Introducing partnership tax

Xero Tax streamlines compliance by making it much easier to prepare and file tax and accounts. Serve even more clients in one place with the addition of partnership tax.

Benefits of partnership tax for your practice

A connected tax workflow

Save time by serving the majority of your client base in one place, with no more switching.

Reduce costs for your practice

The more you can do with Xero Tax, the less you need to spend on additional compliance tools.

Fewer data and filing errors

Validate tax returns with Xero and HMRC to reduce the risk of mistakes.

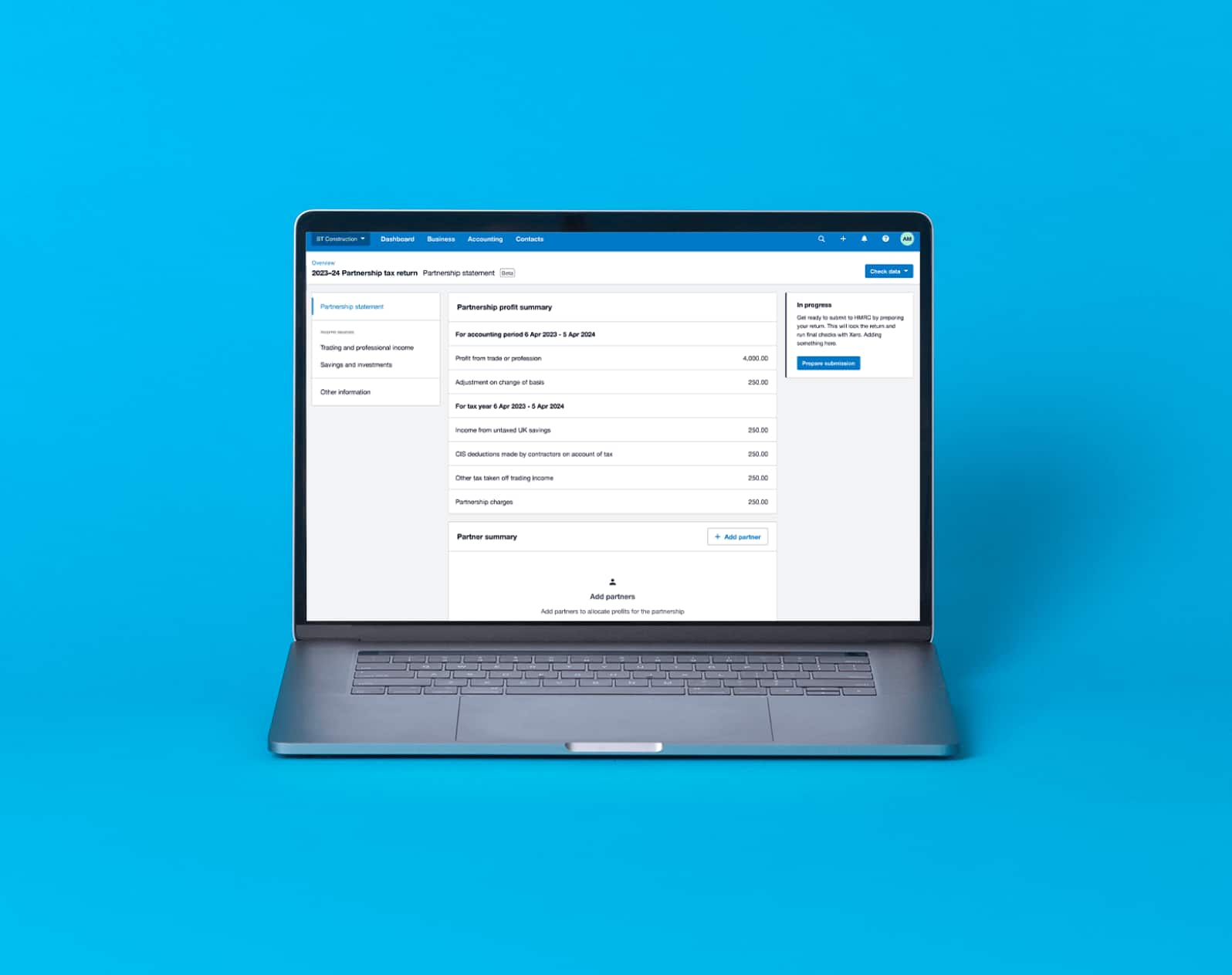

Using partnership tax for your clients

Get started with three easy steps:

1: Review return information

Review pre-populated Xero data and add any additional information.

2: Profit allocation

Allocate partnership profits to individual partners.

3: Check with HMRC and submit

Run checks and submit directly to HMRC to fulfil the obligation.

The way Xero has structured partnership tax is brilliant. It's clean, it's simple, it works. The amount of time it's saved me is phenomenal.

Andy Housley, Square 1 Accounting

Streamline accounts production and tax with Xero

Discover how to streamline accounts production and tax, boost your practice efficiency, plus ask our education specialist any questions.

Watch the webinar

Andy Housley tells us how Xero Tax benefits his practice

Ready to transform your practice?

Enjoy less switching between tools and a more connected tax workflow with your clients.

Explore more Xero Tax resources

Taking control of compliance

How Square 1 Accounting significantly streamlined their tax and accounts filing process with Xero Tax.

Saving time and money

How Box Accounts save at least two hours for each corporation tax return with Xero Tax.

Your complete guide to Xero Tax

Learn how to file accurate accounts and tax returns for corporation, partnership and personal tax.

Partnership tax blog

Learn more about how you can manage most of your clients’ tax needs – corporate, personal, and ordinary partnerships – in one simple, secure platform.

Read the partnership tax blog