Accumulated depreciation: What it means and how to calculate it

Learn if accumulated depreciation is an asset, and how to calculate it for clear, accurate reports.

Written by Jotika Teli—Certified Public Accountant with 24 years of experience. Read Jotika's full bio

Published Monday 5 January 2026

Table of contents

Key takeaways

- Record accumulated depreciation as a credit entry against depreciation expense to accurately reduce your asset values on the balance sheet while lowering your taxable income through the depreciation deduction.

- Calculate accumulated depreciation using the straight-line method by dividing the asset cost minus salvage value by its useful life, then multiply by the number of years to determine total depreciation at any point in time.

- Recognize that accumulated depreciation is a contra asset that reduces your asset values without affecting cash flow, providing tax benefits by lowering taxable income while preserving actual cash in your business.

- Utilize cloud accounting software to automate depreciation calculations and journal entries, ensuring accurate asset valuations and eliminating manual tracking errors as your business grows.

What is accumulated depreciation?

Accumulated depreciation is the total amount an asset has depreciated since you bought it. It shows how much value your asset has lost over time due to wear, tear, and ageing.

Tracking accumulated depreciation helps you:

- Record accurate asset values on your financial statements

- Calculate book value (original cost minus accumulated depreciation)

- Show realistic asset worth for business decisions

For example:

- Office furniture that cost $5,000 and depreciates at $1,000 each year has a book value of $2,000 after 3 years. For tax purposes, assets like furniture and machinery often fall into specific categories, such as the Canada Revenue Agency’s Class 8, which has a Capital Cost Allowance (CCA) rate of 20%.

- Machinery cost $25,000, with $2500 depreciation each year. After 6 years it has depreciated by $15,000, leaving a book value today of $10,000.

Depreciation vs accumulated depreciation

Depreciation is the annual expense that reduces an asset's value each year. Accumulated depreciation is the running total of all depreciation expenses since you bought the asset.

Key differences:

- Depreciation: Annual expense (appears on income statement)

- Accumulated depreciation: Cumulative total (appears on balance sheet)

- Frequency: Depreciation happens yearly; accumulated depreciation grows continuously

Is accumulated depreciation an asset or a liability?

Accumulated depreciation is a contra asset, it's neither an asset nor a liability. It reduces the value of your assets on the balance sheet.

Why it's not a liability:

- No debt owed: You don't have to repay accumulated depreciation

- No obligation: It represents value loss, not money owed

Here are the key points about how contra assets work:

- Negative value: Always shows as a reduction on your balance sheet

- Asset offset: Reduces the original cost of your assets

- Realistic valuation: Shows what your assets are actually worth today

How does accumulated depreciation affect financial statements?

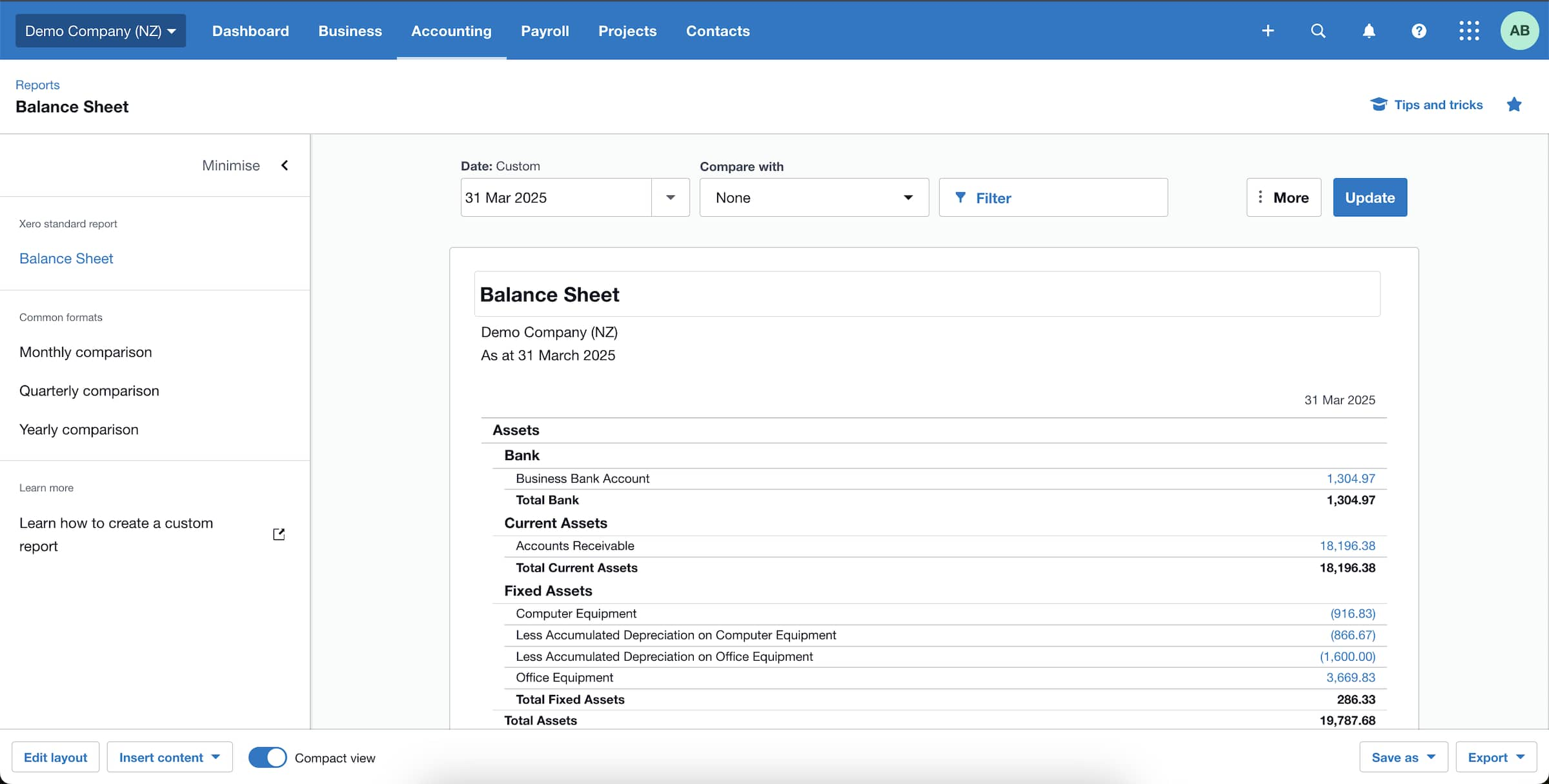

Accumulated depreciation on the balance sheet

Accumulated depreciation reduces an asset's book value on the balance sheet.

Balance sheet impact: Accumulated depreciation reduces your asset values from original cost to current worth.

Accumulated depreciation on the income statement

Depreciation reduces your taxable income and saves you money on taxes. For instance, under certain Canadian tax rules, eligible businesses can deduct the full cost of specific properties, up to $1.5 million in a tax year, significantly lowering their tax burden.

Tax benefits of accumulated depreciation:

- Lower taxable income: Depreciation expense reduces profits on paper

- Tax savings: Pay less tax without spending cash

- Cash preservation: Keep more money in your business

Accumulated depreciation on the cash flow statement

Depreciation gets added back to your cash flow because it's not a real cash expense.

Example: Balance sheet for accumulated depreciation

This example shows how accumulated depreciation changes the net book value of assets and affects your overall financial health.

How to calculate accumulated depreciation

While many small businesses use the straight-line depreciation method for its simplicity, tax rules use other methods. For example, the Canada Revenue Agency applies specific Capital Cost Allowance (CCA) rates to assets like non-residential buildings, which can include an additional allowance of 6% for a total rate of 10% in certain cases.

The straight line depreciation calculation

Straight-line depreciation formula:Annual depreciation = (asset cost − salvage value) ÷ useful life

Formula components:

- Asset cost: Original purchase price

- Salvage value: Estimated resale or scrap value when done

- Useful life: Expected years of use

How each factor affects your calculation:

- Shorter useful life: Higher annual depreciation expense

- Higher salvage value: Lower annual depreciation expense

- Higher asset cost: Higher annual depreciation expense

Calculate straight line depreciation

Now, let's calculate accumulated depreciation using the straight line depreciation method. In this example, the asset costs $1,000, has a useful life of 5 years, and a salvage value of $100.

Step 1: Calculate the annual depreciation expense

Using our formula above, our example gives us:

($1000 – $100) ÷ 5 = $180 per year

Step 2: Track accumulated depreciation each year

Create a depreciation schedule to track how accumulated depreciation increases each year by the depreciation expense. In our example:

Year 1 (1 x $180) = $180 Year 2 (2 x $180) = $360 Year 3 (3 x $180) = $540 Year 4 (4 x $180) = $720 Year 5 (5 x $180) = $900

Step 3: Calculate the asset's book value at a point in time

Use the formula:

Book value = initial cost – accumulated depreciation

In our example, after 3 years, the asset's book value is:

$1000 – $540 = $460

How to record accumulated depreciation

To record accumulated depreciation, you'll make a journal entry. This entry ensures your financial statements are accurate and reflect the asset's reduced value.

The journal entry is:

- Debit: Depreciation Expense

- Credit: Accumulated Depreciation

Here's what this does for your books:

- Debiting the depreciation expense increases your total expenses on the income statement, lowering your taxable income for the period. In Canada, this deduction is officially claimed by entering the amount from Form T777 on line 22900 of your tax return.

- Crediting the accumulated depreciation account increases its balance. As a contra asset, this reduces the net book value of your asset on the balance sheet.

This simple entry keeps your records straight without affecting your cash flow, as no actual money is spent.

Why understanding accumulated depreciation matters for your business

Business planning benefits:

- Asset replacement timing: Know when to replace equipment before it breaks

- Maintenance budgeting: Predict upcoming repair costs

- Accurate valuations: Show realistic asset worth to stakeholders

Financial benefits:

- Tax savings: Reduce taxable income and keep more cash

- Better financing: Accurate asset values improve loan approval chances

- Investment readiness: Present realistic financial position to investors

Manage depreciation efficiently with cloud accounting

Tracking depreciation manually can be time-consuming, especially as your business grows and acquires more assets. Spreadsheets can lead to errors that affect your financial reports and tax filings.

Cloud accounting software simplifies tracking your fixed assets and calculating depreciation. With a platform like Xero, you can set up a fixed asset register and automate depreciation calculations. Once you enter an asset's details, the software can handle the monthly or yearly journal entries for you.

This not only saves you time but also ensures your asset values are always up-to-date, giving you a clear and accurate picture of your financial health. You can run your business with confidence, knowing your books are in order. Start a free trial to see how Xero can streamline your asset management.

FAQs on accumulated depreciation

Here are some of the most commonly asked questions about accumulated depreciation.

How does accumulated depreciation affect cash flow?

Accumulated depreciation doesn't directly affect cash flow because no money actually leaves your business.

Indirect cash benefits:

- Tax savings: Lower taxable income means smaller tax bills

- Cash preservation: Keep money that would otherwise go to taxes

- Improved cash position: More cash available for business operations

What happens to an asset's accumulated depreciation when you sell it?

When you sell an asset, accumulated depreciation is removed from your books, and special tax rules may apply. For example, if you sell a certain class of vehicle, Canadian tax law allows you to claim 50% of the CCA that would have been allowed for that fiscal period.

Sale process:

- Remove accumulated depreciation: Clear the contra asset account

- Calculate book value: Asset cost minus accumulated depreciation

- Determine gain or loss: Compare book value to sale price

Do I record accumulated depreciation as a debit or a credit?

Record accumulated depreciation as a credit because it's a contra asset that reduces asset values.

Why it's a credit:

- Contra asset nature: Offsets the debit balance of assets

- Value reduction: Shows decreasing asset worth over time

- Balance sheet presentation: Appears as a negative against assets

Is accumulated depreciation a current liability?

No, accumulated depreciation is not a current liability. It's a contra asset that reduces asset values.

Key differences:

- Current liabilities: Debts due within 12 months

- Accumulated depreciation: Reduces asset value over time

- No repayment required: Not money owed to anyone

Here's more about current and non-current liabilities.

Disclaimer

Xero does not provide accounting, tax, business or legal advice. This guide has been provided for information purposes only. You should consult your own professional advisors for advice directly relating to your business or before taking action in relation to any of the content provided.

Start using Xero for free

Access Xero features for 30 days, then decide which plan best suits your business.