Free income statement template

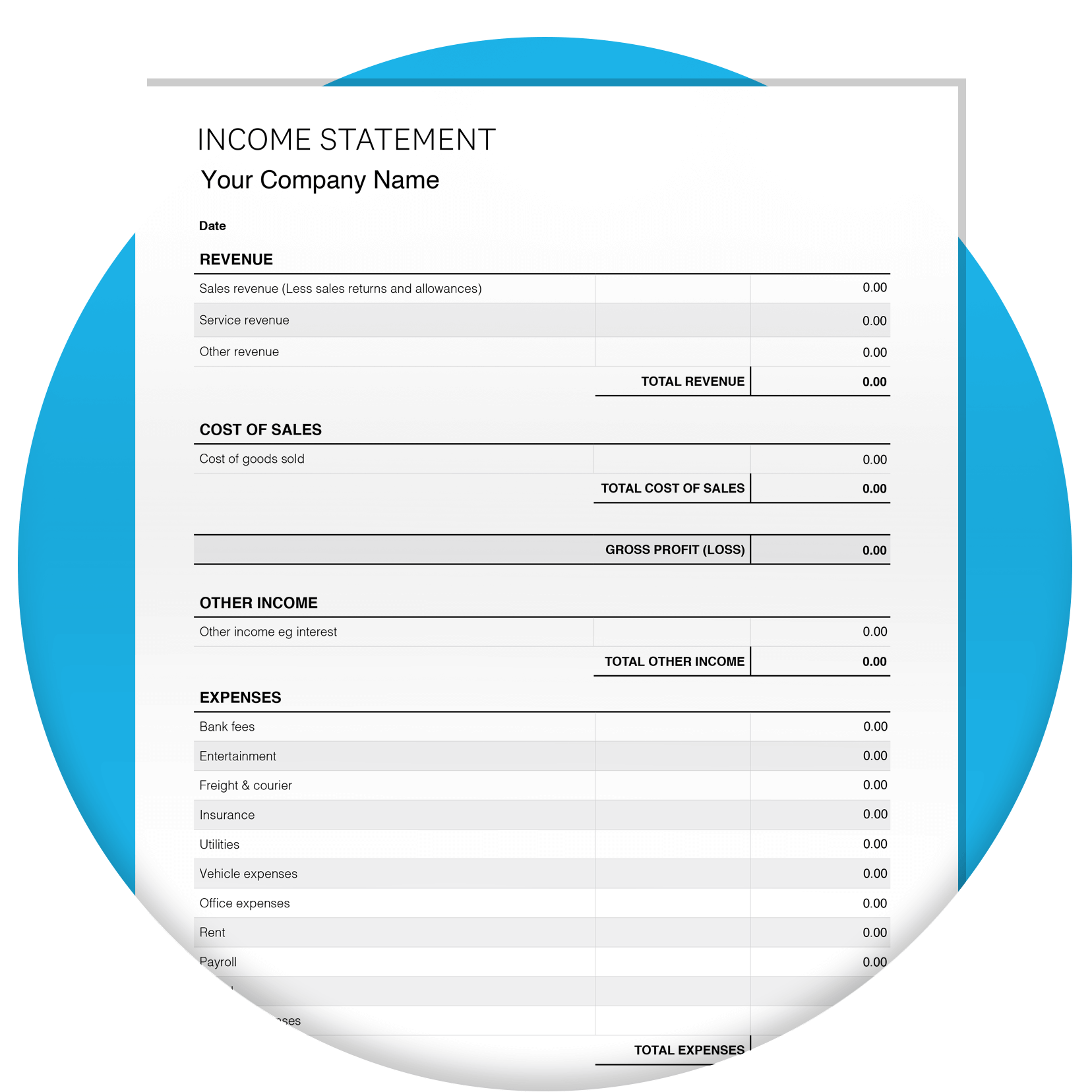

An income statement is a summary of your business income and expenses during a given time period. This free income statement template makes it easy to create an income statement for your business. Simply plug your numbers into the template and you're ready to go.

Accurately track your income and expenses

Record revenue, COGS and indirect expenses to calculate your net profit or loss before taxes.

Clear and friendly design for your business

Just put in your numbers and the calculations are done for you in an income statement format.

Save and keep to use again

Reusable so you can compare with previous saved statements to see how your business is tracking.

Download the free income statement template

Fill in the form to get an income statement template as an editable PDF. We’ll throw in a guide to help you use it.

Got your template? Try Xero for free.

Ready to take control of your business? Xero's got everything you need to succeed, from accounting and invoicing to reporting and payroll.

Getting started with the income statement template

This template comes with an income statement example and how-to guide that shows how to fill one out. We’ve already set up the format of the income statement for you. In short, you’ll add in your revenue then subtract your expenses to find out your profit (or loss).

Check out an example of the income statementThis template comes with an income statement example and how-to guide that shows how to fill one out. We’ve already set up the format of the income statement for you. In short, you’ll add in your revenue then subtract your expenses to find out your profit (or loss).

Check out an example of the income statementAn income statement will show how much money a business is making. It can also help you calculate profit margins, which show how good the business is at converting revenue into profits.

An income statement will show how much money a business is making. It can also help you calculate profit margins, which show how good the business is at converting revenue into profits.

Income statements can be tricky. Missing off a cost or miscalculating income can really throw out your results. It’s a good idea to connect with an accountant or bookkeeper when filling out a template like this. You can find one in our directory.

Find an advisorIncome statements can be tricky. Missing off a cost or miscalculating income can really throw out your results. It’s a good idea to connect with an accountant or bookkeeper when filling out a template like this. You can find one in our directory.

Find an advisor

Why use our income statement template?

- Accurate financial tracking with fields for common business income and expense categories.

- Time-saving, reusable template that lets you plug in numbers quickly.

- Features the most important details about your business's profitability.

- Lets you identify where expenses can be reduced.

Our free income statement template is reusable and simple to use. You can create a statement for internal decision-making or to show lenders

How to format your income statement

Go to the download section on this page, fill in your details and we’ll send you an email with the template as a downloadable PDF. We’ll also send a guide on how to use it with a sample income statement. You’ll need to have a PDF reader installed to use the template.

Check out the download now.Go to the download section on this page, fill in your details and we’ll send you an email with the template as a downloadable PDF. We’ll also send a guide on how to use it with a sample income statement. You’ll need to have a PDF reader installed to use the template.

Check out the download now.Record your income and expenses in line with your accounting method. With the accrual method, you record revenue or expenses when you earn the money or incur the expense, but with the cash basis method, you don't record anything until the cash actually exchanges hands. You must be consistent about using one or the other if you want to create accurate reports.

To learn more, check out cash vs accrual accounting explained.Record your income and expenses in line with your accounting method. With the accrual method, you record revenue or expenses when you earn the money or incur the expense, but with the cash basis method, you don't record anything until the cash actually exchanges hands. You must be consistent about using one or the other if you want to create accurate reports.

To learn more, check out cash vs accrual accounting explained.Income statements cover specific periods of time such as weeks, months, quarters, or years. Consider looking at a variety of time periods to see how your business does during different intervals – for example, an annual report will show how your business did over a year, while quarterly and monthly income statements can help track seasonal trends. Make sure to use consistent date ranges when comparing different periods.

Income statements cover specific periods of time such as weeks, months, quarters, or years. Consider looking at a variety of time periods to see how your business does during different intervals – for example, an annual report will show how your business did over a year, while quarterly and monthly income statements can help track seasonal trends. Make sure to use consistent date ranges when comparing different periods.

List all of your business's revenue from different sources in the designated fields, and the template will automatically calculate a total. Next, list your cost of sales and all of your fixed and variable expenses in their designated fields. Once you've entered everything, the template will subtract expenses from revenue to calculate your net profit before tax.

List all of your business's revenue from different sources in the designated fields, and the template will automatically calculate a total. Next, list your cost of sales and all of your fixed and variable expenses in their designated fields. Once you've entered everything, the template will subtract expenses from revenue to calculate your net profit before tax.

Your net profit before tax will be displayed at the bottom of the template. Use this number and the other details on your report to make informed decisions for your business. Understanding the profitability of your business at different time periods can help you create budgets and make smart financial decisions.

Your net profit before tax will be displayed at the bottom of the template. Use this number and the other details on your report to make informed decisions for your business. Understanding the profitability of your business at different time periods can help you create budgets and make smart financial decisions.

The final row of this income statement template will display the net profit before tax, which can be used to help calculate a business’s tax bill. This assumes that all the expenses listed on the income statement are deductible. Your tax office has details to help you understand what qualifies as being deductible and an accountant can also guide you.

The final row of this income statement template will display the net profit before tax, which can be used to help calculate a business’s tax bill. This assumes that all the expenses listed on the income statement are deductible. Your tax office has details to help you understand what qualifies as being deductible and an accountant can also guide you.

Once you’ve created the statement, it's time to print and/or save it. You can use past income statements to track the history of your business's finances and compare with new reports to see how your business is improving.

Once you’ve created the statement, it's time to print and/or save it. You can use past income statements to track the history of your business's finances and compare with new reports to see how your business is improving.

Want to learn more about how to understand your income statement or check you're in line with local regulations? An accountant or bookkeeper can help you complete your income statement template and avoid mistakes.

Find an advisorWant to learn more about how to understand your income statement or check you're in line with local regulations? An accountant or bookkeeper can help you complete your income statement template and avoid mistakes.

Find an advisor

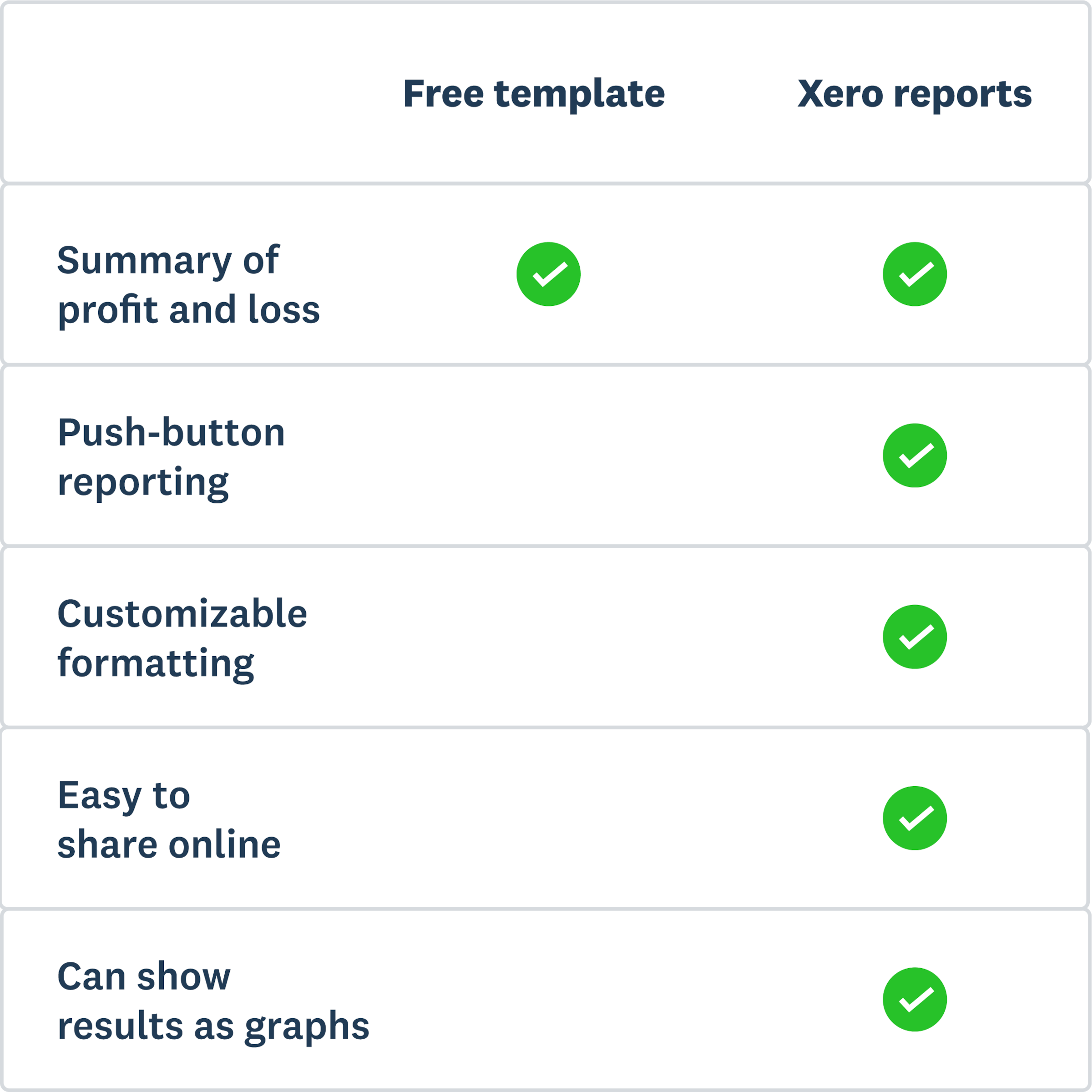

Make income statements better

Software can crank out income statements painlessly. Get Xero to capture your financial data and it’ll create a report whenever you want.

- Create up-to-date reports at the press of a button

- Format them the way you like

- Share them online with your accountant, bookkeeper, and business partners

Disclaimer

Xero does not provide accounting, tax, business or legal advice. This template has been provided for information purposes only. You should consult your own professional advisors for advice directly relating to your business.