Free balance sheet template

Download a balance sheet template for your business. And learn how Xero software can make reporting easier.

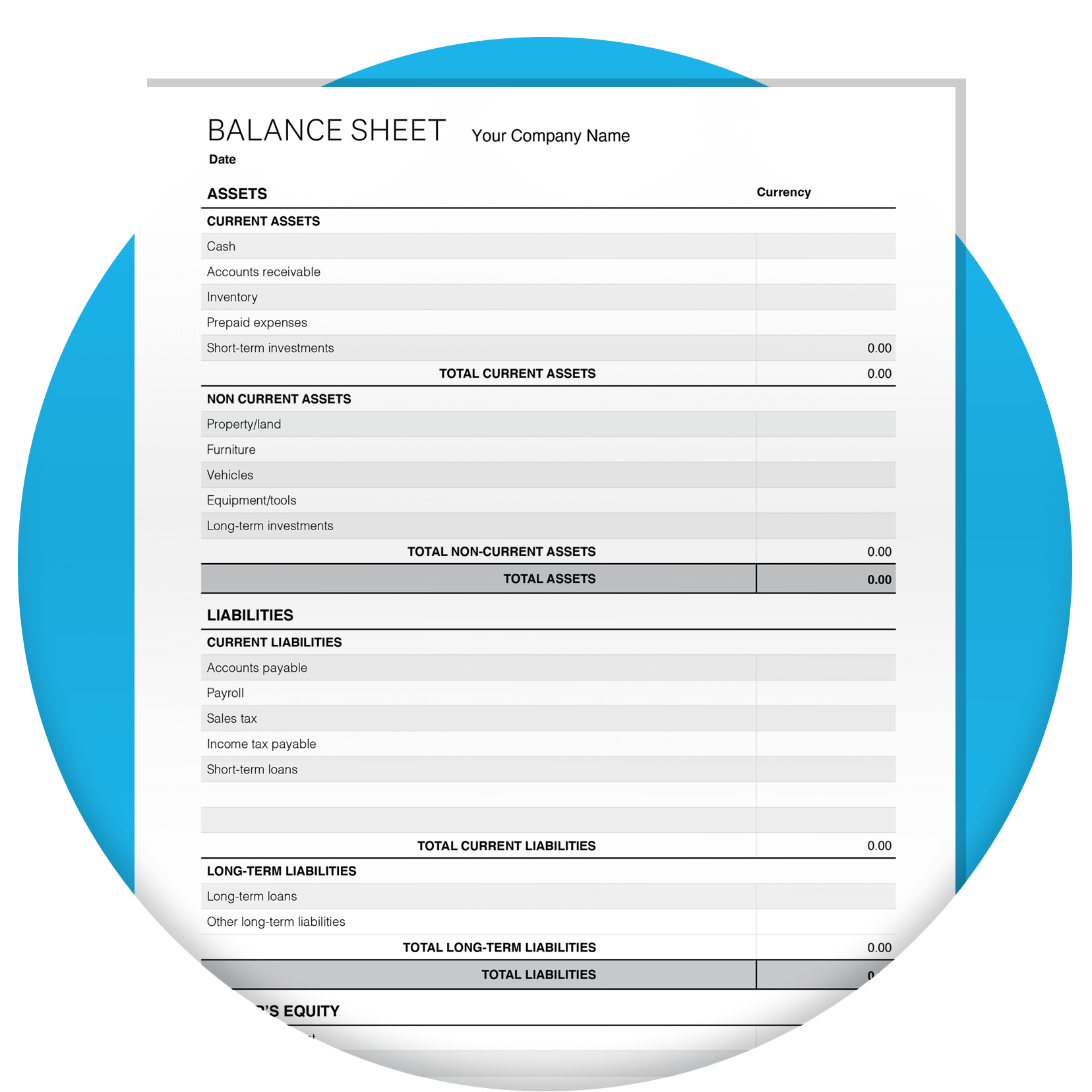

Free and customisable

Download the template for free and tailor it to your business’s branding, structure, and reporting needs.

Simple and easy to use

A clear layout in balance sheet format– you’ll have your balance sheet done in no time.

Designed for small businesses

Xero’s balance sheet template for small businesses makes it easy to track finances and make smarter decisions.

Download the free balance sheet template

Fill in the form to get a balance sheet template as an editable PDF. We’ll throw in a guide to help you use it.

Got your template? Try Xero for free.

Ready to take control of your business? Xero's got everything you need to succeed, from accounting and invoicing to reporting and payroll.

The balance sheet explained

A balance sheet is a financial document that gives you a snapshot of your business’s assets, liabilities, and owner’s equity at a moment in time. The balance sheet’s purpose is to show whether a business can cover its debts or whether it has gained or lost value over time. When used with other financial statements (like the profit and loss statement, and cash flow statement) it’s a great way to judge a business’s financial health and an excellent input into your business decisions.

A balance sheet is a financial document that gives you a snapshot of your business’s assets, liabilities, and owner’s equity at a moment in time. The balance sheet’s purpose is to show whether a business can cover its debts or whether it has gained or lost value over time. When used with other financial statements (like the profit and loss statement, and cash flow statement) it’s a great way to judge a business’s financial health and an excellent input into your business decisions.

The balance sheet formula is assets = liabilities + owner’s equity. True to its name, a balance sheet should balance – the final figure (assets) should equal the sum of the business’s liabilities (what it owes) plus the owner’s equity. If there are discrepancies, your data might be incorrect or missing.

The balance sheet formula is assets = liabilities + owner’s equity. True to its name, a balance sheet should balance – the final figure (assets) should equal the sum of the business’s liabilities (what it owes) plus the owner’s equity. If there are discrepancies, your data might be incorrect or missing.

A balance sheet is usually made up of three main components: assets, liabilities, and owner’s equity. Assets are what the business owns. The balance sheet typically lists them in order of liquidity – that is, how easily they’re converted into cash. Liabilities are what the business owes, and are usually ordered by the date due to be paid. Owner’s equity is the capital invested by the owner into the business, plus any retained earnings (profits you haven’t distributed as dividends). It’s the value remaining in the business after you’ve subtracted your liabilities from your assets.

A balance sheet is usually made up of three main components: assets, liabilities, and owner’s equity. Assets are what the business owns. The balance sheet typically lists them in order of liquidity – that is, how easily they’re converted into cash. Liabilities are what the business owes, and are usually ordered by the date due to be paid. Owner’s equity is the capital invested by the owner into the business, plus any retained earnings (profits you haven’t distributed as dividends). It’s the value remaining in the business after you’ve subtracted your liabilities from your assets.

Why your balance sheet matters

A balance sheet is one of the core financial statements that can help give you a clear view of your business’s financial health. It helps owners, investors, and lenders assess risk, track growth, and make strategic decisions. Use it to:

- Understand your business’s assets, debts, and equity

- Spot trends in spending, growth, or liabilities

- Support financing applications and long-term planning

How to use the free balance sheet template

Before you start filling in the template, make sure you have accurate figures for the three key components of a balance sheet: assets (what your business owns, like cash or equipment), liabilities (what the business owes, such as debts or expenses), and owners equity (retained earnings, if any). The balance sheet is only as accurate as your data, so use reliable sources like your business’s bank statements, loan agreements, and asset valuations. Ask your accountant for help if you need to.

Before you start filling in the template, make sure you have accurate figures for the three key components of a balance sheet: assets (what your business owns, like cash or equipment), liabilities (what the business owes, such as debts or expenses), and owners equity (retained earnings, if any). The balance sheet is only as accurate as your data, so use reliable sources like your business’s bank statements, loan agreements, and asset valuations. Ask your accountant for help if you need to.

Begin by listing all business assets. The template lists your assets in order of liquidity, with cash – always the most liquid asset – at the top. Separate your assets into two categories according to the template: current assets and non-current assets. Current assets are those you expect to convert into cash within a year, such as shares. Non-current assets are long-term holdings, like property.

Learn more about current assets.Learn more about non-current assets.Begin by listing all business assets. The template lists your assets in order of liquidity, with cash – always the most liquid asset – at the top. Separate your assets into two categories according to the template: current assets and non-current assets. Current assets are those you expect to convert into cash within a year, such as shares. Non-current assets are long-term holdings, like property.

Learn more about current assets.Learn more about non-current assets.Next, record all liabilities in the template – these are your business’s financial obligations. Like assets, liabilities fall into two categories: current liabilities, which are due within a year, and non-current liabilities, which cover long-term debts or obligations.

More on differences between current and non-current liabilities.Next, record all liabilities in the template – these are your business’s financial obligations. Like assets, liabilities fall into two categories: current liabilities, which are due within a year, and non-current liabilities, which cover long-term debts or obligations.

More on differences between current and non-current liabilities.Owner’s equity is the money remaining in the business after liabilities are subtracted from assets. For sole traders, this includes any capital you've invested, plus profits retained in the business, minus drawings – money you've taken out for personal use. For businesses, equity typically consists of shareholders’ capital and retained earnings – profits that haven’t been distributed as dividends. To calculate equity, use the formula: total assets – total liabilities = owner’s equity.

What is owner’s equity?Owner’s equity is the money remaining in the business after liabilities are subtracted from assets. For sole traders, this includes any capital you've invested, plus profits retained in the business, minus drawings – money you've taken out for personal use. For businesses, equity typically consists of shareholders’ capital and retained earnings – profits that haven’t been distributed as dividends. To calculate equity, use the formula: total assets – total liabilities = owner’s equity.

What is owner’s equity?Finally, review all entries and calculations to ensure they’re accurate. If you’ve done this right, your balance sheet will reflect the correct totals between assets, liabilities, and equity. Regular balance sheet reconciliation keeps your financial records up to date. Make sure totals align, and update your balance sheet periodically – or whenever there’s a major change in your financial situation.

Finally, review all entries and calculations to ensure they’re accurate. If you’ve done this right, your balance sheet will reflect the correct totals between assets, liabilities, and equity. Regular balance sheet reconciliation keeps your financial records up to date. Make sure totals align, and update your balance sheet periodically – or whenever there’s a major change in your financial situation.

Xero’s PDF template beats spreadsheets

While spreadsheets are a fine tool for anyone starting out, PDFs give you a more professional solution that is ideal for formal reporting or sharing with your stakeholders. A PDF template gives you:

- A polished and professional design

- Fewer errors with locked formatting and built-in formulas

- Security with password protection options

Tips to get your balance sheet right

Incomplete records can cause imbalances. Regular balance sheet reconciliation ensures everything consistently adds up.

Incomplete records can cause imbalances. Regular balance sheet reconciliation ensures everything consistently adds up.

Incorrectly categorising an item distorts your balance. Learn what goes where to keep everything accurate.

Follow the International Financial Reporting Standards (IFRS)Incorrectly categorising an item distorts your balance. Learn what goes where to keep everything accurate.

Follow the International Financial Reporting Standards (IFRS)

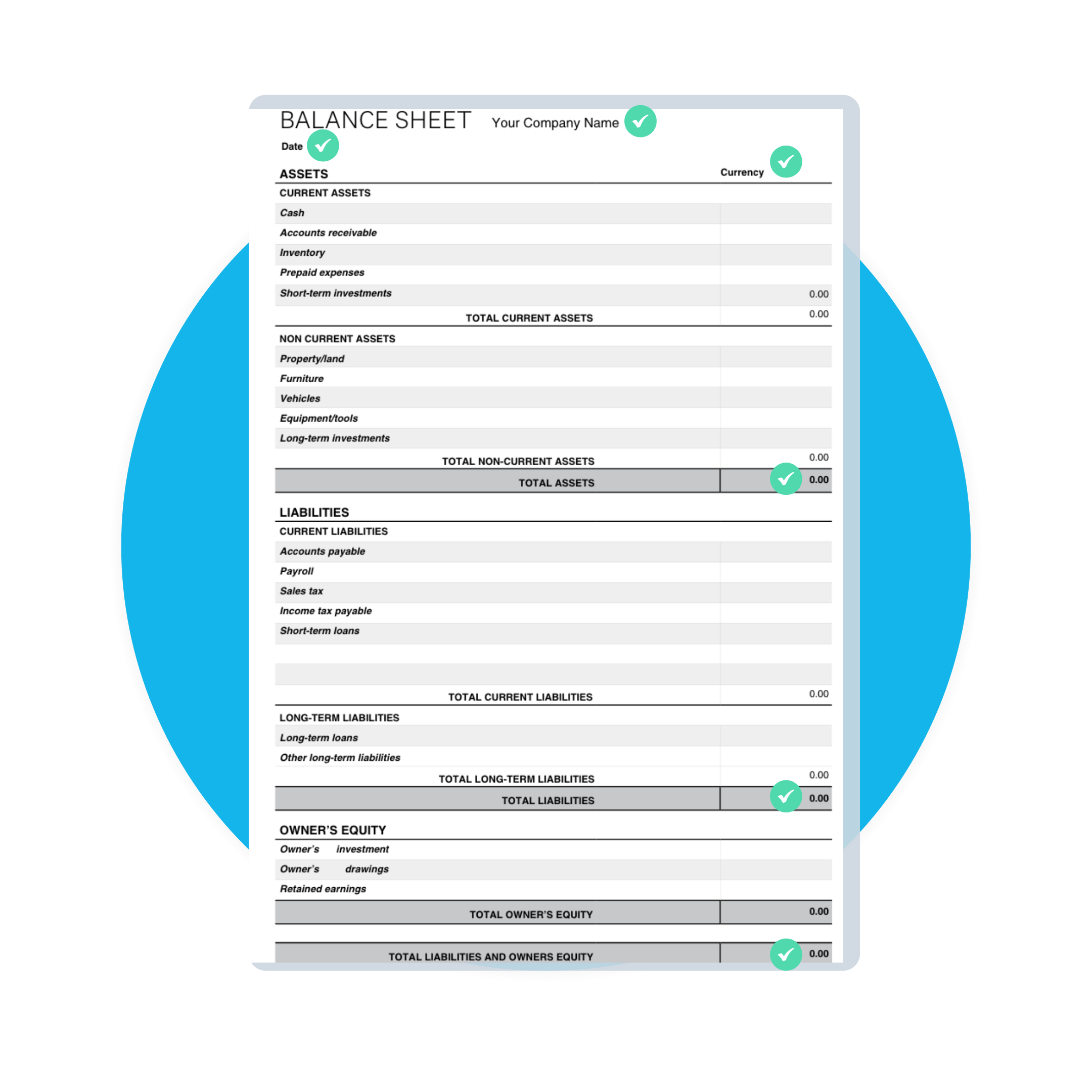

Balance sheet example

Here’s a balance sheet sample filled in for you, to help you understand how to fill out each section. Complete the template by entering:

- Company name

- Date

- Currency

- All your assets

- Any liabilities

- Owner’s equity

Make balance sheets better

Set up Xero to capture your financial data and it’ll create a balance sheet whenever you need one.

- Create up-to-date reports at the press of a button

- Format them the way you like

- Share them online with your accountant, bookkeeper, and business partners

Disclaimer

Xero does not provide accounting, tax, business or legal advice. This template has been provided for information purposes only. You should consult your own professional advisors for advice directly relating to your business.