Xero for BAS agents and accountants

Xero makes submitting business activity statements to the ATO simple. Find the resources you need to get up and running.

Choose the best BAS lodgement method for you

BAS lodgement methods

Xero has two methods for lodging BAS. Which you use depends on the number of clients you have and whether they’re all on Xero.

- Lodge from Xero Tax

- Lodge from a Xero organisation

Lodge from Xero Tax

Lodge from Xero Tax for all your clients whether or not they’re on Xero. Create BAS automatically, prefilled with ATO data and digitally signed.

Lodge from Xero Tax

Lodge from a Xero organisation

Use this method if you have a few clients who all use Xero. Lodge taxable payments annual reports (TPAR) directly from clients’ Xero organisations.

Lodge from Xero

Need more information?

Here’s a handy infographic to help. You’ll also find a checklist for moving to Xero Tax to help you review your current processes.

Download infographicTop Xero Tax features for you

Xero Tax features

Learn more about the top features that make managing and lodging BAS easier with Xero Tax.

- Prefill and import

- Document packs in HQ

- Automatic activity statements

- Pre-lodge

- Guide to setting up Xero Tax

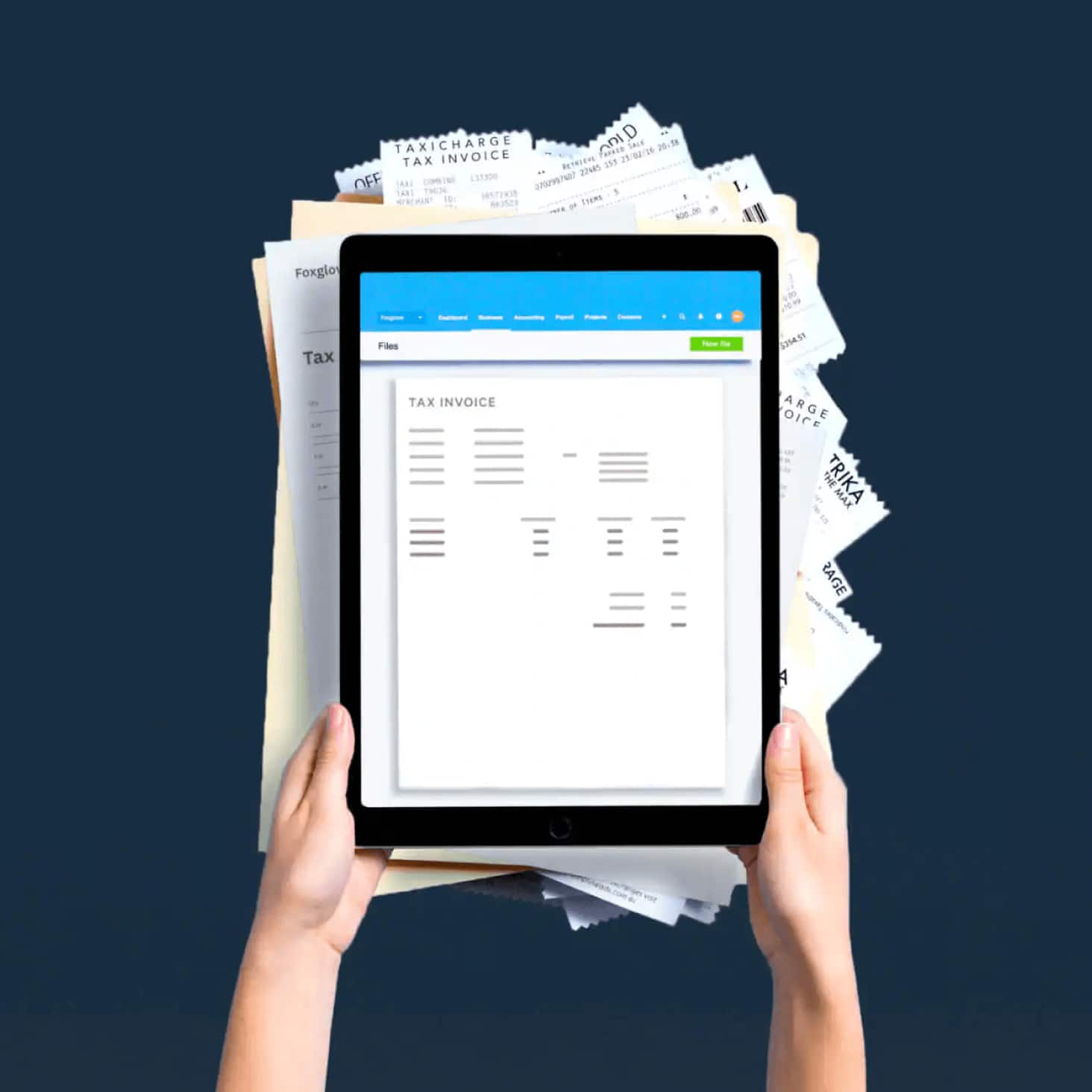

Prefill and import

Import data into Xero Tax from a client’s Xero file to save time and reduce manual errors. Xero Tax can also prefill BAS with data from the ATO.

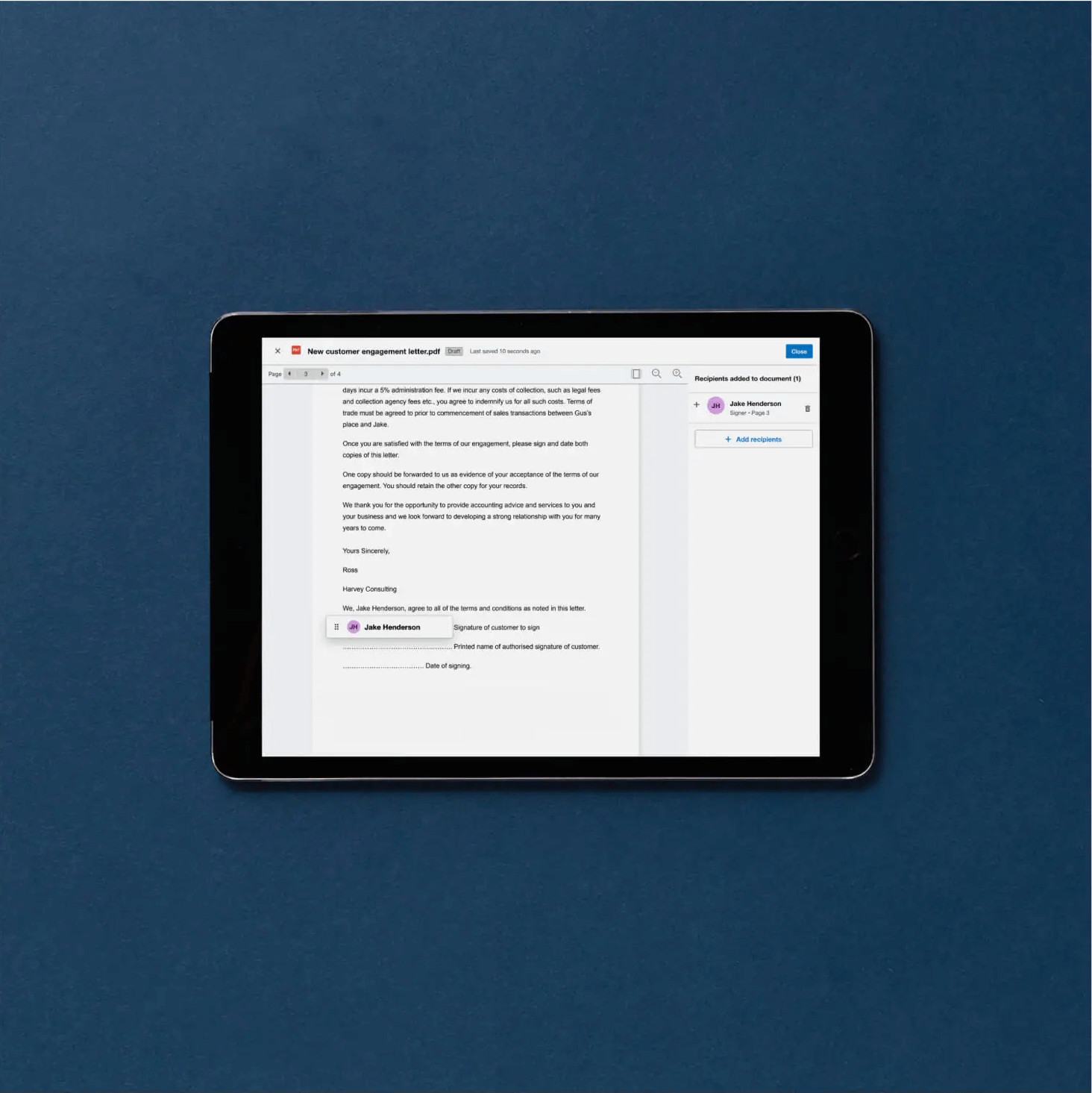

Document packs in HQ

Say goodbye to collating, sending and chasing up individual documents for signatures. Do it all at once quickly with document packs in Xero HQ.

Document packs

Automatic activity statements

Never miss a lodgement. Enable automatic BAS creation to create a statement for clients with outstanding ATO obligations at the start of each month.

Pre-lodge

Pre-lodge is an optional check you can run on statements to check whether the return will pass lodgement with the ATO prior to the client signing it.

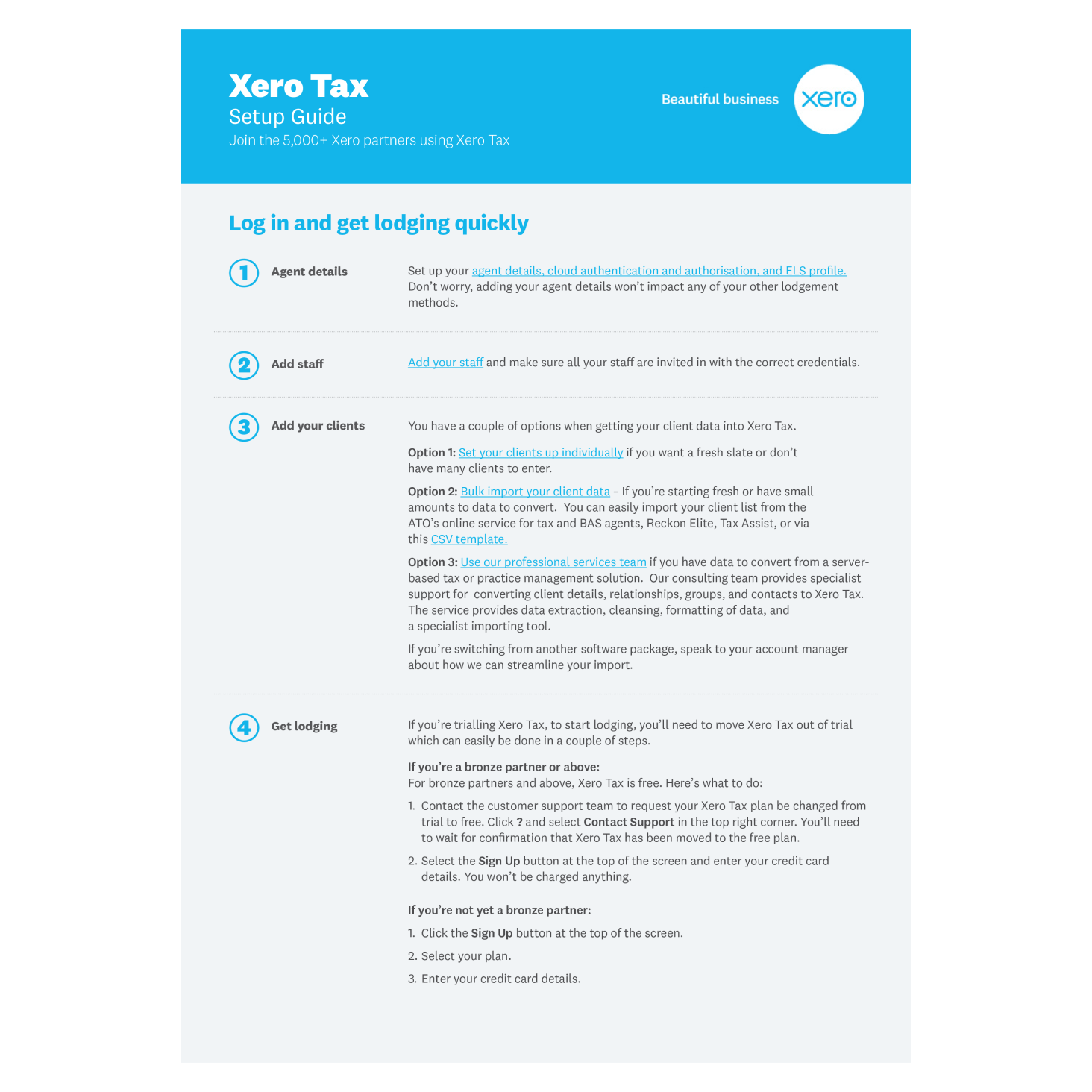

Guide to setting up Xero Tax

You'll find everything you need in this guide to set up Xero Tax. Try Xero Tax for free and follow the steps to start lodging in no time.

Download the setup guide

Training to help you get started

Xero tools for you

Register for one of our upcoming webinars or complete a course to learn more about efficient BAS agent workflows using Xero tools.

- Xero Tax self-implementation

- Xero tools and best practice

- Best practice workflows for BAS agents

Xero Tax self-implementation

Learn how to set up your BAS agent profile, add staff, import clients and optional features such as automatic activity statements and document packs.

Start online course (30 mins)

Xero tools and best practice

Learn our best practice for completing a bookkeeping job in Xero. Hear from an experienced BAS agent for advice and tips to make the move a success.

Watch webinar recording (60 mins)Best practice workflows for BAS agents

Follow best practice workflows for managing BAS lodgements, regular ongoing work, and one-off services as well as business performance reporting.

Watch webinar recording (54 mins)

No more dealing with paperwork, chasing signatures and keeping a manual log of what’s been lodged. Xero Tax does everything for us.

Kirsten Norman, Founder, BizWhiz Business Solutions

Become a Xero partner

Join the Xero community of accountants and bookkeepers. Collaborate with your peers, support your clients and boost your practice.