Take payments on tap with Tap to Pay on Xero

Say goodbye to chasing payments with Xero, the first major accounting platform to offer Tap to Pay, powered by Stripe.

Accept payments on the spot

Simplify your payment process with Stripe and Xero, by accepting in-person payments once the work is done. This way, you spend less time chasing payments and more time getting paid.

No physical terminal needed

Send invoices and receive payments from customers via Stripe using the Xero Accounting app on your mobile.

Go paperless for reduced admin

With less paperwork comes less admin. Create a new invoice or select an existing unpaid invoice to take payment. Once payment is made, the invoice is automatically marked as paid, ready to reconcile.

Another secure way to get paid

Get end-to-end sales and secure payments with Xero. Offering more ways to pay makes you look more professional. Once you’ve set up your invoice, payment is only a tap away.

Using Tap to Pay is easy

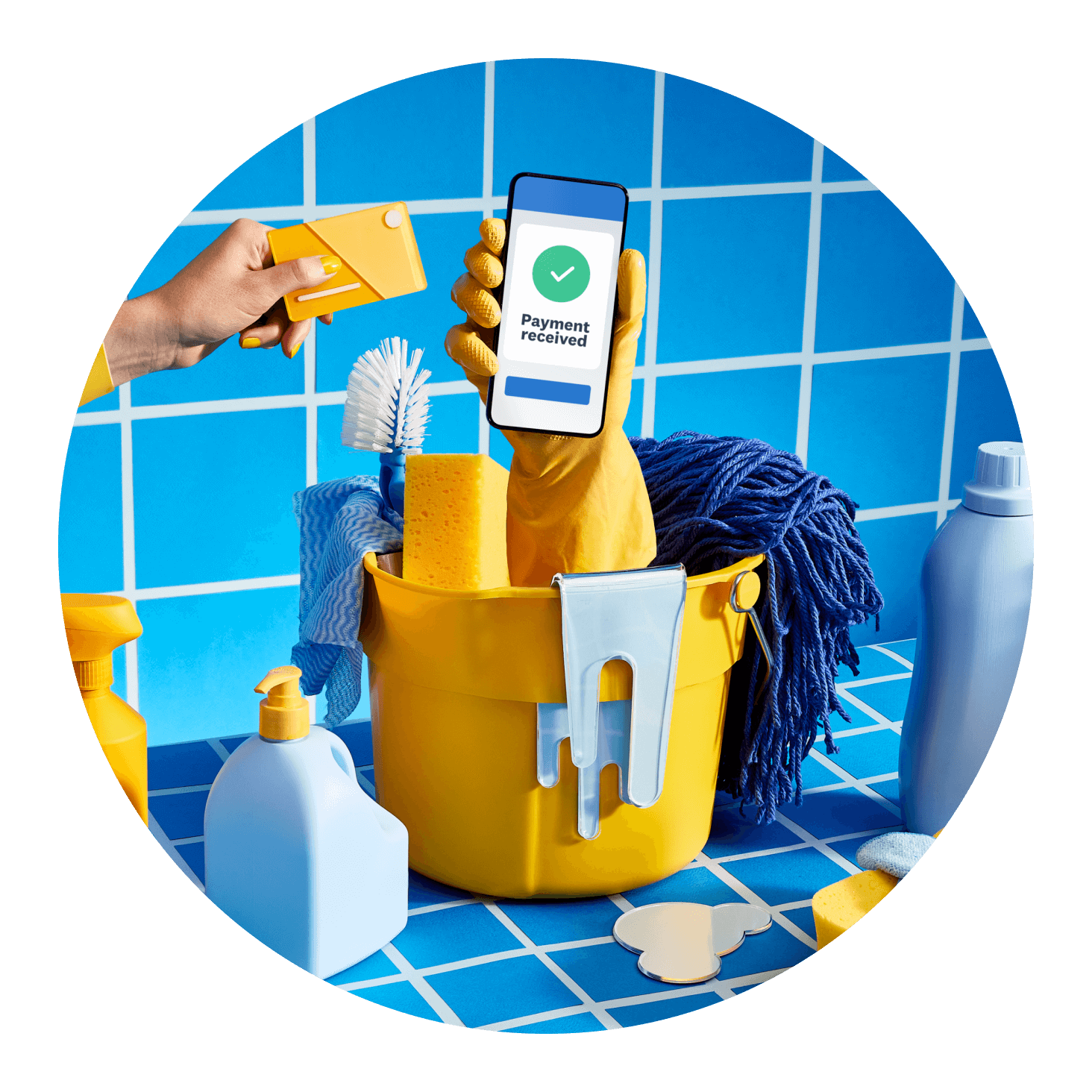

Your customers can pay with a physical card, digital wallet, or a wearable device like a smartwatch.

1. Take payment

Create an invoice in the Xero Accounting app and select ‘Take payment’. The customer pays you.

2. Optionally, send a receipt

After payment, you can send a receipt to your customer.

3. Reconcile the paid invoice

The invoice is automatically marked as paid in Xero, ready for reconciliation.

More about Tap to Pay with Xero

Use Tap to Pay on Android to accept payments from customers using contactless physical cards; digital wallets or wearable devices like smartwatches.

See how Tap to Pay on Android worksUse Tap to Pay on Android to accept payments from customers using contactless physical cards; digital wallets or wearable devices like smartwatches.

See how Tap to Pay on Android worksWith Tap to Pay on iPhone you can accept contactless payments right on your iPhone—from physical debit and credit cards to Apple Pay and other digital wallets.

See how Tap to Pay on iPhone worksWith Tap to Pay on iPhone you can accept contactless payments right on your iPhone—from physical debit and credit cards to Apple Pay and other digital wallets.

See how Tap to Pay on iPhone worksSmall businesses can accept contactless payments with physical cards, digital wallets, or wearable devices like smartwatches. This can be done straight from the Xero Accounting app on a mobile phone, once an invoice has been raised.

Small businesses can accept contactless payments with physical cards, digital wallets, or wearable devices like smartwatches. This can be done straight from the Xero Accounting app on a mobile phone, once an invoice has been raised.

There are no sign-up, setup or monthly costs included. However, there is a Stripe fee charged by Xero once your customer makes payment. The fees are 1.4% + £0.20 per transaction for European Economic Area (EEA) cards and 2.9% + £0.20 per transaction for non-EEA cards.

There are no sign-up, setup or monthly costs included. However, there is a Stripe fee charged by Xero once your customer makes payment. The fees are 1.4% + £0.20 per transaction for European Economic Area (EEA) cards and 2.9% + £0.20 per transaction for non-EEA cards.

Passing on card processing fees to customers is generally not permitted in the UK. While the option to enable surcharging is available in Xero Web, it's the responsibility of each business to ensure compliance with local regulations. If you're unsure, we recommend seeking legal or financial advice before applying any surcharges.

Passing on card processing fees to customers is generally not permitted in the UK. While the option to enable surcharging is available in Xero Web, it's the responsibility of each business to ensure compliance with local regulations. If you're unsure, we recommend seeking legal or financial advice before applying any surcharges.

Xero is launching Tap to Pay in partnership with Stripe. To use it, you’ll need a Stripe account and the Xero Accounting app on your mobile phone. Both are free to download and easy to set up. Tap to Pay isn't currently available for users with multiple Stripe accounts connected to their organisation.

Xero is launching Tap to Pay in partnership with Stripe. To use it, you’ll need a Stripe account and the Xero Accounting app on your mobile phone. Both are free to download and easy to set up. Tap to Pay isn't currently available for users with multiple Stripe accounts connected to their organisation.

Tap to Pay supports payments made using physical cards, a digital wallet or a wearable device.

Tap to Pay supports payments made using physical cards, a digital wallet or a wearable device.

Start using Xero for free

Access Xero features for 30 days, then decide which plan best suits your business.