Solvency vs liquidity: Understand the key differences

Learn the difference between solvency and liquidity to protect cash flow and plan for long term growth.

Written by Lena Hanna—Trusted CPA Guidance on Accounting and Tax. Read Lena's full bio

Published Saturday 31 January 2026

Table of contents

Key takeaways

- Monitor both solvency and liquidity ratios regularly to get a complete picture of your business's financial health, as you can be solvent with valuable long-term assets but still fail if you can't manage day-to-day cash needs.

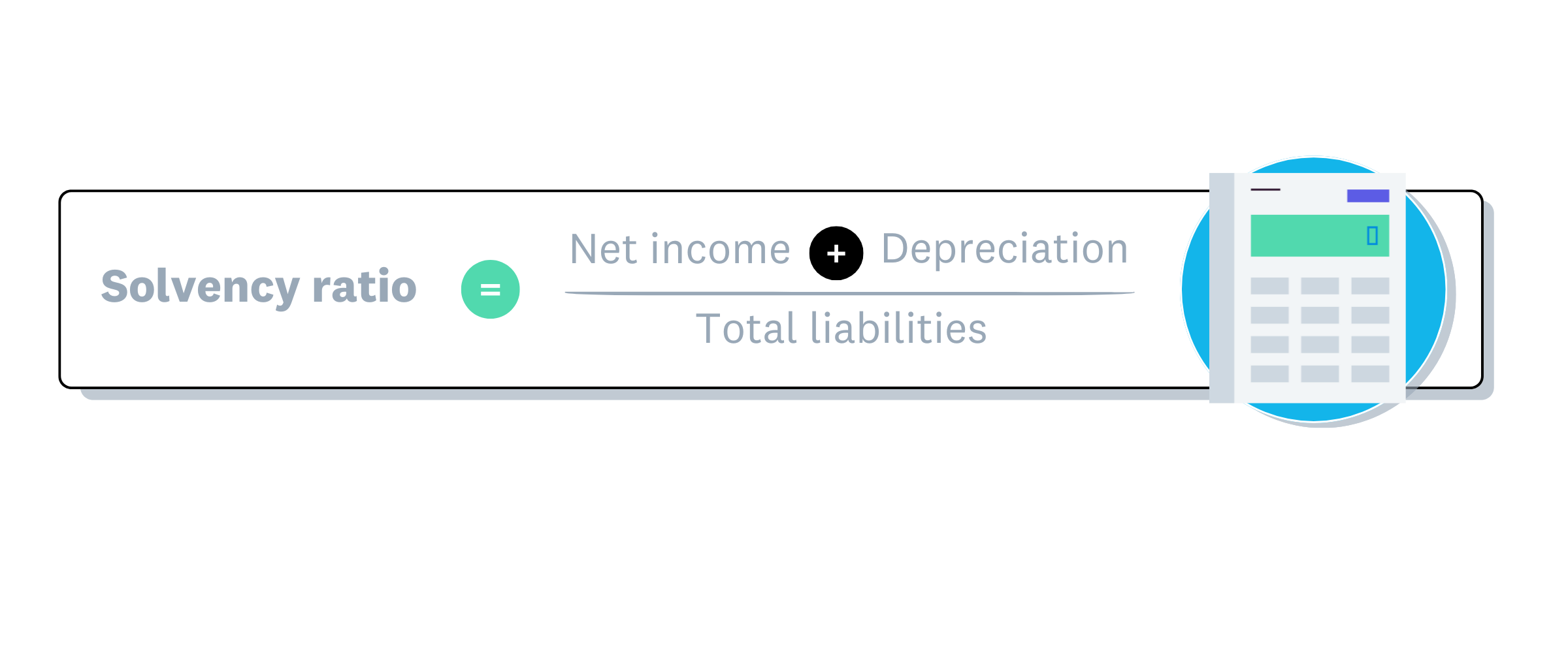

- Calculate your solvency ratio by adding net income and depreciation, then dividing by total liabilities; aim for 20% or above to indicate you can meet long-term debt obligations.

- Improve liquidity by accelerating collections through easier invoice payment options, building cash reserves for emergencies, and monitoring cash flow regularly to ensure you can pay short-term bills on time.

- Use your strong solvency position to access better financing terms and attract investors, while maintaining adequate liquidity to seize growth opportunities and handle unexpected costs without disrupting operations.

What does solvency mean in business?

Solvency is your business's ability to meet long-term financial obligations. A solvent business has positive net equity. This means your total assets exceed your total liabilities.

What factors affect your solvency?

To keep your business solvent, you must:

- Maintain consistent profitability: Generate steady profits to keep assets above liabilities

- Manage debt strategically: Negotiate favourable loan terms, understand collateral requirements, and monitor the debt risk of a business using metrics like the interest coverage ratio to ensure you can cover interest obligations

- Optimize asset usage: Ensure assets like inventory generate returns that cover debt obligations

What is solvency vs profitability?

Solvency measures your ability to pay long-term debts, while profitability measures how much money you make versus your costs.

A profitable business earns more than it spends on producing goods or services. Strong profits help maintain solvency by building assets.

To protect your solvency, manage debt carefully. If you take on new loans, make sure you have a clear plan to repay existing ones so your liabilities do not exceed your assets.

You can read more in the Xero glossary entry on profitability.

How does solvency affect your business growth?

Strong solvency supports business growth by helping you:

- Access financing: Banks and lenders feel confident you can repay loans

- Attract investors: Bring additional resources and expertise to your business

- Negotiate better supplier terms: Use cash reserves for bulk purchases and lower unit costs

- Plan strategically: Make long-term business decisions with confidence

What does liquidity mean in business?

Liquidity measures your business's ability to pay short-term bills and loan payments. It's often expressed as a current ratio comparing current assets to current liabilities; generally, the larger the ratio, the more liquid a business is considered.

Current liabilities are amounts you owe within one year. Current assets include cash, inventory, accounts receivable, and assets you can sell quickly.

Other liquidity ratios

Small businesses commonly use several liquidity ratios. In addition to the three common ratios below, another helpful measure of liquidity is the current debt to equity ratio, which indicates a firm's ability to pay its short-term debts.

- Current ratio: Current assets divided by current liabilities

- Quick ratio: Cash, short-term investments, and receivables divided by current liabilities

- Cash ratio: Cash and cash equivalents divided by current liabilities

Learn more in the Xero guide on liquidity ratios.

How liquid are your assets?

Assets have different liquidity levels based on how quickly you can convert them to cash.

Most liquid assets:

- Cash: Physical currency and immediately available bank funds

- Accounts receivable: Outstanding customer invoices (liquidity decreases with longer payment terms)

Less liquid assets:

- Physical assets: Buildings and equipment that take months to sell

Liquidity vs other financial concepts

Liquidity relates to several financial concepts but serves different purposes:

- Liquidity: Measures ability to pay short-term obligations

- Cash flow: Tracks money moving in and out of your business

- Working capital: Shows remaining funds after covering short-term costs

- Free cash flow: Indicates cash available after capital investments

How does liquidity affect business growth?

Strong liquidity supports business growth by helping you:

- Seize opportunities: Launch new products or hire additional staff quickly

- Handle unexpected costs: Cover emergency expenses like equipment repairs

- Maintain operational stability: Avoid disrupting operations to find alternative funding

The main differences between solvency and liquidity

Table of the difference between solvency and liquidity

Solvency takes a long-term view of your financial health, while liquidity focuses on the short term. Together, they give you a rounded picture of how stable and flexible your business finances are.

Keep a steady eye on both your business's liquidity and solvency to stay on top of its financial picture.

How to measure solvency and liquidity in your business

To calculate your solvency ratio, use the following formula.

Solvency ratio formula

Solvency ratio formula

Solvency ratio calculation example:

Martha's cafe financial data:

- Net income: $50,000

- Asset depreciation: $10,000

- Total liabilities: $300,000

Calculation steps:

- Add net income and depreciation: $50,000 + $10,000 = $60,000

- Divide by total liabilities: $60,000 ÷ $300,000 = 0.20 (20%)

A ratio of 20% or above indicates healthy solvency. Martha's business can likely meet its long-term debt obligations.

*Depreciation is the decrease of the value of your assets over time from normal wear and tear, which is entered on your balance sheet as a deduction from the assets value.

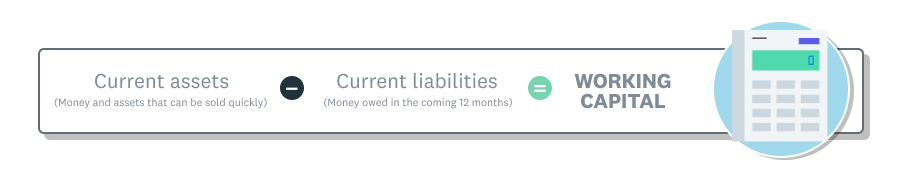

Liquidity ratio formula

There are several liquidity ratios, like the cash ratio, quick ratio, and the working capital ratio, which is a useful long-term measure of liquidity.

Here's the formula for the working capital ratio:

Liquidity ratio calculation example:

Sadiq's sports shop financial data:

- Current assets: $120,000

- Current liabilities: $80,000

Calculation steps:

- Divide current assets by current liabilities: $120,000 ÷ $80,000 = 1.5

- Compare to benchmark: 1.5 is above 1.0

A ratio above 1.0 indicates good liquidity. Sadiq can likely meet his short-term financial obligations.

Why solvency and liquidity matter for your small business

Strong solvency provides financial stability and supports business growth. When your business is solvent, you can manage risks and meet stakeholder expectations with confidence.

Strong liquidity ensures you can pay staff and suppliers on time and handle unexpected costs or market changes. By keeping both solvency and liquidity healthy, you reduce the risk of debt payment difficulties, cash flow pressures, or formal insolvency.

Monitoring both metrics helps you make better operational and strategic financial decisions.

Tips to improve your financial solvency and liquidity

Use these strategies to improve your financial health:

Improve solvency:

- Attract new investment: Bring in additional capital to strengthen your balance sheet

- Restructure existing debt: Renegotiate, refinance, or consolidate loans for better terms

- Optimize operations: Reduce costs through strategic restructuring if necessary

Improve liquidity:

- Monitor cash flow regularly: Track and plan payments based on cash availability

- Benchmark against industry standards: Compare your ratios to similar businesses

- Accelerate collections: Make invoice payments easier and faster for customers

- Build cash reserves: Maintain emergency funds for unexpected expenses

Managing both for long-term business success

Solvency and liquidity paint two different pictures of your financial health, but you need both to see the full story. A business can be solvent with valuable long-term assets, but still fail if it can't manage its day-to-day cash needs. On the other hand, a liquid business might meet its short-term bills but struggle to grow if its debts are too high.

Balancing short-term liquidity with long-term solvency is key to sustainable growth. By regularly monitoring both metrics, you can make confident decisions, plan for the future, and keep your business financially stable. The right tools can make this process simple, giving you a clear view of your finances at a glance.

Use Xero to track your solvency and liquidity

With Xero accounting software, you know exactly what's happening with your numbers. Maybe you want to scrutinize your daily spending with real-time information, or you need an overview of your long-term solvency based on financial reports. Either way, let Xero give you the full financial picture.

Learn more about Xero financial reports for your business or try Xero for free.

FAQs on solvency and liquidity

Here are answers to common questions about solvency and liquidity for small businesses.

What does it mean to provide liquidity?

Providing liquidity means ensuring your business has enough cash to pay short-term bills and obligations. You can improve liquidity by accelerating cash flow, such as offering early payment discounts.

Can my business have good solvency but poor liquidity?

Yes, a business can be solvent but not liquid. Your business might have valuable fixed assets like property that ensure long-term solvency. However, weak cash flow can create short-term liquidity problems for paying immediate bills.

Is solvency good or bad?

Solvency is positive because it means your business can meet its long-term financial obligations.

What is a good solvency ratio for my small business?

It depends on your industry. In general, a ratio of 20% or more indicates you can meet your long-term financial obligations.

Start using Xero for free

Access Xero features for 30 days, then decide which plan best suits your business.