Financial statement guide: Understand your business's health

Learn how your financial statement can help you track, analyze, and grow with confidence.

Written by Lena Hanna—Trusted CPA Guidance on Accounting and Tax. Read Lena's full bio

Published Monday 15 December 2025

Table of contents

Key takeaways

- Use all four types of financial statements together (balance sheet, income statement, cash flow statement and statement of changes in equity) to see your business's overall financial health.

- Apply key financial ratios like the current ratio, quick ratio, and debt-to-equity ratio to assess your business's liquidity and ability to cover short-term obligations and make informed decisions about expenses and cash management.

- Distinguish between recorded revenue and actual cash inflows by tracking your cash flow statement separately from your income statement, as profitable businesses can still face cash shortages if revenue hasn't reached the bank account yet.

- Compare your financial statements across multiple periods to identify trends in revenue, expenses, and liabilities, enabling you to invest in successful areas and address problems before they become serious.

What is a financial statement?

Financial statements are formal records that track your business's financial activities and performance over a specific period. These documents help you assess your business's financial health, secure funding from lenders, and make informed decisions about growth and operations.

Most financial statements cover monthly, quarterly, or annual periods. This regular reporting helps you spot trends early and adjust your strategy before problems become serious.

Types of financial statements

The four main types of financial statements give you a complete picture of your business's financial health. Each statement shows different aspects of your finances:

- Balance sheet: Shows what you own versus what you owe at a specific point in time

- Income statement: Tracks revenue, expenses, and profit over a period

- Cash flow statement: Records money moving in and out of your business

- Statement of changes in equity: Shows how much profit you retain in the business

Balance sheet

A balance sheet shows what your business owns versus what it owes at a specific point in time. This snapshot helps you understand your business's net worth and financial stability.

Assets (what you own):

- Cash and bank accounts

- Inventory and equipment

- Property and machinery

- Intellectual property and patents

Liabilities (what you owe):

- Loans and long-term debt

- Accounts payable

- Unpaid expenses

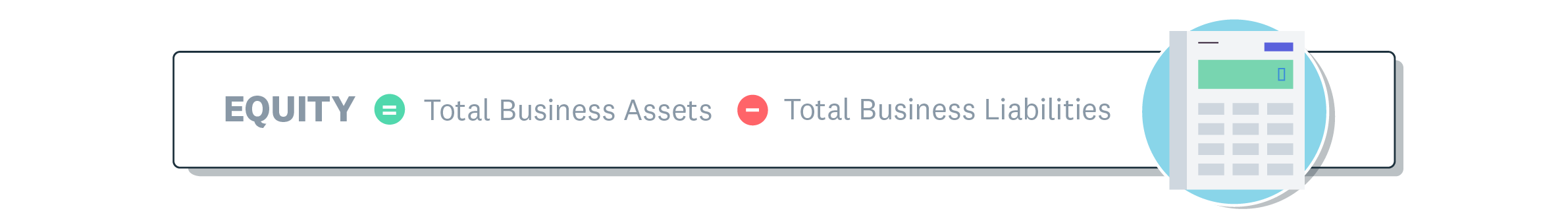

Equity equals your total assets minus total liabilities. This figure helps determine your business's net worth and value.

Income statement / profit and loss statement

An income statement (also called a profit and loss statement) shows whether your business is profitable over a specific period. It compares your total revenue against all expenses to calculate your net profit or loss.

Key components of an income statement:

- Revenue: Total money earned from sales

- Operating expenses: Costs like rent, utilities, and salaries

- Cost of sales: Direct costs to produce your product or service

- Net income: Your profit after all expenses

Example: A manufacturing business with $150,000 revenue, $50,000 operating expenses, and $70,000 cost of sales would have $30,000 net income.

Cash flow statement

The cash flow statement tracks how cash moves in and out of your business over time. This statement shows whether you can cover short-term expenses like bills and payroll.

It records three types of activities:

- Operating activities: Customer sales and daily business operations

- Investment activities: Purchases and sales of assets like machinery

- Financial activities: Money from loans, investments, or stock sales

Statement of changes in equity

The statement of changes in equity (also called retained earnings statement) shows how much profit your business keeps after paying all costs and dividends.

You might retain earnings to:

- Repay debt

- Reinvest in business growth

- Build emergency reserves

Understanding your financial statements

Understanding financial statements becomes easier when you focus on key areas. Each statement tells a different part of your business's financial story. You don't need to master every detail, just the essential metrics that drive decisions.

Reading your balance sheet

Reading your balance sheet starts with comparing assets to liabilities on a specific date.

How to read your balance sheet:

- Compare totals: Assets should exceed liabilities in healthy businesses

- Calculate equity: Assets minus liabilities equals your business's net worth

- Check ratios: Use current ratio and debt-to-equity ratio for deeper insights

Interpreting your income statement

The income statement shows your performance over time, like a month or a quarter. Start at the top with your total revenue, then look through your expenses.

The most important number is at the bottom: net income. If it's positive, you're profitable. If it's negative, your expenses were higher than your income for that period.

Understanding your cash flow statement

This statement tracks the actual cash moving in and out of your business. The key section to check is 'cash flow from operating activities'.

A positive number here means your core business operations are bringing in more cash than they use, which is a good sign of financial health. This helps you see if you have enough cash to pay bills and staff, no matter what your income statement says about profit.

How to create financial statements

Creating financial statements doesn't have to be complicated. While you can do it manually with spreadsheets, using accounting software makes the process much faster and more accurate. Here's a simple overview of the steps involved.

Gather your financial documents

Before you can create any statements, you need to collect all your financial records for the period. This includes:

- Bank and credit card statements

- Records of sales and invoices sent to customers

- Receipts and bills from suppliers

- Payroll records and expense claims

- Loan agreements and asset details

Choose your method: manual or automated

Manually entering this data into spreadsheets is time-consuming and can lead to errors. It requires you to build formulas and constantly update the information yourself.

Accounting software automates most of this work. By connecting your bank accounts, the software imports transactions automatically; you just need to categorize them. From there, software like Xero can generate your balance sheet, income statement and cash flow statement to give you real-time insights without the administrative headache.

Why financial statements are important for small businesses

Financial statements are essential for small businesses because they provide clear insights into your business's financial health. These documents help you:

- Make informed decisions based on real data

- Manage cash flow and profitability effectively

- Meet tax and compliance requirements so you report all your income and avoid a 10% penalty on any unreported amount

- Secure funding from lenders and investors

Supports business growth

Financial statements give you the data you need to grow strategically. They can help you:

- Identify which products or services generate the most revenue

- Highlight areas that need improvement

- Use financial data to guide smart investments

Improves financial management

Accurate financial statements make it easier to stay on top of your business finances. They allow you to:

- Track cash flow to cover payroll and operating expenses

- Measure profitability and overall financial health

- Prepare for seasonal fluctuations and future planning

Builds stronger external relationships

Solid financial reporting also strengthens your credibility with outsiders. With clear statements, you can:

- Present reliable financial data to attract investors

- Demonstrate repayment ability to secure business loans

- Meet tax and regulatory requirements with confidence so you avoid a penalty of 50% of the tax attributable to any omission

How to use financial statements to analyze your business

Using financial statements to analyze your business helps you make data-driven decisions and spot problems early. Each statement provides specific insights that guide your strategy and ensure tax compliance.

1. Analyze financial performance with the income statement

Use your income statement to:

- Measure profitability: Compare total revenue against expenses to see if your business is making money.

- Control costs: Identify overspending in categories like cost of goods sold and operating expenses.

- Track growth: Compare statements across periods to spot revenue trends, cost efficiency changes, and profit margin improvements.

You can use your income statement to calculate gross profit, operating income and net income. These numbers help you decide if you need to adjust prices or reduce costs to improve profits.

2. Manage assets and plan for growth with the balance sheet

The balance sheet helps you:

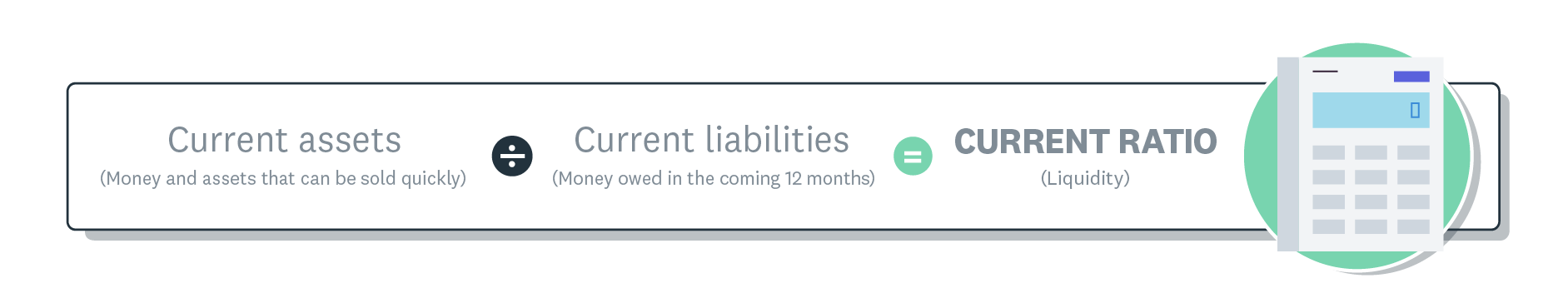

- Assess liquidity by comparing your business's current assets to its current liabilities. Use liquidity ratios like the current ratio and the quick ratio (see below) to decide whether you can cover your short-term obligations.

- Evaluate your business's solvency by examining its long-term liabilities and equity. A high debt-to-equity ratio may signal a risk to the business's financial stability, while a healthy equity base (a lower ratio) indicates strong financial health.

- Track asset management by examining how efficiently you're managing assets like inventory, property, and equipment, and whether they're contributing to your revenue.

You use your balance sheet to work out liquidity and solvency ratios, like the current ratio, quick ratio and debt-to-equity ratio. These show how much cash your business has to pay its bills.

The cash ratio formula helps you see if you have enough cash to cover payroll, expenses and loan payments over the next year.

The current ratio formula, unlike the quick ratio, includes your business's inventory value from your balance sheet. Use the current ratio to help you decide about your expenses and cash on hand.

3. Manage your cash flow with the cash flow statement

Strong cash flow means your business can pay its bills. The cash flow statement shows how strong your cash flow is, so you can improve it if you need to.

In particular, use the cash flow statement to:

- Analyze cash flow from operations to see if your core business activities generate enough cash to sustain the business and support healthy profits

- Judge the quality of investments by tracking how much cash you're using for capital expenditures like equipment or expanding your operations. This shows whether the business is reinvesting to stimulate future growth

- Monitor financing activities by reviewing cash flow from loans, equity financing, or dividends to see how external financing affects the company's cash position

You can find more advice on managing your finances and cash flow. For support in your area, check your local accounting standards and use free government tools to get a tailored list of government programs and services for your business.

4. Analyze growth with the retained earnings statement

This statement is useful for demonstrating your business's:

- Growth potential: If your business's retained earnings grow from one financial period to the next, it suggests your business can comfortably retain profits and reinvest in itself without borrowing, perhaps by purchasing new equipment or paying off debts.

- Financial health: A decline in retained earnings suggests a business is using profits to cover losses or debts, which can be a warning sign of financial problems.

Financial statement templates for your business

It's easier to create financial statements with templates. They help you or your accountant quickly make balance sheets, income statements and cash flow statements, so you can spend more time on your business.

Get started with Xero's free financial statement templates.

Ways to use your financial statements

These practical strategies help you extract maximum value from your financial statements and improve your business performance.

Consider the big picture, not just profit

If you focus only on net income and ignore other areas like cash flow, your business can become financially vulnerable.

To get a full view of your business's financial health, look at all your financial statements together: income statement, balance sheet, cash flow statement and retained earnings statement.

Pay attention to your cash flow

If you overlook the cash flow statement, you could run short of cash even if your business is profitable. Check these statements to track your liquidity and make sure there's enough cash to cover short-term costs.

Know the difference between revenue and cash

Recorded revenue, like sales, isn't the same as cash on hand. Revenue you've recorded may not have reached your business's bank account yet.

Make sure you know the difference between sales (revenue) and actual cash inflows, so you know how much your business can spend. If you track accounts receivable separately, you'll keep this distinction clear.

Analyze trends by comparing your financial statements

Compare your financial statements over several periods to spot patterns in revenue, expenses and liabilities. This helps you invest in what's working and make smart choices about areas that need improvement.

Get across your financial ratios

Financial ratios help you understand your business's liquidity, profitability and financial health.

Learn how to use and analyze key financial ratios, like the current ratio and quick ratio, to help you evaluate your company's financial position and make better business decisions.

Simplify your financial statements with Xero

Easily create, track, and share financial statements in real time with Xero. Get clear insights into your cash flow and performance so you can make smarter business decisions.

FAQs on financial statements

Get answers to the most common questions small business owners ask about financial statements.

What's the difference between the income statement and cash flow statement?

Your income statement shows whether you're profitable by comparing revenue to expenses. Your cash flow statement tracks actual cash moving in and out of your business.

The key difference: You can be profitable on paper but still run out of cash if customers haven't paid their invoices yet.

Does my small business need all four types of financial statements?

Most small businesses need three core financial statements: balance sheet, income statement, and cash flow statement. These give you the essential insights for managing your finances.

The fourth statement, retained earnings, becomes important when you're reinvesting profits for growth projects or debt repayment.

How often should I prepare financial statements?

Prepare financial statements monthly or quarterly for optimal business management. Monthly reporting helps you catch problems within 30 days, while quarterly reporting aligns with tax deadlines and investor expectations.

Regular reporting lets you adjust strategies before small issues become expensive problems.

Disclaimer

Xero does not provide accounting, tax, business or legal advice. This guide has been provided for information purposes only. You should consult your own professional advisors for advice directly relating to your business or before taking action in relation to any of the content provided.

Start using Xero for free

Access Xero features for 30 days, then decide which plan best suits your business.