Current ratio: What it is, formula, and how to use it

Discover how the current ratio shows your ability to pay bills, spot cash gaps, and plan next steps with confidence.

Written by Jotika Teli—Certified Public Accountant with 24 years of experience. Read Jotika's full bio

Published Monday 26 January 2026

Table of contents

Key takeaways

- Calculate your current ratio by dividing current assets by current liabilities to determine if you can cover short-term debts, aiming for a ratio of 1.0 or higher to maintain financial health.

- Monitor your current ratio consistently at the same time each month to identify trends and avoid misleading snapshots, as this metric fluctuates throughout billing cycles.

- Interpret ratios above 2.0 as potential signs of excess cash that could be invested in growth opportunities, while ratios below 1.0 indicate liquidity challenges requiring immediate attention.

- Combine current ratio analysis with other financial measures like quick ratio, cash flow projections, and working capital to get a complete picture of your business's financial position.

Current ratio definition

Current ratio is a liquidity ratio that measures your business's ability to pay short-term debts. It shows whether you have enough current assets to cover current liabilities due within one year.

People also call this the working capital ratio. It is a broader measure of liquidity than the quick ratio because it includes all current assets, including inventory that takes longer to convert to cash.

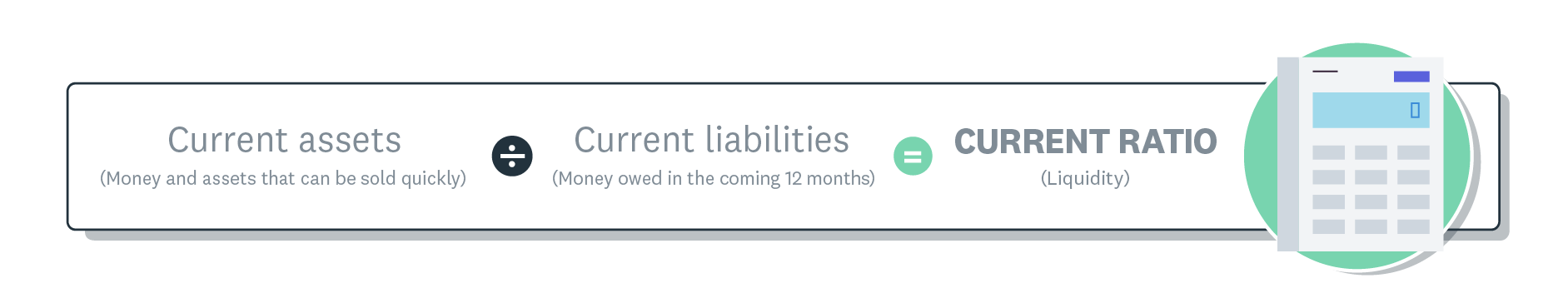

Current ratio formula

Current ratio liquidity formula.

You need two key numbers from your balance sheet to calculate current ratio:

Current assets include:

- cash and cash equivalents

- inventory

- other assets convertible to cash within one year

Current liabilities include:

- accounts payable

- short-term loans

- other debts due within one year

The current ratio formula is:

current ratio = current assets ÷ current liabilities

Example of a current ratio calculation

A small construction business wants to work out its current ratio, to see if it can cover upcoming loan repayments and material costs.

The business has $250,000 in current assets and $175,000 in current liabilities. The current ratio calculation is:

$250,000 ÷ $175,000 = 1.43

The current ratio is above one, which means the business can cover upcoming liabilities. For every $1 of liabilities, the business has $1.43 available.

The business could invest the remaining cash in other areas. Or it could keep the extra cash to help cover times when assets are lower and liabilities are higher.

How to interpret your current ratio

A current ratio of 1.0 or higher means your business can cover short-term debts and is generally financially healthy.

A ratio consistently above 2.0 might indicate excess cash that could be invested in growth opportunities.

A ratio below 1.0 suggests potential liquidity challenges. This can happen temporarily during growth phases when you're investing heavily. Aim to keep your current ratio at 1.0 or higher over the long term.

The current ratio changes over the course of a billing cycle, so it's a good idea to measure it at the same time every month. That way you're comparing like for like, and you can see the long-term trend of the current ratio.

While you can learn a lot from analyzing your current ratio, it is only one view of your finances. Combine it with other profitability ratios and cash flow projections to assess and manage your finances.

Current ratio vs quick ratio and other liquidity ratios

Compare current ratio with other liquidity measures to get a complete picture. Three common measures are:

- quick ratio: uses only assets convertible to cash within 90 days (excludes inventory)

- cash ratio: uses only cash and cash equivalents (most conservative measure)

- current ratio: uses all current assets (broadest liquidity measure)

Using a combination of financial ratios can tell you how much cash you have available at different times, for different purposes. Learn more about these metrics in our guide to liquidity ratios.

Current ratio in relation to working capital and cash flow

Current ratio works alongside other financial measures to give you a complete view. Key related measures include:

- working capital: the dollar amount left after covering current liabilities (current assets minus current liabilities)

- cash flow: net money moving in and out of your business over time

- free cash flow: cash remaining after operating expenses and capital investments

What are the limitations of using the current ratio?

Current ratio has some limitations you need to keep in mind:

- It is a snapshot in time, so use it alongside daily cash flow reports to understand payment timing.

- It treats all current assets equally, so check how quickly each asset can be turned into cash. Cash is immediately available, but inventory might take months to sell.

- It does not show when each liability is due, so review due dates across the year to see when you need cash on hand.

- If your business is seasonal, look at the ratio across your peak and quiet periods so you can see how sales patterns affect it.

Monitor your finances in real-time with Xero

Xero can take care of the complex calculations for you, so you get a clear picture of the cash available in your business. You can see cash flow at a glance, track spending, and monitor key financial metrics over time.

Use Xero reporting features to create forecasts and projections, and make informed financial decisions with confidence. Try Xero for free.

FAQs on current ratio

Here are answers to common questions about current ratio and how to use it effectively.

What is a good current ratio for small businesses?

A current ratio between 1.5 and 3.0 is generally considered good for most small businesses. This range shows you can cover short-term debts while maintaining enough working capital for operations.

What does a current ratio of 2.5 mean?

A current ratio of 2.5 means you have $2.50 in current assets for every $1.00 of current liabilities. This indicates strong liquidity and the ability to easily meet short-term obligations.

Is a current ratio of 1.0 acceptable for my business?

A current ratio of 1.0 is the minimum acceptable level, showing you can just cover current liabilities. While not ideal, it's manageable if you have predictable cash flow and good relationships with suppliers and lenders.

Disclaimer

Xero does not provide accounting, tax, business or legal advice. This guide has been provided for information purposes only. You should consult your own professional advisors for advice directly relating to your business or before taking action in relation to any of the content provided.

Start using Xero for free

Access Xero features for 30 days, then decide which plan best suits your business.