Accounting software for your Singaporean small business

Take control of your financial admin with Xero online accounting software. Send online invoices, reconcile your bank transactions with the help of Xero’s automation features, and run quick reports for fresh insights into your business.

Save yourself hours with Xero accounting software

Short on time? Xero’s smart tools automate admin, track finances, and provide insights—helping you stay organized and grow your business.

Paperless record-keeping

Keep all your financial records in one central place with Xero online accounting software. Never lose a receipt!

Automations that fast-track your admin

Save time on your jobs, from automating your invoice reminders to managing your business expenses.

Smart data and insights to grow your business

Make confident decisions with sophisticated trend analysis and clear, comprehensive reports tailored to your business.

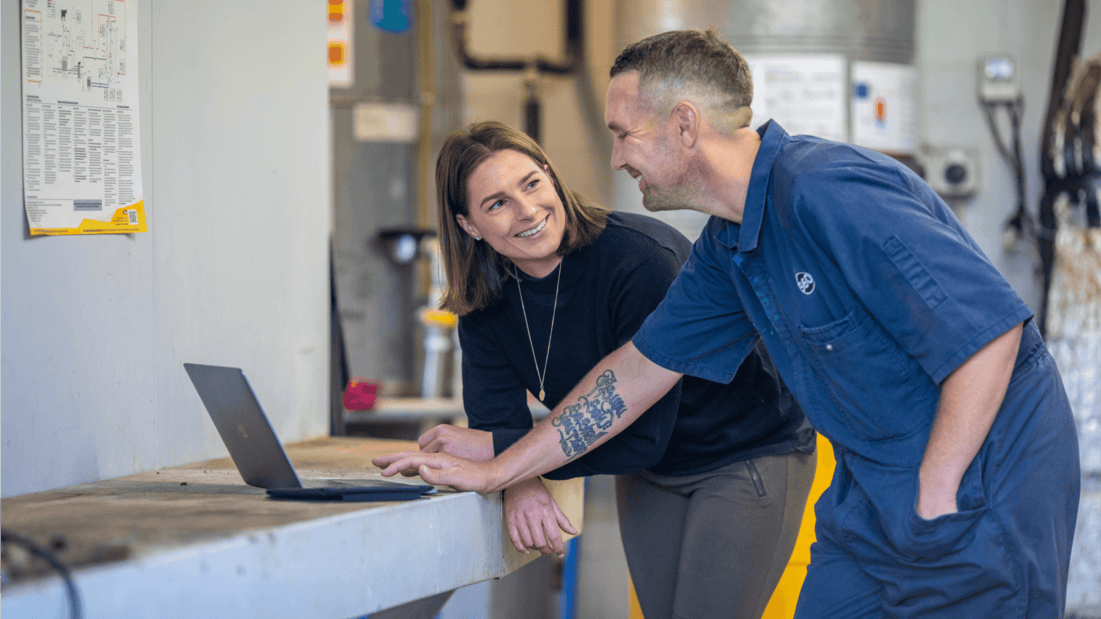

Life before Xero was a nightmare. Using a spreadsheet took a ridiculous amount of time.

Ryan is no longer dogged by paperwork.

All your small business accounting in one place

Xero is powerful online accounting software for Singaporean small businesses, automating invoicing, bank reconciliations, and reporting. Get real-time financial insights, track expenses, and keep accurate records – all in one place – to simplify cash flow management and tax preparation.

- Automate tasks like invoicing, bank reconciliations, and reporting

- Get up-to-date financial data for a full picture of your business

- Keep accurate records in a single place for easier tax returns

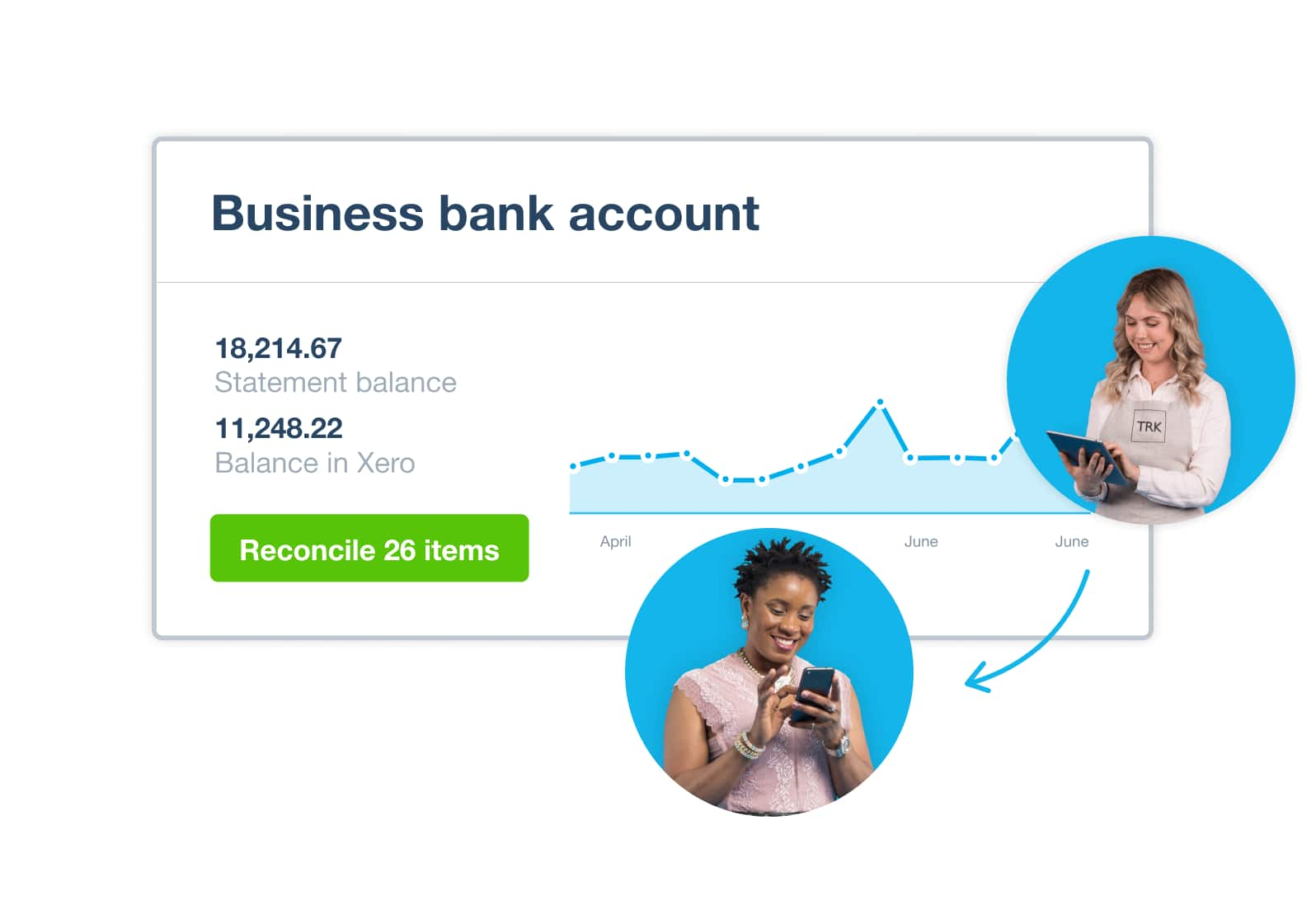

Accounting software that connects to your bank

Xero’s bank feed securely imports your transactions into Xero bookkeeping software each business day. No more logging in multiple places and toggling between web pages – just zip through your bank reconciliations on a single screen, whenever you want!

- Connect all your business bank accounts to Xero

- Get your bank transactions into Xero automatically

- Track your business’s current cash flow

Collaborate online in real time

Use Xero accounting software in Singapore to talk business with your employees, bookkeeper, or accountant – even if they’re on the opposite side of the world. Share your screen view to discuss a set of numbers, look over a financial report together, and get clear data visualisations.

- Access the same financial information at the same time

- Take action while you’re talking and see the effects in your data instantly

- Collaborate with your employees online by letting them submit expenses and request leave in the Xero Me mobile app

Customise to suit your needs

Make Xero online accounting software work for you. Add what you need to make it easier to run your small business.

- Build on your plan with add-ons like Xero Expenses and Xero Projects

- Connect to third party apps like Stripe and Vend

- Browse the Xero App Store to easily find, try, and buy apps that connect with Xero

Plans to suit your business

All pricing plans cover the accounting essentials, with room to grow.

The Xero Accounting app: for businesses on the move

Financial admin needn’t pile up while you’re away from your desk. Take care of jobs with the Xero Accounting app and stay productive – from effortlessly tracking your mileage and expenses, to checking outstanding invoices. Wherever you go, the mobile app keeps your small business growing.

Get more done with the Xero Accounting app

How Xero’s accounting software works for you

Running a business can feel like a battle with paperwork. Use online accounting software to automate tasks and simplify your financial admin. With Xero, you can manage cash flow, send invoices, and handle taxes from anywhere—making it easier to stay on top of your business accounting.

Handle admin away from your desk

Log in anytime, from anywhere, to send invoices, pay bills, and manage your cash flow.

Simplify tax time

Filing returns needn’t be stressful. Get them done faster and comply with regulations more easily.

Get customer support

Get help with your financial admin from Xero experts whenever you need it.

FAQs on accounting software

With your accounting and bookkeeping software and data stored in the cloud, you can access your up-to-date accounts anywhere there’s an internet connection. You can receive automated bank feeds into your accounting software and connect to other business apps for greater efficiency. You can also collaborate with other people, like accountants and bookkeepers, by giving them access to view and share your figures. Xero regularly backs up your data and protects it with multiple layers of security.

See why online accounting is good for your businessWith your accounting and bookkeeping software and data stored in the cloud, you can access your up-to-date accounts anywhere there’s an internet connection. You can receive automated bank feeds into your accounting software and connect to other business apps for greater efficiency. You can also collaborate with other people, like accountants and bookkeepers, by giving them access to view and share your figures. Xero regularly backs up your data and protects it with multiple layers of security.

See why online accounting is good for your businessNo, but it’s very useful. The mobile app works with Xero accounting software to help you run your small business from anywhere. Keep track of your unpaid and overdue invoices, bank account balances, profit and loss, cash flow, and bills to pay. You can also reconcile bank accounts and convert quotes to invoices. The mobile app is free with every subscription, and is compatible with iOS and Android.

See how to stay connected to your business on the goNo, but it’s very useful. The mobile app works with Xero accounting software to help you run your small business from anywhere. Keep track of your unpaid and overdue invoices, bank account balances, profit and loss, cash flow, and bills to pay. You can also reconcile bank accounts and convert quotes to invoices. The mobile app is free with every subscription, and is compatible with iOS and Android.

See how to stay connected to your business on the goCheck out the Xero App Store to find, demo, and buy business apps that connect to Xero. Apps like Stripe, Vend, and Shopify connect seamlessly and sync data with Xero.

Check out the Xero App StoreCheck out the Xero App Store to find, demo, and buy business apps that connect to Xero. Apps like Stripe, Vend, and Shopify connect seamlessly and sync data with Xero.

Check out the Xero App StoreOnce you’re set up in Xero you can import all your data from your previous accounting and bookkeeping software for small business, including the chart of accounts, invoices, bills, contacts, and fixed assets. It’s best to work with an accountant or bookkeeper, preferably one with Xero experience, when you move to Xero online accounting software.

Here’s how to convert to Xero from other accounting softwareOnce you’re set up in Xero you can import all your data from your previous accounting and bookkeeping software for small business, including the chart of accounts, invoices, bills, contacts, and fixed assets. It’s best to work with an accountant or bookkeeper, preferably one with Xero experience, when you move to Xero online accounting software.

Here’s how to convert to Xero from other accounting softwareThere are three basic steps to setting up an accounting system. The aim is to keep everything simple and accurate. First, open a dedicated business account for all your incoming and outgoing payments. Second, decide which accounting method (cash or accrual) suits your business. Third, choose accounting software, such as Xero, that has the features you need, like the ability to use eInvoicing and send foreign currency payments.

There are three basic steps to setting up an accounting system. The aim is to keep everything simple and accurate. First, open a dedicated business account for all your incoming and outgoing payments. Second, decide which accounting method (cash or accrual) suits your business. Third, choose accounting software, such as Xero, that has the features you need, like the ability to use eInvoicing and send foreign currency payments.

It’s easy to use Xero’s basic features. The software is intuitive, so people with no accounting or finance background can learn the basics quickly. It’s easy to connect your bank so your transactions flow into Xero, and to create professional invoices from scratch. Xero has all sorts of resources on business and finance topics to help, all written in plain English for when you want clear, simple answers. If you’re still unsure, Xero users can contact our support team 24/7 for help.

It’s easy to use Xero’s basic features. The software is intuitive, so people with no accounting or finance background can learn the basics quickly. It’s easy to connect your bank so your transactions flow into Xero, and to create professional invoices from scratch. Xero has all sorts of resources on business and finance topics to help, all written in plain English for when you want clear, simple answers. If you’re still unsure, Xero users can contact our support team 24/7 for help.

Yes, you aren’t required to have an accountant in most regions so you can certainly run your business without one. However, it can be beneficial to bring one on and utilise their expertise to help your business perform. Online resources – such as those by Xero – explain topics like managing cash flow, tracking payments, and creating invoices. Read these materials to stay up to date with regulatory and other changes around tax and record keeping. Cloud-based accounting software like Xero is a big help. This keeps all your financial records in one secure place. Its automated calculations prevent data entry mistakes, save you time, and make tax season easier. And you can always get expert advice from an accountant.

Check out Xero’s directory of accountants and bookkeepersYes, you aren’t required to have an accountant in most regions so you can certainly run your business without one. However, it can be beneficial to bring one on and utilise their expertise to help your business perform. Online resources – such as those by Xero – explain topics like managing cash flow, tracking payments, and creating invoices. Read these materials to stay up to date with regulatory and other changes around tax and record keeping. Cloud-based accounting software like Xero is a big help. This keeps all your financial records in one secure place. Its automated calculations prevent data entry mistakes, save you time, and make tax season easier. And you can always get expert advice from an accountant.

Check out Xero’s directory of accountants and bookkeepersTechnically, yes. But it can be a time-consuming process to work across different data sources and tools. Accounting software like Xero does this work for you. Xero keeps all information in one secure place, and makes automatic calculations to keep your records accurate and up to date. Because Xero is based in the cloud, you can log in at any time, from anywhere, and give your accountant and bookkeeper access so you can easily work with them on your finances.

Technically, yes. But it can be a time-consuming process to work across different data sources and tools. Accounting software like Xero does this work for you. Xero keeps all information in one secure place, and makes automatic calculations to keep your records accurate and up to date. Because Xero is based in the cloud, you can log in at any time, from anywhere, and give your accountant and bookkeeper access so you can easily work with them on your finances.

Why small businesses prefer Xero

Across the world, people use Xero to manage their finances and control their cash flow, no matter their industry. Our accounting software is designed for small businesses and gives you flexibility, control, and visibility of your finances. Xero is used by:

- Tech startups

- Retailers

- Landlords

- Non-profits

- Football clubs

More help with accounting software

Here’s some more guidance on accounting software tools and how they could suit your small business.

Cash flow statement template

Get a free cash flow template for your business. And learn how Xero software can make reporting easy.

Invoice template

An invoice template creates a professional look, does the math, and makes it easy for customers to follow.

Margin calculator

Calculate your gross profit margin with this simple calculator to check you’re hitting your targets.

FAQs about Xero in Singapore

The best accounting software depends on your needs. Xero’s accounting software has flexible plans so you can adjust your subscriptions to access the features you need as your business grows.

Check out Xero’s pricing plansThe best accounting software depends on your needs. Xero’s accounting software has flexible plans so you can adjust your subscriptions to access the features you need as your business grows.

Check out Xero’s pricing plansNo – Xero is based in the cloud, so all you need is an internet connection. But you need a multi-factor authentication (MFA) app to log in to Xero. MFA extra layer of security by checking that it’s really you when you log in.

Learn about data protection with XeroNo – Xero is based in the cloud, so all you need is an internet connection. But you need a multi-factor authentication (MFA) app to log in to Xero. MFA extra layer of security by checking that it’s really you when you log in.

Learn about data protection with XeroYes, the Xero App Store has hundreds of apps to help manage your business, including apps specifically designed for your industry and for doing business wherever you are located.

Check out the Xero App StoreYes, the Xero App Store has hundreds of apps to help manage your business, including apps specifically designed for your industry and for doing business wherever you are located.

Check out the Xero App Store

Start using Xero for free

Access Xero features for 30 days, then decide which plan best suits your business.

Useful features to run your business

Xero’s online accounting software is designed to make life easier for small businesses – anywhere, any time.