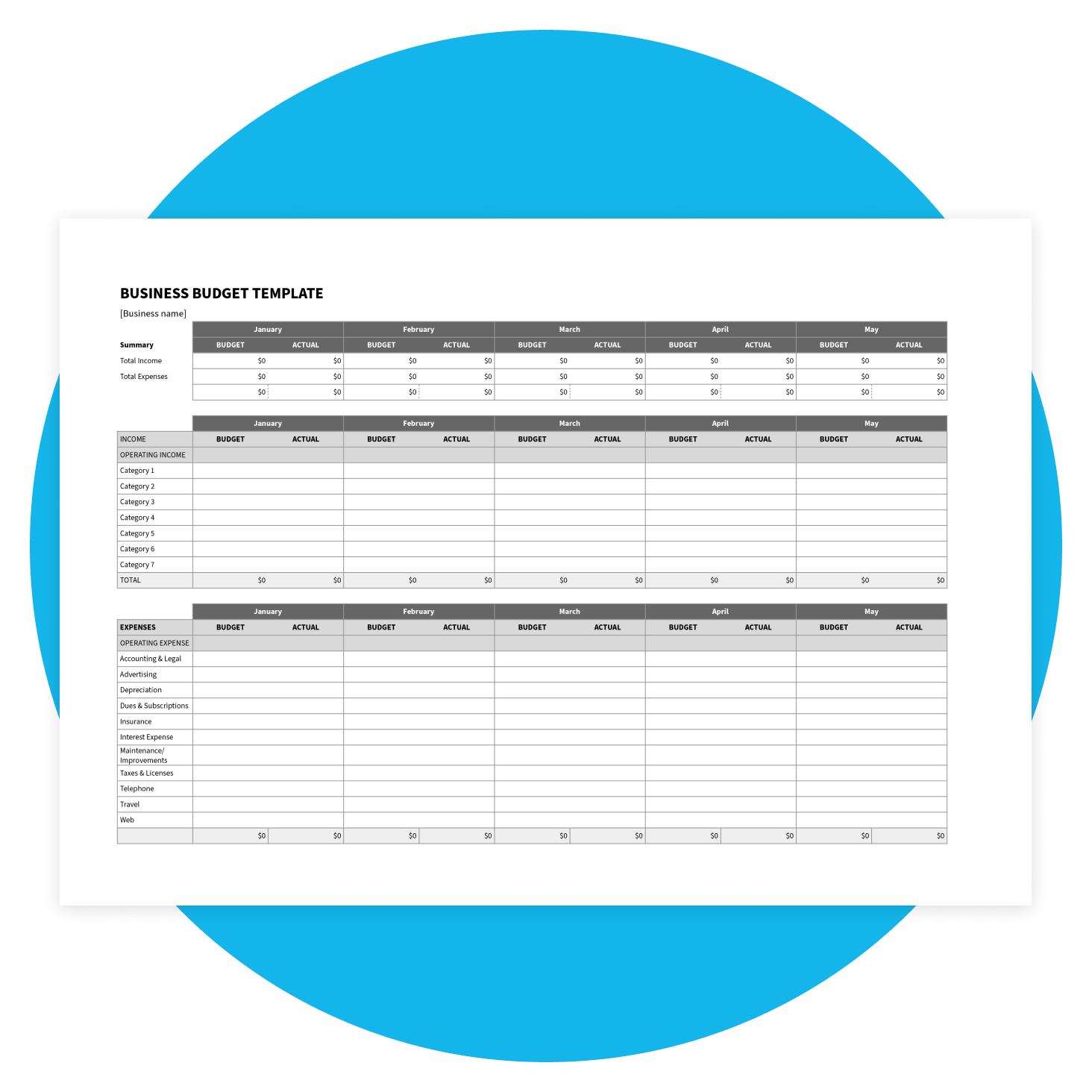

Free budget template

Build your small business budget with our free business budget template, perfect for whichever industry you’re in. Here’s how our template works, and how to use it to enhance your financial planning, manage your money, and get financial insights.

Customise to any business

Tailor the free template to your needs – our template is flexible enough to suit any business in any industry

Track income and expenses seamlessly

Download and use the editable budget sheet to track cash flow and identify any spending issues.

Streamline your financial planning

Organise your business budget planning in one place for greater financial management and insights.

Download the free budget template

It’s an editable, printable budget template – you can use it as an excel, sheets or pdf file to budget over different time periods.

Got your template? Try Xero for free.

Ready to take control of your business? Xero's got everything you need to succeed, from accounting and invoicing to reporting and payroll.

What is a business budget?

A business budget is a financial plan outlining your business’s expected income and expenses over a specific period – typically a year.

Benefits of a budget

Here are ways building a budget helps your business:

Set financial goals

Record your expenses to understand how many sales you need to break even.

Calculate your break-even pointAllocate resources effectively

Strategically distribute your finances and other resources across your operations to achieve your goals.

Monitor your cash flow with confidence

Track your income and spending to see where your money’s going to forecast your cash flow, and decide if your business needs more financing

14 ways to finance your business

Key features of our budget template

Monitor your income and spending, get an accurate summary of your finances at the end of a financial period, and get clear financial projections for your business.

Monthly income and expense tracking

Monitor your cash flow with confidence and identify spending issues.

Year-end financial summary

Gain insights into your annual budgeting and spending, and be better prepared for year-end reporting.

Budget variance analysis

Track how well your business is keeping to budget by checking your spending against your budget sheet.

Forecasts you can customise

Tailor your budget projections to business goals – for example, by changing the time periods you budget for.

How to use your free budget template

You need accurate, reliable figures as a foundation for your budget. So record your income, expenses, and assets in exact figures to get a clear overview of your business’s financial health. Accurate financial information also ensures your financial reports are true, reliable and transparent.

Understand reporting requirements to support your budgetingYou need accurate, reliable figures as a foundation for your budget. So record your income, expenses, and assets in exact figures to get a clear overview of your business’s financial health. Accurate financial information also ensures your financial reports are true, reliable and transparent.

Understand reporting requirements to support your budgetingBreak down your cash flow into different categories, like recurring or expected income and expenses. Then incorporate the numbers from other other areas of your business, like payroll and overheads. You can then use other tools, like a profit and loss template, to generate reports from this information.

Get the profit and loss templateBreak down your cash flow into different categories, like recurring or expected income and expenses. Then incorporate the numbers from other other areas of your business, like payroll and overheads. You can then use other tools, like a profit and loss template, to generate reports from this information.

Get the profit and loss templatePersonalise Xero’s business budget template to your needs. Tailor it to outline your financial goals, forecast and track your spending, and help you identify savings and potential investments. Download and save the budget template to get started.

Personalise Xero’s business budget template to your needs. Tailor it to outline your financial goals, forecast and track your spending, and help you identify savings and potential investments. Download and save the budget template to get started.

FAQs on budgeting

A budget is a business planning tool. By writing one, you’re trying to make realistic projections of your business’s income and spending so you can make sensible decisions about your business’s future. To start doing this, first outline your fixed and variable costs, and use your budget sheet (such as Xero’s template) to identify money available for reinvesting and hiring help. It’s a good idea to create two versions of your budget: an aspirational one for a positive year, and a more conservative one in case of unexpected change. To keep your budget accurate and relevant, update it often to reflect financial or operational changes in your business.

Read our budgeting guide for more informationA budget is a business planning tool. By writing one, you’re trying to make realistic projections of your business’s income and spending so you can make sensible decisions about your business’s future. To start doing this, first outline your fixed and variable costs, and use your budget sheet (such as Xero’s template) to identify money available for reinvesting and hiring help. It’s a good idea to create two versions of your budget: an aspirational one for a positive year, and a more conservative one in case of unexpected change. To keep your budget accurate and relevant, update it often to reflect financial or operational changes in your business.

Read our budgeting guide for more informationYes, you can. Creating a budget with Google Sheets is possible, but it may take time and lead to human errors. Luckily, you can upload this Excel template to Google Sheets, make any customizations you need, then save it as a non-editable PDF to easily share with stakeholders and investors. Accounting software is a better way to build your budget.

Learn more about Xero accounting software.Yes, you can. Creating a budget with Google Sheets is possible, but it may take time and lead to human errors. Luckily, you can upload this Excel template to Google Sheets, make any customizations you need, then save it as a non-editable PDF to easily share with stakeholders and investors. Accounting software is a better way to build your budget.

Learn more about Xero accounting software.Having a financial plan for your project will help you manage finances effectively, control spending, and ensure the project stays on track. By using a project budget template, you can confirm and allocate available funding, track expenses, and prepare for or prevent unexpected costs. Without a budget, your project will carry greater financial risk and could face overspending and unforeseen costs.

Having a financial plan for your project will help you manage finances effectively, control spending, and ensure the project stays on track. By using a project budget template, you can confirm and allocate available funding, track expenses, and prepare for or prevent unexpected costs. Without a budget, your project will carry greater financial risk and could face overspending and unforeseen costs.

Yes, accountants and bookkeepers both play important roles in helping businesses budget. Accountants can help you create a budget that aligns with your financial goals, support with cash flow management and report on your financial performance. Bookkeepers record and theme your expenses so you can track spending and analyse trends across different categories. Both accountants and bookkeepers support your financial planning and management to ensure you can achieve your business objectives.

Find a financial advisor to help with your budgetYes, accountants and bookkeepers both play important roles in helping businesses budget. Accountants can help you create a budget that aligns with your financial goals, support with cash flow management and report on your financial performance. Bookkeepers record and theme your expenses so you can track spending and analyse trends across different categories. Both accountants and bookkeepers support your financial planning and management to ensure you can achieve your business objectives.

Find a financial advisor to help with your budget

Make budgeting easy with Xero accounting software

Xero accounting software helps you track your finances in real time and compare your budget against your spending. Run reports to clearly understand your business’s financial health, and to make more accurate forecasts.

- Get up-to-date financial reports anytime

- Compare actual spending against budgeted amounts

- Identify trends and make accurate projections

Disclaimer

Xero does not provide accounting, tax, business or legal advice. This template has been provided for information purposes only. You should consult your own professional advisors for advice directly relating to your business.