Xero advocates for Small Businesses

More than one million UK small business customers trust us to support their businesses. This gives us a great perspective to see what makes them tick, celebrate the great contribution they make to the economy and their communities, and to understand how to make life better for small businesses.

Xero’s manifesto for small business success

For decades, late payments have hindered and frustrated small businesses. It is time to change the culture that allows big businesses to avoid paying what they owe. We need to call late payments what they are: “unapproved debt” and bring in legislation to hold big businesses accountable so small businesses receive the money they are owed, on time.

For decades, late payments have hindered and frustrated small businesses. It is time to change the culture that allows big businesses to avoid paying what they owe. We need to call late payments what they are: “unapproved debt” and bring in legislation to hold big businesses accountable so small businesses receive the money they are owed, on time.

Simplify the complex UK tax system for small firms. There are too many exemptions, allowances and cliff edges which disincentivise small businesses and affect productivity.

Simplify the complex UK tax system for small firms. There are too many exemptions, allowances and cliff edges which disincentivise small businesses and affect productivity.

Expand the remit of the Small Business Commissioner to include digital skills. Introduce tax breaks and work with partners to improve access to digital, financial and business training and expand the apprenticeship levy to a wider skills and training levy.

Expand the remit of the Small Business Commissioner to include digital skills. Introduce tax breaks and work with partners to improve access to digital, financial and business training and expand the apprenticeship levy to a wider skills and training levy.

Appoint a Cabinet Minister responsible for fighting for small businesses. As part of that, data-driven insights to inform decisions will be critical, making use of Xero’s near-real time Xero Small Business Index.

Appoint a Cabinet Minister responsible for fighting for small businesses. As part of that, data-driven insights to inform decisions will be critical, making use of Xero’s near-real time Xero Small Business Index.

Ensure that the HMRC is responsive to users - whether they are accountants, bookkeepers or small business owners - so they get the best service carry out tax compliance smoothly and simply. Part of this process will include co-creation with small business industry groups and ensuring HMRC is able to deliver any current or future regulatory changes such as Making Tax Digital.

Ensure that the HMRC is responsive to users - whether they are accountants, bookkeepers or small business owners - so they get the best service carry out tax compliance smoothly and simply. Part of this process will include co-creation with small business industry groups and ensuring HMRC is able to deliver any current or future regulatory changes such as Making Tax Digital.

Accountants are a small business’s most trusted advisor, and often the outsourced Chief Financial Officer. They operate in every community across the UK and are trusted advocates and mentors for business owners - they are the unsung heroes. This needs to be promoted more widely, and their voices need to be heard in policy-making.

Accountants are a small business’s most trusted advisor, and often the outsourced Chief Financial Officer. They operate in every community across the UK and are trusted advocates and mentors for business owners - they are the unsung heroes. This needs to be promoted more widely, and their voices need to be heard in policy-making.

If all small businesses, employing up to ten people, digitalised at the pace of the top 20%, then small business turnover would be £77.3bn higher, creating a further 885,000 jobs. Committing to a ‘Making Business Digital’ strategy will deliver higher productivity and a truly digital-led economy. Small business interests must be at the heart of this, with initiatives to help them digitalise at their own pace and with the right support. Whether that be via tax incentives, a ‘Chief Technology Officer’ as a service, scaling mentoring and advice schemes like Small Business Britain’s ‘Small & Mighty’, or regulatory drivers such as eInvoicing and digital ID.

If all small businesses, employing up to ten people, digitalised at the pace of the top 20%, then small business turnover would be £77.3bn higher, creating a further 885,000 jobs. Committing to a ‘Making Business Digital’ strategy will deliver higher productivity and a truly digital-led economy. Small business interests must be at the heart of this, with initiatives to help them digitalise at their own pace and with the right support. Whether that be via tax incentives, a ‘Chief Technology Officer’ as a service, scaling mentoring and advice schemes like Small Business Britain’s ‘Small & Mighty’, or regulatory drivers such as eInvoicing and digital ID.

Small businesses will be a major consumer of AI, which will help support them with efficiencies. It will become even more critical as small businesses look to digitalise. The small business user perspective must therefore be taken into account as part of the regulatory debate. The Cabinet Office Minister responsible for small business should also be the small business AI champion.

Small businesses will be a major consumer of AI, which will help support them with efficiencies. It will become even more critical as small businesses look to digitalise. The small business user perspective must therefore be taken into account as part of the regulatory debate. The Cabinet Office Minister responsible for small business should also be the small business AI champion.

Settle up. Shining a light on the late payments scandal

This report reveals that public concern to the late payments crisis - a huge issue for small businesses that rarely gets the attention it deserves - is growing: 70% view late payment as theft or bullying, and 72% prefer not to buy from companies that pay late. It is time to act.

Read report

A special day at the House of Commons

We came together to connect and celebrate small businesses and the community that supports them. It was truly an inspirational day.

.1709826917314.png)

Small and Mighty Programme

In partnership with Small Businesses Britain and ARU University, we’re delivering the Small and Mighty Programme, which includes more than 2000 alumni. This is an online course that offers skills support like business strategy and marketing, finance and resilience and individual mentoring sessions.

Find out more

Beating the “digital drag”

The UK’s smallest businesses fuel the economy and create more than a quarter of all jobs. Our report shows a ‘digital drag’ is holding them back, costing our economy billions. By working together we can help to speed up digitalisation and unleash the potential of our small business economy.

Download our report with Cebr here

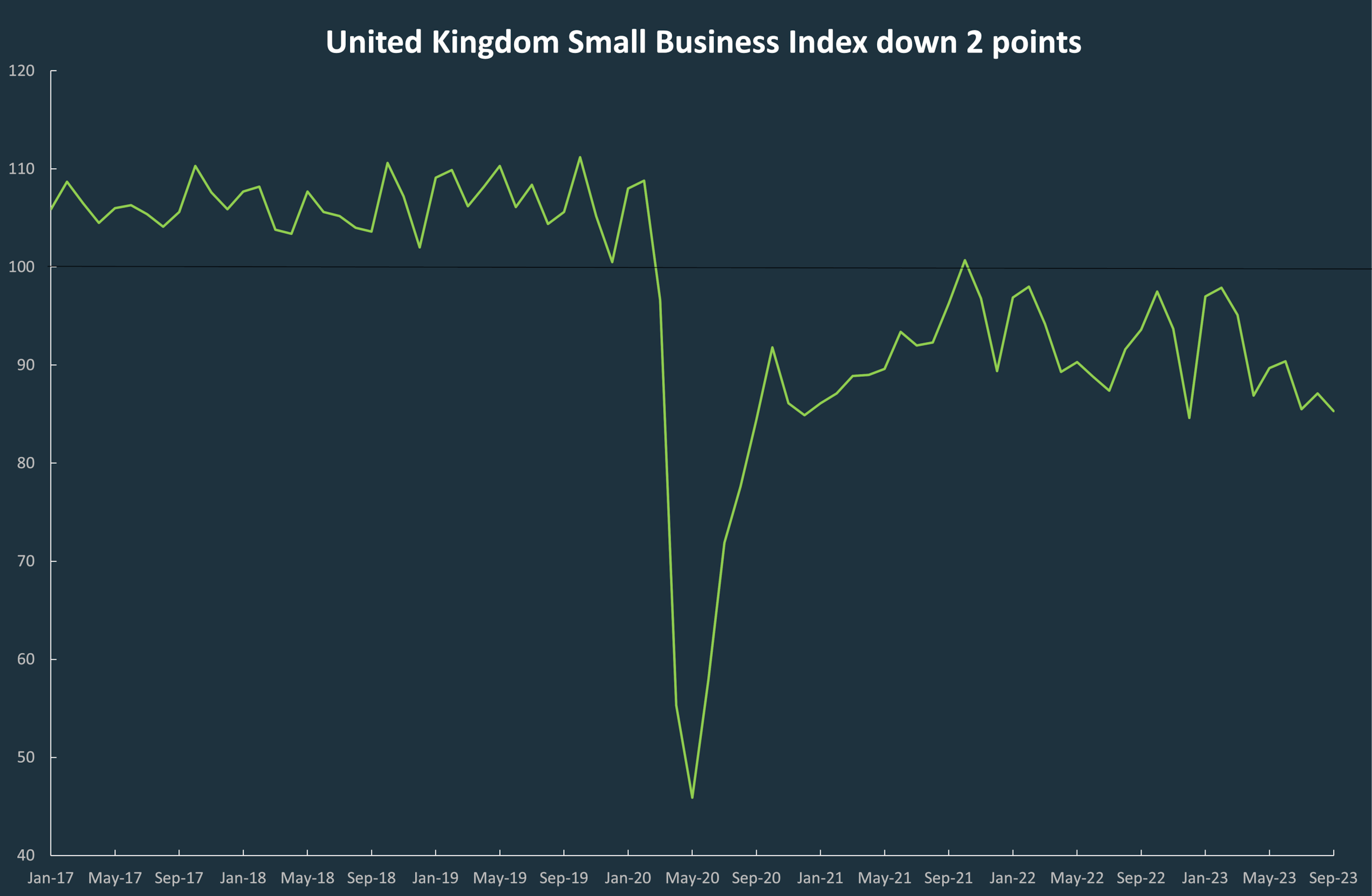

UK Xero Small Business Index

We use anonymised and aggregated data to track the performance of and improve understanding of small businesses. This index shows changes in the overall performance of UK small businesses from month to month.

Find out more

Xero Beautiful Business Fund

Congratulations to all the Xero Beautiful Business Fund winners.

Find out more

Start using Xero for free

Access Xero features for 30 days, then decide which plan best suits your business.