Gross margin calculator

Calculate your gross profit margin with this simple calculator. Just punch in costs and revenue.

- Calculate gross margin

- See profit percentages in an instant

- Use it to help set prices

Margin Calculator

Calculate your margin on a particular product or service, or across everything you sell.

Your gross margin 0%

Xero serves up the numbers you need to track profits and manage your margins. Try Xero for free

Tired of manual calculations?

Let Xero handle the numbers so you can focus on growing your business. Sign up for free!

How to use this gross margin calculator

Enter the revenue earned from a particular product or service and the costs of providing that product or service (known as cost of goods sold). The gross margin calculator does the rest. Prices and costs change over time so using revenue and cost data from longer periods – like a quarter or a year – will give you a more accurate picture of margin.

Learn about cost of goods sold (glossary)Enter the revenue earned from a particular product or service and the costs of providing that product or service (known as cost of goods sold). The gross margin calculator does the rest. Prices and costs change over time so using revenue and cost data from longer periods – like a quarter or a year – will give you a more accurate picture of margin.

Learn about cost of goods sold (glossary)Enter your total sales revenue and total cost of goods sold for a given time period. The gross margin calculator will spit out your profit percentage. Try to use revenue and cost data from longer time periods – like a quarter or a year – as that will give a more reliable picture of your gross margin.

Learn about cost of goods sold (glossary)Enter your total sales revenue and total cost of goods sold for a given time period. The gross margin calculator will spit out your profit percentage. Try to use revenue and cost data from longer time periods – like a quarter or a year – as that will give a more reliable picture of your gross margin.

Learn about cost of goods sold (glossary)Enter a proposed sale price for a product or service and the costs of providing that product or service to the customer. The calculator will tell you what margin you’d make at that price.

Enter a proposed sale price for a product or service and the costs of providing that product or service to the customer. The calculator will tell you what margin you’d make at that price.

Gross margin FAQs

Margin (short for gross margin) is the percentage of sales revenue that’s left after a business has paid for the products or services its customers bought. It’s sometimes called profit percentage.

Margin (short for gross margin) is the percentage of sales revenue that’s left after a business has paid for the products or services its customers bought. It’s sometimes called profit percentage.

Gross profit / Revenue x 100 = Gross profit margin. To calculate gross margin you need to know your gross profit, which is revenue minus cost of goods sold. You divide that gross profit by the revenue and multiply it by 100 to see what percentage of revenue is gross profit. Or you could just enter your revenue and cost into the profit margin calculator on this page.

Learn about gross profit (glossary)Gross profit / Revenue x 100 = Gross profit margin. To calculate gross margin you need to know your gross profit, which is revenue minus cost of goods sold. You divide that gross profit by the revenue and multiply it by 100 to see what percentage of revenue is gross profit. Or you could just enter your revenue and cost into the profit margin calculator on this page.

Learn about gross profit (glossary)Margin and markup refer to the same thing – your gross profit – but from different perspectives. Margin shows gross profit as a percentage of revenue. Markup shows gross profit as a percentage of costs. So markup is the percentage you add to the cost of a product or service to arrive at a sale price.

Learn about margin vs markup (glossary)Margin and markup refer to the same thing – your gross profit – but from different perspectives. Margin shows gross profit as a percentage of revenue. Markup shows gross profit as a percentage of costs. So markup is the percentage you add to the cost of a product or service to arrive at a sale price.

Learn about margin vs markup (glossary)Gross profit is the money left after paying for the products or services you sell. This bucket of money will be used to pay for general costs like rent, utilities, insurance and so on. Only once all those additional costs are paid can you think about pocketing a net profit – which is the money your business gets to keep. Gross margin is therefore critical to the viability of your business. If gross margins are too tight, you may not generate enough gross profit to meet your general costs and bank a net profit.

Learn the difference between gross and net profit (glossary)Gross profit is the money left after paying for the products or services you sell. This bucket of money will be used to pay for general costs like rent, utilities, insurance and so on. Only once all those additional costs are paid can you think about pocketing a net profit – which is the money your business gets to keep. Gross margin is therefore critical to the viability of your business. If gross margins are too tight, you may not generate enough gross profit to meet your general costs and bank a net profit.

Learn the difference between gross and net profit (glossary)

How to get the margin you want

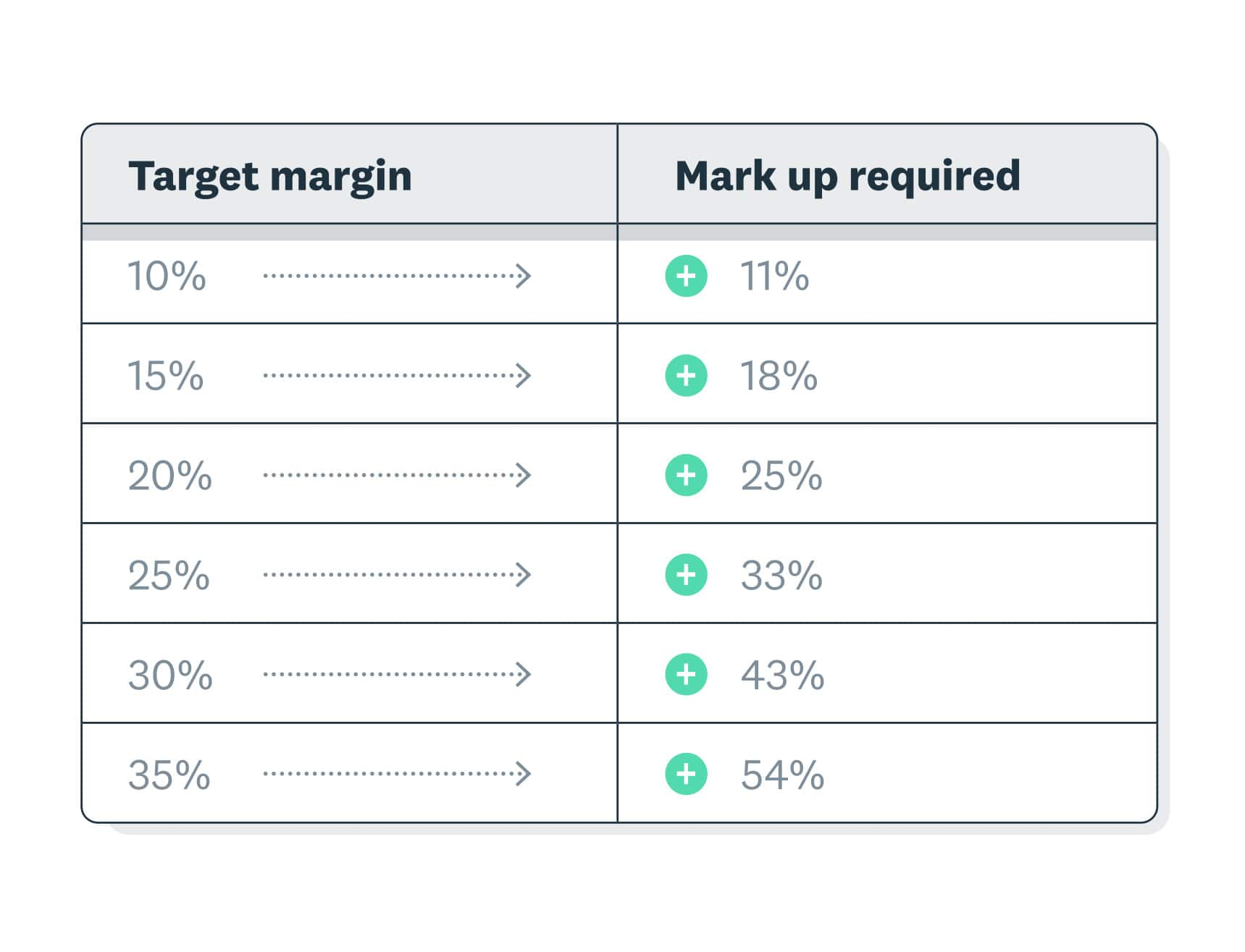

Do you know how to achieve a 20% margin? Hint: it’s not by marking up an item by 20%.

Margin is smaller than the markup

So you’ll need a 25% markup to get that 20% margin. Use this table to figure out what markup is required to achieve the margin you want.

How to increase margin

Growing your profit percentages

You have two options.

- Increase prices (or estimates) so you have more wiggle room

- Lower your costs and bank the savings

- OK, three options… you can do a little of both

Profitability tools from Xero

Xero serves up the numbers you need to track profitability and manage your margins.

- Get a snapshot of your gross or net profit margins at any time (Xero does the maths for you)

- Simply click to compare time periods and see how profits are trending

- Share reports online with advisors and partners to start key conversations

Disclaimer

Xero does not provide accounting, tax, business or legal advice. This calculator has been provided for information purposes only. You should consult your own professional advisors for advice directly relating to your business.

Start using Xero for free

Access Xero features for 30 days, then decide which plan best suits your business.