Reduce errors and delays with eInvoicing

Exchange eInvoices between the accounting software of New Zealand businesses and government agencies for efficient, secure invoicing.

Instant invoicing.

What eInvoicing is

eInvoicing is a New Zealand government initiative designed to make exchanging invoices and doing business more efficient. It’s a quick, easy and secure way to send invoices directly from, and receive them directly into, a business’s accounting software.

eInvoicing uses the Peppol network

eInvoices are sent between accounting systems via Peppol’s secure global public network rather than email.

Government committed to eInvoicing

The New Zealand government leads the way on eInvoicing and pays eInvoices of up to $1 million within 10 days.

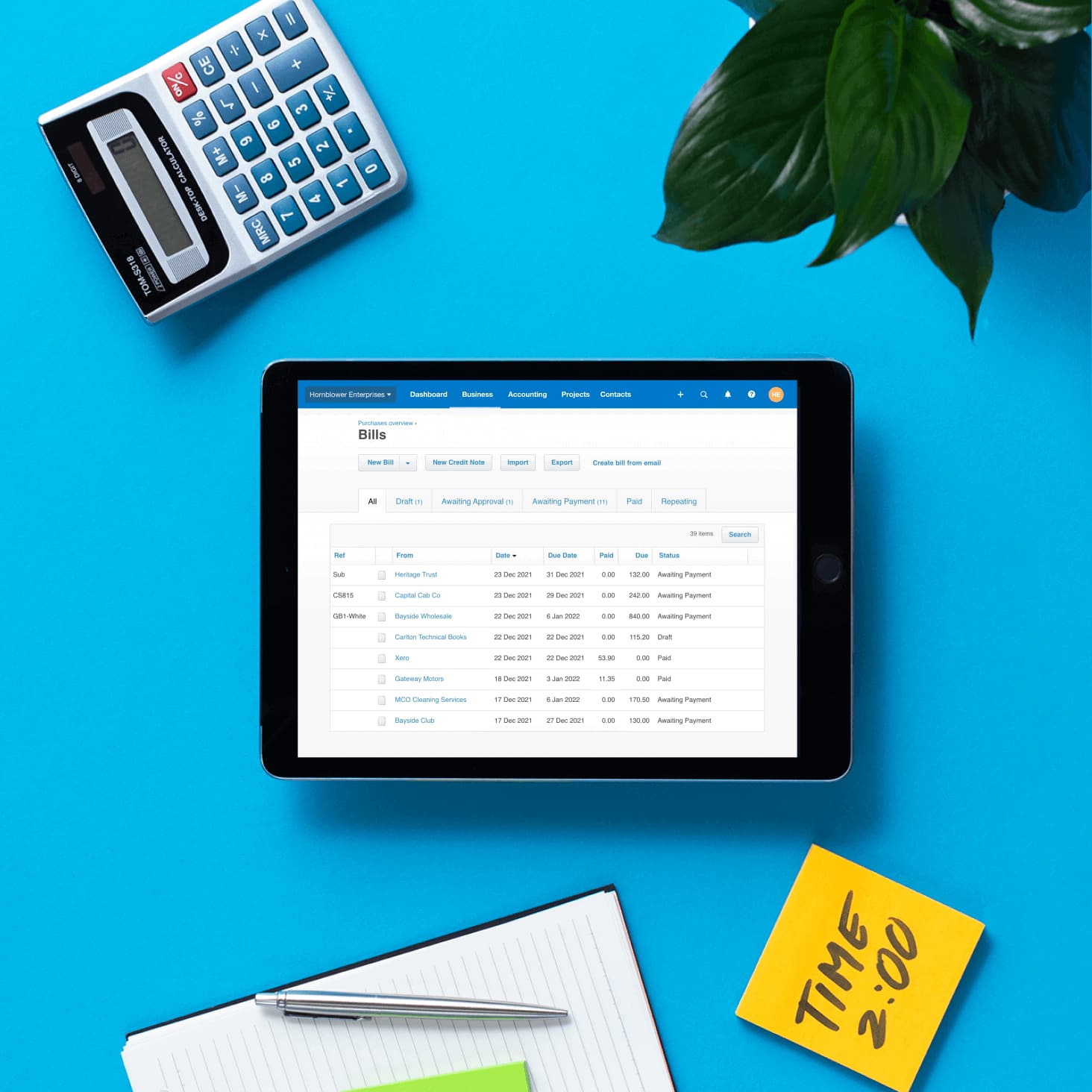

Bills automatically prepopulated

eInvoicing does away with manual entry of bills, reduces errors and delays in getting paid, and lowers costs.

Free registration for eInvoicing

Register with the Peppol network from within Xero using your NZBN to start receiving eInvoices.

Benefits of eInvoicing

The benefits of eInvoicing, as described by the NZ government, include the following.

- Improves business efficiency

- Makes it quicker and easier to get paid

- Reduces administrative delays and payment issues

- Faster payment and more streamlined processing can improve trading relationships

New Zealand government eInvoicing

At the same time as encouraging local and wider government to adopt and use eInvoicing, the NZ government set these eInvoicing targets for central government in June 2021:

- All central government agencies to be able to receive eInvoices by 31 March 2022

- 90% of invoices from business to central government are eInvoices by July 2026

eInvoicing for Xero businesses in NZ

Businesses that use Xero software can send and receive eInvoices from businesses and New Zealand government agencies that are registered for eInvoicing.

Learn more about eInvoicing in Xero

More about eInvoicing

eInvoicing is part of a New Zealand government initiative to help businesses be paid on time by improving the way they interact with each other. Through digitising and using eInvoicing software, businesses can lower their costs by improving payment times.

See why governments are promoting eInvoicingeInvoicing is part of a New Zealand government initiative to help businesses be paid on time by improving the way they interact with each other. Through digitising and using eInvoicing software, businesses can lower their costs by improving payment times.

See why governments are promoting eInvoicingMBIE in New Zealand, ATO in Australia, HMRC in the UK, IRB in Malaysia, and IMDA in Singapore have all chosen Peppol as the global network provider for eInvoicing. They’re at various stages of adopting eInvoicing as take up accelerates and is accepted as best practice around the world.

Search for registered businesses on the Peppol directoryMBIE in New Zealand, ATO in Australia, HMRC in the UK, IRB in Malaysia, and IMDA in Singapore have all chosen Peppol as the global network provider for eInvoicing. They’re at various stages of adopting eInvoicing as take up accelerates and is accepted as best practice around the world.

Search for registered businesses on the Peppol directoryCost savings are one of the benefits of eInvoicing. According to the Ministry of Business, Innovation and Employment (MBIE), it costs businesses around $26 to process a paper invoice, $23 for an emailed PDF invoice, and under $10 to process an eInvoice due to the time saved by reducing manual handling. The NZ government also estimates that, with over 280 million business-to-business invoices exchanged in New Zealand annually, savings to the economy through eInvoicing will be around $4.4 billion over 10 years.

Learn what the government says about the benefits of eInvoicingCost savings are one of the benefits of eInvoicing. According to the Ministry of Business, Innovation and Employment (MBIE), it costs businesses around $26 to process a paper invoice, $23 for an emailed PDF invoice, and under $10 to process an eInvoice due to the time saved by reducing manual handling. The NZ government also estimates that, with over 280 million business-to-business invoices exchanged in New Zealand annually, savings to the economy through eInvoicing will be around $4.4 billion over 10 years.

Learn what the government says about the benefits of eInvoicingeInvoicing is included in Xero Ignite, Grow, Comprehensive and Ultimate plans; you don’t need to purchase any additional add-on or external service to use it. Registration is easy and can be completed in a few clicks.

Learn how eInvoicing works in XeroeInvoicing is included in Xero Ignite, Grow, Comprehensive and Ultimate plans; you don’t need to purchase any additional add-on or external service to use it. Registration is easy and can be completed in a few clicks.

Learn how eInvoicing works in Xero

Set up for eInvoicing with Xero

Get started in a few simple steps if you’re subscribed to any Xero business plan.

Register to receive eInvoices

Register with the Peppol network from within Xero using your NZBN (New Zealand Business Number).

Get ready to send eInvoices

Enter your NZBN in Xero. Add your customer’s NZBN and check they’re registered with the Peppol network.

Watch for draft bills in Xero

Check regularly for eInvoices that have arrived in Xero as bills to pay. Then just approve and pay the bills.

See how to receive eInvoices and what to do when you receive them

Try Xero free for 30 days

Access Xero features for 30 days, then decide which plan best suits your business. Note: eInvoicing isn’t available in the free trial.

Explore more about eInvoicing

Advice from the NZ government

The government encourages businesses to take the next step and share the benefits of eInvoicing.

Preparing suppliers for eInvoicing

Use this communications toolkit to encourage your Xero suppliers to begin sending you eInvoices.

Top eInvoicing questions answered

Find answers to the top questions that advisors ask about eInvoicing in this Xero blog.