Net profit margin calculator

Calculate your net profit margin with this simple calculator. Just punch in costs and revenue.

- Calculate net profit margin

- See profit percentages in an instant

- Best used at a business-wide level

Net Profit Margin Calculator

Calculate your net profit margin to find out what portion of your revenue makes it to the bottom line.

Your net profit margin 0%

Get tips to increase profit margin: How to increase profits

Tired of manual calculations?

Let Xero handle the numbers so you can focus on growing your business. Sign up for free!

How to use this net profit margin calculator

To calculate your net profit margin before taxes, enter the revenue from sales and your total business costs. When entering revenue, don’t include income from things like interest, dividends, sales of assets, or sublets (unless you're actually a leasing business). But keep in mind that sales and expenses fluctuate. To get a more accurate sense of your net profit margin, look at long periods of time such as quarters or years. Don't forget to compare the numbers from different periods of time so you can learn about seasonal trends.

To calculate your net profit margin before taxes, enter the revenue from sales and your total business costs. When entering revenue, don’t include income from things like interest, dividends, sales of assets, or sublets (unless you're actually a leasing business). But keep in mind that sales and expenses fluctuate. To get a more accurate sense of your net profit margin, look at long periods of time such as quarters or years. Don't forget to compare the numbers from different periods of time so you can learn about seasonal trends.

To see your net profit margin after tax, enter sales and revenue as above, but this time add your income tax bill to your expenses. If earnings are keeping pace with last year, you can use last year's tax bill to estimate this year's tax bill. Make adjustments if you’re looking at a shorter time period. For example, if you're looking at a quarter, divide your annual tax bill by four. If you're looking at six months, divide your annual tax bill by half. Get an accountant to help you estimate your tax bill if your profits are significantly different from last year.

To see your net profit margin after tax, enter sales and revenue as above, but this time add your income tax bill to your expenses. If earnings are keeping pace with last year, you can use last year's tax bill to estimate this year's tax bill. Make adjustments if you’re looking at a shorter time period. For example, if you're looking at a quarter, divide your annual tax bill by four. If you're looking at six months, divide your annual tax bill by half. Get an accountant to help you estimate your tax bill if your profits are significantly different from last year.

Net profit margin FAQs

Your profit margin is the percentage of sales revenue that your business gets to keep. In other words, it's the portion of your revenue that doesn't go back out the door to cover expenses. There’s a gross profit margin and a net profit margin. Gross is calculated by subtracting certain types of costs. Net is calculated by subtracting all costs.

Learn more about gross profit vs net profitYour profit margin is the percentage of sales revenue that your business gets to keep. In other words, it's the portion of your revenue that doesn't go back out the door to cover expenses. There’s a gross profit margin and a net profit margin. Gross is calculated by subtracting certain types of costs. Net is calculated by subtracting all costs.

Learn more about gross profit vs net profitNet profit can be calculated before tax, with the formula: revenue – expenses. Or it can be calculated after tax, with the formula: revenue – expenses – tax. In the small business setting, net profit commonly means net profit after tax because that’s the money you get to keep. However, it’s handy to know the before-tax and after-tax numbers. A big drop-off between the two may indicate that you need help with your tax planning.

Net profit can be calculated before tax, with the formula: revenue – expenses. Or it can be calculated after tax, with the formula: revenue – expenses – tax. In the small business setting, net profit commonly means net profit after tax because that’s the money you get to keep. However, it’s handy to know the before-tax and after-tax numbers. A big drop-off between the two may indicate that you need help with your tax planning.

Net profit / Revenue x 100 = Net profit margin. To run this formula, you first need to calculate your net profit, which is sales revenue minus expenses minus taxes. Or sales revenue minus expenses, if you want pre-tax net profit margin.

Learn about net profitNet profit / Revenue x 100 = Net profit margin. To run this formula, you first need to calculate your net profit, which is sales revenue minus expenses minus taxes. Or sales revenue minus expenses, if you want pre-tax net profit margin.

Learn about net profitNet profit margin shows what portion of your revenue turns into profits. If you have a low margin, it means you have to do a lot of work and make a lot of sales in order to make any money. Small margins also limit your room for error. A small change in expenses or a dip in sales could push you into the red.

Net profit margin shows what portion of your revenue turns into profits. If you have a low margin, it means you have to do a lot of work and make a lot of sales in order to make any money. Small margins also limit your room for error. A small change in expenses or a dip in sales could push you into the red.

How to increase profit margin

Growing your profit percentages

To increase your profit margins, you have three options.

- Increase revenue.

- Lower your costs.

- Improve your tax efficiency.

Get practical tips: How to increase profitability

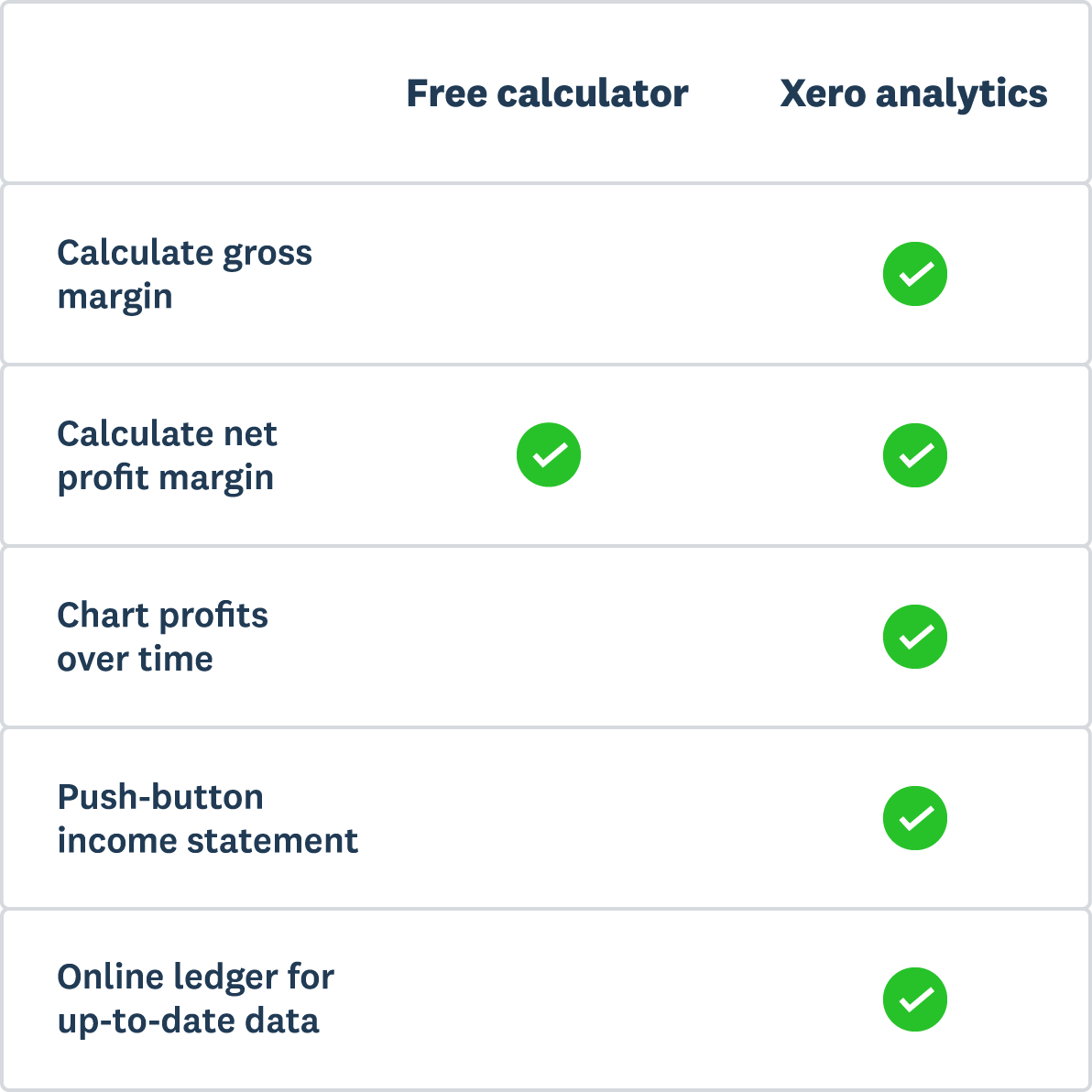

Profitability tools from Xero

If you want your business to be successful, you need a firm grasp on the numbers. Xero serves up the information you need to track profitability and manage your margins.

- Get a snapshot of your gross or net profit margins at any time (Xero does the math for you)

- Simply click to compare time periods and see how profits are trending

- Share reports online with advisors and partners to start key conversations

Power up your profits

How to increase prices

Learn the awkward art of increasing prices.

Learn to measure profitability

Find out how to measure margins, so you can make profit a priority.

Find a profit coach

Search a directory of business advisors that can boost your bottom line.

*Disclaimer

Xero does not provide accounting, tax, business or legal advice. This calculator has been provided for information purposes only. You should consult your own professional advisors for advice directly relating to your business.

Start using Xero for free

Access Xero features for 30 days, then decide which plan best suits your business.