Gross profit margin: What it is and how to improve yours

Gross profit margin shows how much money you keep after covering direct costs. Learn how to calculate and improve it.

Written by Lena Hanna—Trusted CPA Guidance on Accounting and Tax. Read Lena's full bio

Published Friday 7 November 2025

Table of contents

Key takeaways

• Calculate your gross profit margin by subtracting cost of goods sold from revenue, dividing by revenue, and multiplying by 100 to determine what percentage of each sales dollar remains after direct costs.

• Monitor your gross profit margin trends regularly to identify patterns in business performance and make informed decisions about pricing, supplier relationships, and operational efficiency.

• Improve your gross profit margin by adjusting prices strategically, negotiating better rates with suppliers to reduce cost of goods sold, and streamlining operations to eliminate waste.

• Benchmark your gross profit margin against industry standards and similar-sized businesses in your sector to assess whether your margins are sufficient to cover operating expenses and generate net profit.

What is gross profit margin?

Gross profit margin measures the percentage of sales revenue left after paying your cost of goods sold (COGS).

This metric tells you:

- How efficiently you produce and sell products or services

- What proportion of sales income stays in your business after direct costs

- Which areas of your business are most profitable

- Whether margins are sufficient to cover operating expenses and generate net profit

Higher gross margins mean you have more money to pay for essential expenses like rent, utilities and marketing, while still making a profit.

Gross profit margin vs gross profit

Gross profit vs gross profit margin are related but distinct metrics:

- Gross profit: The dollar amount left after subtracting cost of goods sold from revenue (e.g., $50,000)

- Gross profit margin: The percentage that gross profit represents of total revenue (e.g., 25%)

Gross margin is simply another term for gross profit margin – they're used interchangeably to describe the same percentage-based profitability measure.

How to calculate gross profit margin

Here's how to calculate gross profit margin.

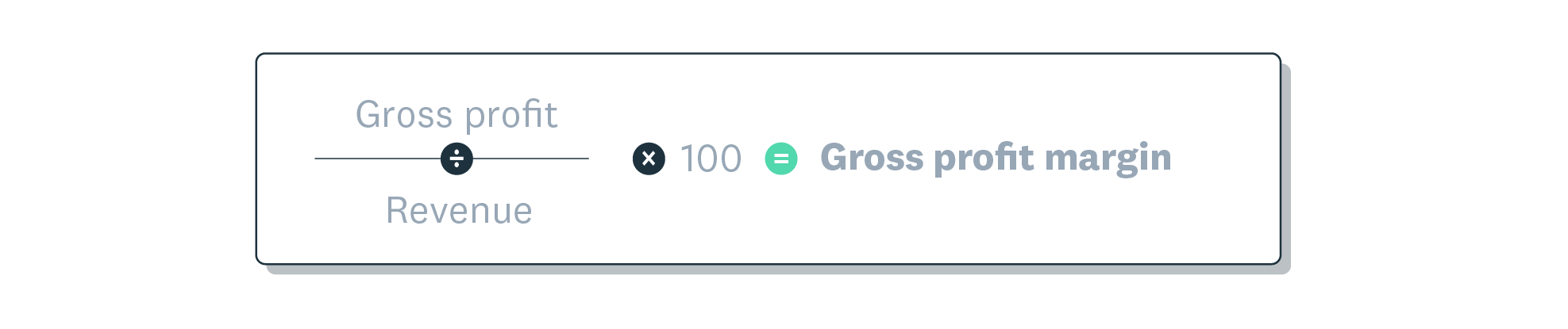

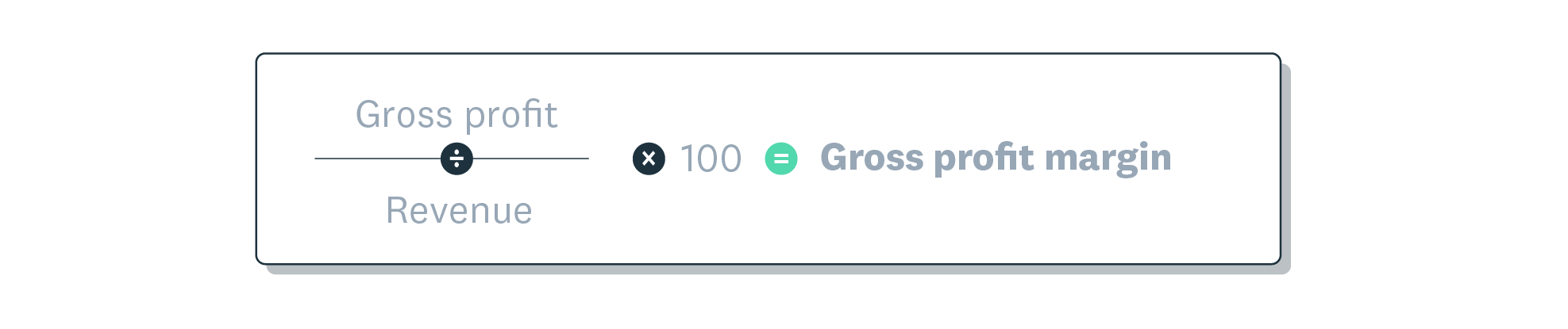

Gross profit margin (calculation)

The gross profit margin is your gross profit divided by revenue, times 100.

Gross profit margin formula explained

First, find your gross profit by subtracting your cost of goods sold from your sales. Then, use the gross profit margin formula to work out your margin.

Gross profit margin example calculation

Example calculation:

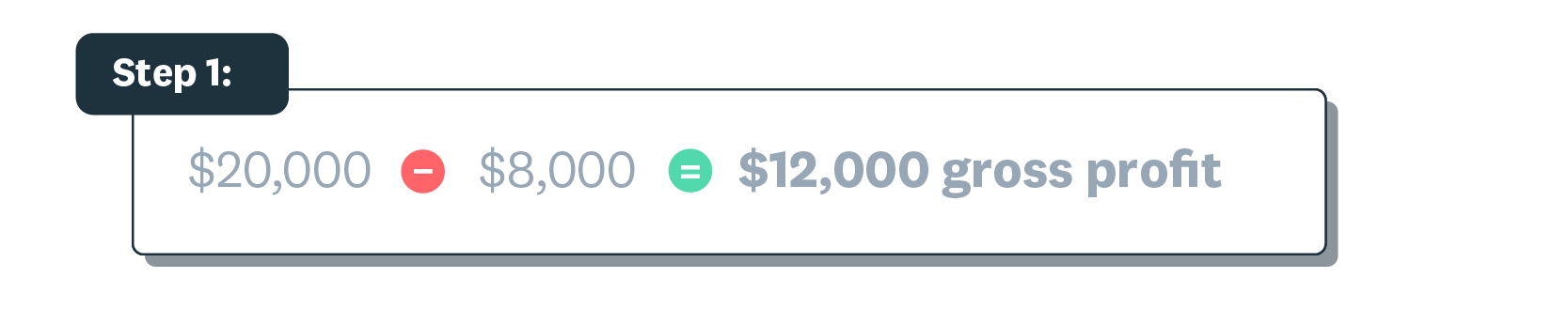

Step 1: Calculate gross profit

- Revenue: $20,000 (office cleaning services)

- Cost of goods sold: $8,000 (cleaning supplies, labour)

- Gross profit: $20,000 - $8,000 = $12,000

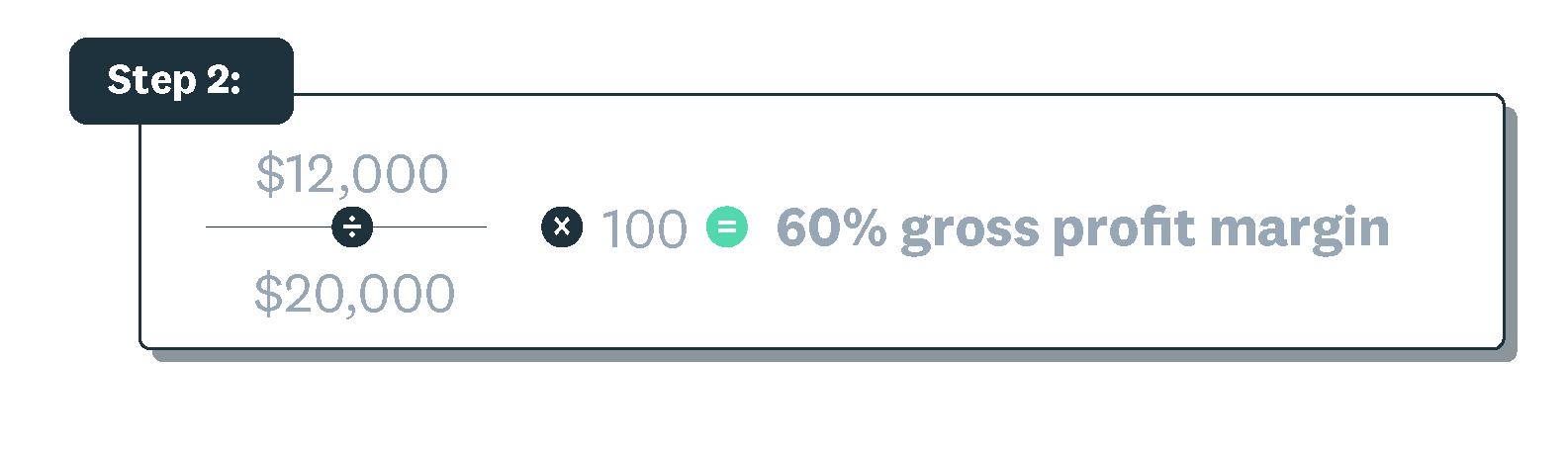

Step 2: Calculate gross profit margin

- Gross profit margin: ($12,000 ÷ $20,000) × 100 = 60%

This means you keep 60 cents of every dollar earned after covering direct costs.

Avoid common calculation mistakes

Avoid common calculation mistakes by accurately identifying your cost of goods sold (COGS):

Include in COGS:

- Raw materials and inventory costs

- Direct labour for production or service delivery

- Manufacturing overhead directly tied to production

Don't include in COGS:

- Operating expenses like rent, utilities, marketing

- Administrative costs and office supplies

- Interest payments and taxes

Correctly categorising these costs helps you get an accurate gross profit margin and make better business decisions.

Analysing gross profit margin for business insights

Gross profit margin analysis can help you understand the profitability and performance of each part of your business, so you know where you need to improve.

Price your products competitively to increase sales. Manage your costs to boost your profit margin.

Interpreting gross profit margin trends

Monitor your gross margin trends over time to spot patterns in your business performance – for example, where your revenue is strong and how your costs change by product or season.

Factors affecting gross profit margin

External factors affecting gross profit margin:

Market demand changes:

- Decreased demand forces price reductions to attract customers

- Increased demand allows for higher pricing and improved margins

Rising supplier costs:

- Material price increases directly reduce your profit margins

- Labour cost inflation squeezes margins unless prices are adjusted

Economic conditions:

- Consumer spending decline reduces sales volume and pricing power

- Inflation affects both your costs and customers' purchasing ability

These factors require ongoing margin monitoring and strategic pricing adjustments.

What is a good gross profit margin?

A good gross profit margin typically ranges from 20% to 80%, but varies significantly by industry and business model.

Your margin must be sufficient to:

- Cover operating expenses like rent, utilities, and marketing

- Pay taxes and interest on business loans

- Generate net profit for reinvestment and owner compensation

Key factors determining what's "good" for your business:

- Industry standards (service businesses often achieve 50-80%, retail 20-40%)

- Business size and operational efficiency

- Market competition and pricing pressure

Factors affecting your margins

Several things affect what makes a good gross profit margin.

Industry

Different industries have different cost levels and structures that affect margins. Hospitality, for instance, has high overhead costs and relatively low product costs, while financial services have lower overhead costs and higher service fees.

Region

Costs, expenses, and market forces vary wildly between regions. For example, some countries have higher or lower taxes, and a shop in a big city gets more customers than one in a small village.

Business type

Ecommerce stores typically have lower overhead costs and more scope for sales than traditional retailers, and therefore potentially higher margins.

Market competition

The forces of competition in industries like electronics retail drive down prices, squeezing profit margins.

Benchmarking your gross profit margin

To see how your business is performing, compare your gross profit margin with similar businesses in your industry.

You'll get the clearest picture of your gross profit margin if you benchmark it against similar-sized businesses that operate in the same industry, market or region.

Industry benchmarks for gross profit margin

Gross profit margins vary by sector. For example, jewellery and cosmetics businesses often have margins over 55%, while electronics and alcoholic beverages may have margins below 45%. These differences reflect the costs and pricing in each industry.

Your accountant or bookkeeper can help you find gross profit margin benchmarks for small to medium-sized businesses in your industry, and show you what to aim for.

When to reassess your gross profit margin

Check your gross profit margins regularly, especially if your costs change or if you miss your growth targets.

Your gross profit margin needs to cover the cost of selling your products or services (your cost of goods sold) and other costs like operating expenses and taxes. Your accountant can help you find the right gross margin for your business.

Understanding and monitoring your gross profit margin is essential for business success. This key metric helps you make informed pricing decisions, identify profitable areas of your business, and ensure sufficient margins to cover all expenses.

Ready to track your gross profit margin easily? Xero financial reporting tools calculate your margins and give you real-time insights into your business profitability. Try Xero for free and make decisions that boost your bottom line.

Gross profit margin compared with other metrics

Here’s how gross profit margin compares with two other business metrics, and how you can use each one to measure your business’s profitability.

Gross profit margin vs operating profit margin

While gross profit margins only consider the cost of goods sold (COGS), operating profit margins are the next step in analysing revenue versus profit, as they also include other operational costs like rent and utilities.

Gross profit margin vs net profit margin

Net profit margin goes a step further than operating profit margin. Net profit margin shows your overall financial health, after taking into account your operating costs, interest and taxes. It's your bottom line profit.

How to use each metric

Use these metrics to:

- analyse your cost of goods sold and make pricing and resource allocation decisions

- determine your pricing, resource allocation and budgeting work with operating profit margins

- plan for the long term with net profit margins, as businesses with consistently high net profit margins are more resilient to economic changes

- Gross profit margins to analyse your COGs and to make pricing and resource allocation decisions

- Operating profit margins together with your gross profit margins to determine your pricing, resource allocation and budgeting work

- Net profit margins for long-term financial planning as businesses with consistently high net profit margins are more resilient to economic changes

How to improve gross profit margin

You can take simple steps to improve your gross profit margin.

1. Adjust your prices

You might need to update your prices as market conditions change. If a competitor lowers their price, you may need to adjust yours to keep sales up. You can also improve your products or services to support higher prices and better margins.

2. Reduce your cost of goods sold

Your costs eat into your gross profit margin, so watch them closely. Find affordable suppliers and build good relationships – you might get bulk discounts and better rates, which can lower your long-term costs.

3. Streamline your operations

Reduce waste and automate your processes – for example, by using accounting software – to cut costs and boost profit margins. Effective inventory management can also help you minimise excess stock and lower storage costs.

Track your gross profit margin with confidence

Xero helps you stay on top of your financial metrics as a small business owner. It makes it easy to track your gross profit margin and other key numbers, so you have more time to plan for success.

FAQs on gross profit margin

Here are answers to some common questions about gross profit margin.

What does gross profit margin tell you?

Gross profit margin tells you how much profit your business makes from each dollar of revenue, after accounting for the direct costs of producing your goods or services. It's a key measure of your operational efficiency and pricing strategy. A higher margin means you keep more money from your sales to cover other expenses and generate net profit.

What does a 40% gross profit margin mean?

A 40% gross profit margin means that for every dollar of revenue your business earns, you keep 40 cents as gross profit. The remaining 60 cents is spent on the cost of goods sold (COGS). This indicates you have a healthy amount left over to pay for operating expenses like rent, marketing, and salaries.

Is a higher gross profit margin always better?

Generally, a higher gross profit margin is a good sign of profitability and efficiency. However, it's not the only factor to consider. Sometimes, a business might strategically lower its prices (and its margin) to capture more market share or sell a higher volume of products, which can lead to greater overall profit. It's important to balance your margin with your sales volume and business goals.

Disclaimer

Xero does not provide accounting, tax, business or legal advice. This guide has been provided for information purposes only. You should consult your own professional advisors for advice directly relating to your business or before taking action in relation to any of the content provided.