New Zealand Small Business Insights

This analysis focuses on core performance metrics of sales growth, jobs growth, wages growth, late payments and time to be paid.

Small business performance continues to improve

Published: 26 February 2026

The latest Xero Small Business Insights (XSBI) data for New Zealand shows small businesses had a reasonable end to 2025, building on the signs of improvement seen in the September quarter. During the December quarter sales growth recorded the best result in three years, jobs growth was the strongest in two years and the late payment time metric was the shortest in the history of the series. Overall, while small business performance is still below average, it was clearly on an improving trend heading into 2026.

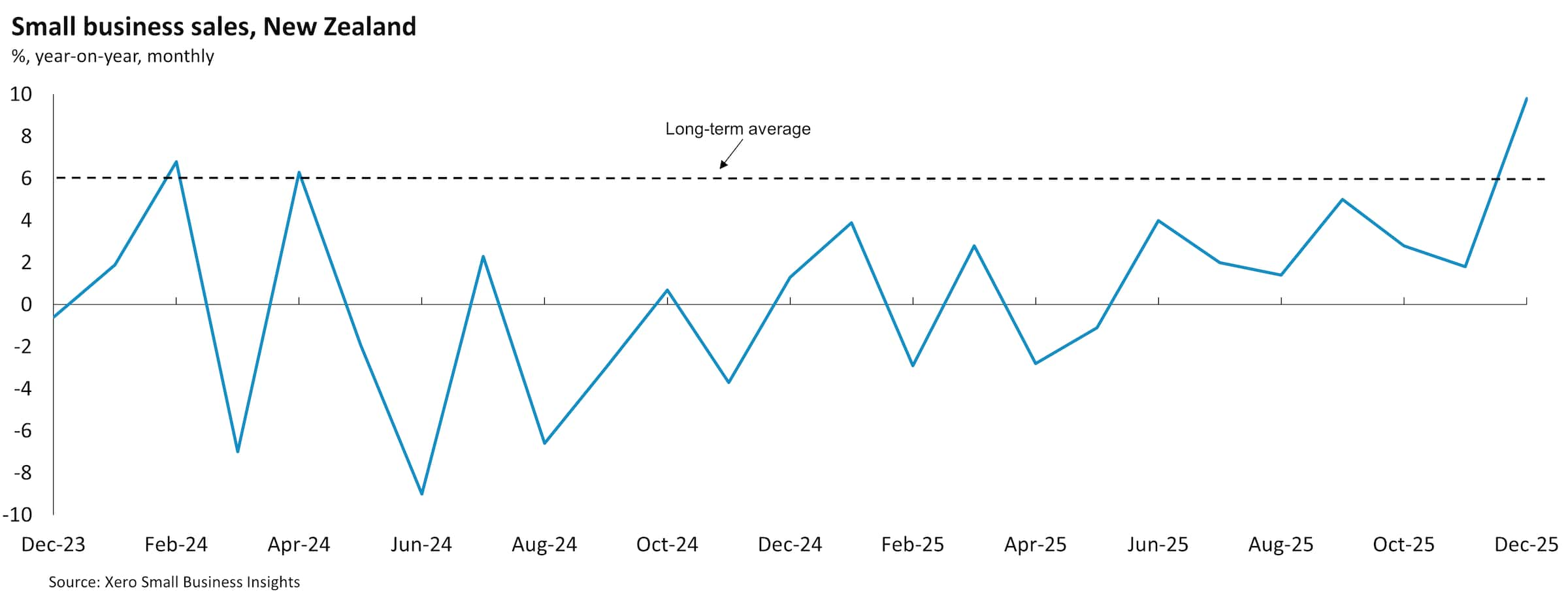

Sales in small businesses rose 4.8% year-on-year (y/y) in the December quarter, after a 2.8% y/y rise in the September quarter (revised up from 1.9% y/y initially reported). The December quarter result represents the largest rise in sales in three years. Small businesses had a particularly good final month of the year, with sales up 9.8% y/y in the month of December - which is above the long-term average for this series (6.2% y/y). This outcome suggests that the aggressive easing in interest rates by the Reserve Bank of New Zealand, underway since mid-2024, is starting to flow through to small businesses.

The improvement in sales wasn't uniform, with some industries and regions recording stronger sales growth than others. The best performing industry in the December quarter was professional services (+8.6% y/y) - driven by a near-record 18.5% y/y rise in the month of December. Real estate (+6.5% y/y) and manufacturing (+5.2% y/y) also had solid December quarters. Retail trade sales rose 4.5% y/y, building on the 3.9% y/y rise in the September quarter, suggesting the benefits of lower mortgage rates are starting to flow through to retailers. Unfortunately, the news was not as positive for hospitality, which continues to be soft. Sales increased only 0.5% y/y, similar to the 0.6% y/y rise the previous quarter.

The South Island continues to outperform the North Island. Sales in Canterbury (+8.0% y/y) and Otago (+6.2% y/y) outpaced Auckland (+4.4% y/y) and Wellington (+3.7% y/y). The one North Island region to go against this trend was Bay of Plenty, where sales rose 6.3% y/y - the best result for this region since the September quarter 2022.

The latest XSBI data shows small businesses had a reasonable end to 2025, building on the signs of improvement seen in the September quarter.

XSBI NZ October 2025 - December 2025 data

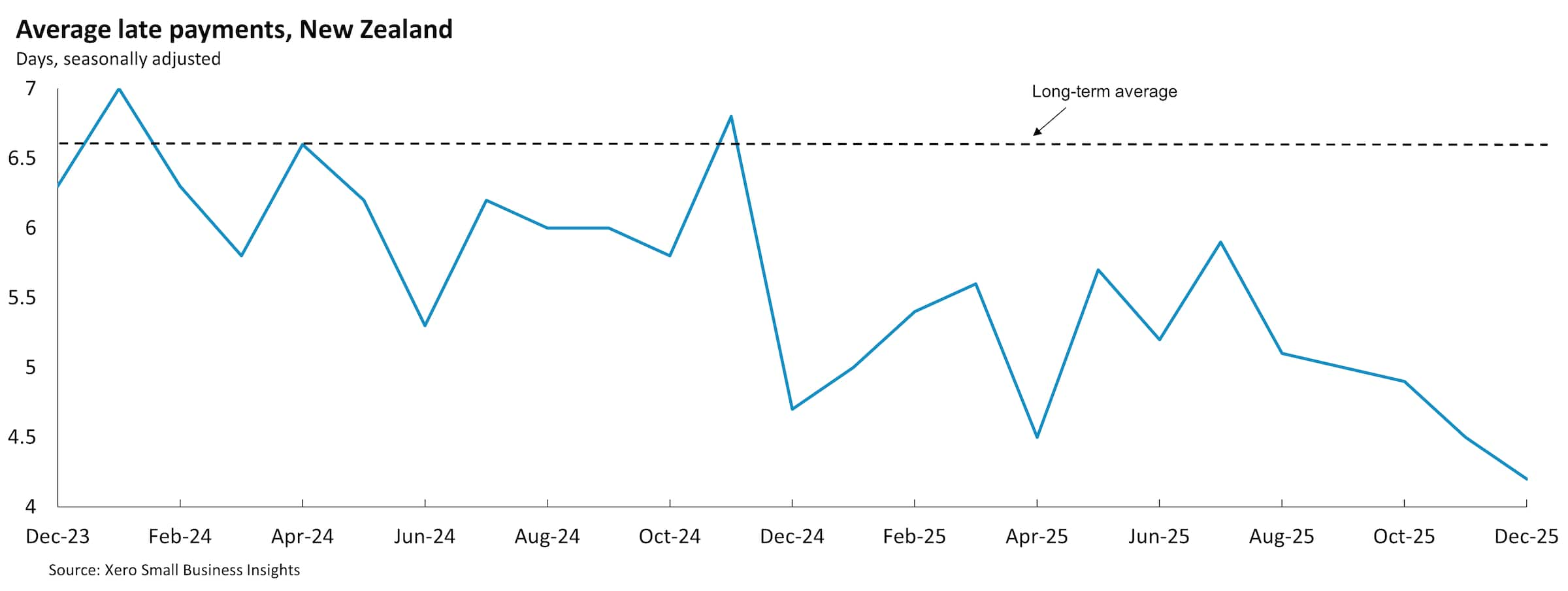

On average small businesses were paid 4.5 days late in the December quarter - the lowest level since the series began (in January 2017). Of course, this means that small businesses are, on average, still being paid late suggesting there is more work to do in this important policy area.

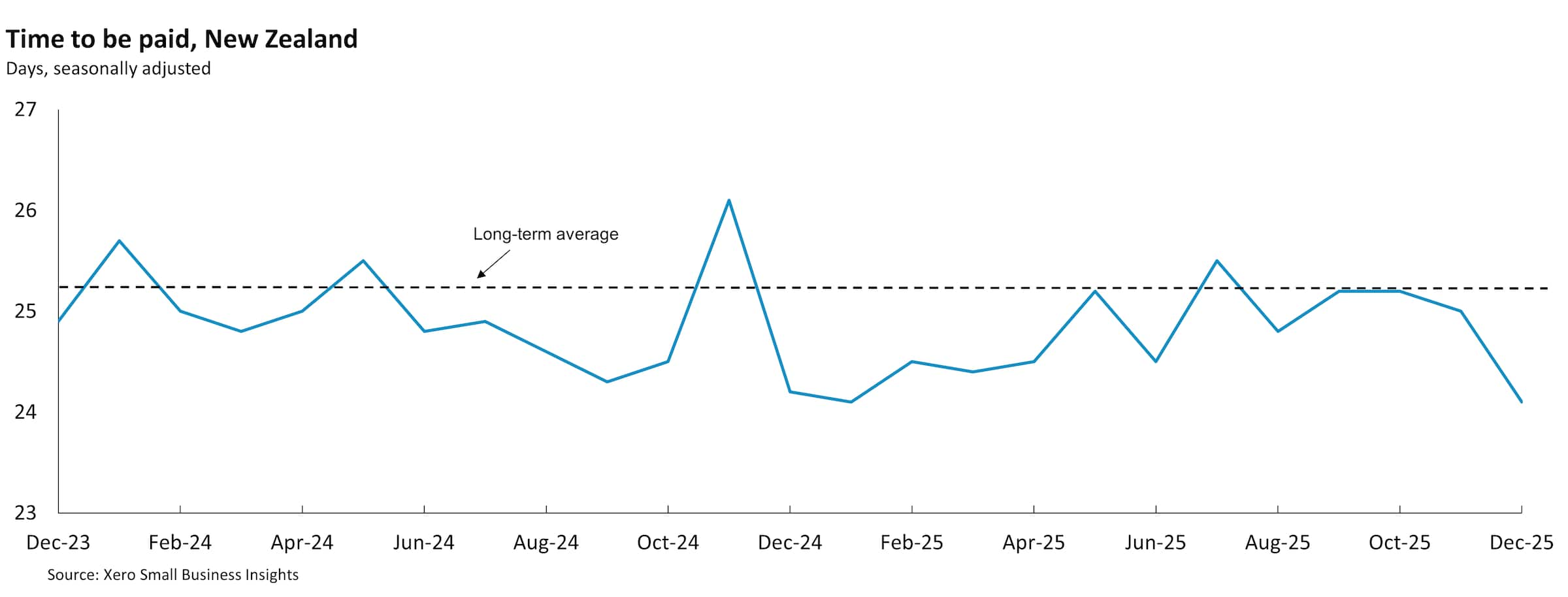

The average length of time small businesses waited to be paid, after issuing an invoice, was 24.8 days in the December quarter, down from 25.2 days in the September quarter. Over the whole year payment times in 2025, at 24.8 days, were little changed from 2024, at 24.9 days.

Despite the national improvement in late payments, there remains considerable variation in payment practices across industries. Small manufacturing businesses were paid an average of 9.1 days late in the December quarter, much longer than construction (7.3 days) and professional services (7.6 days). Retail trade (3.1 days) and hospitality (2.4 days) are the industries closest to actually being paid on time.

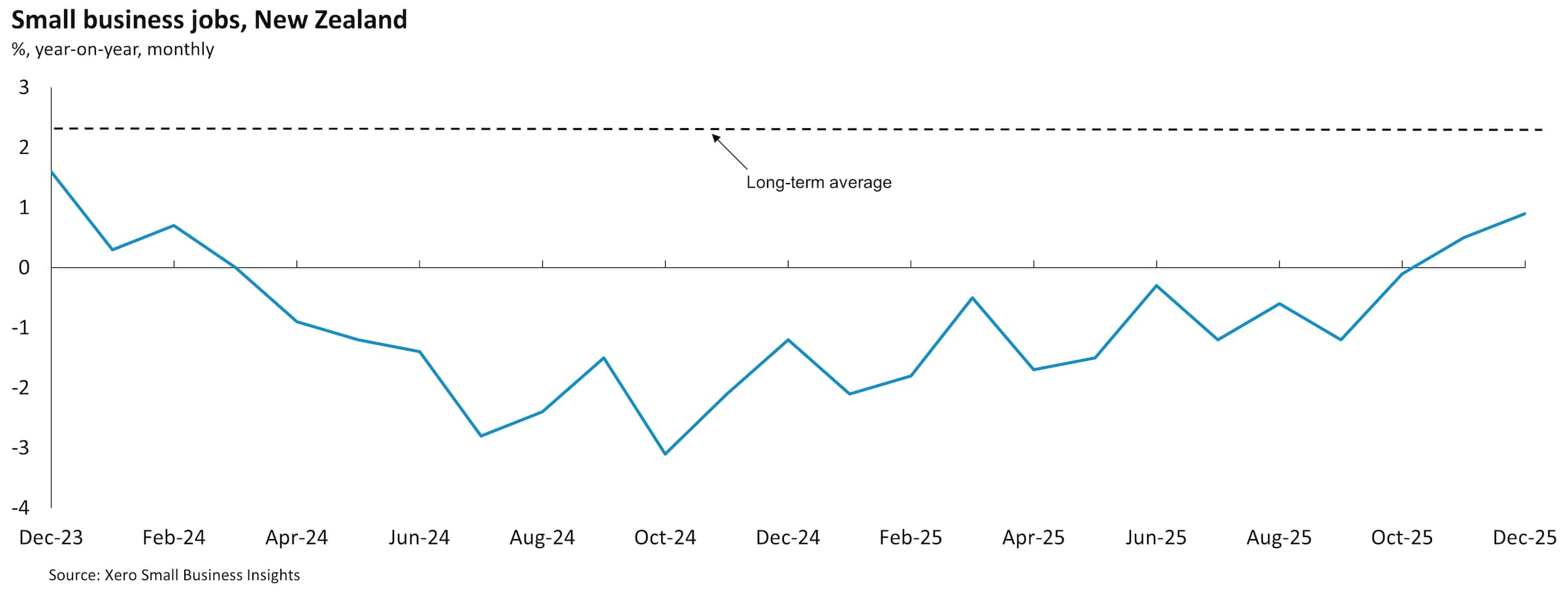

The labour market has started to respond to the improved sales performance. Jobs grew 0.4% y/y in the December quarter. This is the first quarter of positive jobs growth since the March quarter 2024. It is a positive sign for the overall health of the small business economy, as owners become more confident that the pick-up in sales in the second half of 2025 is sustainable enough to start growing their staff numbers again.

Jobs growth was not uniform across industries during the December quarter. Hospitality (-2.0% y/y), retail trade (-1.5% y/y) and construction (-0.9% y/y) all still employ fewer people than a year ago. In contrast, agriculture (+2.9% y/y) and manufacturing (+2.3% y/y) are both seeing healthy jobs gains.

Regional job patterns were similar to sales, with Canterbury (+3.2% y/y) and Otago (+2.5% y/y) doing better than Auckland (-0.5% y/y) and Wellington (-2.6% y/y), which both have fewer small business jobs than the same time last year.

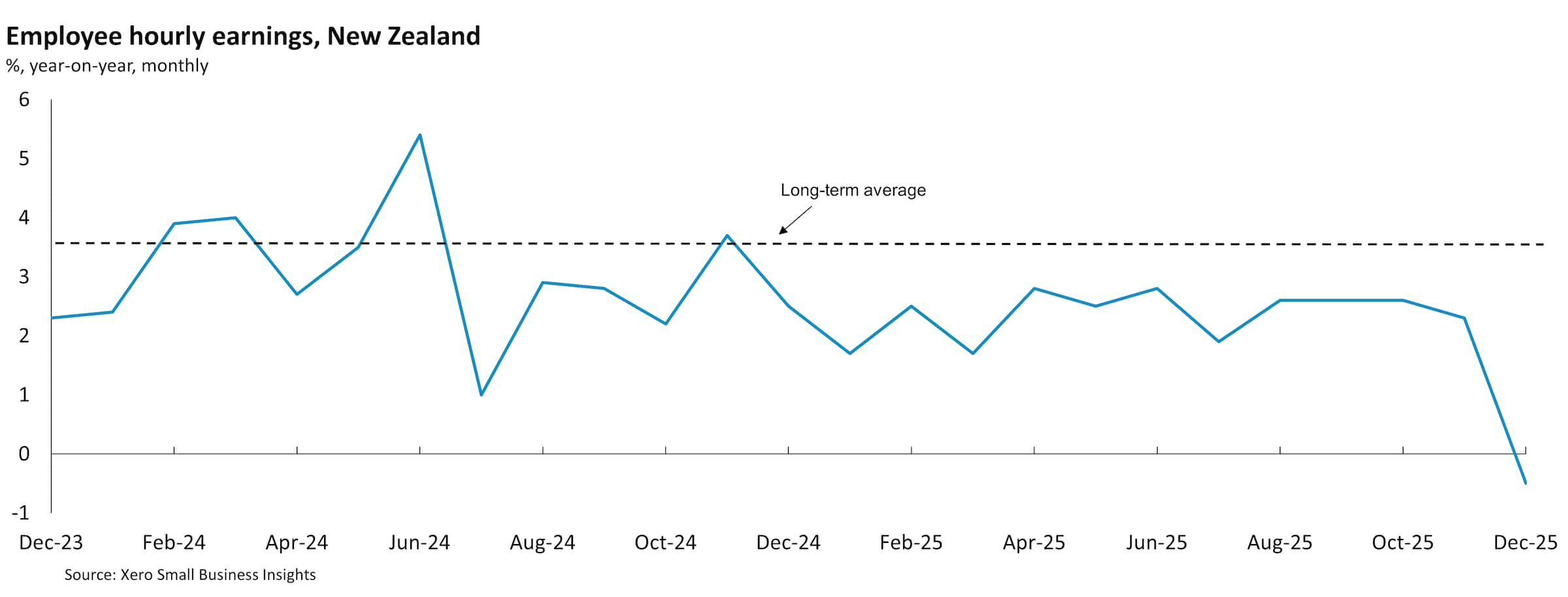

Wages rose only 1.5% in the December quarter, largely due to a very weak December result (-0.5% y/y). This doesn't mean NZ wages fell in the month, however. Instead it is a regular pattern of XSBI data, due to the holiday period delaying wage reporting in Xero's system. We expect this result to be revised up in the future as more data becomes available. Setting the December month result aside, wages grew an average of 2.5% y/y in October and November - similar to the 2.4% rise in the September quarter and below the long-run average for this series of 3.6% y/y.

Overall, the latest XSBI data confirms that the recovery in the NZ economy is becoming more sustainable. Sales, jobs and wages growth are still below the historical averages for these series but they are improving. The payment time indicators, especially late payments, show that small business owners are getting paid 'less late' but this metric needs to be at 0 to reflect small businesses are getting paid when they should be.

Looking ahead, the latest economic forecasts from the Reserve Bank of New Zealand also indicate that the economy is in the early stages of recover, consistent with the XSBI data. The RBNZ also noted that, in response to previous cuts in the OCR, economic growth is broadening across sectors of the economy, such as manufacturing, construction and some retail. Economic growth is expected to increase over 2026. In further good news for small business owners, the RBNZ also indicated that monetary policy is likely to remain accommodative for some time, suggesting it is not in a hurry to follow its counterpart in Australia and start raising the official cash rate in the near-term.

For more information on the XSBI metrics, see our methodology page.

Disclaimer

This report was prepared using Xero Small Business Insights data and publicly available data for the purpose of informing and developing policies to support small businesses.

This report includes and is in parts based on assumptions or estimates. It contains general information only and should not be taken as taxation, financial, investment or legal advice. Xero recommends that readers always obtain specific and detailed professional advice about any business decision.

The insights in this report were created from the data that was available as at the date it was extracted. Data used was anonymised and aggregated to ensure individual businesses can not be identified.

Find out more about XSBI

If you have any questions about Xero Small Business Insights, reach out to us.