Margin of safety formula: calculate it for your business

Learn the margin of safety formula to spot risk, plan pricing and inventory, and protect your profit.

Written by Shaun Quarton—Accounting & Finance Content Writer and Growth Marketer. Read Shaun's full bio

Published Wednesday 18 February 2026

Table of contents

Key takeaways

- Calculate your margin of safety using the formula (Current sales − Break-even sales) ÷ Current sales to determine how far your sales can drop before your business starts losing money.

- Aim for a margin of safety between 20% to 30% for most small businesses, though you may need a higher percentage if your revenue is unpredictable or a lower one if you have stable, recurring income.

- Use your margin of safety to make smarter business decisions by setting realistic sales targets, adjusting pricing strategies, controlling costs, and evaluating new product launches based on how they affect your financial buffer.

- Monitor your margin of safety monthly or quarterly to catch problems early and recalculate it whenever your costs, pricing, or sales patterns change significantly.

What is the margin of safety?

the margin of safety measures how far your sales can drop before your business hits its break-even point. It's the gap between your current revenue and the minimum revenue needed to cover all costs.

It's your financial buffer. A wider margin means more protection against unexpected drops in demand or rising costs.

What is the margin of safety formula?

You can calculate the margin of safety using this formula:

Margin of safety = (Current sales − Break-even sales) ÷ Current sales

Each component means the following:

- Current sales: Your total revenue from selling goods and services over a specific period.

- Break-even sales: The exact revenue needed to cover all fixed and variable costs, where profit equals zero.

For example:

A business has current sales of $50,000 and needs $30,000 in sales to break even.

Margin of safety = ($50,000 − $30,000) ÷ $50,000 = 0.4 (40%)

This means sales could drop by 40% before the business starts losing money. Any further decline would result in a loss.

How to calculate margin of safety

Here's how to break down the margin of safety calculation.

1. Find your current sales

Determine your current sales, whether actual figures or forecasts. Your current sales figures should be readily available through your existing sales tools.

Forecasting takes analysis. Four approaches to consider:

- Analyze historical data: Review your financial reports for past sales trends and seasonal patterns. Check your POS system, eCommerce platform, or accounting software like Xero.

- Conduct market research: Study your target market, industry trends, and competitor performance.

- Gather qualitative insights: Ask your sales team or industry experts for their perspectives.

- Apply quantitative methods: Use statistical analysis on your historical and market data to predict future sales more accurately.

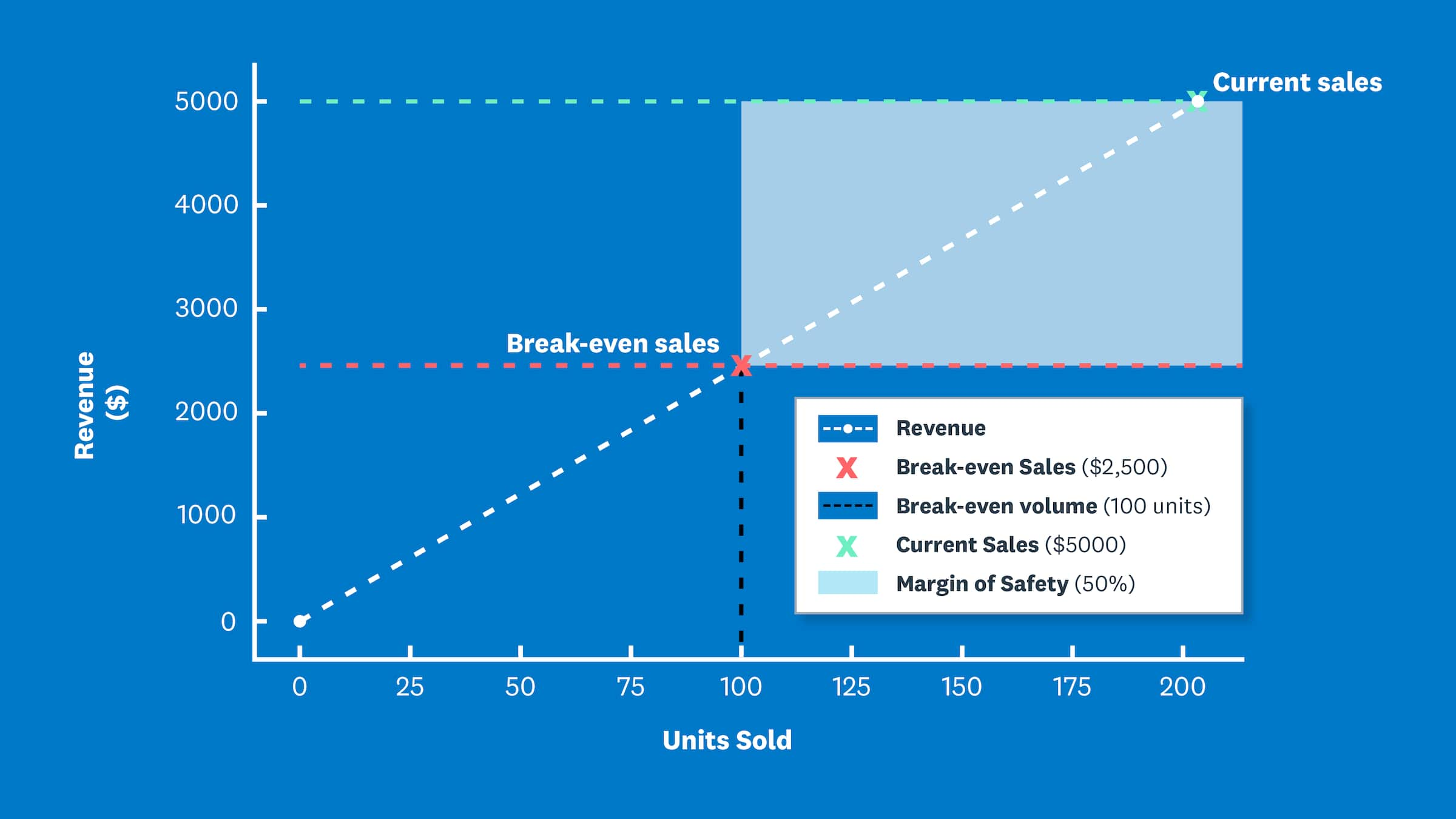

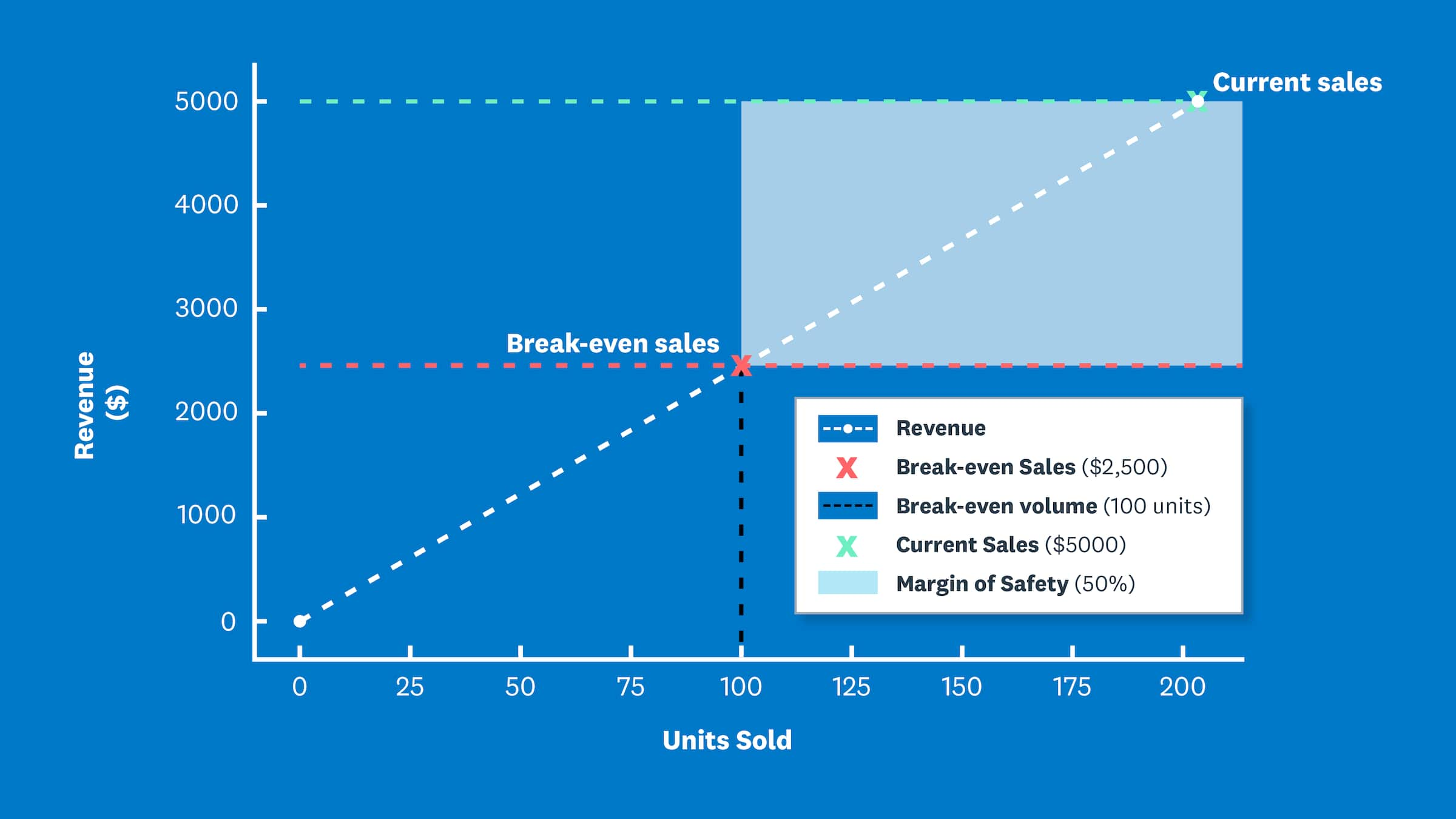

For example, a craft business uses a POS system to track monthly sales. Last month, sales were $5,000. This figure is used in the next steps of the calculation.

2. Calculate your break-even sales revenue point

For the margin of safety calculation, you need your break-even point as a sales revenue figure, not a unit count. The formula:

Break-even sales = Fixed costs ÷ ((Sales price − Variable cost) ÷ Sales price)

The formula includes:

- Fixed costs: Expenses that stay the same regardless of sales volume, such as salaries and rent.

- Variable costs: Expenses that change with sales volume, such as raw materials and sales commissions.

Learn more about variable costs and how they differ from fixed costs. Your accountant can also help you distinguish between them.

Using the craft business example:

- Fixed costs: $2,000

- Variable costs: $5 per unit

- Sales price: $25 per unit

The calculation:

$2,000 ÷ ((25 − 5) ÷ 25) = $2,000 ÷ 0.8 = $2,500

With a sales price of $25, you need revenue of $2,500 (100 units) to break even.

Break-even point formula explained.

3. Apply the margin of safety formula

Apply the margin of safety formula:

Margin of safety = (Current sales − Break-even sales) ÷ Current sales

The result is your margin of safety ratio, expressed as a percentage. This shows how far sales can fall before your business starts operating at a loss.

Using the craft business example with current sales of $5,000 and break-even sales of $2,500:

($5,000 − $2,500) ÷ $5,000 = 0.5 = 50%

The craft business has a 50% margin of safety. Sales could fall by half before reaching the break-even point.

The importance of the margin of safety for your small business

The margin of safety is essential to your risk management strategy. The Canadian government even has financial risk management guidelines for Crown corporations. It shows how far sales can fall before your business starts making a loss.

- High margin of safety: Your risk is low. Your business can absorb shifts in demand or costs without major disruption.

- Low margin of safety: Your risk is higher. You're operating close to your break-even point with less room to manoeuvre.

Consider how an external shock would affect your business. A jump in supplier prices increases your variable costs, which pushes up your break-even point. This eats into your margin of safety and leaves your business exposed to further cost increases or falling sales.

How the margin of safety supports your business decisions

Your margin of safety helps you make smarter decisions across key areas of your business.

- Performance targets: Calculate a clear break-even point to set achievable sales targets that keep you profitable.

- Pricing strategy: If your margin is shrinking, review your pricing so each sale contributes enough to cover costs.

- Cost control: A low margin signals the need to cut costs and protect your buffer.

- New product evaluation: Before launching something new, assess how additional costs affect your margin of safety and profitability.

Consider how the margin of safety works alongside other financial metrics.

Other metrics work with the margin of safety in your accounting analysis

The margin of safety works best alongside other financial metrics. When combined with CVP analysis, for example, it gives you a clearer view of both profitability and risk than either metric alone.

Margin of safety and CVP analysis

Cost-volume-profit (CVP) analysis is a forward-looking exercise that models how changes to your cost structure, sales volume, and pricing affect profitability. It shows how adjusting any one of these factors, up or down, affects your bottom line.

The margin of safety is an output of CVP analysis. While CVP helps you plan for different scenarios, your margin of safety shows the financial buffer you have right now.

Learn more about management accounting and decision-making.

Master your margin of safety with Xero

Calculating your margin of safety takes time. You need to track down figures, update spreadsheets, and manually piece together reports.

Xero takes the manual work out of the process. You get quick access to the financial data and reports you need to work out your margin of safety faster and make informed decisions with confidence. Get one month free.

FAQs on margin of safety

Here are answers to common questions about calculating and using your margin of safety.

What is a good margin of safety percentage?

A margin of safety of 20% to 30% is generally considered healthy for most small businesses. The ideal percentage depends on your industry, business model, and risk tolerance. Businesses with unpredictable revenue streams may want a higher margin, while those with stable, recurring income can operate comfortably with a lower one.

Can my margin of safety be negative?

Yes, a negative margin of safety means your current sales are below your break-even point, so your business is operating at a loss. This signals an urgent need to either increase sales or reduce costs to become profitable again.

How often should I calculate my margin of safety?

Calculating your margin of safety monthly or quarterly helps track trends and catch problems early. This cadence aligns with major financial monitoring practices. The Bank of Canada updates its key financial stability indicators quarterly.

You should also recalculate it whenever your costs, pricing, or sales patterns change significantly.

What's the difference between margin of safety and profit margin?

margin of safety measures how far sales can drop before you hit break-even, expressed as a percentage of current sales. profit margin measures how much profit you keep from each dollar of revenue. One measures risk buffer; the other measures how profitable you are.

Disclaimer

Xero does not provide accounting, tax, business or legal advice. This guide has been provided for information purposes only. You should consult your own professional advisors for advice directly relating to your business or before taking action in relation to any of the content provided.

Start using Xero for free

Access Xero features for 30 days, then decide which plan best suits your business.