What is a pro forma invoice? How, when and why to use them

Need a preliminary bill of sale before your work is complete? Get up to speed on pro forma invoices and how to use them.

Published Wednesday 14 December 2022

What is a pro forma invoice?

A pro forma invoice is sent to a buyer before the sale is final, to help identify products and prices that will be involved in the transaction. It’s not really an invoice at all because it’s not actually a request for payment. So it doesn’t have an invoice number or a due date. Nor is it entered into the business books as money owed to the business (accounts receivable).

Three common reasons for issuing a pro forma invoice

- Pro forma invoices are used to confirm the cost of an order so the buyer can arrange finance to make the purchase.

- Pro forma invoices state the value of imported goods for customs. Without the detailed information of a pro forma invoice, goods may not be cleared in some countries.

- Some customers request a pro forma invoice as part of their procurement process because it’s considered more definite than a quote.

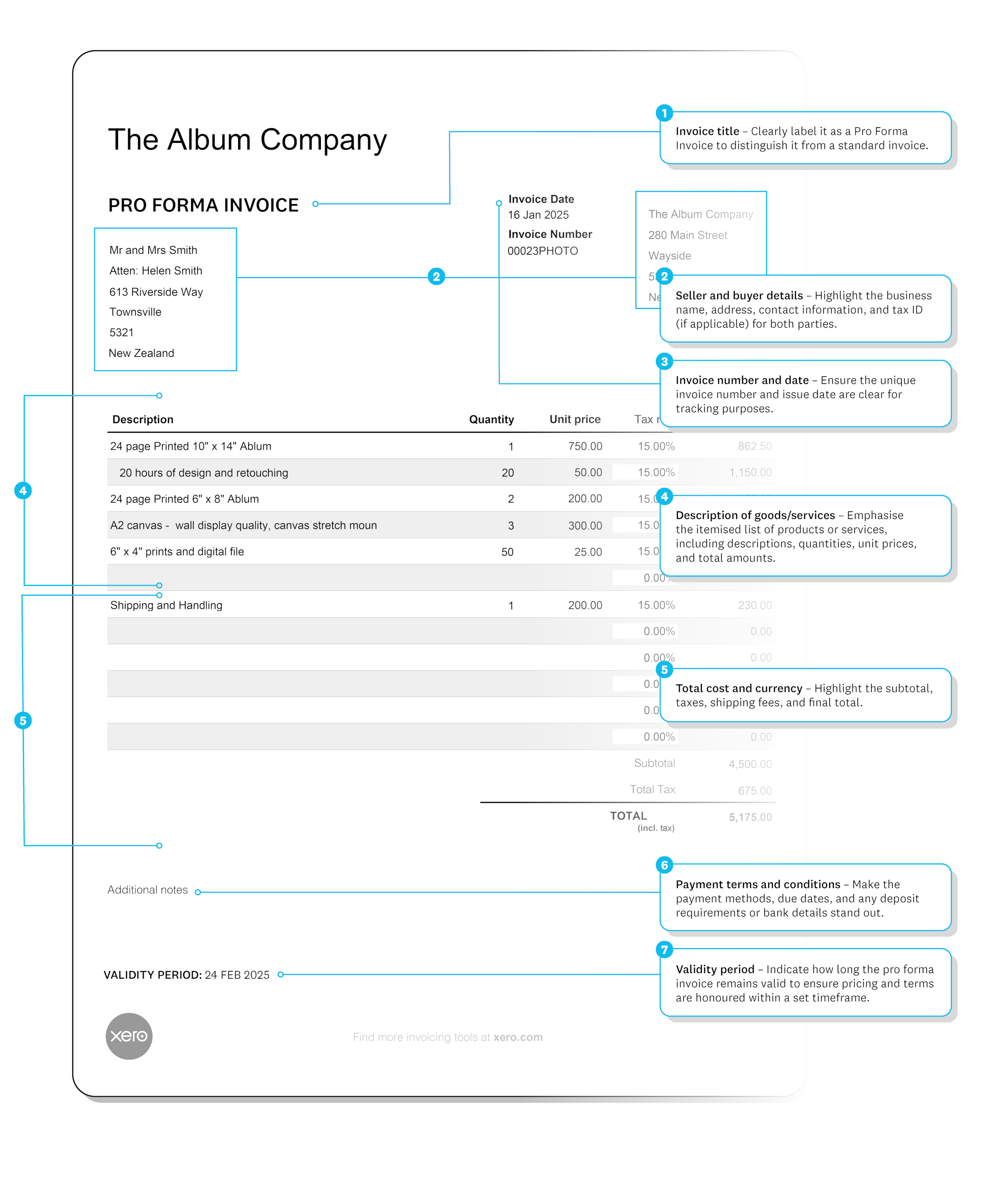

What should a pro forma invoice look like?

A pro forma invoice looks like a regular invoice but must be labeled 'pro forma invoice'. It includes all the usual invoice information such as details of the buyer and seller, a list of products and prices, and terms of the sale. It should also include a reference number so it’s easy for customers to save and retrieve, but this isn’t an official invoice number.

Some importers may also require a pro forma invoice to include the weights and measures of products and shipping costs.

How is a pro forma invoice different from other invoices (and quotes)?

A pro forma invoice shouldn’t be confused with a sales invoice, commercial invoice, or quote.

- Sales invoice: A normal sales invoice is a request for payment that’s sent once the transaction is final. It signals that money is officially owed from the buyer to the seller. A pro forma invoice is sent before the sale, so it doesn’t have a due date.

- Commercial invoice: A commercial invoice is a special sort of sales invoice exchanged between importers and exporters. It includes extra information about the responsibilities of the buyer and seller, and may also identify tariffs that apply to the shipment. A pro forma invoice is also used in shipping, as the details on it can help estimate customs duties and fees, but that’s where the similarities end. As a form of sales invoice, a commercial invoice indicates a sale is final while a pro forma invoice doesn’t.

- Quote: Quotes are very similar to pro forma invoices in that they’re used to agree prices between a supplier and buyer. But while a pro forma invoice can be part of the negotiation process, it’s more typically sent after the deal is agreed to support administrative tasks with customs, lenders, or procurement.

When to send a pro forma invoice

Businesses generally only send a pro forma invoice when a customer requests one. Even then, it generally comes after a quote has been accepted and both parties are committed to the deal. Customers request them to support administrative tasks such as costing out import duties or satisfying their internal procurement department. If your customer is an importer, you may want to ask if they need a pro forma invoice.

The sale is not final at this stage. Seek a final OK from your customer before processing the sale, shipping the products, or issuing the final sales invoice.

How to create a pro forma invoice?

To create a pro forma invoice, you can use a standard invoice template and complete all the required fields. Ensure that it’s labeled ‘Pro forma Invoice’ so that your client knows that it’s not the final invoice.

Don’t enter the invoice into your accounts receivable ledger, as the sale is yet to be confirmed and so no one owes you anything yet. If you’re using accounting software, ask your provider how to send a pro forma invoice. You don’t want to accidentally send a sales invoice, as that will record the sale as income if your business uses accrual accounting.

Frequently asked questions about pro forma invoices

Is a pro forma invoice legally binding?

Pro forma invoices are not legally binding like an invoice. You create a pro forma invoice before you deliver your products and services. It’s a good-faith agreement.

Can a pro forma invoice be canceled?

Pro forma invoices are not legal documents nor are they official invoices used for accounting purposes. If the sale isn't complete, there’s no need for you to edit or cancel the invoice.

Can you turn pro forma invoices into commercial invoices?

No, you can't turn pro forma invoices into commercial invoices. Though they contain similar information, a commercial invoice also includes terms from the UCC with details of the rules and regulations of the sale to the import broker, freight forwarder, marine insurance company and the buyer’s and seller’s banks.

How can a pro forma invoice help you?

Certain types of customers, such as importers, may require a pro forma invoice. Being able to produce them will therefore help you do business with them.

Is it OK to pay a pro forma invoice?

You shouldn’t pay a pro forma invoice because it’s not a binding agreement and the price may still change. Wait until an official sales invoice has been issued.

What are the advantages of pro forma invoices?

The three main advantages of the pro forma invoice are that:

- they ensure both the buyer and seller are on the same page

- they can assist businesses to provide necessary information to get through customs

- you can easily make changes to the products, services and costs listed without having to edit your business accounts

Related content

What is an invoice?

Get the lowdown on invoices.

How to send an invoice

Find out when and how to send an invoice.

How to make an invoice

Let’s walk through the process of making an invoice.

Disclaimer

Xero does not provide accounting, tax, business or legal advice. This guide has been provided for information purposes only. You should consult your own professional advisors for advice directly relating to your business or before taking action in relation to any of the content provided.

Start using Xero for free

Access Xero features for 30 days, then decide which plan best suits your business.