Strengthen your payroll system with Xero and integrated apps

Want simpler pay days? Xero connects with third-party apps to give you a powerful digital system for your Indonesian small business. Choose an app to automate your payroll admin so you can work faster. Then see the data in Xero and get detailed financial reports and insights.

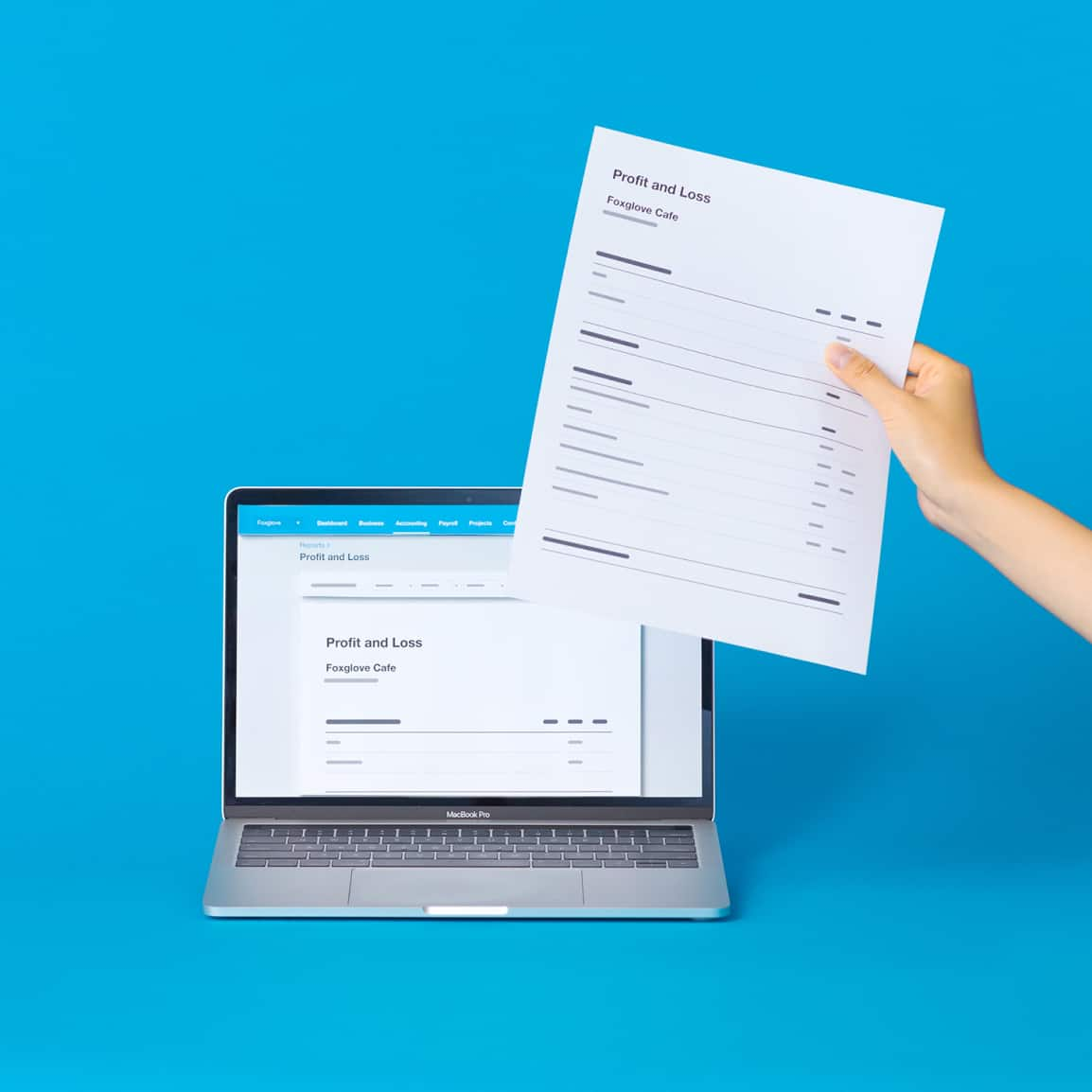

A full view of your finances

Any apps you connect feed data to Xero for a single, accurate view of your payroll expenses and finances.

Easy collaboration

Online meetings with your accountant or team are straightforward with Xero’s cloud-based software.

Improved compliance

It’s easier to follow rules with clear digital pay records all in one place.

How payroll software works

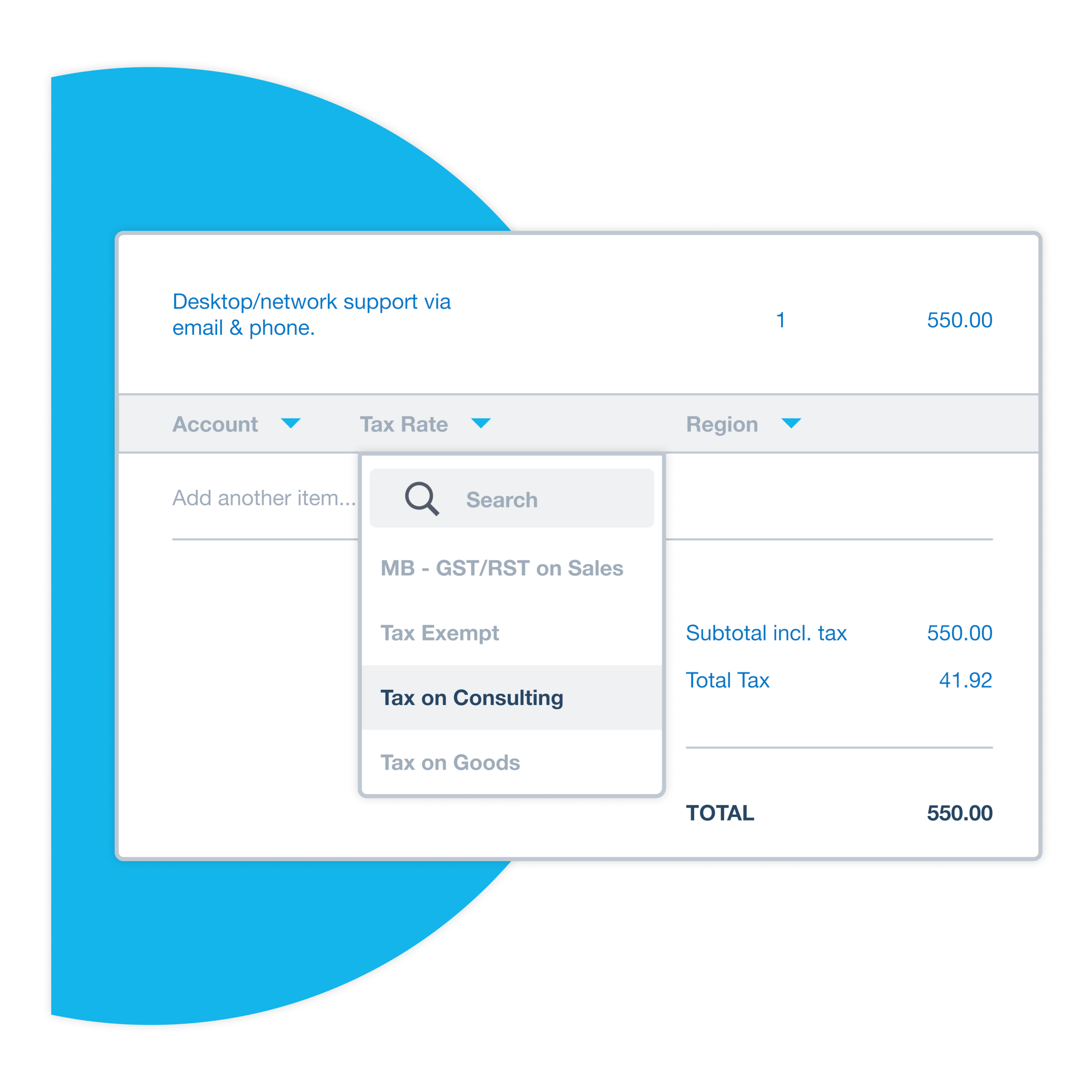

Start with Xero’s core accounting features. You can then connect the third-party apps that work best for your small business payroll, whether it’s help for your monthly pay runs or a more comprehensive platform for your HR and finances.

- Apps integrate easily with Xero’s online software – no tech experience needed

- Data is frequently refreshed across the payroll system, so figures are up to date

- Data reports and insights in Xero help you understand your payroll expenses and grow your business

Simplify your compliance in Indonesia

Xero helps you follow the rules for your payroll and tax reporting. Integrate a specialist payroll app and see all your financial data in Xero’s cloud-based software. That way, you keep clear, accurate records of your pay cycles, ready to go whenever you need them.

Get a clear financial view

When you connect a payroll app to Xero, your employee pay data automatically flows into your accounting records. No more fuzzy numbers or switching between tools! You get a totally clear view of your finances to speed up reconciliations and a better understanding of your cash flow and expenses.

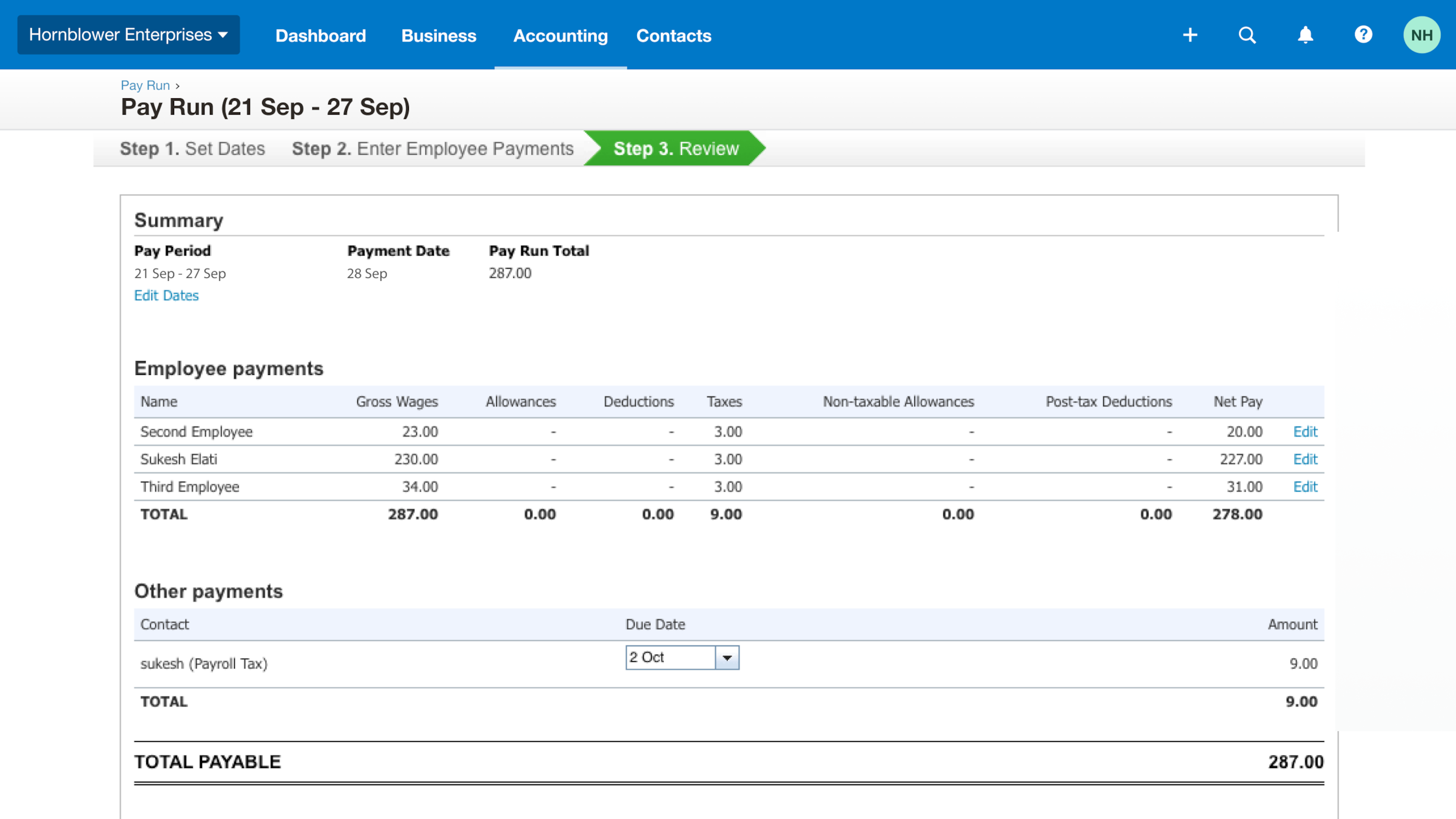

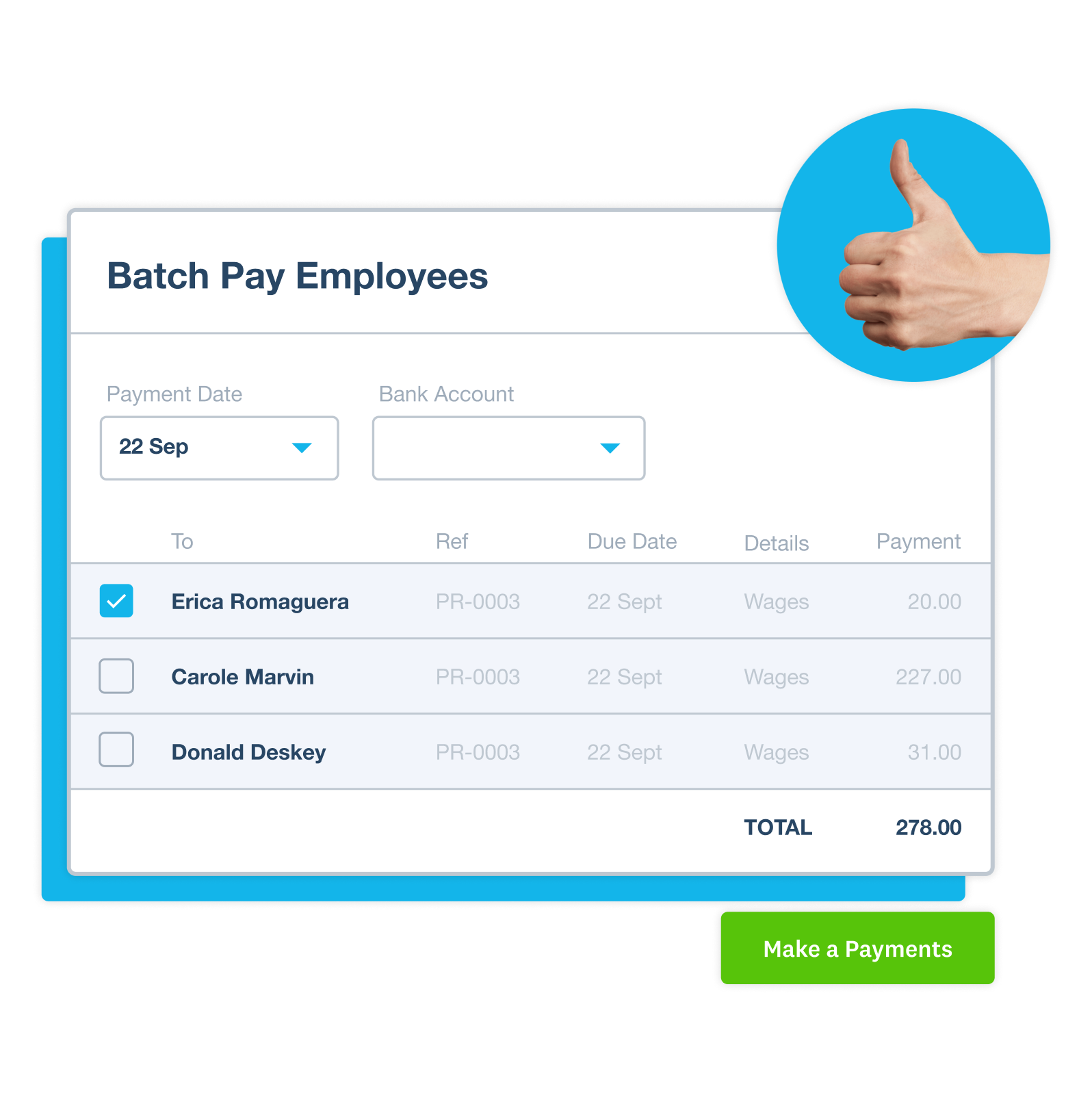

Automate your employee payments

Win back time in your day by automating your pay cycles. Payroll apps work with Xero to help automate wage calculations, manage deductions, and pay your team on time. Tiresome admin is replaced with a fast, reliable process!

See how Xero can help

HReasily

Simplify your processes with HReasily – a comprehensive platform for all your payroll jobs, from pay calculations to leave management.

Talenox

This app brings together your payroll and HR to efficiently manage your employee data, contributions, and regulatory submissions.

Deel

Got international teams and contractors? Deel smooths your global payroll and compliance with its impressive automations.

Xero App Store

Find your perfect app for your Indonesian payroll needs.

Ease all your financial admin with Xero

Xero doesn’t just help your payroll – it improves all your financial admin, from online invoicing and receiving payments to reporting your finances. Lighten your workload with its clever tools and automations, so you can get back to what matters: running your Indonesian small business.

See all Xero features

I’ve gone from zero control to Xero control

Made by the Forge uses Xero to make quick decisions

FAQs on small business payroll software

You need to integrate a third-party payroll app with your Xero organisation. These apps help you manage your pay and tax calculations, deductions, and reporting without any errors. This data then syncs with your Xero books so you have accurate, detailed records for your Indonesian compliance.

You need to integrate a third-party payroll app with your Xero organisation. These apps help you manage your pay and tax calculations, deductions, and reporting without any errors. This data then syncs with your Xero books so you have accurate, detailed records for your Indonesian compliance.

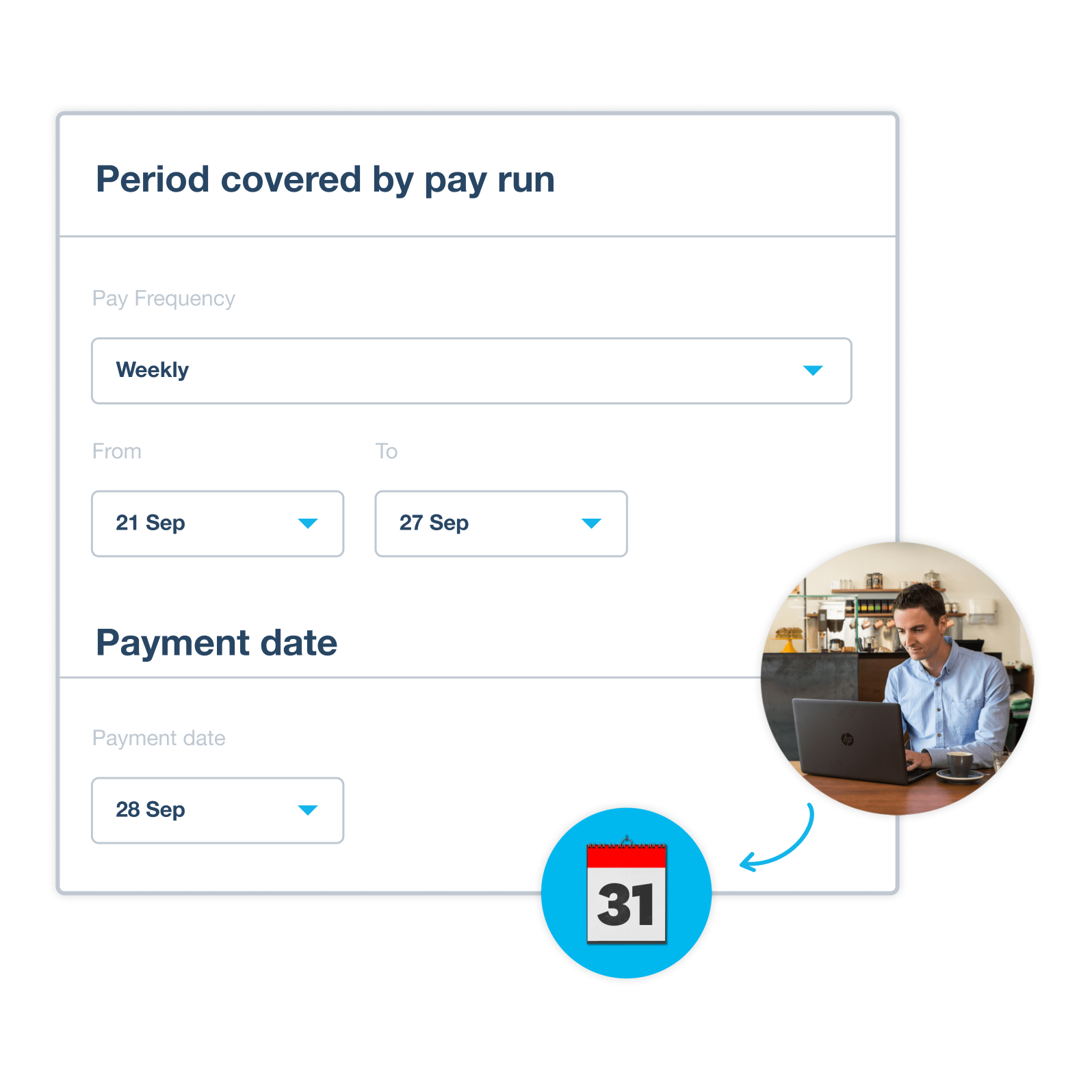

You need to choose and connect a specialist payroll app that meets your specific requirements for Indonesian. All Xero-certified apps are reviewed and rated in the Xero App Store. Once you’ve connected an app, you can set up your employee details and pay cycles within the app.

You need to choose and connect a specialist payroll app that meets your specific requirements for Indonesian. All Xero-certified apps are reviewed and rated in the Xero App Store. Once you’ve connected an app, you can set up your employee details and pay cycles within the app.

Xero’s cloud-based software lets you easily connect apps to form a powerful payroll system. You can handle your payroll admin from anywhere with an internet connection and always pay your team on time. You can also securely store all your payroll and financial records for your government compliance.

Xero’s cloud-based software lets you easily connect apps to form a powerful payroll system. You can handle your payroll admin from anywhere with an internet connection and always pay your team on time. You can also securely store all your payroll and financial records for your government compliance.

Your pay frequency might be weekly, fortnightly, or monthly – it depends on factors like your business’s cash flow, employee agreements, and Indonesian labour laws. You can set up payroll apps to suit your preferred pay frequency.

Your pay frequency might be weekly, fortnightly, or monthly – it depends on factors like your business’s cash flow, employee agreements, and Indonesian labour laws. You can set up payroll apps to suit your preferred pay frequency.

A payslip must provide a detailed breakdown of an employee’s earnings, deductions (like tax and loan repayments), net pay, and year-to-date totals. It’s an employer’s responsibility to share this information with their employees and to keep clear financial records

A payslip must provide a detailed breakdown of an employee’s earnings, deductions (like tax and loan repayments), net pay, and year-to-date totals. It’s an employer’s responsibility to share this information with their employees and to keep clear financial records

Yes – you can integrate an app that allows flexibility in the way you pay your team, from fixed annual salaries to hourly wages, commissions, and overtime. This includes automating the calculation of gross pay, deductions, and net pay based on the specific pay rates and hours worked, or the salary agreements.

Yes – you can integrate an app that allows flexibility in the way you pay your team, from fixed annual salaries to hourly wages, commissions, and overtime. This includes automating the calculation of gross pay, deductions, and net pay based on the specific pay rates and hours worked, or the salary agreements.

For sure. Choose a payroll app that lets your employees fill in and submit timesheets for your approval. (Ideally, make sure this app also calculates wages, taxes, and deductions; creates payslips; and prepares compliance filings.) This data is automatically pushed into Xero for accurate financial reporting and easy bank reconciliations.

For sure. Choose a payroll app that lets your employees fill in and submit timesheets for your approval. (Ideally, make sure this app also calculates wages, taxes, and deductions; creates payslips; and prepares compliance filings.) This data is automatically pushed into Xero for accurate financial reporting and easy bank reconciliations.

If you pay your employees an hourly or project-based rate, ask them to use the payroll app to fill out online timesheets. You can then adjust any errors and approve these timesheets before the app acts as an employer’s payroll tax calculator. This way, you get accurate figures for each employee’s gross pay.

If you pay your employees an hourly or project-based rate, ask them to use the payroll app to fill out online timesheets. You can then adjust any errors and approve these timesheets before the app acts as an employer’s payroll tax calculator. This way, you get accurate figures for each employee’s gross pay.

The Xero App Store: where your business grows

If you want to grow, to strengthen, to specialise – there’s an app to help. Discover what’s possible by visiting the Xero App Store and start planning your next steps.

Apps to smooth your everyday financial workflows

Discover payroll apps to speed up and simplify your admin, from your monthly pay runs to business expense reimbursements.

Apps for specialised needs

Dig into the details of how you want to manage your payroll and other admin, then find an app with the right features.

Ways to expand your business

Imagine more for your business – Xero connects seamlessly with a wealth of apps to help you extend your offerings.

Guides and other resources on payroll

Boost your understanding of payroll with these essential guides, written in plain English.

What is payroll?

Get an overview of the typical payroll process and definitions of common payroll terms from the Xero glossary.

Invoice template

An invoice template creates a professional look, does the math, and makes it easy for customers to follow.

Cash flow statement template

Get a free cash flow template for your business. And learn how Xero software can make reporting easy.

FAQs about Xero in Indonesia

The best accounting software depends on your needs. Xero’s accounting software has flexible plans so you can adjust your subscriptions to access the features you need as your business grows.

Check out Xero’s pricing plansThe best accounting software depends on your needs. Xero’s accounting software has flexible plans so you can adjust your subscriptions to access the features you need as your business grows.

Check out Xero’s pricing plansNo – Xero is based in the cloud, so all you need is an internet connection. But you need a multi-factor authentication (MFA) app to log in to Xero. MFA adds an extra layer of security by checking that it’s really you when you log in.

Learn about data protection with XeroNo – Xero is based in the cloud, so all you need is an internet connection. But you need a multi-factor authentication (MFA) app to log in to Xero. MFA adds an extra layer of security by checking that it’s really you when you log in.

Learn about data protection with XeroYes, the Xero App Store has hundreds of apps to help manage your business, including apps specifically designed for your industry and for doing business wherever you are located.

Check out the Xero App StoreYes, the Xero App Store has hundreds of apps to help manage your business, including apps specifically designed for your industry and for doing business wherever you are located.

Check out the Xero App Store

Start using Xero for free

Access Xero features for 30 days, then decide which plan best suits your business.

Plans to suit your business

All pricing plans cover the accounting essentials, with room to grow.

Already subscribed and need help with Xero Payroll?

Xero Central is filled with articles to get you started and answer your questions.

Payroll reports

Find technical information on how to run payroll reports, including the ‘Gross to net’ report.

Adding employee contacts for a pay run

Learn how to add your employees’ basic details while you’re processing a pay run, and more.

Payslips for pay runs

Find out how to generate payslips for your employees after you process a pay run.