Quick guide to assets and liabilities for small business owners

This guide explains assets and liabilities, and helps with understanding your balance sheet.

Understanding assets and liabilities is key to knowing how much your business is making (its bottom line or net profit). Here’s a rundown to explain both assets and liabilities, so you can understand the numbers on your balance sheet.

What are small business assets?

The assets of your business are everything that it owns. This includes buildings, machinery plants, vehicles, computers, and office equipment. Company assets also include more obvious things like cash, inventory and royalties. For your balance sheet, the more assets your business has, the more your business is likely to be worth, and the healthier it probably is.

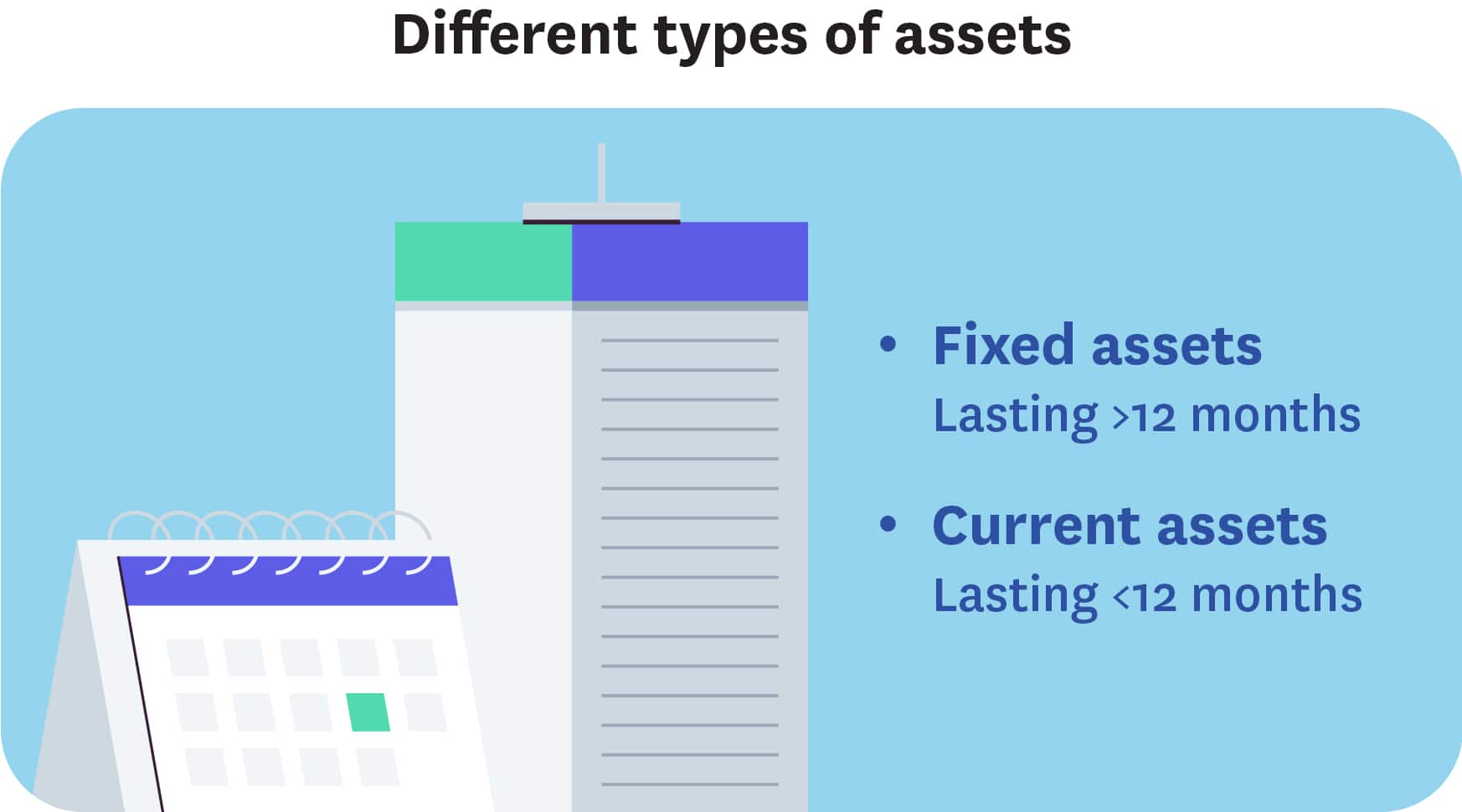

Different types of assets

Your balance sheet shows two types of assets. These are current assets and fixed assets. The main difference is the length of time that they are held by your business. Fixed assets are generally long-term assets that the business will own for longer than a year, while current assets are owned for 12 months or less.

Fixed assets

Fixed assets are also called long-term assets because they are owned for a longer period of time. In terms of your balance sheet, any asset owned, or expected to be owned, for longer than 12 months is a fixed asset.

The two types of fixed assets are tangible and intangible assets:

- Tangible assets are physical assets. These include things such as real estate, commercial vehicles, business equipment and raw materials. Tangible assets can show depreciation as they lose value over time. This affects company profits.

- Intangible assets are non-physical assets. These include items such as copyrights, business patents, and brand value.

Current assets

Current assets are also called liquid assets. They are a short-term asset that is owned for less than 12 months and can easily be converted into cash. These are things used to operate the business day-to-day, and to cover your immediate expenses.

Typical examples of current assets include petty cash, accounts receivable, inventory, and prepaid expenses.

What are small business liabilities?

The liabilities of your business are all of the business' operating costs and financial obligations. They include both current expenses and those in the future. They are the costs you keep an eye on to make sure you can cover them.

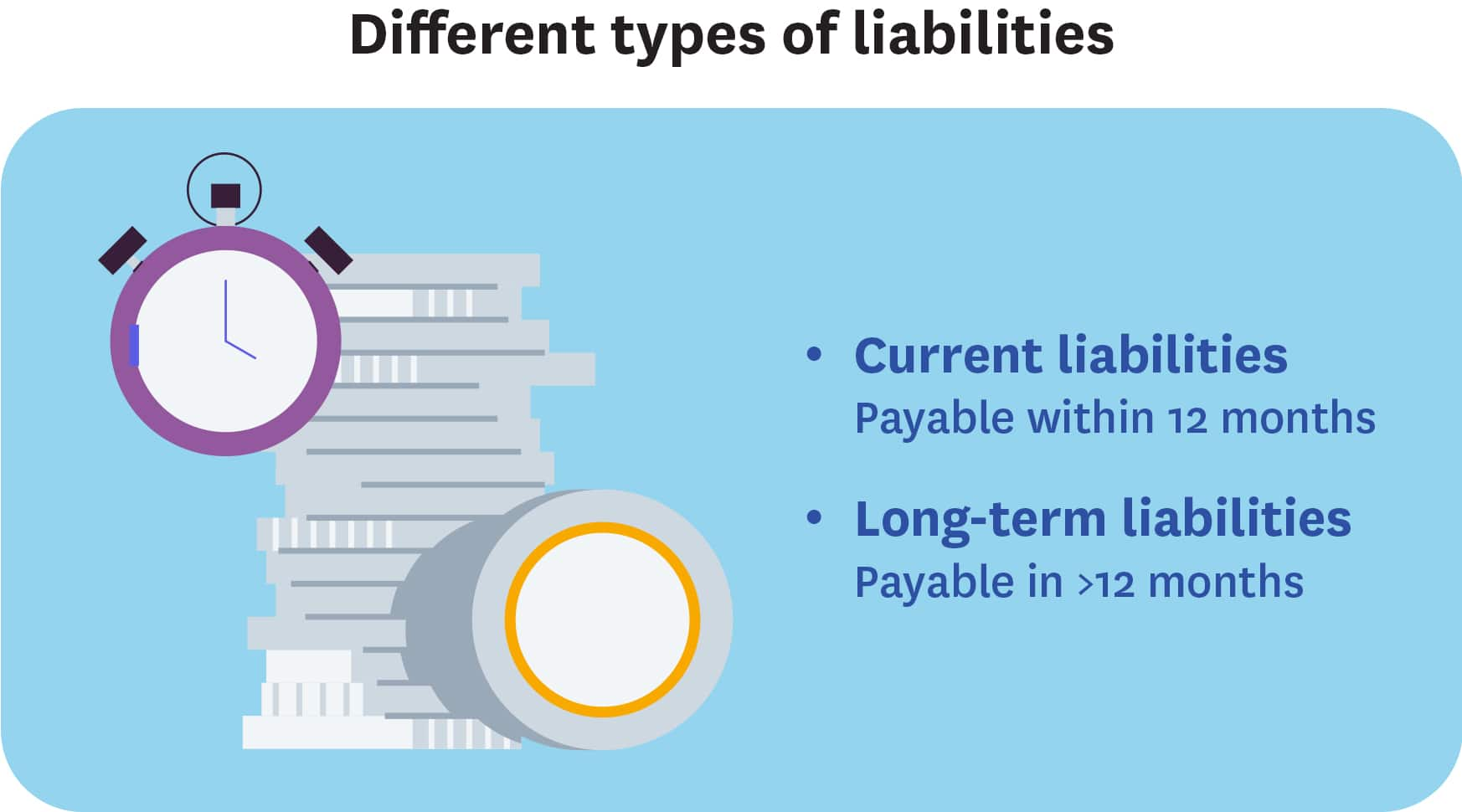

Different types of liabilities

Your balance sheet shows two types of liabilities. These are current liabilities and long-term liabilities. The main difference is that some have to be paid in the immediate future, and some have to be paid in the long-term future. All businesses need to manage debt, and while too much is a bad thing, some debt is normal. Keeping your liabilities lower than your assets is the key to a positive balance sheet.

Current liabilities

Current liabilities are also called short-term liabilities. They are any expenses that your business needs to pay within 12 months and, in reality, usually within a few months. These are the typical expenses that your business incurs in order to operate day-to-day.

Typical examples of current liabilities are your credit card bills, staff salaries, accounts payable, and overdraft fees on your bank account.

Long-term liabilities

Long-term liabilities are also called non-current liabilities. These are the debts your business has that need to be paid in more than 12 months.

Examples of your non-current liabilities include your loans, mortgage, and deferred tax.

Is a liability the same as an expense?

Liabilities are not the same as expenses. They are recorded differently in bookkeeping.

The key difference is that an expense is a cost of doing business to make money, such as rent and utilities. A liability, on the other hand, is what your business owes, but it isn’t actually a cost of doing business. This includes things like loans or taxes payable.

In terms of bookkeeping, liabilities and expenses are shown differently. Liabilities are shown on your balance sheet, whilst your expenses go on your income statement.

Valuing your business – seeing what it’s worth

To establish the approximate worth of your business, use this accounting equation:

Assets = Liabilities + Owner’s equity

To understand this better, you can also use this:

Assets – Liabilities = Owner’s equity

If your total assets are greater than your total liabilities, then your equity is positive. If your liabilities are more than your assets, then you have a problem and need to take immediate action.

Owner’s equity is the business’s net worth. Knowing your net worth can be important if you are applying for a loan or looking for investors. They will want to know how your business is doing and if it’s financially viable.

Accounting for your assets and liabilities

Both your assets and liabilities go on your business’ balance sheet. As the balance sheet uses the double-entry bookkeeping system, both sides of the balance sheet must appear equal. The balance sheet provides you with a summary of your business.

Your balance sheet is divided into two columns. On the left side are your assets, and on the right side are your liabilities and owner’s equity. In accounting, everything has a debit and a credit entry, and if the two sides aren’t equal, there is a problem.

Common errors preventing a balance sheet from balancing can include:

- duplicate entries

- incorrect dates

- forgetting a transaction

- putting the wrong inventory numbers or values

These errors will be in your accounting ledger. Your bookkeeper will need to go back and check so that you can balance your books.

The balance sheet is one of the three main financial statements that organizations use to summarize the financial health of their business. The purpose of the balance sheet is to provide you with a snapshot summary of your business’ assets, liabilities, and equity to show you your current financial position.

Reviewing your balance sheets

It is important to review your balance sheet (and all of your financial statements) regularly with a professional. An accountant can help you understand the financial health of your small business and assist you to determine your future operations and projects. They are a key part of your financial planning process.

Using accounting software such as Xero can help produce your balance sheet, income statement, and profit and loss statement quickly and easily. As the system is automated, there are less likely to be errors, which is essential if you are audited.

Disclaimer

Xero does not provide accounting, tax, business or legal advice. This guide has been provided for information purposes only. You should consult your own professional advisors for advice directly relating to your business or before taking action in relation to any of the content provided.

Start using Xero for free

Access Xero features for 30 days, then decide which plan best suits your business.