Automate and file GST online

Prepare accurate returns automatically, and securely file GST online from Xero to Inland Revenue.

Prepare GST effortlessly

Xero records GST and includes it in returns.

Manage GST online

View and adjust GST transactions and manage GST from prior periods.

Connect to IRD

Securely lodge online GST returns directly to Inland Revenue.

Prepare GST effortlessly

Xero calculates GST on each transaction and generates online GST returns, whichever method you use.

- Commonly used GST rates are already set up

- Xero automatically records GST on each transaction

- Enter transaction amounts as GST inclusive or exclusive

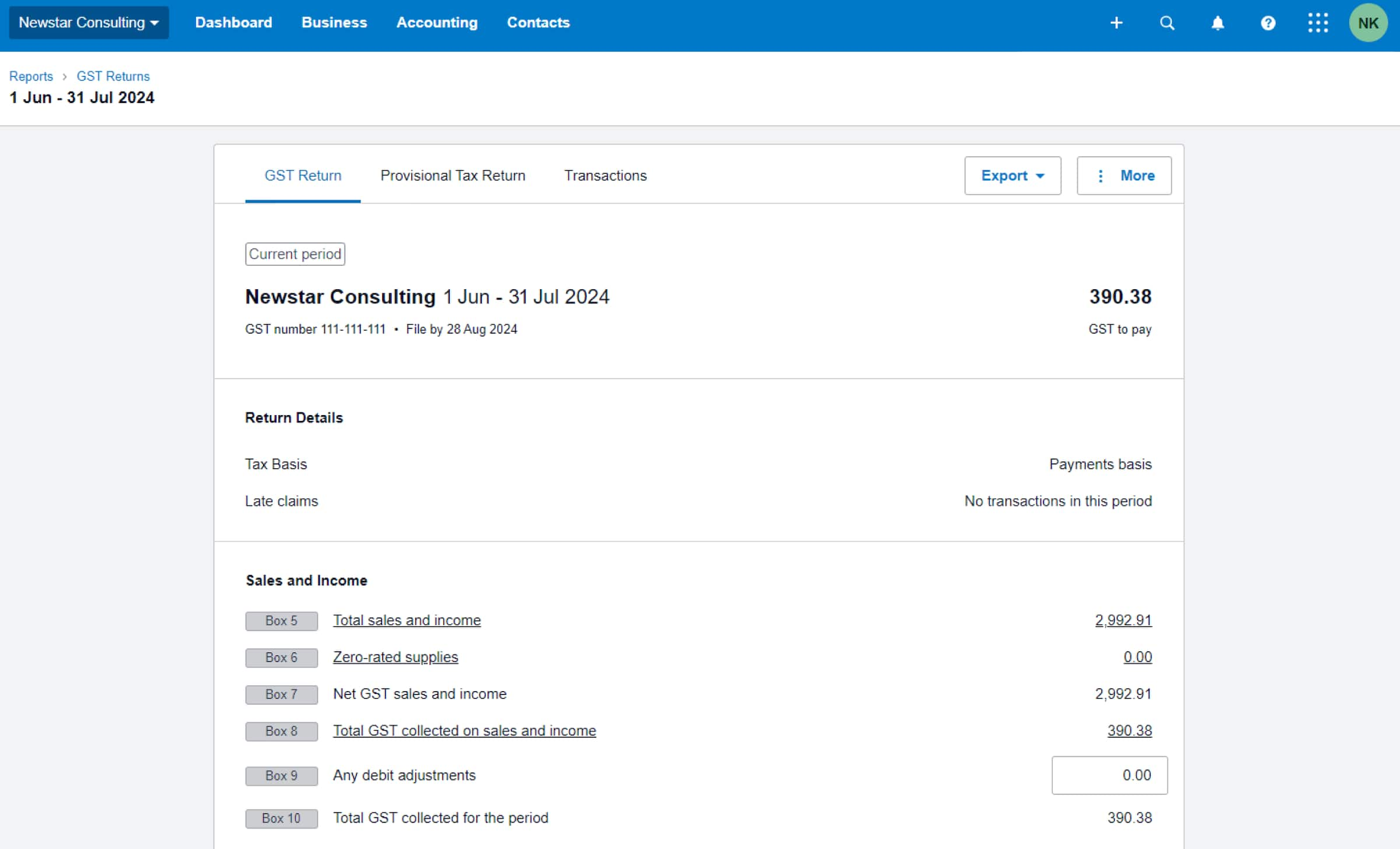

Manage GST online

Accurately track, review and manage GST transactions using the GST software in Xero.

- View the next due date and GST you owe at any time

- See, check and amend the transactions on a return as needed

- Changes from prior returns show up on your latest return

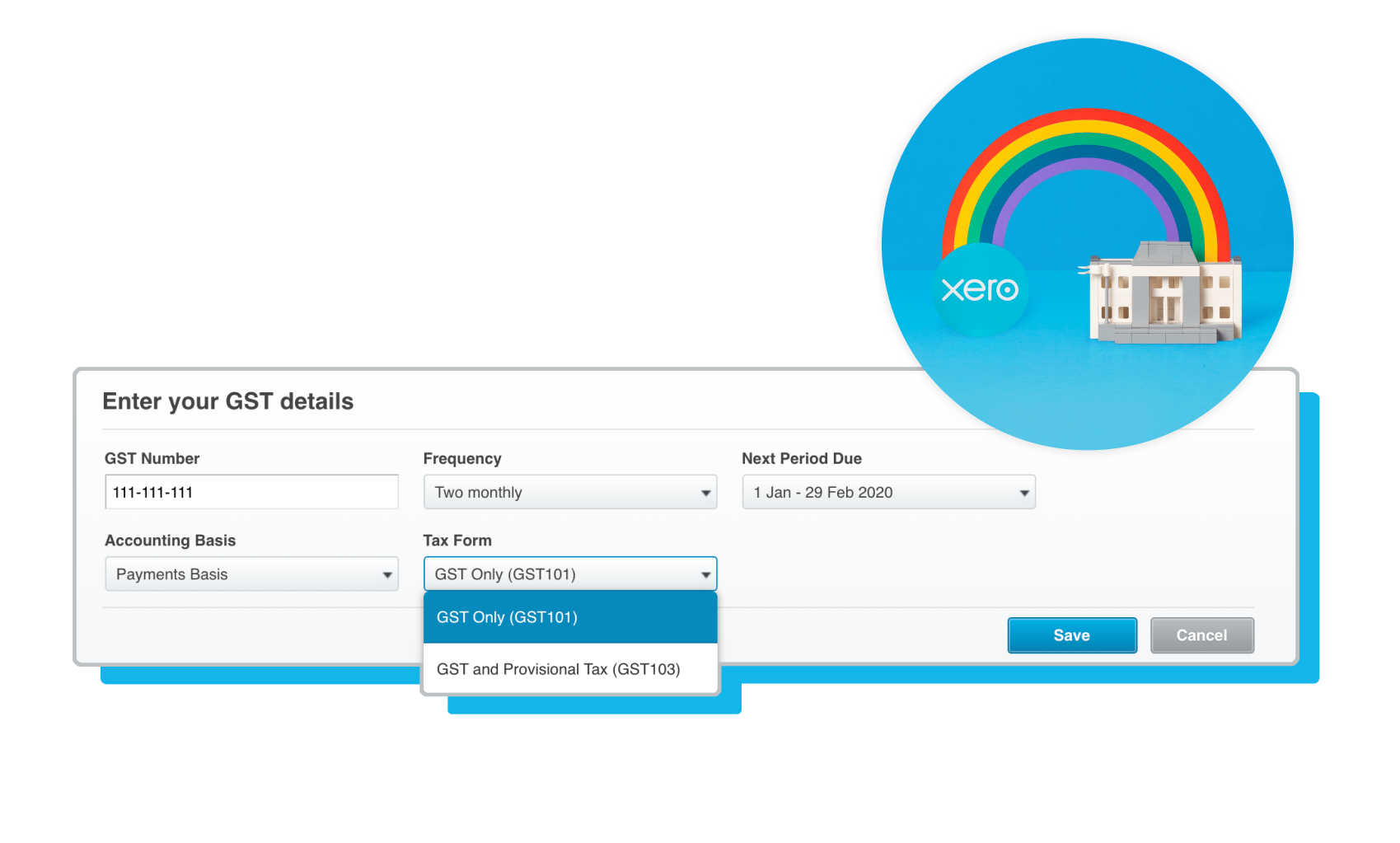

Connect to IRD

Submit returns securely to IRD using the GST filing software in Xero. Reduce errors and double handling.

- File a GST only, or GST and provisional tax return

- The time and date of your filing are confirmed in Xero

- Track your return’s progress in myIR the next business day

Accounting software for your small business

Run your business accounting online with Xero. Easy-to-use accounting software, designed for your small business.

- Everything in one place

- Connect to your bank

- Collaborate in real time

- Customise to suit your needs

Start using Xero for free

Access Xero features for 30 days, then decide which plan best suits your business.

I find Xero’s interface really user friendly

Studio Banaa use Xero to look after their businesses finances