Accounting software for your startup business

Save time on bookkeeping tasks and keep a close eye on cash flow and the financial health of your startup business with Xero’s intuitive accounting software.

Access your startup business financials when and where you need

Stay connected with the Xero Accounting app

Manage your startup business and track your business finances from anywhere with the Xero Accounting app. You can use it on your phone or other Android or iOS device.

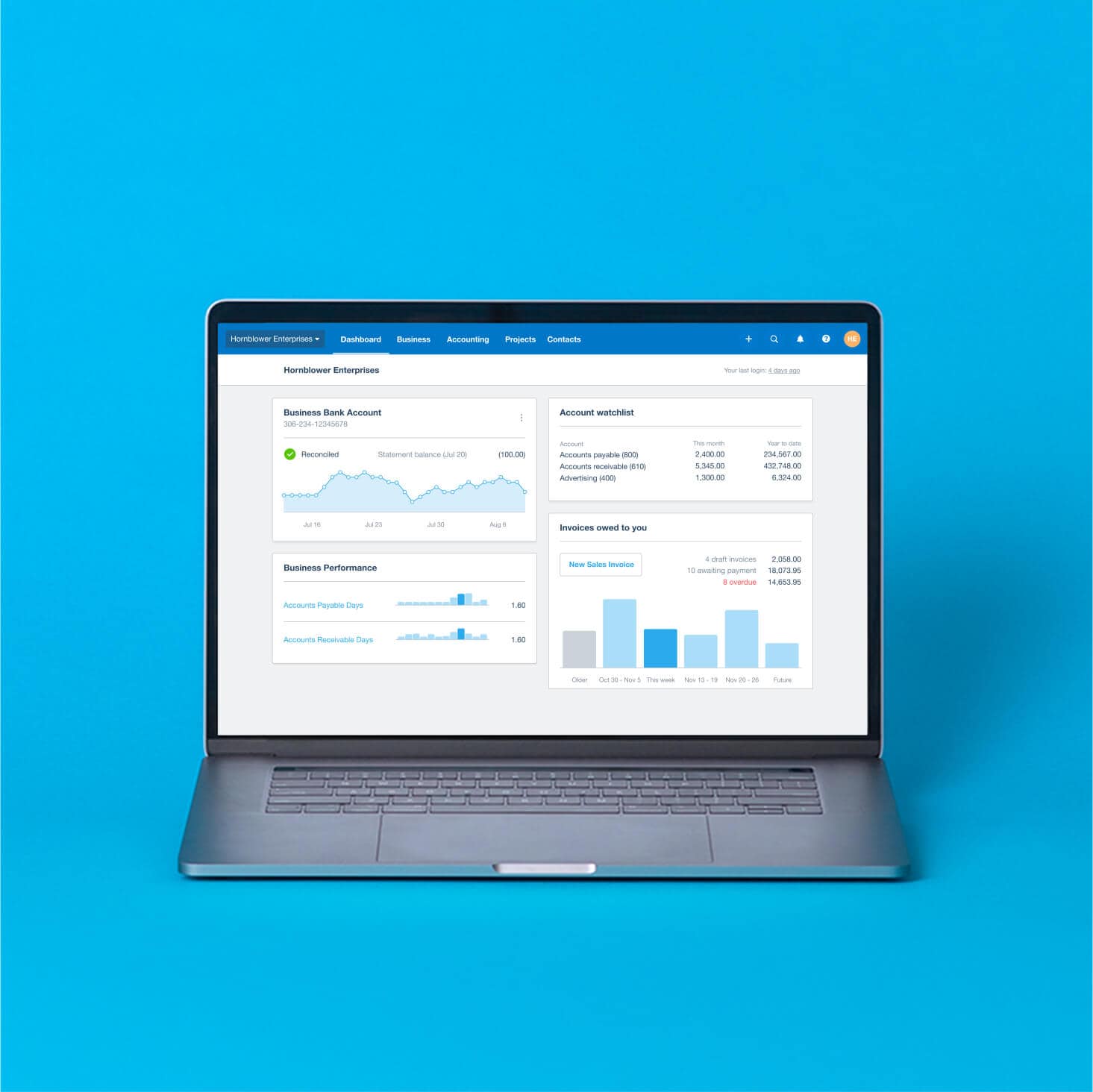

Check the financial health of your startup

Gain insight into your accounts and business financials effortlessly with clear charts and tables on the Xero dashboard. Monitor key metrics like bank account balances, income, expenses, and upcoming bills at a glance.

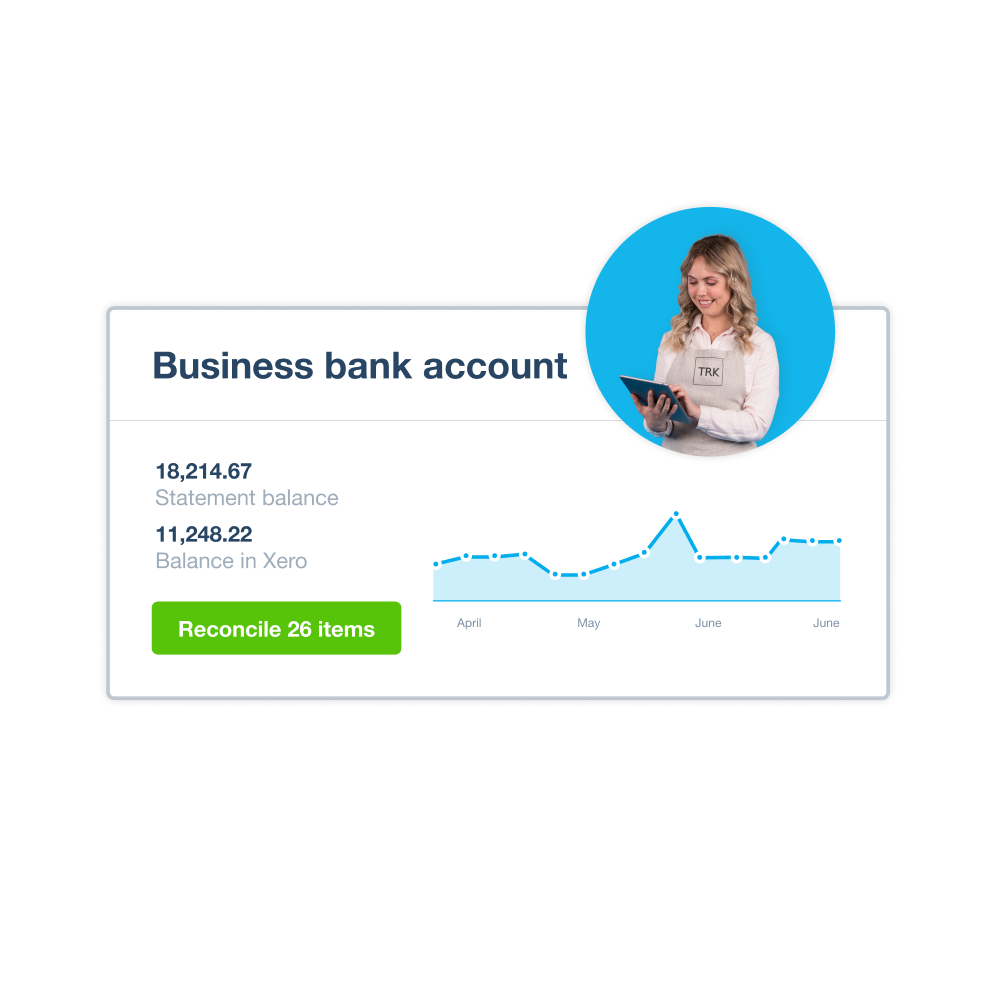

Connect your bank accounts for daily feeds

Get financial transactions flowing from your credit cards and bank accounts automatically so you have an up-to-date view of cash flow in Xero. It makes keeping accurate records and day-to-day bookkeeping for your startup really simple.

Easily customise and send invoices wherever you are

Get professional-looking invoices out the door and money coming into your startup business fast with accounting software that lets you send invoices from the mobile app or from the Xero software on your computer.

Accept payments instantly

Accept online payments into your startup business from a debit or credit card, or with third-party payment services, right from the invoice, and quickly reconcile them in Xero.

With the app, you can check on numbers, invoicing and expenses when you’re out and about or travelling.

Mark’s discovered Xero. No wonder he’s all smiles.

Start using Xero for free

Access Xero features for 30 days, then decide which plan best suits your business.

Connect Xero accounting software to apps for your startup business

Over 1000 third-party apps connect with Xero. Find apps for your business at the Xero App Store.

- App

Stripe

Use Stripe to accept payments from debit and credit cards, Apple Pay, and Google Pay for online invoices sent from Xero.

- App

Shopify integration by Xero

Connect your Shopify store to your Xero account for easy management of your ecommerce business finances.

- App

Cin7 Core

Cin7 Core lets you manage all your products, customers, suppliers, contacts, purchases and sales in one system.