Tackling unapproved debt

Six recommendations for dealing with the late payments crisis

Looking for a print version? Download a PDF copy of this page. Tackling unapproved debt (PDF, 354kb)

Introduction: a decades-old crisis

For decades small businesses have been struggling to get hold of the money they are owed. And the problem isn’t getting any better. Some 59 per cent of small business owners experienced big business customers increasing their payment terms during the pandemic. Too often it’s a case of the bigger the firm, the bigger the problem. Companies in the FTSE 350 pay up seven days later than smaller firms, on average.

The economy depends on small firms to create new jobs. So this isn’t good enough. We need to ensure small firms are allowed to have, and use, the money they have already earned and which should already be theirs.

Instead, too much of small firms’ working capital is tied up in big firms’ late payments. This often forces small firms to seek alternative and expensive sources of finance. This inhibits their ability to grow at the pace they could (and should). At Xero, we have long played our part in helping to tackle the late-payments problem. We have helped innovate technology that makes it easier than ever to pay on time. But we want to do more.

So we convened the “late payments task force”, which first met in September 2021. The group consists of eminent experts from the worlds of business, academia, psychology and media. The group produced a series of recommendations to help end the late payments crisis. These were discussed more broadly at a public event on 7 October 2021.

Some of these are recommendations for government to discuss and implement. Others can be taken forward by all those who have a stake in ensuring small businesses can get hold of the money they have earned and are owed. This report sets out the recommendations and the background to developing them. Finally, we explore how Xero will continue to champion the recommendations and support small businesses in getting hold of the money they are owed.

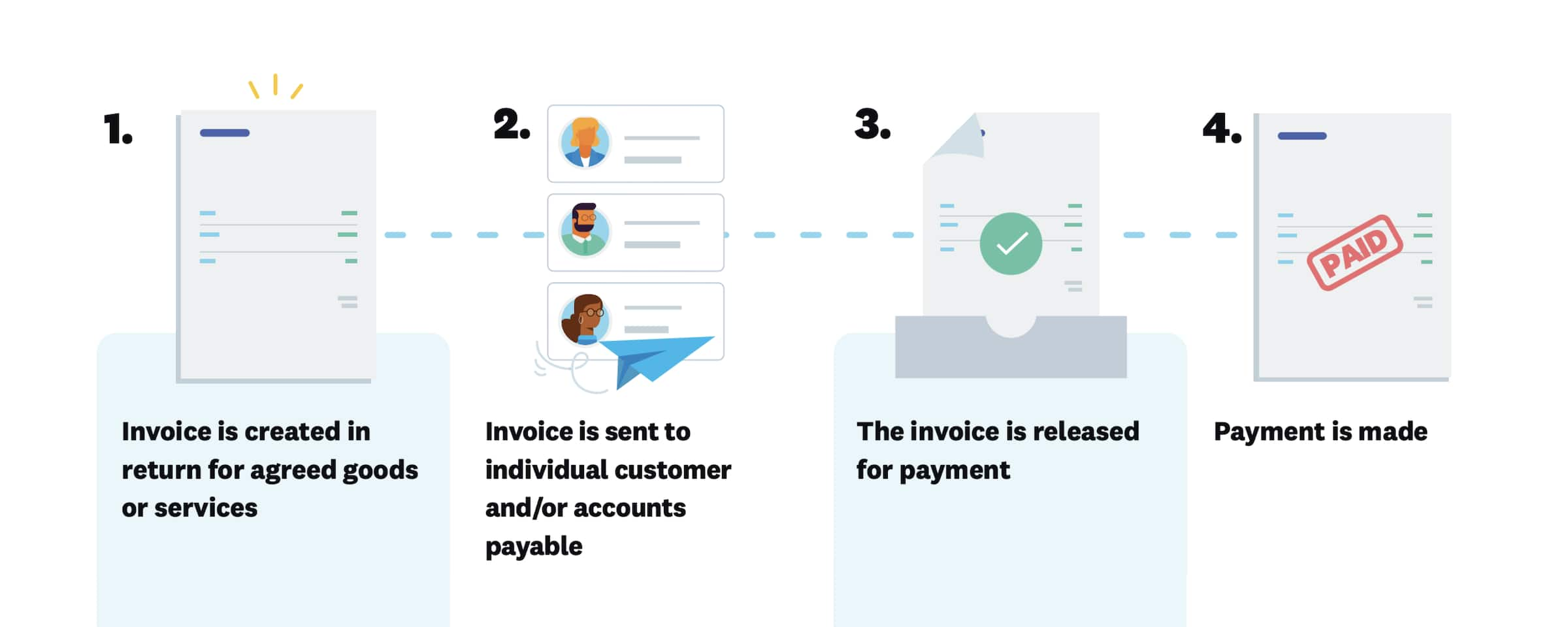

The life cycle of an invoice

Ahead of our roundtable discussion, we reviewed the existing literature on late payments. This helped us identify insights to shape and inform our understanding. It is critical to properly understand the different causes for late payments, at different points in the payment cycle. Different causes point to different solutions. To this end, we developed our analysis based on the “life cycle of an invoice”.

This sets out the four key stages of an invoice’s journey within the payment process. It looks at the common causes of delay at each stage and briefly notes ideas that could accelerate it. Too often, the debate on late payment focuses on incidental causes, leading to ineffective solutions. This approach anchored the debate during the subsequent discussions.

Step 1: The invoice is created in return for agreed goods or services

- Work is agreed and done. A purchase order (PO) may be raised.

- Potential delays include: Unsatisfactory work, or delays with the purchase order.

- Potential accelerants include: Ensuring the purchase order is in place in good time, and understanding the customer processes.

Step 2: The invoice is sent to the individual customer and/or accounts payable

- The invoice is approved by the client who is responsible for payment.

- It is addend into the payment system.

- The invoice is matched against a purchase order.

- Potential delays include: When the invoice is not forwarded internally, or it does not match the purchase order.

- Potential accelerants include: Internal efficiency and training.

Step 3: The invoice is released for payment

- The invoice is released subject to the customer organisation's written payment terms.

- The invoice is subject to the customer organisation's business practices.

- Potential delays include: "Prudential" cash flow policy.

- Potential accelerants include: Management will, legal threats, voluntary best practice, regulatory pressure or reporting requirements.

Step 4: Payment is made

- The payment is made subject to the customer's payment cycle.

- Potential delays include: Irregular payment cycles

- Potential accelerants include: Streamlining internal payment processes.

Convening the late payments task force

The initial late payments task force roundtable debate centred around the “life cycle of an invoice”. This was followed up by a public event for further discussion. The task force consisted of:

- Kara Curtayne FICB MAAT - Director at Karaccounts LTD

- Dr Alexandra Dobra-Kiel - Banking & Capital Markets Insight Lead at Deloitte UK

- Dr Veronika Koller - Professor of Discourse Studies at Lancaster University

- Pritesh Mody - Cocktail Developer & Founder of World of Zing

- Simon Read - Journalist and Author

- Dr Audrey Tang - Chartered Psychologist and Author

- Gary Turner - Previous Managing Director at Xero

Both roundtable and public discussion was chaired by Philip Salter, founder or The Entrepreneurs Network.

Recommendations

The task force has issued the following recommendations.

Rename late payment “unapproved debt”, to call it what it is

- The expression “late payment” legitimises poor practice

- It should be renamed “unapproved debt” to draw attention to bad practice

- The Government should run a national promotional campaign to establish “unapproved debt” as the common term

- Regardless of what is agreed in individual contracts, often on a “take it or leave it basis”, 30 days should be deemed the fair time for payment. Anything beyond should be classed as unapproved debt

- Businesses should start using “unapproved debt” in their language

- Other organisations that are concerned about the issues, should use the same language

Build transparency into regulation and reporting

- Large firms should be required to set out in their annual reports how much unapproved debt they are carrying (based on the working assumption that payments should be made in 30 days, regardless of agreed terms which can run to hundreds of days)

- This should be included in the annual report in a way that is clear and obvious. It should not be buried or hidden away

- Where firms do not pay within 30 days, they simply need to explain why not. It does not make paying within 30 days compulsory. It’s a case of “comply or explain why”

- Credit ratings firms should be encouraged to factor the amount of unapproved debt into credit scoring (remember Carillion)

- The Government could engage FTSE350 CEOs and CFOs to enhance their reporting on unapproved debt, and to confirm they are comfortable with how their firms treat their suppliers

Redefine great workplaces to include how suppliers are treated

- Firms rightly give a great deal of attention to how they treat their workforce, recognising that it is a hallmark of what it means to be a good company, and critical to attracting and retaining the best people

- This approach should be expanded to include their suppliers and members of the non-employee workforce

- To truly be a responsible company, and a good employer, firms should also address how they treat their smaller partners

- Providers of “great workplace” awards and best practice, should be encouraged to include how they treat their suppliers in their criteria

- They could create websites or apps where small firms can rate their payment experiences with big companies to help draw attention to the issue

Corporate reputation and publicity as a sanction

- In recent years, companies have dramatically changed their approach to sustainability, diversity and their local community

- In part, these changes have resulted from increased social and media pressures, which have encouraged firms to act for the sake of their communities and reputation

- Too often, the small business owners that depend on prompt payment are faceless and lack public sympathy. Yet the human cost of late payment is significant

- Instead of storing their data on an obscure website, government should use their data to create a “late payments league”. This would make it easier to draw attention to this issue, call out bad practise and celebrate good payers. This league should be promoted with press releases and social media

- The big environmental, social and governance (ESG) agencies should factor in unapproved debt into a company’s ESG rating

Underpin legislation with a fair buyers’ act

- New legislation should prevent large firms from increasing payment times for their small business suppliers

- Too often, terms of 60, 90 or even on occasion 360 days are enforced on small firms. A standard of 30-days should be set

- Legislate on this issue, and ensure that big businesses pay their small business suppliers on time

- Until that legislation has passed, 30 days should be taken as the fair level, regardless of what might be agreed in individual contracts

Sourcing better education to inform best practice

- Build this into all small business training and support

- Accountants can help businesses to set up efficient payment systems

- Government should do more to promote the role of accountants as strategic advisors to small businesses. This is the best way of giving a wide range of firms access to valuable coaching by tapping into a readymade network of advisers who understand the issues they face. The UK’s accountancy network is uniquely placed to provide this service

Start using Xero for free

Access Xero features for 30 days, then decide which plan best suits your business.