Free invoice generator

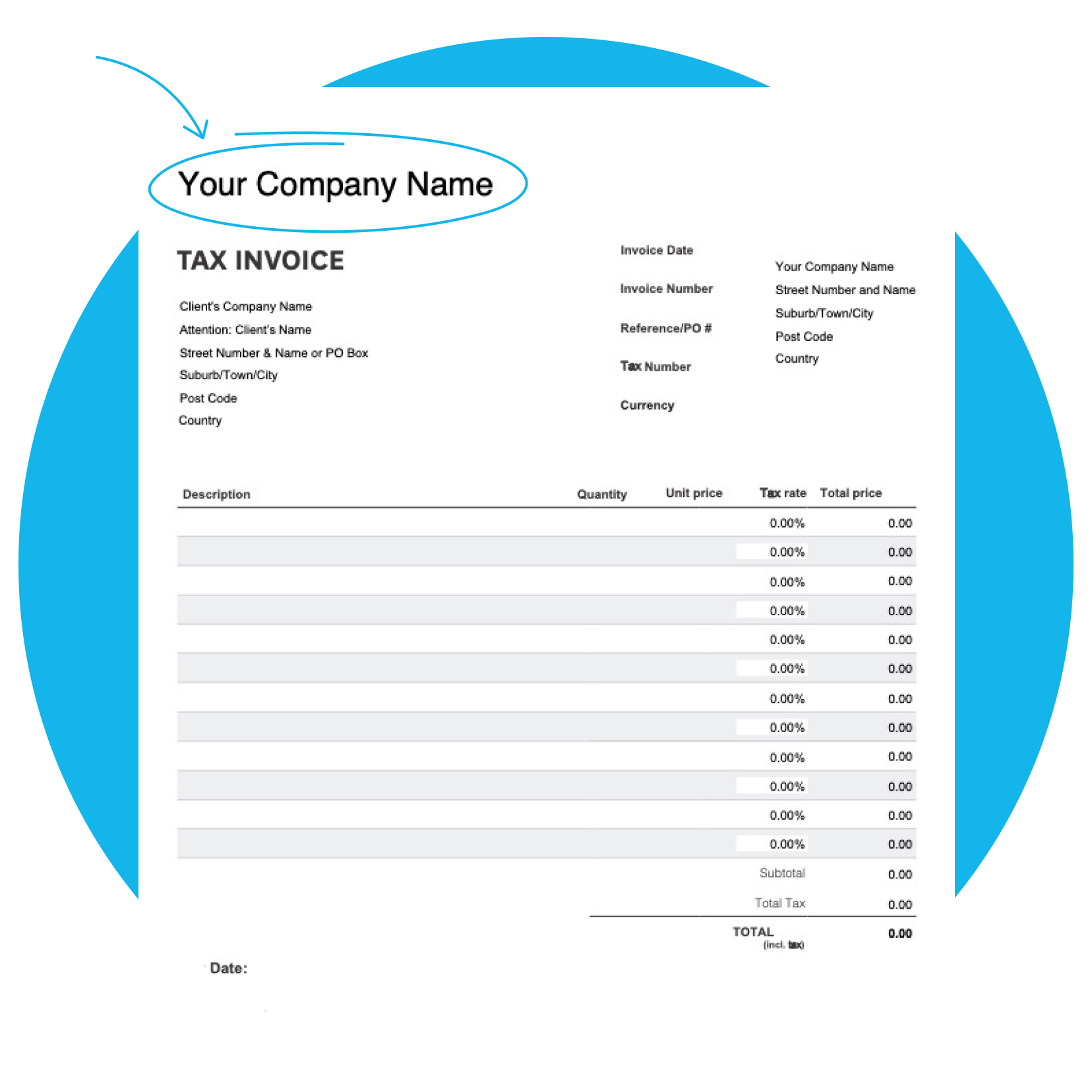

Simplify your billing process with our free invoice generator. Create professional invoices in a few clicks by downloading our customisable invoice maker and adding the product or service details. Send invoices to customers and keep copies for your financial records.

Customisable for your business

Add an item description, costs, tax, and more. Tailor invoices to your specific services or products.

Professional-looking invoices

Use this invoice generator again and again for standardised invoices that always look great.

Better record-keeping

Easily create and save customer invoices for your financial records – an essential compliance task.

Download the free invoice generator

Fill in the form to get a blank invoice generator as an editable PDF, with a how-to guide. You’ll get a tax and non-tax version.

Got your template? Try Xero for free.

Ready to take control of your business? Xero's got everything you need to succeed, from accounting and invoicing to reporting and payroll.

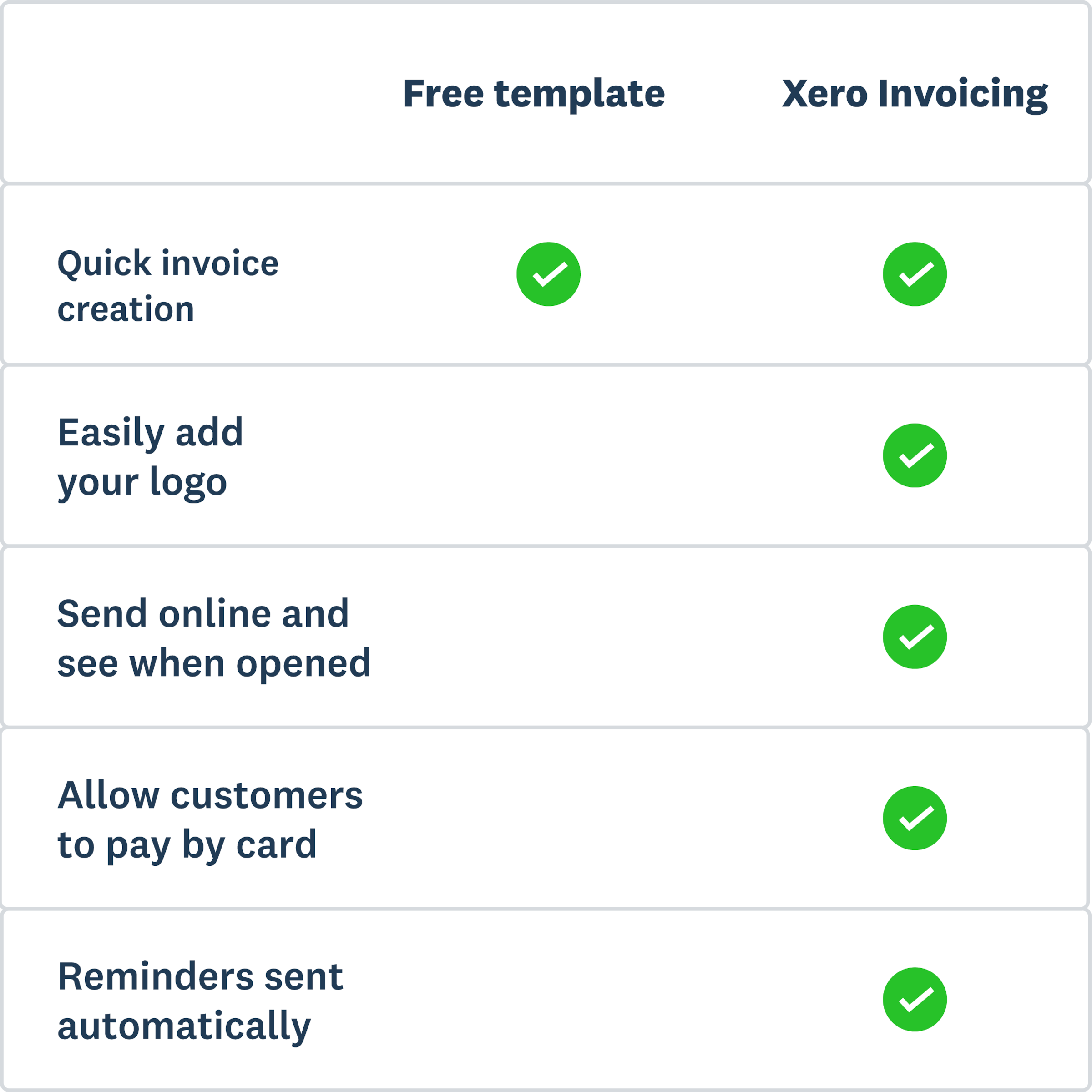

Free invoice generator vs Xero invoicing software

An invoice generator quickly gives you a professional-looking invoice when you’re short on time. Invoicing software takes this a step further, by automating and simplifying a range of billing processes. This means you spend less time invoicing and more time earning.

Invoice generator

This is free to use and good for infrequent invoicing. Download the generator, edit the template, and send invoices to customers.

Invoicing software

This is suitable for regular and complex invoicing. It also connects with accounting software, making tax and record-keeping easier.

What types of invoices can this generator be used for?

Use this online invoice generator for all of your billing requirements. Whether you’re looking for an industry-specific invoice or sending recurring invoices to repeat customers, our invoice creator works for all kinds of businesses.

- Sales invoice generator

- Tax invoice generator

- Interim invoice generator

- Final invoice generator

- Recurring invoice generator

- Retail invoice generator

- Services invoice generator

How to use the invoice generator

Creating a professional invoice quickly couldn’t be easier with our free invoice maker.

Fill in the form and download the generator

Open the PDF and add billing details (e.g. item, cost)

Send the invoice to your client and keep your own copy

Invoice generator FAQs

Absolutely – you can add your business details to this generator and save a template for using over and over again.

Absolutely – you can add your business details to this generator and save a template for using over and over again.

Yes. Simply include the currency in the cost section of the invoice. You can also add currency details to the notes section if you feel your customers need an extra nudge.

Yes. Simply include the currency in the cost section of the invoice. You can also add currency details to the notes section if you feel your customers need an extra nudge.

Consistency is key. An invoice generator provides you with a reusable template you can edit and send again and again. If you want to go a step further, add your business name to the invoice generator for a professional branded template.

Consistency is key. An invoice generator provides you with a reusable template you can edit and send again and again. If you want to go a step further, add your business name to the invoice generator for a professional branded template.

Yes – keeping records of your income and expenditure can help you run a financially healthy business. You’ll also need copies of your invoices for tax time. Sometimes sending a copy of the invoice helps when you’re following up on late payments. It shows you have evidence of the sale, and reminds customers of what was purchased.

Find out more about tax and invoicing requirements in the UKYes – keeping records of your income and expenditure can help you run a financially healthy business. You’ll also need copies of your invoices for tax time. Sometimes sending a copy of the invoice helps when you’re following up on late payments. It shows you have evidence of the sale, and reminds customers of what was purchased.

Find out more about tax and invoicing requirements in the UKIn its simplest form, the invoicing process is how you get paid. Start by setting payment terms with the customer so you have an agreed timeline for getting paid. Next, fill in an invoice with the details of the transaction – for example, the goods or services provided, plus customer information and tax rates (where relevant). Don’t forget to add the due date. Then, send the invoice to the customer. You might decide to follow up before or after the due date, depending on your terms and process.

Read more on nailing the invoicing processIn its simplest form, the invoicing process is how you get paid. Start by setting payment terms with the customer so you have an agreed timeline for getting paid. Next, fill in an invoice with the details of the transaction – for example, the goods or services provided, plus customer information and tax rates (where relevant). Don’t forget to add the due date. Then, send the invoice to the customer. You might decide to follow up before or after the due date, depending on your terms and process.

Read more on nailing the invoicing process

Need a reusable invoice file?

Our invoice template is fully customisable and reusable, allowing you to tailor it to your needs and save it for ongoing use. While our generator can create a ready-to-use invoice in seconds, the customisable template offers a reusable format perfect for those who frequently need to adjust invoices for different clients or projects.

Download the free invoice templateSmall businesses thrive on cloud software

Many businesses streamline operations with digital tools. Xero’s cloud-based invoicing and accounting software helps complete tasks efficiently and accurately, providing a clear view of your business’s financial health. Xero is ideal for any type of business, including:

- Retail

- Construction

- Trade

- Hospitality

- Nonprofit

Other tools and guides to help you run your business

Xero has a range of resources to help your small business thrive. Check out the templates and guides below.

Expense report template

Get a clear picture of your business finances by tracking expenditure alongside sales.

Timesheet template

Having a consistent process for tracking team hours will help you bill right, every time.

How to invoice

Get your billing process running smoothly with these steps to successful invoicing.

Disclaimer

Xero does not provide accounting, tax, business or legal advice. This template has been provided for information purposes only. You should consult your own professional advisors for advice directly relating to your business.