What is the current ratio and how can you use it?

The current ratio tells you how well your business can cover its bills. Get to grips with the current ratio formula, definition, and example calculations.

Current ratio definition

The current ratio is a type of liquidity ratio that measures a business’ ability to pay upcoming bills and make loan repayments. You might also see it called the working capital ratio.

It’s a broader measure of liquidity than quick ratio because it factors in assets that can take longer to liquidate – like inventory.

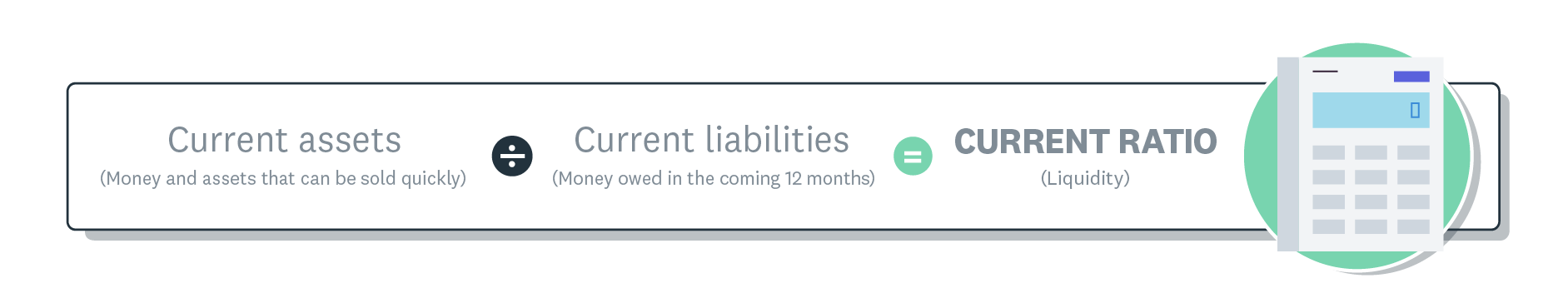

Current ratio formula

Current ratio liquidity formula.

You need to know your current assets and current liabilities to do a current ratio calculation. Fortunately, both of these amounts can be found on your balance sheet.

- Current assets include cash, accounts receivable, inventory, and other assets that you expect to convert into cash within a year.

- Current liabilities are the obligations your business must pay within the same period, such as accounts payable, short-term loans, and other debts.

Here’s what the current ratio formula looks like:

Example of a current ratio calculation

A small construction business wants to work out its current ratio, to see if it can cover upcoming loan repayments and material costs.

The business has £250,000 in current assets and £175,000 in current liabilities. The current ratio calculation is:

£250,000 / £175,000 = 1.43

The current ratio is above one, which means the company can cover upcoming liabilities. For every £1 of liabilities, the company has £1.43 available.

It might also be possible for the company to invest in other areas with the remaining cash. Or, the business could hang on to its extra cash in case there’s a time when its assets are lower and liabilities are higher.

How to interpret your current ratio

A current ratio of 1.0 or more shows a business can cover its short-term debts and is generally healthy. However, if it’s consistently very high, this might be a sign that you should invest in growth and development.

A ratio below 1.0 is less attractive – but it happens from time to time. A growing business, for example, will be making investments and may find their current ratio drops below 1.0. Nevertheless, most businesses will want to avoid having a ratio permanently below 1.0.

The current ratio changes over the course of a billing cycle, so it’s a good idea to measure it at the same time every month. That way you’re comparing like for like, and you can see the long-term trend of the current ratio.

While there’s plenty to learn from your current ratio analysis, remember, it’s only one view of your finances. Combine it with other profitability ratios and cash flow forecasts to assess and manage your finances.

Current ratio vs quick ratio and other liquidity ratios

While current ratio is a useful measure, it’s also helpful to calculate other liquidity ratios to see how your finances are stacking up.

- Quick ratio (or, acid test ratio) gives you a more conservative view, only including assets that can be quickly converted into cash (usually within 90 days).

- Cash ratio is the most stringent liquidity measure because it only compares cash and cash equivalents to current liabilities. All other assets are excluded.

Using a combination of financial ratios can tell you how much cash you have available at different times, for different purposes. Learn more about these metrics in our guide to liquidity ratios.

Current ratio in relation to working capital and cash flow

Current ratio is a measure of spending power, similar to working capital, cash flow, and free cash flow. Knowing how these measures interact helps you understand your finances better.

Each of these terms has its own complexities, but here’s a quick breakdown:

- Working capital shows you how much money is left after covering current liabilities – things like supplier bills and loan repayments. Your working capital amount is the difference between current assets and current liabilities.

- Cash flow refers to the general availability of cash in your business. It looks at the net amount of money moving in and out of your bank account.

- Free cash flow is what you have left after subtracting capital expenditure from operating cash flow. It gives you a good indication of how profitable your business is, showing your remaining cash after investing in things like equipment or property.

What are the limitations of using the current ratio?

Like all liquidity ratios, the current ratio only provides a snapshot of your finances.

The current ratio takes all current assets into account without distinguishing between their liquidity or quality. For example, cash is the most liquid current asset and could be ready to spend immediately. Inventory is also a current asset, but this may not be made liquid for months until your customers purchase something.

The current ratio also doesn’t reflect the timing of cash inflows and outflows. It assumes all liabilities will be paid in the same period when that won’t necessarily be the case. Cash flow can change on a daily basis, and the timing of payments impacts your cash position. Seasonal businesses might struggle to get a realistic picture of their overall business health too, given that some periods include high sales, while others are much quieter.

Monitor your finances in real-time with Xero

Xero can take care of the complex calculations for you, giving you a clear picture of the cash available in your business.

See cash flow at a glance, track expenditure, and monitor financial performance indicators over time.

Easily create forecasts and projections using our reporting features, and make better-informed financial decisions, easily.

Disclaimer

Xero does not provide accounting, tax, business or legal advice. This guide has been provided for information purposes only. You should consult your own professional advisors for advice directly relating to your business or before taking action in relation to any of the content provided.

Start using Xero for free

Access Xero features for 30 days, then decide which plan best suits your business.