Making Tax Digital for Income Tax beta resource hub

Welcome to Xero’s resource hub, where you’ll find everything you need to know for you and your clients about being part of HMRC’s MTD for Income Tax beta with Xero.

Why there is a beta

This beta is an important step in preparing for the April 2026 mandate, and we’d love you to be part of it. It gives partners early access to new features and the chance to influence the final product. A beta is a testing phase – both HMRC and Xero are trialling and refining the end solution.

Who can join the beta

To sign up your clients to the beta, you need to be part of Xero’s partner programme. All taxpayers wanting access to the beta with Xero must first:

- Be eligible and signed up with HMRC

- Have a Xero business plan subscription (Xero Simple, Ignite, Grow, Comprehensive or Ultimate)

- Must not have complex personal tax needs, such as losses, capital gains or state benefits

HMRC eligibility

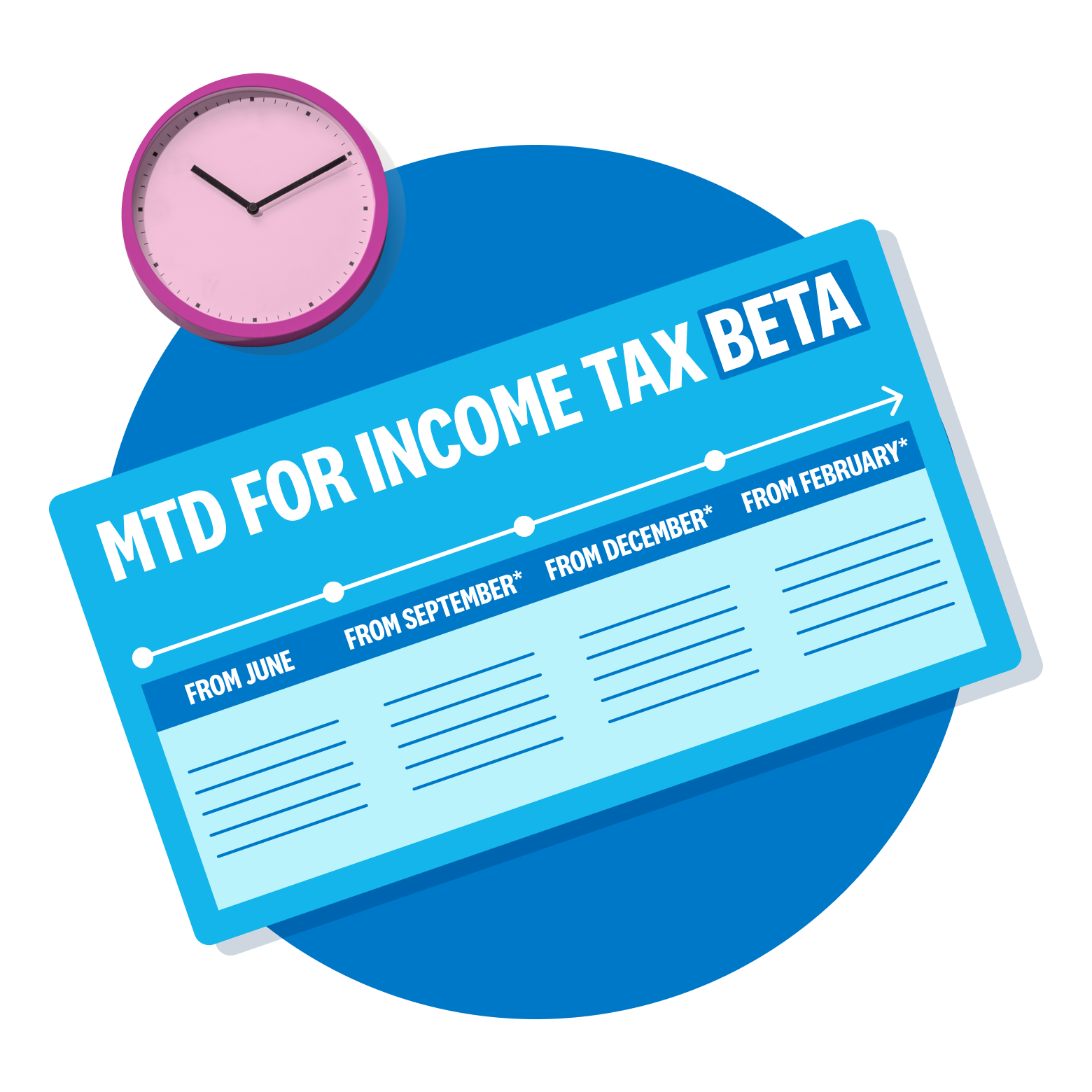

HMRC is rolling out the 2024/25 beta in phases, so not all taxpayers are eligible. Full functionality will be in place April 2026.

Check HMRC beta eligibility criteria for your clientXero partner programme

If you're not already part of the partner programme join over 250,000 accountants and bookkeepers using Xero.

Join the partner programme

How access to the beta is being managed

To ensure a smooth onboarding experience, we're enabling access to the beta in phases, based on business type and reporting complexity.

Once you register a client

If eligible, you’ll get MTD for IT beta access for that client once onboarding starts. We’ll confirm by email.

What to do while waiting for access

While you and your clients are waiting to get onboarded onto the beta, here are a few things you can do to prepare:

- Encourage digital record keeping – clients should start keeping digital records now so they’re ready for quarterly updates once onboarded

- Understand penalties – in the 2025-26 beta, late quarterly updates won’t incur penalties. New penalties still apply for late 25/26 tax returns and payments

- Stay informed – we’ll send you a monthly progress email to update you on your clients’ onboarding status

What’s next after onboarding

Once we enable MTD for Income tax access for your clients in Xero, you’ll be able to test immediately. While taking part in the beta, you and your client will be able to:

- Keep digital records of their income and expenses in Xero

- Submit quarterly updates and a final declaration to HMRC – all from within Xero

- Provide direct feedback to our product team

- Have full support from our team throughout the beta

Ready to join? Follow the steps below to get started

Step 1: Select and sign up clients with HMRC

Check your clients meet HMRC’s beta eligibility and sign them up for the 2025-26 tax year.

Check HMRC eligibilityStep 2: Register client details in Xero

Fill out the Xero registration form with info about your selected clients.

Complete registration formStep 3: Wait while we verify client eligibility

We'll check your client details to confirm they meet the eligibility criteria and then determine which onboarding phase they'll be part of.

See onboarding phasesStep 4: We'll confirm access by email

Once a client is onboarded, we’ll email you so you can start using MTD for Income Tax in Xero.

Step 5: Prepare clients for digital submissions

Clients should be keeping digital records to make submitting quarterly updates to HMRC in Xero seamless.

Resources to support your MTD clients

Xero Simple, a plan for non-VAT clients

Xero Simple is the perfect plan for your non-VAT clients who need an easy way to manage MTD for Income Tax

MTD for Income Tax guide for your clients

Everything your clients need to know about MTD for Income Tax explained.

MTD for Income Tax client email templates

These templates are designed to help you explain MTD for Income Tax to your clients.

Beta FAQs

To join the MTD for Income Tax beta, your clients must meet HMRC's criteria: UK residency with a National Insurance number, at least one submitted self-assessment tax return, an accounting period ending 31 March or 5 April, and up-to-date tax records with no outstanding liabilities. You must select the 2025–26 tax year when signing them up with HMRC, HMRC also specifies exclusions - please check these before signing up. Please note that to sign clients up and participate on Xero, you must be a Xero partner and your clients must have a Xero business edition subscription and simple personal tax needs.

Check HMRC eligibility criteriaTo join the MTD for Income Tax beta, your clients must meet HMRC's criteria: UK residency with a National Insurance number, at least one submitted self-assessment tax return, an accounting period ending 31 March or 5 April, and up-to-date tax records with no outstanding liabilities. You must select the 2025–26 tax year when signing them up with HMRC, HMRC also specifies exclusions - please check these before signing up. Please note that to sign clients up and participate on Xero, you must be a Xero partner and your clients must have a Xero business edition subscription and simple personal tax needs.

Check HMRC eligibility criteriaTo choose clients for the MTD for Income Tax beta, consider those with a range of income types and situations, such as single self-employment or UK property businesses, those using different agents for updates and declarations, clients with multiple businesses using a single Xero subscription, and those with income from jointly-owned or foreign property. However, avoid clients with complex personal tax affairs or those whose tax information is only available close to the January filing deadline. Note we are onboarding clients in phases based on their business type and reporting complexity, so clients may not get immediate access.

Find out moreTo choose clients for the MTD for Income Tax beta, consider those with a range of income types and situations, such as single self-employment or UK property businesses, those using different agents for updates and declarations, clients with multiple businesses using a single Xero subscription, and those with income from jointly-owned or foreign property. However, avoid clients with complex personal tax affairs or those whose tax information is only available close to the January filing deadline. Note we are onboarding clients in phases based on their business type and reporting complexity, so clients may not get immediate access.

Find out moreTo complete the Xero registration form for the MTD for Income Tax beta, you'll need to provide client details, including information about their self-employment and/or property businesses, detailing all businesses if they have multiple. You'll need to specify your agent authorisation status, indicating whether you're the main agent (where you’ll have full access to all services, including final declaration) or a supporting agent (quarterly updates only). You'll also need to let us know if their personal tax needs are simple or complex, ensuring their full tax needs are met during the beta. You can register up to 5 clients per form, with the option to submit additional forms for more clients.

Register clients onto the betaTo complete the Xero registration form for the MTD for Income Tax beta, you'll need to provide client details, including information about their self-employment and/or property businesses, detailing all businesses if they have multiple. You'll need to specify your agent authorisation status, indicating whether you're the main agent (where you’ll have full access to all services, including final declaration) or a supporting agent (quarterly updates only). You'll also need to let us know if their personal tax needs are simple or complex, ensuring their full tax needs are met during the beta. You can register up to 5 clients per form, with the option to submit additional forms for more clients.

Register clients onto the betaFirstly, you’ll need to have successfully signed up your clients with HMRC and then registered them with Xero. If a client is eligible and they meet the criteria of the business type and reporting complexity phase we are ready to onboard, we’ll enable MTD for Income Tax in that clients’ Xero organisations. You will be notified by email once that happens. Note: Signing up and registering doesn’t guarantee immediate access – clients will only be enabled once they fall into the current beta onboarding phase.

Sign up your clients with HMRCRegister clients onto the betaFirstly, you’ll need to have successfully signed up your clients with HMRC and then registered them with Xero. If a client is eligible and they meet the criteria of the business type and reporting complexity phase we are ready to onboard, we’ll enable MTD for Income Tax in that clients’ Xero organisations. You will be notified by email once that happens. Note: Signing up and registering doesn’t guarantee immediate access – clients will only be enabled once they fall into the current beta onboarding phase.

Sign up your clients with HMRCRegister clients onto the betaThe new MTD for IT features can be accessed from the Accounting dropdown menu. Users will need the standard or advisor role to access the organisation, and the organisation type must be set to ‘Person’ or ‘Sole trader’. Please check the organisation details if you don’t see the beta features in the menu.

How to update your organisation's detailsThe new MTD for IT features can be accessed from the Accounting dropdown menu. Users will need the standard or advisor role to access the organisation, and the organisation type must be set to ‘Person’ or ‘Sole trader’. Please check the organisation details if you don’t see the beta features in the menu.

How to update your organisation's detailsYou can choose to opt your clients out of the beta at any time via your HMRC online services account. This means you’ll need to complete a self assessment tax return for them as usual. We’d really appreciate that you also let us know by contacting our customer support team with the client’s details, so that we can keep our records up to date.

HMRC beta opt-out processFind out moreYou can choose to opt your clients out of the beta at any time via your HMRC online services account. This means you’ll need to complete a self assessment tax return for them as usual. We’d really appreciate that you also let us know by contacting our customer support team with the client’s details, so that we can keep our records up to date.

HMRC beta opt-out processFind out moreWe appreciate your taking the time to participate in Xero’s MTD for Income Tax beta. Our team is here to support you every step of the way. If you have any questions or run into something unexpected, just reach out to Xero Support as you normally would; we’re here to help and will get back to you as soon as possible.

Find out moreWe appreciate your taking the time to participate in Xero’s MTD for Income Tax beta. Our team is here to support you every step of the way. If you have any questions or run into something unexpected, just reach out to Xero Support as you normally would; we’re here to help and will get back to you as soon as possible.

Find out more

Any other questions?

You’ll find everything you need to know about the beta process on our detailed FAQs page.