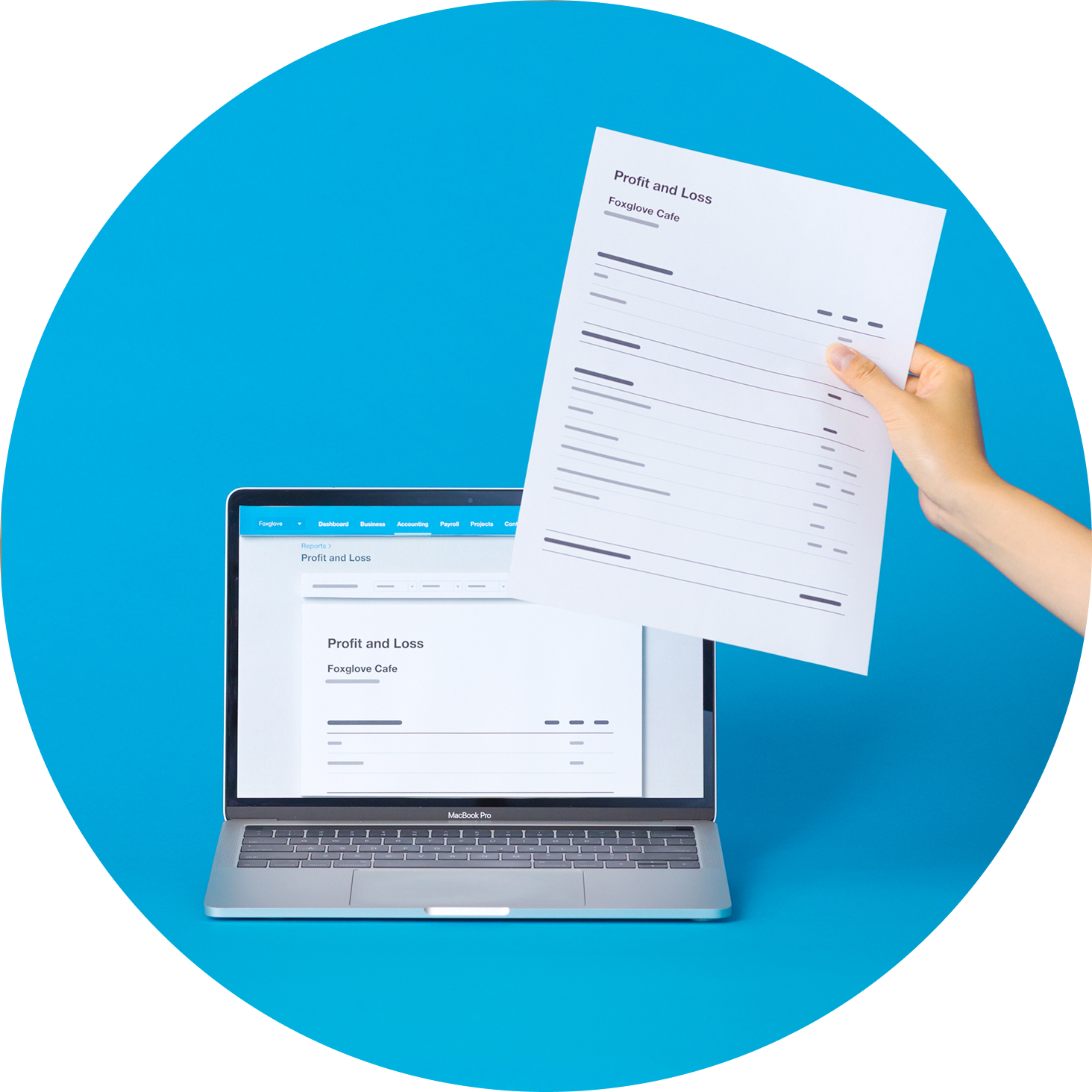

Accounting software for nonprofits

Easily see the cash flowing in and out of your nonprofit with Xero accounting software. Stay on top of expenses and plan ahead with cash summary reports, easy-to-read dashboards, and real-time transaction data.

- Get discounts for your nonprofit organisation

- Share reports with stakeholders

- Stay connected wherever you are

More tools and guides for your charity or nonprofit

Manage your organisation confidently, with tools and resources that help you keep your finances healthy.

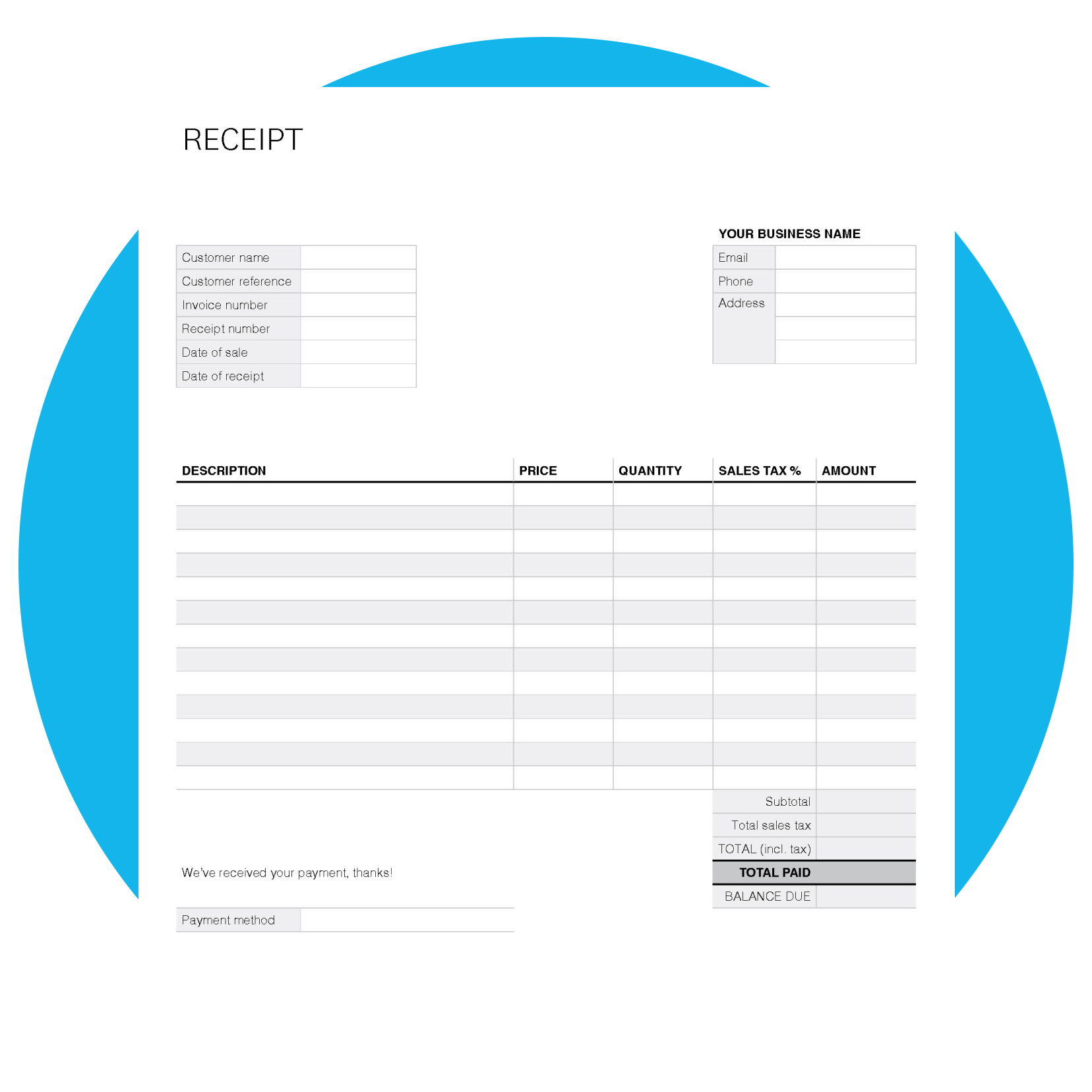

Receipt template

Send professional receipts that include all the key transaction details.

How to start a nonprofit

Just starting out? Read our guide for setting up your nonprofit.

Business plan template

Get the basics right for your business using this tool.

Disclaimer

Xero does not provide accounting, tax, business or legal advice. This template has been provided for information purposes only. You should consult your own professional advisors for advice directly relating to your business.