Reduce errors and delays with eInvoicing

Exchange eInvoices between the accounting software of UK businesses and government agencies for efficient, secure electronic invoicing.

Instant invoicing.

What eInvoicing is

Go digital with invoices that arrive directly in your Xero accounting software. No more data entry and paper records – just streamlined automation for a fast and accurate process. Register for eInvoicing within Xero and get started for free.

eInvoicing using the Peppol network

Many countries use Peppol’s secure global public network to send eInvoices between accounting systems.

UK government encourages eInvoicing

The UK government is working towards all government bodies being able to accept eInvoices.

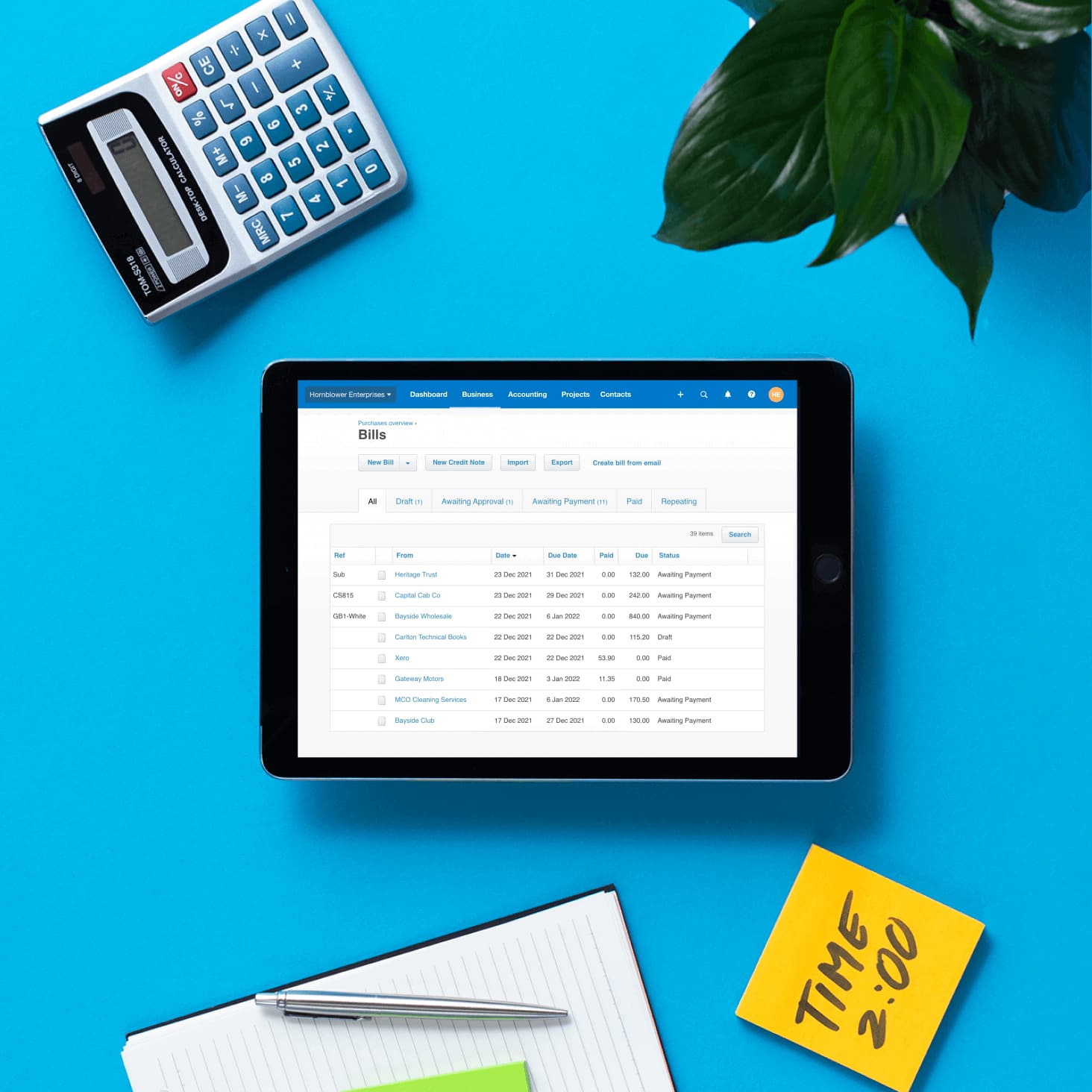

Bills automatically prepopulated

eInvoicing does away with manual entry of bills, reduces errors and delays in getting paid, and lowers costs.

Free registration for eInvoicing

Register with the Peppol network from within Xero to start receiving eInvoices from VAT-registered suppliers.

Benefits of eInvoicing

The benefits of eInvoicing include the following.

- Improves business efficiency for buyers and suppliers

- Makes it quicker and easier to get paid

- Reduces admin costs, fewer delays, and fewer errors

UK government commitment to eInvoicing

The British government encourages businesses to send, receive, and process eInvoices when making B2G transactions.

- Except for the National Health Service (NHS), there’s no requirement to use eInvoicing in the UK

- eInvoicing isn’t mandatory for business-to-business payments

eInvoicing for Xero businesses in the UK

Xero customers can receive eInvoices from businesses and UK government agencies that are registered for eInvoicing.

Learn more about eInvoicing in Xero

More about eInvoicing

Many governments around the world are introducing eInvoicing as a way to drive digitisation of the small business economy, with some regions mandating its use. eInvoicing helps businesses be paid on time by improving the way they interact with each other. Through digitising and using eInvoicing software, businesses can lower their costs and improve payment times. We believe that eInvoicing is set to become a global best practice standard and a natural part of cloud accounting invoicing solutions.

See why governments are promoting eInvoicingMany governments around the world are introducing eInvoicing as a way to drive digitisation of the small business economy, with some regions mandating its use. eInvoicing helps businesses be paid on time by improving the way they interact with each other. Through digitising and using eInvoicing software, businesses can lower their costs and improve payment times. We believe that eInvoicing is set to become a global best practice standard and a natural part of cloud accounting invoicing solutions.

See why governments are promoting eInvoicingIn 2023, Xero became the first major small business accounting software company to launch eInvoicing in the UK, starting with businesses being able to receive their monthly Xero subscription bill as an eInvoice. The ability to send eInvoices will follow, as the adoption of eInvoicing in the UK increases.

Read the blog announcing Xero eInvoicing in the UKIn 2023, Xero became the first major small business accounting software company to launch eInvoicing in the UK, starting with businesses being able to receive their monthly Xero subscription bill as an eInvoice. The ability to send eInvoices will follow, as the adoption of eInvoicing in the UK increases.

Read the blog announcing Xero eInvoicing in the UKPeppol is mandatory for business-to-government transactions (B2G) across the EU, and in Norway, Iceland and Switzerland. In addition, MBIE in New Zealand, ATO in Australia, MDEC in Malaysia, and IMDA in Singapore have all chosen Peppol as the global network for eInvoicing. Countries are at various stages of adopting eInvoicing as take up accelerates and is accepted as best practice around the world.

Search for registered businesses on the Peppol directoryPeppol is mandatory for business-to-government transactions (B2G) across the EU, and in Norway, Iceland and Switzerland. In addition, MBIE in New Zealand, ATO in Australia, MDEC in Malaysia, and IMDA in Singapore have all chosen Peppol as the global network for eInvoicing. Countries are at various stages of adopting eInvoicing as take up accelerates and is accepted as best practice around the world.

Search for registered businesses on the Peppol directoryCentral Crown Services (CCS) in Wales has estimated that savings of between 48p and £5.40 per transaction, dependent on current systems, can be achieved by eInvoicing through the Peppol network. And as more businesses adopt eInvoicing, the savings to a country’s economy become significant.

Central Crown Services (CCS) in Wales has estimated that savings of between 48p and £5.40 per transaction, dependent on current systems, can be achieved by eInvoicing through the Peppol network. And as more businesses adopt eInvoicing, the savings to a country’s economy become significant.

eInvoicing is included in Xero Ignite, Grow, Comprehensive and Ultimate plans; you don’t need to purchase any additional add-on or external service to use it. Registration is easy and can be completed in a few clicks.

Learn how eInvoicing works in XeroeInvoicing is included in Xero Ignite, Grow, Comprehensive and Ultimate plans; you don’t need to purchase any additional add-on or external service to use it. Registration is easy and can be completed in a few clicks.

Learn how eInvoicing works in Xero

Set up for eInvoicing with Xero

Get started in a few simple steps if you’re on any Xero business edition plan.

Register to receive eInvoices

Register with the Peppol network from within Xero using your VAT number.

Get ready to send eInvoices

In Xero, enter your own and your customer’s VAT number, and check they’re registered with the Peppol network.

Watch for draft bills in Xero

Check regularly for eInvoices that have arrived in Xero as bills to pay. Then just approve and pay the bills.

See how to receive eInvoices and what to do when you receive them

Try Xero free for 30 days

Access Xero features for 30 days, then decide which plan best suits your business. Note: eInvoicing isn’t available in the free trial.