Financial literacy resources for small business owners

New research from Xero reveals a notable gap in financial literacy among Canadian small business owners. This infographic looks at how people get started in business and the common challenges they face.

Understanding finances can be a challenge

Among the top challenges small business owners face after start up are optimizing tax strategies, managing cash flow, and interpreting financial metrics.

Businesses want to grow but find it challenging

Over half of Canadian business owners surveyed say building awareness and acquiring customers is their top non-financial challenge when starting out.

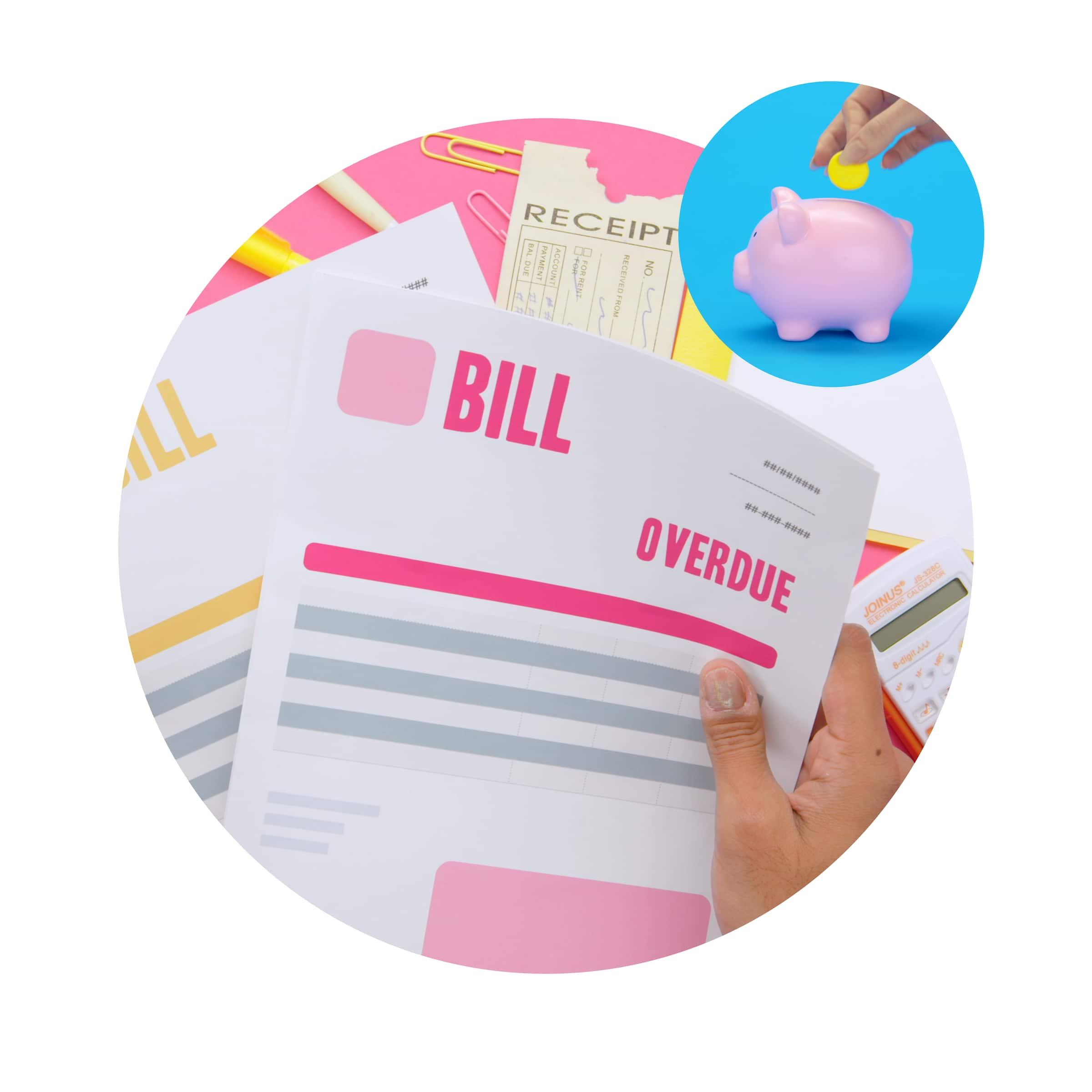

Few businesses plan for the unexpected

10% of small businesses have no plan in place for unexpected expenses while 16% have yet to recover from financial issues they’ve experienced.

Managing business finances

Here are some handy resources to help you get going when it comes to business finances.

Creating a budget

Businesses need budgets. So how do you go about setting a business budget? What are the main things you need to put in?

Managing cash flow

Cash flow management is vital for a growing business. Here are five rules to help you keep cash flow under control.

Interpreting metrics (KPIs)

How do you measure the success of your business? KPIs (key performance indicators) can help you. Here’s how they work.

Growing your business

Building awareness and acquiring customers

Learn how to increase sales to old customers and new, and pick up selling tips from businesses like yours.

Digital marketing for small businesses

Digital marketing is a mystery to most. And yet everyone says you have to have it. So let’s learn how to do it.

Growing your business

Are you ready to give it your all and take your business to the next level? Let’s look at how to grow.

Adapting to change

10 monthly tasks for good business health

Time flies when you're running your own business. This monthly checklist will help ensure you keep things on track.

Financial and business survival during a crisis

When a crisis strikes, income shrinks quickly. So how can you plan and work your way out when there’s a disaster?

Recession-proofing your business

Small business experts explain how to build a resilient business in a changing economy.