Difference between bookkeeping and accounting

Bookkeeping vs accounting (comparison)

Bookkeeping traditionally referred to financial record-keeping but the remit is growing. Accountants are trained financial analysts and tax experts.

Bookkeeping and accounting are both important parts of managing business finances. There’s plenty of overlap between the two tasks – especially as both sets of professionals have expanded the services they offer – but there are important differences.

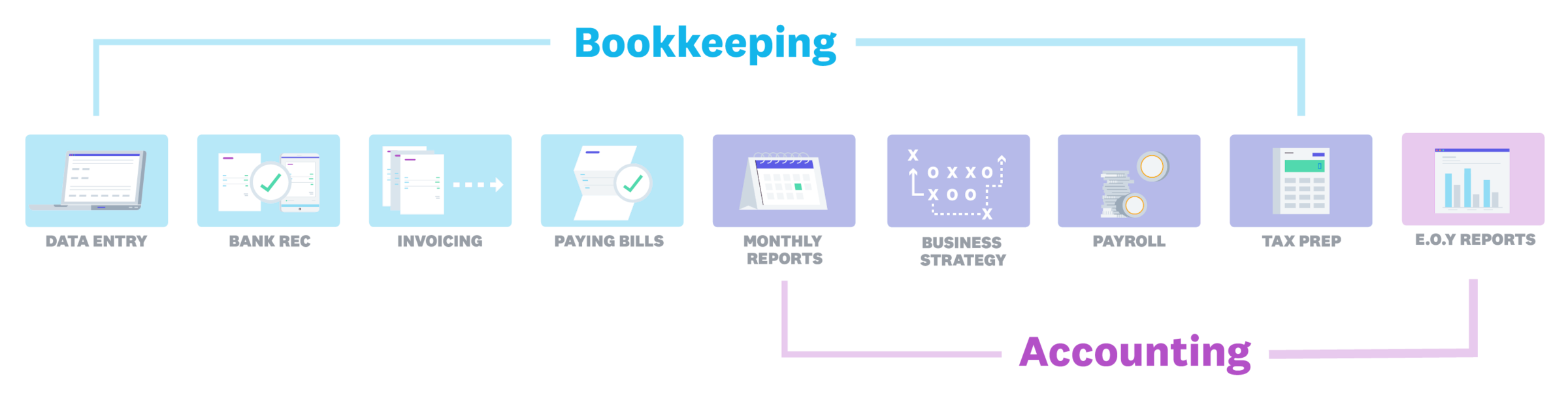

Bookkeeping covers data entry to strategy. Accounting covers reporting, taxes and strategy.

What bookkeepers do

Bookkeepers ensure business transactions are correctly recorded and categorised in the business accounts, often using software like Xero. This includes quality control steps like bank reconciliation to double-check the data is correct. Bookkeepers often run monthly reports to show owners how the business is doing.

Some bookkeepers also issue and pay bills, run payroll, and support tax reporting for the business. Increasingly, they’ll help business owners analyse financial reports and work up strategies to improve business performance.

What accountants do

Accountants have specific training in financial analysis and often also in tax law. They prepare official end-of-year financial reports such as income statements (also known as profit and loss statements), balance sheets, and cash flow statements.

Because of their deep familiarity with accounting reports and their analytical training, accountants often provide several kinds of complex financial advice and practical management advice. Accounting practices may also provide bookkeeping services.

The difference between accountants and bookkeepers

A bookkeeper used to prepare accounts for an accountant to run the reports, provide the analysis, and do the taxes. The handover is not so clear anymore.

Many bookkeepers now offer a wider range of services, depending on the formal training and experience they’ve attained. As a general rule, however, bookkeeping qualifications don’t require the same level of financial, analytical, or tax training as an accountant. Many businesses will have a bookkeeper and an accountant – giving specific responsibilities to each.

Handy resources

Advisor directory

You can search for experts in our advisor directory

When you should hire a bookkeeper

Find out all the things bookkeepers can do for your business

Xero dashboard

See your key information on the business dashboard

Disclaimer

This glossary is for small business owners. The definitions are written with their requirements in mind. More detailed definitions can be found in accounting textbooks or from an accounting professional. Xero does not provide accounting, tax, business or legal advice.

See related terms

Handy resources

Advisor directory

You can search for experts in our advisor directory

When you should hire a bookkeeper

Find out all the things bookkeepers can do for your business

Xero dashboard

See your key information on the business dashboard

Disclaimer

This glossary is for small business owners. The definitions are written with their requirements in mind. More detailed definitions can be found in accounting textbooks or from an accounting professional. Xero does not provide accounting, tax, business or legal advice.