Professional tax software for accounts & tax compliance

Take control of accounts and tax returns for companies, partnerships and individuals in one place, in the cloud, with Xero Tax.

Manage tax returns

Produce corporate, partnership and personal tax returns.

Share data across Xero

Data flows between books, accounts and tax returns.

Produce accounts easily

Streamline clients’ accounts production.

Submit returns online

File tax returns and accounts from Xero Tax.

Partnership tax is now live

Partnership tax enables you to serve more of your client base in one place. No need for multiple, disconnected tools.

Manage tax returns

Xero Tax streamlines compliance by making it much faster to prepare and file accurate accounts and tax.

- Connect to bookkeeping data from Xero

- Produce and file accounts

- Prepare and file company, partnership and personal tax returns

Share data across Xero

Data flows easily between Xero and Xero Tax which keeps data entry to a minimum.

- Data is protected by multiple layers of security

- Client details and accounts data flow from Xero into Xero Tax

- Import trial balance amounts from Xero accounts into tax returns

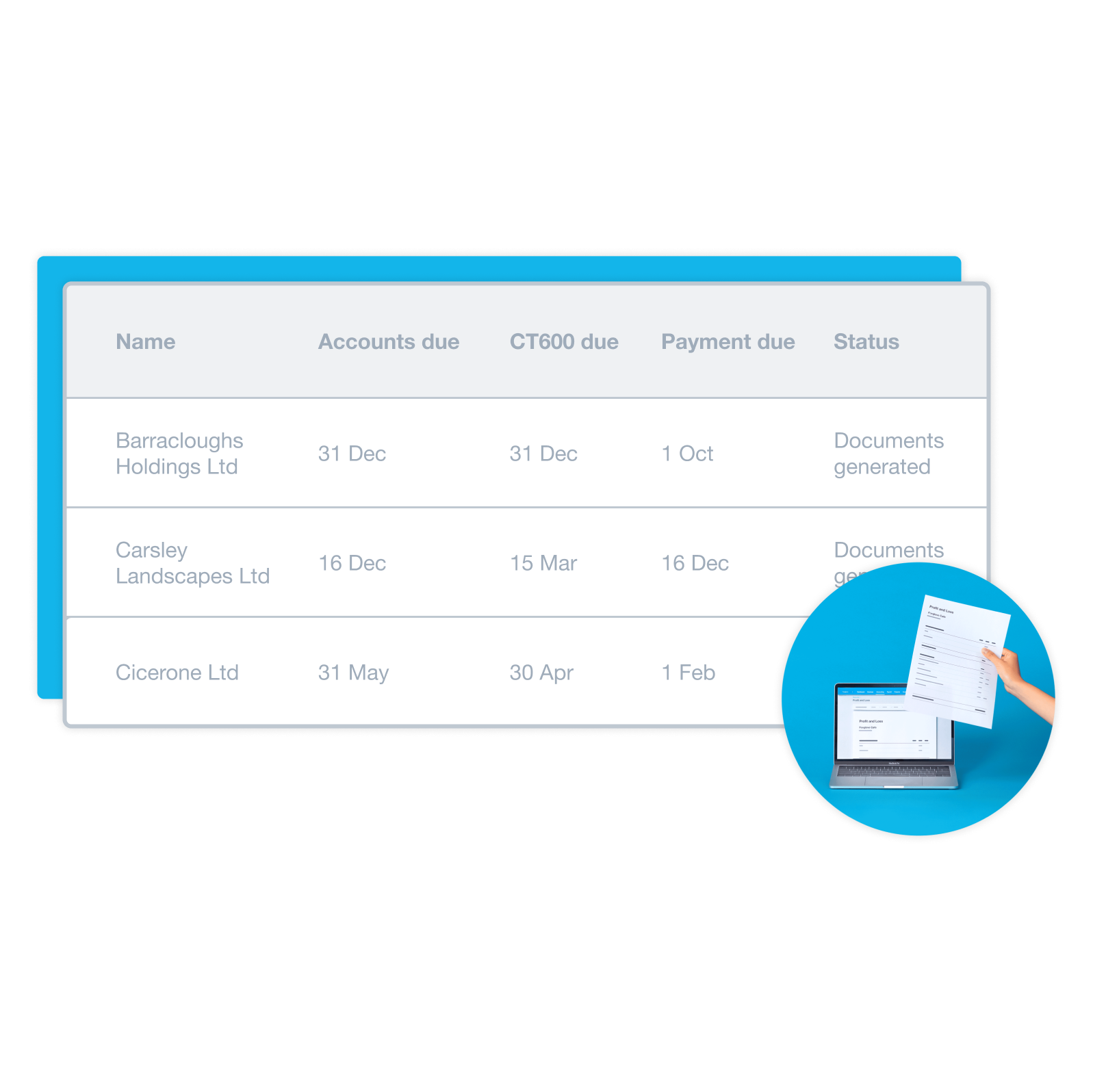

Produce accounts easily

Streamline accounts production for sole traders and partnerships, as well as companies.

- Populate company accounts and tax returns from Xero’s core data

- Retrieve data from Companies House to populate company accounts

- Produce accounts for sole traders, with income schedules populated from Xero

- Produce accounts for partnerships, with data populated from Xero

Submit returns online

File annual accounts and tax returns for company and individual clients directly from Xero Tax.

- Submit corporate tax returns for company clients to HMRC

- Submit partnership tax returns for partnership clients to HMRC

- Submit personal tax returns for individual clients to HMRC

- File company accounts with Companies House direct from Xero

"The way Xero has structured partnership tax is brilliant. It's clean, it's simple, it works. The amount of time it's saved me is phenomenal."

Andy Housley, Square 1 Accounting

Read the case study

More about Xero Tax

No special connection is needed. Just enable Xero Tax in Xero HQ and give staff access. Xero Tax uses your existing Xero login details.

See how to set up Xero TaxNo special connection is needed. Just enable Xero Tax in Xero HQ and give staff access. Xero Tax uses your existing Xero login details.

See how to set up Xero TaxXero Tax is only available to our UK Xero partners, check what features and forms Xero Tax supports.

Find out moreXero Tax is only available to our UK Xero partners, check what features and forms Xero Tax supports.

Find out moreTo help you get going, we’ve created a handy all-in-one downloadable guide containing best practices.

Download the guideTo help you get going, we’ve created a handy all-in-one downloadable guide containing best practices.

Download the guideJoin our Xero experts for a live webinar where they’ll walk you through Xero Tax with a live Q&A at the end.

Register for webinarJoin our Xero experts for a live webinar where they’ll walk you through Xero Tax with a live Q&A at the end.

Register for webinarAccess our comprehensive Become a Xero Tax specialist self-paced course anytime, anywhere. This course covers how you can prepare your accounts and returns for company, personal and sole-trader clients.

Learn at your own paceAccess our comprehensive Become a Xero Tax specialist self-paced course anytime, anywhere. This course covers how you can prepare your accounts and returns for company, personal and sole-trader clients.

Learn at your own paceHear how Paras Shah, Workflow Manager at DSK Partners, has achieved time savings of 25% since adopting Xero Tax.

Watch the case studyHear how Paras Shah, Workflow Manager at DSK Partners, has achieved time savings of 25% since adopting Xero Tax.

Watch the case study

Start using Xero Tax for free

Xero Tax is included in Xero HQ. It’s available to accountants and bookkeepers in practice – at no extra cost – as part of the Xero partner programme.