Simple and effortless GST filing

Easily manage GST F5 returns using IRAS-compliant software, and file your returns directly from Xero to IRAS.

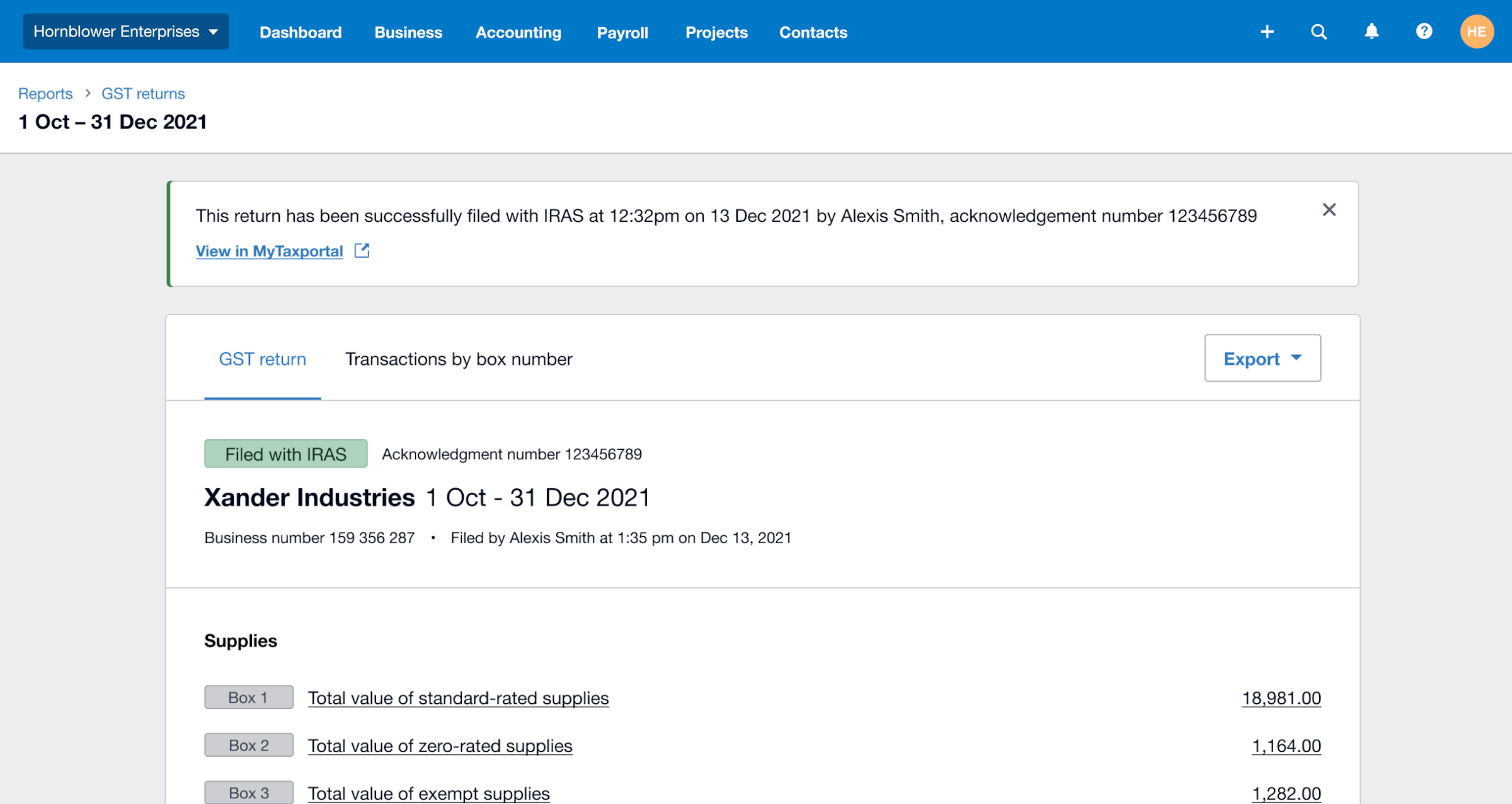

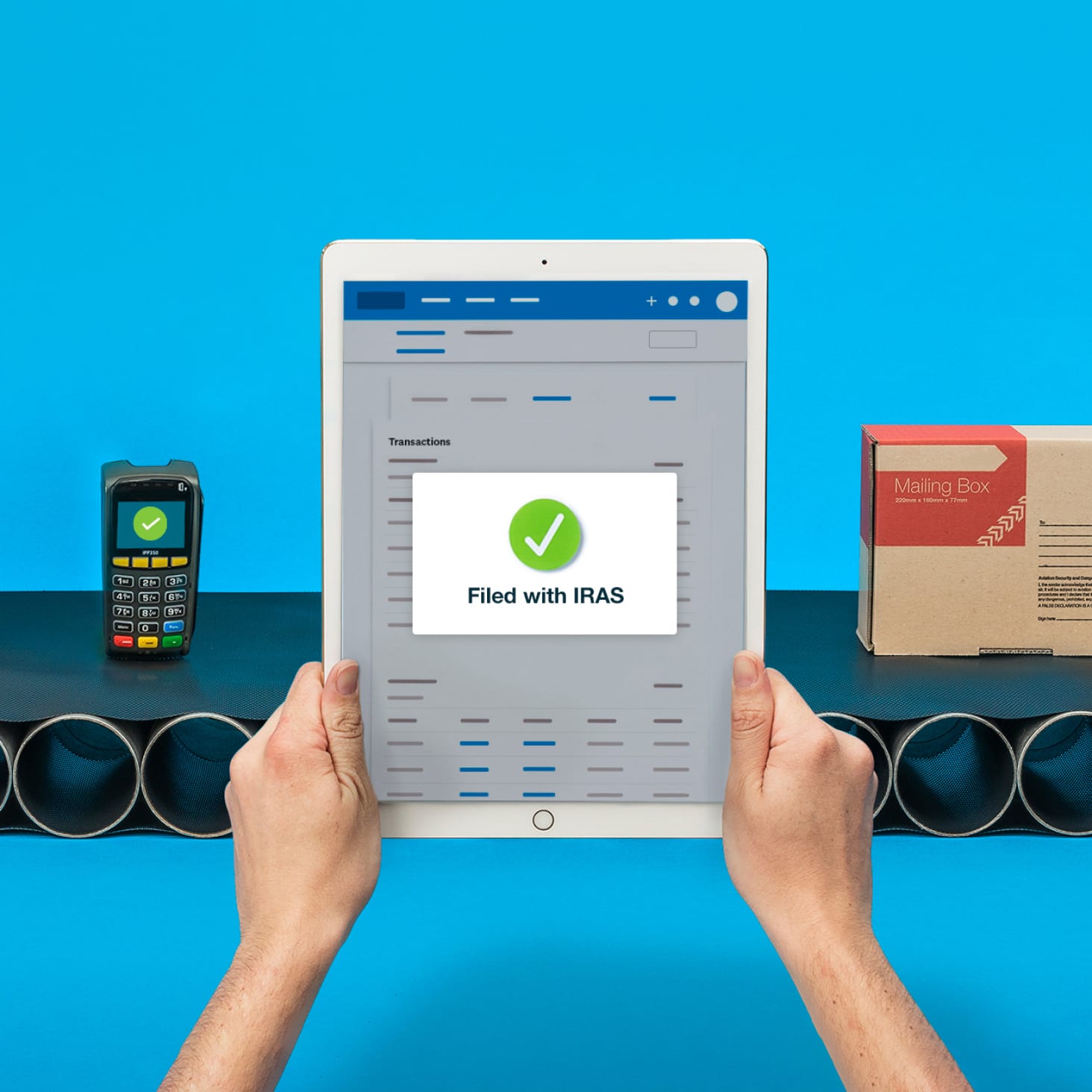

File straight to IRAS

Submit your GST return directly from Xero to IRAS in one click, making the filing process simpler.

Prepare GST online effortlessly

Xero calculates GST on supplies and purchases, and automatically populates a GST F5 return.

Handle foreign currencies

Xero converts transactions back to SG dollars.

Manage GST with ease

View and adjust GST transactions and manage GST from prior periods.

On 1 Jan 2024, the GST rate in Singapore will increase from 8% to 9%. Here’s what we’ve done to make it easy to manage this change in Xero. Read blog

GST is increasing on 1 January 2024

On 1 January 2024, the GST rate in Singapore will increase from 8% to 9%.

- We'll make the new 9% rate available in Xero by 5 December 2023.

- Any default tax rates will continue to default to 8% until you update them.

- On 2 January 2024, we'll introduce a new button at the top of your Chart of Accounts page, called ‘Update to 9% defaults’. All you need to do is select ‘Update’ to update the GST rate on your contacts, inventory items and accounts. If you have more than one Xero organisation, you’ll need to do this for each one.

File straight to IRAS

Submit your GST return directly from Xero to IRAS in one click, making the filing process simpler.

- Review and finalise GST returns with your team and advisor, before submitting to IRAS

- Only the data that you authorise for submission is sent from Xero to IRAS - no other data is shared

Prepare GST online effortlessly

Xero calculates GST on supplies and purchases, and automatically populates a GST F5 return.

- Standard GST rates are already set up

- Xero automatically records GST on each transaction

- Enter transaction amounts as GST inclusive or exclusive, or no tax

Handle foreign currencies

Xero automatically includes foreign currency transactions and their realised gains or losses in GST F5 returns.

- Include foreign currency conversion with GST in invoices

- Convert invoices, payments and bills from over 160 currencies

- Produce financial statements and GST F5 in SG dollars

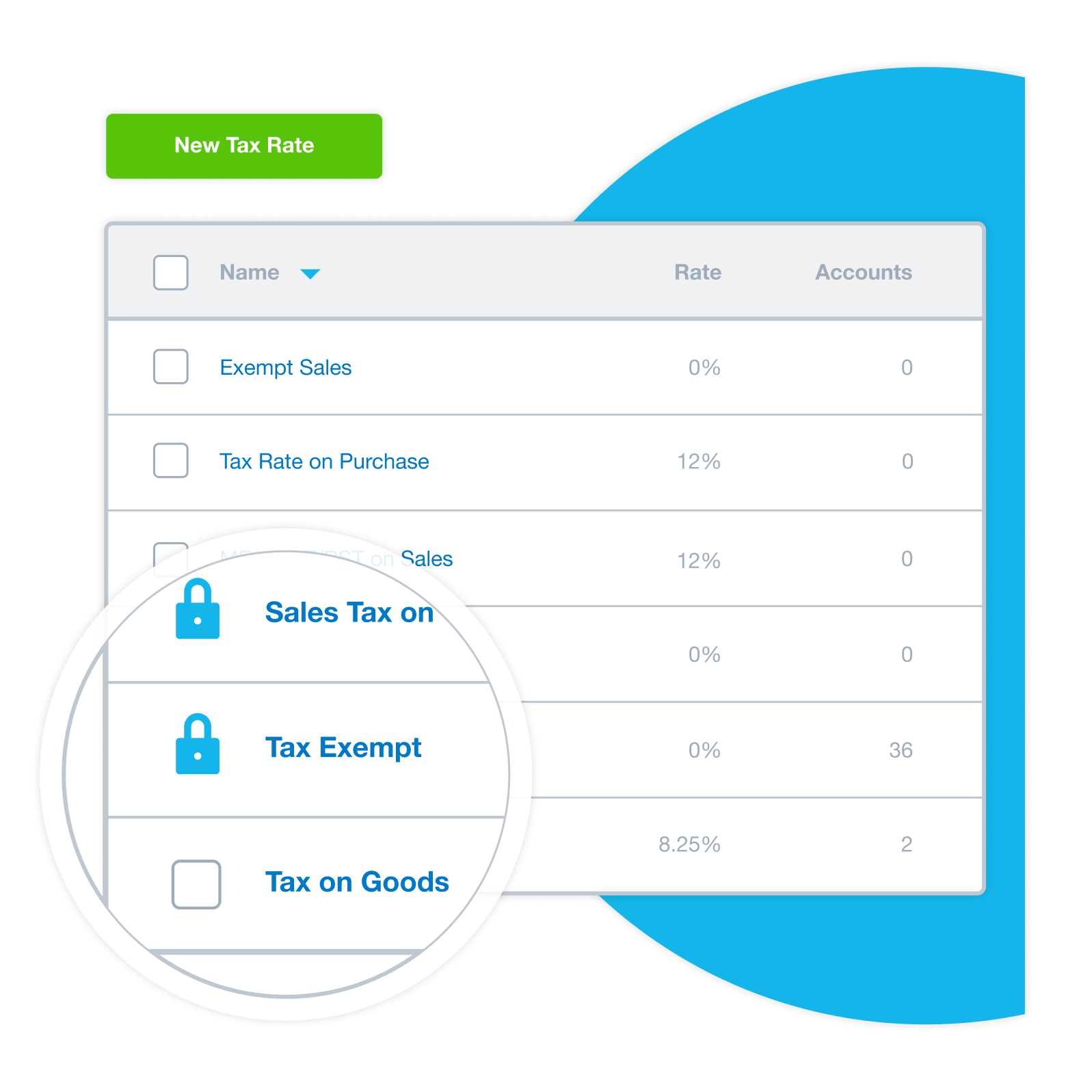

Manage GST with ease

Accurately track, review and manage GST transactions in Xero, and collaborate with your advisor using the same set of data in real-time.

- View the next due date and GST you owe at any time

- Sort transactions into groups based on IRAS filing requirements

- Check and amend the individual transactions that make up a return

Start using Xero for free

Access Xero features for 30 days, then decide which plan best suits your business.

Accounting software for your small business

Run your business accounting online with Xero. Easy-to-use accounting software, designed for your small business.

- Everything in one place

- Connect to your bank

- Collaborate in real time

- Customise to suit your needs

Through digitisation and seamless integration, Xero made our business more efficient than ever before.

Zairyo uses Xero to take care of their financial needs