Accounting software for your Singapore small business

Take control of your financial admin with Xero online accounting software. Pay staff, send invoices, accept online payments and get tailored reports to help you make better decisions for your business.

Automate your bookkeeping admin

Smart small business bookkeeping software that tracks your income. Expenses and automates your invoices.

Connect your Singapore bank using bank feeds

Xero bank feeds connect with Singapore’s major banks to bring your transactions into Xero, automatically.

Make your tax compliance easy

Tailored reports and access to all your data helps you manage your GST, InvoiceNow and IRAS compliance.

Customise your Xero with third-party apps

The Xero App Store has thousands of third-party apps and integrations to help you run your business your way.

Join over 4.6 million subscribers using Xero

Awards and recognition for our work

Streamline your billing

Send invoices anytime, anywhere, and get paid sooner.

Ace your inventory

Manage stock levels, track high-selling items, and scale your inventory as you grow.

Pay staff easily

Pay staff on time, every time and make IRAS compliance easy.

Send quotes instantly

Send invoices anytime, anywhere, and get paid sooner.

Give your customers payment options

Make it easy for customers to pay you.

Keep on top of projects

Handle your projects from start to finish with Xero.

Supercharge your business with Xero’s powerful features, all built into the Xero accounting software for small business. Learn more about what Xero can do

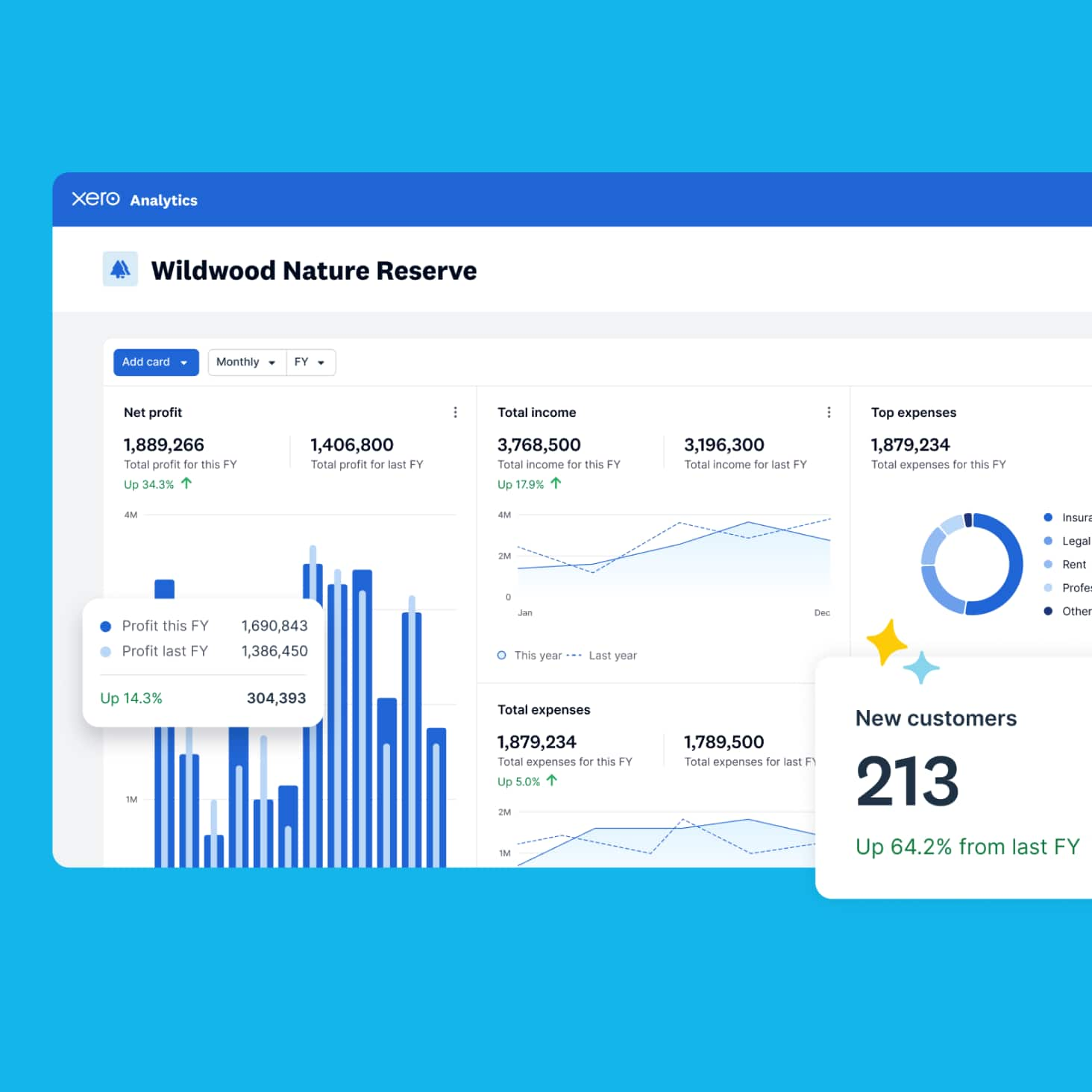

Track your income and expenses to clarify your cash flow

Xero’s user-friendly bookkeeping software helps Singapore businesses get a handle on their incoming and outgoing cash. Xero automated tools reduce errors, clarify your numbers, and save you time.

- Track income and expenses for total clarity on your numbers

- Automate your invoicing and payment reminders to keep the cash flowing

- Don’t miss a thing – stay up to date on your vital business metrics with the Xero Dashboard

Here’s how the Xero dashboard gives you your vital data up front

Your latest data every day: Xero bank feeds

Xero’s Singapore accounting software for small businesses connects directly with Singapore’s major banks like DBS, OCBC, and UOB. Get all your transactions in Xero for fast reconciliation, up-to-date cash flow figures, and clear financial insights.

- Do your reconciliation in a flash with daily bank feeds straight into Xero

- Keep on top of your cash flow and transactions in near-real time

- Spot fraud faster so you can act quickly when it counts

Simplify your tax filing for an easier tax season

Stay compliant with the IRAS with a smoother, easier tax process. Xero’s bookkeeping software for small businesses supports Singapore’s e-invoicing rules, to help you save time, reduce errors, and get paid sooner through InvoiceNow.

Simplify your tax prep and processes with Xero

Customise Xero to suit your business

Need a feature or tool? Make Xero’s cloud accounting software work for you, with hundreds of third-party apps from the Xero App Store. Find tools and integrations that help you run and build your business.

- Connect and customise apps to fit your business

- Add apps like Invoice and Expensify to enhance your processes and workflows

- Easily add or remove apps as your business evolves

We’ve used Xero right from the start and it’s become an integral part of the business.

Lelian of The Floral Atelier brings flowers to everyday life

Plans to suit your business

All pricing plans cover the accounting essentials, with room to grow.

Start using Xero for free

Access Xero features for 30 days, then decide which plan best suits your business.

FAQs on accounting software

Because Xero is based in the cloud, there’s nothing to install – just log in online with Xero’s secure multi-factor authentication (MFA) tool. Then access your latest data anytime and from anywhere, connect to bank feeds and business apps, collaborate with your accountant on your numbers in real time, and get automatic backups and world-class data protection – all in one platform.

See how Xero’s accounting software can help your small businessBecause Xero is based in the cloud, there’s nothing to install – just log in online with Xero’s secure multi-factor authentication (MFA) tool. Then access your latest data anytime and from anywhere, connect to bank feeds and business apps, collaborate with your accountant on your numbers in real time, and get automatic backups and world-class data protection – all in one platform.

See how Xero’s accounting software can help your small businessNo, but it’s very useful. The mobile app works with Xero accounting software to help you run your small business from anywhere. Keep track of your unpaid and overdue invoices, bank account balances, profit and loss, cash flow, and bills to pay. You can also reconcile bank accounts and convert quotes to invoices. The mobile app is free with every subscription, and is compatible with iOS and Android.

See how to stay connected to your business on the goNo, but it’s very useful. The mobile app works with Xero accounting software to help you run your small business from anywhere. Keep track of your unpaid and overdue invoices, bank account balances, profit and loss, cash flow, and bills to pay. You can also reconcile bank accounts and convert quotes to invoices. The mobile app is free with every subscription, and is compatible with iOS and Android.

See how to stay connected to your business on the goOnce you’re set up in Xero you can import all your data from your previous accounting and bookkeeping software for small business, including the chart of accounts, invoices, bills, contacts, and fixed assets. It’s best to work with an accountant or bookkeeper, preferably one with Xero experience, when you move to Xero online accounting software.

Here’s how to convert to Xero from other accounting softwareOnce you’re set up in Xero you can import all your data from your previous accounting and bookkeeping software for small business, including the chart of accounts, invoices, bills, contacts, and fixed assets. It’s best to work with an accountant or bookkeeper, preferably one with Xero experience, when you move to Xero online accounting software.

Here’s how to convert to Xero from other accounting softwareIt’s straightforward. There are three basic steps to setting up an accounting system. First, open a dedicated business account for all your incoming and outgoing payments. Second, decide which accounting method (cash or accrual) suits your business. Third, choose accounting software like Xero that has the features you need, like e-invoicing and the ability to send foreign currency payments.

Here’s more on cash vs accrual accountingIt’s straightforward. There are three basic steps to setting up an accounting system. First, open a dedicated business account for all your incoming and outgoing payments. Second, decide which accounting method (cash or accrual) suits your business. Third, choose accounting software like Xero that has the features you need, like e-invoicing and the ability to send foreign currency payments.

Here’s more on cash vs accrual accountingIt’s easy to use Xero’s basic features. The software is intuitive, so people with no accounting or finance background can learn the basics quickly. It’s easy to connect your bank so your transactions flow into Xero, and to create professional invoices from scratch. Xero has all sorts of resources on business and finance topics to help, all written in plain English for when you want clear, simple answers. If you’re still unsure, Xero users can contact our support team 24/7 for help.

It’s easy to use Xero’s basic features. The software is intuitive, so people with no accounting or finance background can learn the basics quickly. It’s easy to connect your bank so your transactions flow into Xero, and to create professional invoices from scratch. Xero has all sorts of resources on business and finance topics to help, all written in plain English for when you want clear, simple answers. If you’re still unsure, Xero users can contact our support team 24/7 for help.

Yes, but you’ll have to do more of the accounting admin yourself.For help, check out Xero’s online resources on how to manage cash flow, track payments, and create invoices. Accounting software like Xero is a big help, too – it keeps all your financial records in one place and its automations help prevent errors, save you time, and make tax season easier. And you can always get expert advice from an accountant if you need it.

Find an accountant in Xero’s advisor directoryYes, but you’ll have to do more of the accounting admin yourself.For help, check out Xero’s online resources on how to manage cash flow, track payments, and create invoices. Accounting software like Xero is a big help, too – it keeps all your financial records in one place and its automations help prevent errors, save you time, and make tax season easier. And you can always get expert advice from an accountant if you need it.

Find an accountant in Xero’s advisor directoryTechnically, yes. But it can be a time-consuming process to work across different data sources and tools. Accounting software like Xero does this work for you. Xero keeps all information in one secure place, and makes automatic calculations to keep your records accurate and up to date. Because Xero is based in the cloud, you can log in at any time, from anywhere, and give your accountant and bookkeeper access so you can easily work with them on your finances.

Technically, yes. But it can be a time-consuming process to work across different data sources and tools. Accounting software like Xero does this work for you. Xero keeps all information in one secure place, and makes automatic calculations to keep your records accurate and up to date. Because Xero is based in the cloud, you can log in at any time, from anywhere, and give your accountant and bookkeeper access so you can easily work with them on your finances.

See more of what Xero can do

Do more with Xero

Xero’s online accounting software is designed to make life easier for small businesses – anywhere, any time.