How to calculate gross profit

Gross profit (calculation)

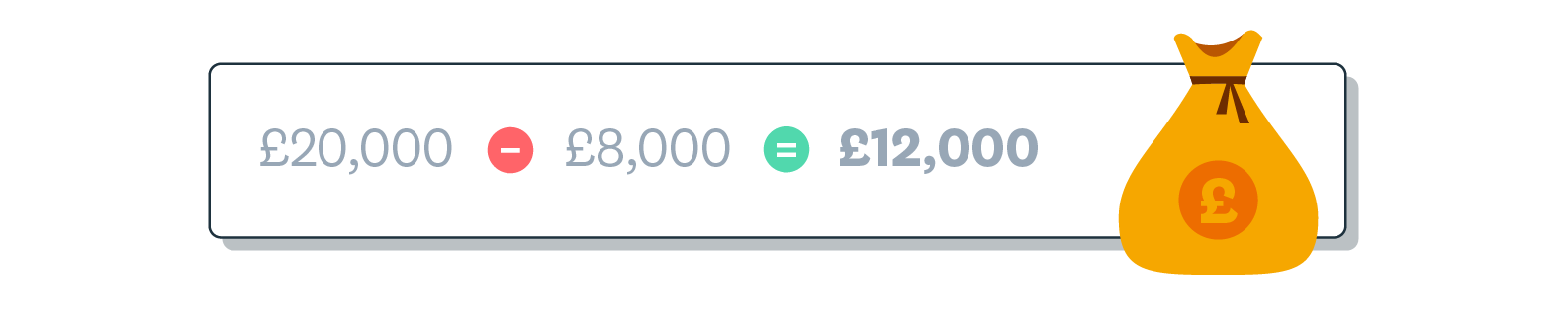

Gross profit is revenue minus the cost of providing the goods or services sold.

How to calculate gross profit

Example of a gross profit calculation

Let’s say your business sold £20,000 worth of products or services, and it cost you £8000 to make those products or provide those services.

Gross profit is the difference between what you sold goods and services for and what you paid for those same things. It’s only a stepping stone to net profit. You still have to pay for things like office supplies, rent and loan repayments out of your gross profit.

See related terms

Handy resources

Advisor directory

You can search for experts in our advisor directory

Profit & Loss template

Download Xero’s profit and loss statement template to show how much money you business is making

Financial reporting

Keep track of your performance with accounting reports

Disclaimer

This glossary is for small business owners. The definitions are written with their requirements in mind. More detailed definitions can be found in accounting textbooks or from an accounting professional. Xero does not provide accounting, tax, business or legal advice.