Stripe Promotion Terms & Conditions - Free Online Invoice Payments for 60 Days

1. This offer is open to Xero subscribers who have a current Xero subscription during the Promotion Period, residing in Australia, New Zealand, United Kingdom, the United States, and Canada and who have not connected a Stripe payments service account in Xero and have received the message with this Promotion (“Eligible Subscriber”).

2. To claim this offer, the Eligible Subscriber must set up a new Stripe account, managed by Xero, between 12:01am on 1 November 2025 and 11:59 pm on 20 December 2025 (PDT). The Stripe Account must be set up in the same country as the Xero subscription (i.e. Australia, United Kingdom, the United States, Canada or New Zealand).

3. Once set up, the Eligible Subscriber will not be charged the fees for the Eligible Transactions listed in the table below, for any invoice sent from Xero, for the earlier of:

a) 60 days; or

b) until the Eligible Subscriber reaches the Total Transaction Volume Limit.

4. At the end of 60 days, or once the Eligible Subscriber has reached the Total Transaction Volume Limit, the standard transaction fees, listed for the region the Eligible Subscriber resides in here, will apply to every transaction.

5. The Total Transaction Volume Limit for the region the Eligible Subscriber is located in, is:

a) Australia: $15,000 AUD

b) United Kingdom: £8,000 GBP

c) United States: $10,000 USD

d) Canada: $10,000 CAD

e) New Zealand: $15,000 NZD

6. To learn more about what constitutes an “Eligible Transaction”, please refer to the table below. Please note that below fees are excluded from the promotion as ineligible transactions:

Australia

Eligible transactions

Online Card Payments

- 1.7% + A$0.30 for domestic cards, GST inclusive.

- 3.5% + A$0.30 for international cards, GST inclusive. (NOTE: The Eligible Subscriber will be charged +2% for international cards if currency conversion is required, exclusive of GST)

Tap to Pay (in person payments)

- 1.7% + A$0.25 per transaction for domestic cards, GST inclusive

- 3.5% + A$0.25 per transaction for international cards

PayTo

- 1.3% + A$0.30 capped at A$5.00, GST inclusive

Zip

- “Pay in N” flexible payments up to 3 months interest free: 5.49% + A$0.30, GST inclusive

Fees excluded from the promotion

Australia Foreign Exchange Fees

- + 2% for international cards if currency conversion is required, exclusive of GST

Instant Payouts

- 1.5% of Instant Payouts volume, exclusive of GST

All other fees will continue to be charged during the Promotion, the fees are outlined here.

UK

Eligible transactions

Online Card Payments

- 1.5% + 20p for standard UK domestic cards (including consumer cards issued by Visa and Mastercard, all cards issued by Discover, Diners Club, and UnionPay)

- 1.9% + 20p for premium UK domestic cards (including commercial, corporate, or business cards issued by Visa and Mastercard, and all cards issued by American Express)

- 2.5% + 20p for European Economic Area cards (NOTE: The Eligible Subscriber will be charged +2% if currency conversion is required)

- 3.25% + 20p for international cards (NOTE: The Eligible Subscriber will be charged +2% if currency conversion is required)

Tap to Pay (in person payments)

- 1.4% + £0.20 per transaction for UK standard & premium domestic cards and European Economic Area (EEA) cards

- 2.9% + £0.20 per transaction for non-EEA cards

Pay by Bank

- 0.5% + 20p, capped at £5

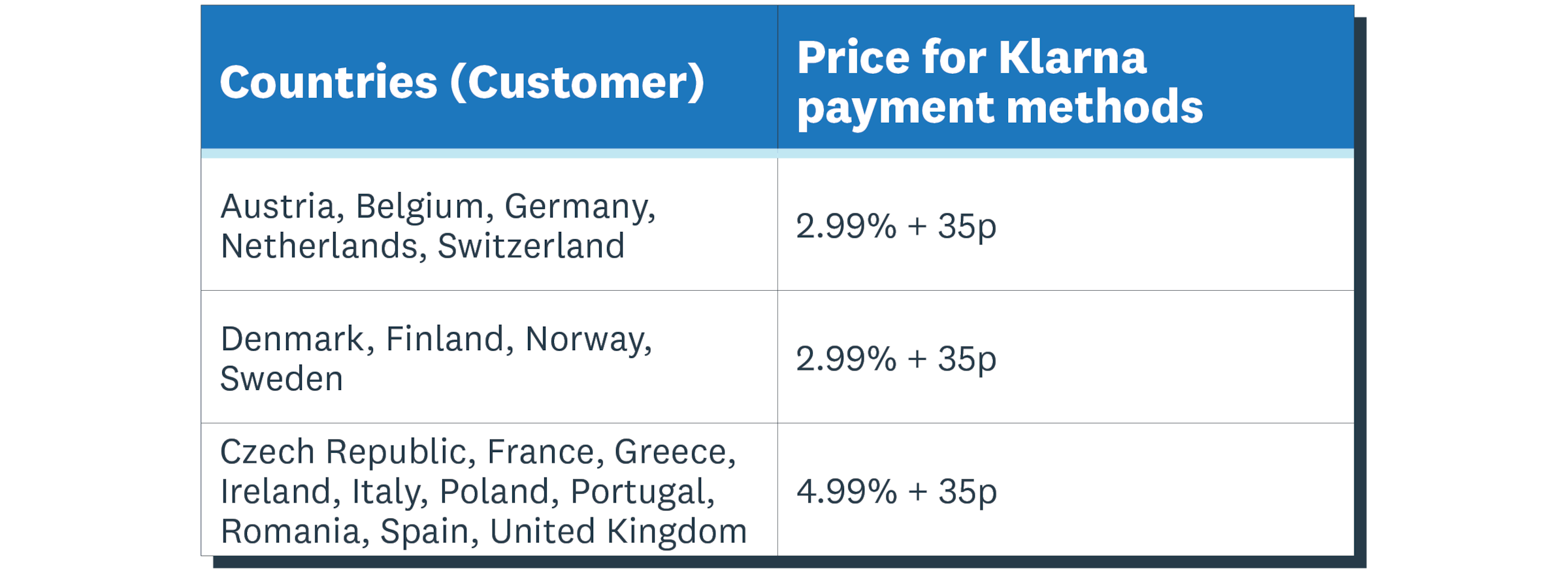

Klarna

- Klarna payment options vary in pricing and availability based on your customer’s country.

Fees excluded from the promotion

Currency conversion

- + 2% if currency conversion is required

Instant Payouts

- 1% of Instant Payouts volume, minimum fee of 40p

Disputes

- £20 fee applies for lost disputes

All other fees will continue to be charged during the Promotion, the fees are outlined here.

United States

Eligible transactions

Cards

- 2.9% + 30c for domestic cards

- 4.4% + 30c for international cards (NOTE: The Eligible Subscriber will be charged +1% for international cards if currency conversion is required)

Bank Transfer

- 0.5% capped at $5.00 per transaction (50¢ fee per successful domestic refund)

- $15.00 per wire payment

ACH Debit

- 1% capped at $9.00 per transaction

Klarna

- 5.99% + 30c fee applies for Klarna payment methods

Tap to Pay (in person payments)

- 2.7% + USD$0.15 per transaction for domestic cards

- 4.2% + USD$0.15 per transaction for international cards

Fees excluded from the promotion

Currency conversion

- + 1% if currency conversion is required

Instant Payouts

- 1.5% of Instant Payouts volume, minimum fee of 50c

Klarna disputes

- $15 fee applies for lost disputes

All other fees will continue to be charged during the Promotion, the fees are outlined here.

Canada

Eligible transactions

Online Card Payments

- 2.9% + C$0.30 for domestic cards

- 3.7% + C$0.30 for international cards (NOTE: The Eligible Subscriber will be charged +2% if currency conversion is required)

Tap to Pay

- 2.7% + C$0.20 per transaction for most cards

- 3.5% + C$0.20 per transaction for international cards

- Interac debit cards are C$0.30 per transaction

Klarna

- 5.99% + C$0.30 fee applies for Klarna payment methods

Fees excluded from the promotion

Currency conversion

- + 2% if currency conversion is required

Instant Payouts

- 1% of Instant Payouts volume, minimum fee of C$0.60

Klarna Disputes

- $20 fee applies for lost disputes

All other fees will continue to be charged during the Promotion, the fees are outlined here.

New Zealand

Eligible transactions

Online Card Payments

- 2.7% + NZ$0.30 for domestic cards

- 3.7% + NZ$0.30 for international cards (NOTE: The Eligible Subscriber will be charged +2% if currency conversion is required)

Klarna

- 4.99% + NZ$0.65 fee applies for Klarna payment methods

Tap to Pay

- 2.7% + NZ$0.20 per transaction for domestic cards

- 3.5% + NZ$0.20 per transaction for international cards

Fees excluded from the promotion

Currency conversion

- + 2% if currency conversion is required

Klarna Disputes

- $25 fee applies for lost disputes

All other fees will continue to be charged during the Promotion, the fees are outlined here.

7. Each Xero organization, that is an Eligible Subscriber, is only entitled to one promotion per Xero organization under this offer.

8. If the Eligible Subscriber deletes their Stripe account before the Promotion End Date, then provided they reconnect via the same steps outlined above, and have not reached the Total Transaction Volume Limit, then they can access the remaining benefit, subject to these Terms and Conditions.

Start using Xero for free

Access Xero features for 30 days, then decide which plan best suits your business.