What is profitability?

June 2023 | Published by Xero

Profitability (definition)

Profitability is a measure of how efficiently a business converts its expenses into profits for its owners.

Profit margin is perhaps the most common profitability measurement. It shows what portion of each sale goes toward meeting costs, and what portion goes into the bank.

Profit vs profitability

Profit is the amount of income a business banks. Profitability is often the portion of income a business banks.

You can have:

- big profits with low profitability if, for example, your business banks 1M in profits but you had to make 7M in sales to generate those earnings

- high profitability with small profits if, for example, your business banks 50% of each sale as profits but only made 10K worth of sales

Businesses try to strike a balance between profit and profitability, most often through the way they price their products and services.

Profitability measurements

Gross profit margin

This ratio shows what portion of sales income is left after meeting the costs of delivering services, creating products, or buying inventory.

Net profit margin

This ratio shows what portion of sales income is left after meeting all business costs, including costs of production and other operating expenses like rent, marketing, insurance and interest on loans.

EBIDTA is another profitability measure that is sometimes used in corporations but it isn’t commonly used in the small business setting.

Profitability calculations

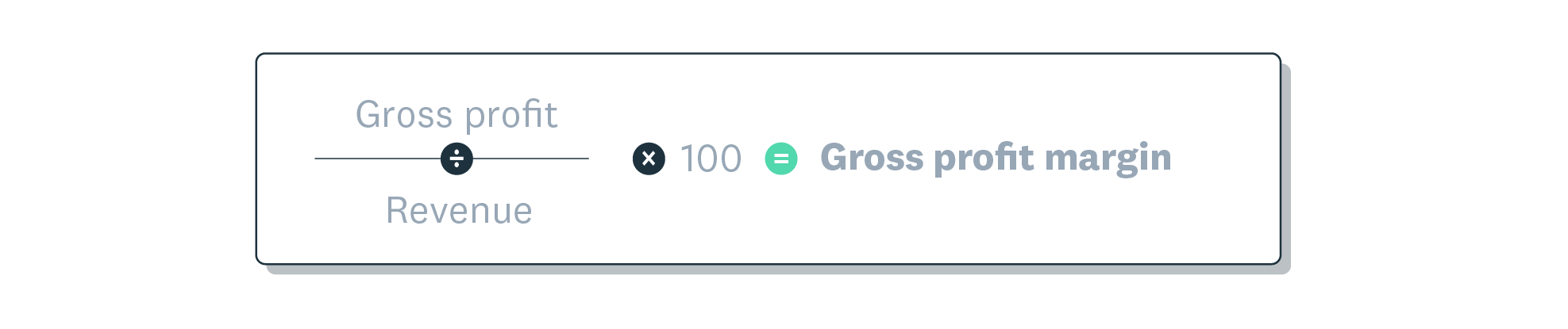

Gross profitability formula:

The results show you what percentage of your sales income is gross profit.

In this profitability calculation, gross profit is revenue minus the cost of goods sold (also known as direct costs). These numbers can be found on your profit and loss statement.

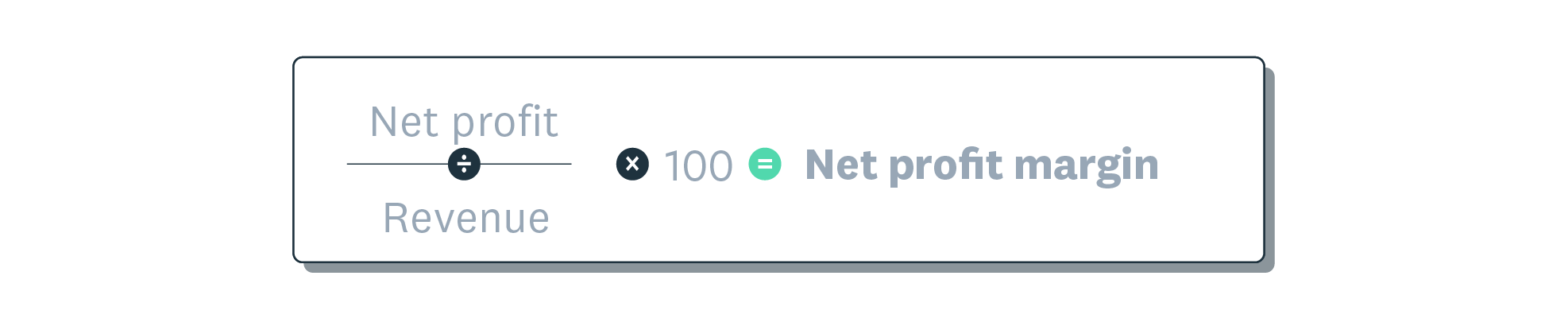

Net profitability formula:

The result shows you what percentage of your sales income is net profit.

In this profitability calculation, net profit is revenue minus all business expenses (direct and indirect costs). These numbers can be found on your profit and loss statement.

Why profitability matters

The more profit you capture from each sale – or from each hour worked – the more efficient your business is. It means an increase in business activity will boost profits significantly. Or, if you’re more interested in finding better work-life balance, it means you can generate good income while working less.

Businesses with super high margins may, however, risk becoming too expensive for their customers. This would slow sales and could end up reducing revenue and profits.

Common ways to increase profitability

- Increase prices and/or change fee structures

- Offer fewer price promotions

- Set standards around marketing ROI

- Find cheaper suppliers

- Buy supplies in bulk

- Develop more efficient workflows

- Track projects against budgets

- Submit change orders when clients ask for out-of-scope work

- Automate processes

- Reduce costs

See related terms

Handy resources

Advisor directory

You can search for experts in our advisor directory

P&L template

Download a P&L template to help track your profitability

Instant profitability reports

Generate key reports at the click of a mouse with Xero accounting software

Disclaimer

This glossary is for small business owners. The definitions are written with their requirements in mind. More detailed definitions can be found in accounting textbooks or from an accounting professional. Xero does not provide accounting, tax, business or legal advice.