Free invoice template

Download the web’s simplest invoice template and use it over and over and over again.

Professional

Created by Australian invoicing experts, so all the formatting is right.

Simple

Clear layout is super easy for customers to follow and is suitable for just about any business type.

Smart

It does the maths for you. Punch in costs and quantities, and the invoice generator template adds everything.

Download the free invoice template

Fill in the form to get a blank invoice template as an editable PDF, with a how-to guide. There's a version for GST and non-GST businesses.

Got your template? Try Xero for free.

Ready to take control of your business? Xero's got everything you need to succeed, from accounting and invoicing to reporting and payroll.

Why use this free invoice template

Built by invoicing nerds

Xero makes invoices. And we made this free one for you.

- Works for products and services.

- All formatting requirements checked with local experts.

- Includes an invoice example to help you fill it out.

- Comes in tax and non-tax versions (we’ll send both).

- Plus you get expert tips on how to get paid.

Invoice payment stats

Xero records the time between when invoices are issued and when they’re paid, so we know the wait times. This data is refreshed monthly.

Australian invoices getting paid in 22.1 days

You can shrink these wait times with a few well chosen tactics.

Get tips for quicker paymentOverdue invoices are running 6.1 days late

Invoices go past due a lot. What will your next move be?

Learn how pros handle unpaid invoices

Benefits of professional invoices

A regular invoice pattern helps customers know when to pay

A regular invoice pattern helps customers know when to pay

Your customers have all the details they need to pay your invoice

Your customers have all the details they need to pay your invoice

Reliable, detailed invoices clearly show you what was sold

Reliable, detailed invoices clearly show you what was sold

Accurate transaction records help you get your tax right

Accurate transaction records help you get your tax right

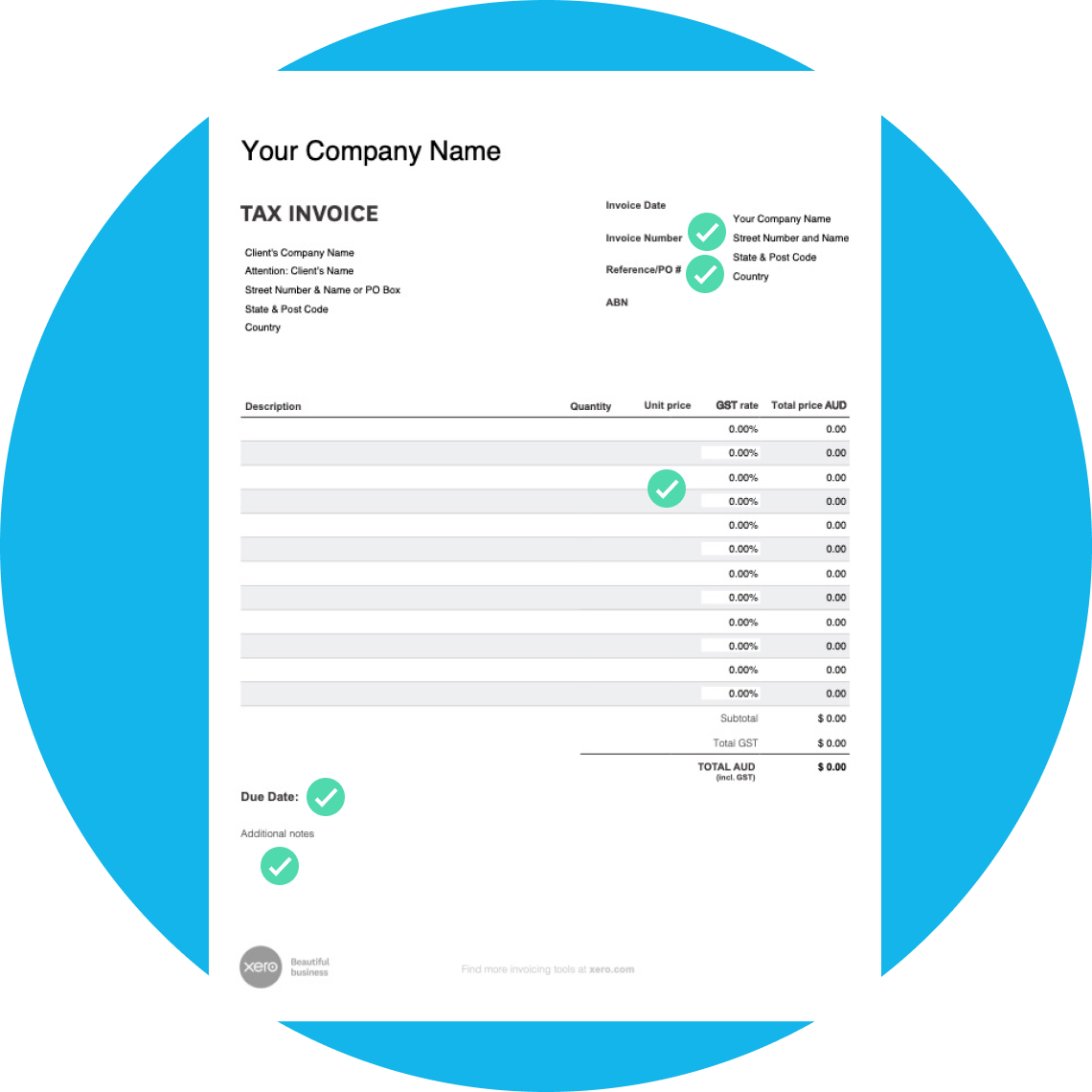

Invoice example

Avoid rookie mistakes when filling in your blank invoice template. Here are four tips to start with (invoice example included in download).

Give two dates

Say when the invoice was sent. And even more importantly, say when payment is due.

Add an invoice number

Include a unique code for quick reference. Customers can quote it when making bank transfers.

Be clear about tax

If adding taxes, show the rate and dollar amount being charged. Be equally clear if you’re not charging taxes.

Tell them how to pay

Tell customers how to pay in ‘Additional notes’ section of this PDF invoice template. Include bank details.

Getting paid sooner

You want to get customers on the clock ASAP. And they may also respond faster when the work is fresh in their mind.

You want to get customers on the clock ASAP. And they may also respond faster when the work is fresh in their mind.

You don’t have to give customers 30 days to pay. Try 14 or even 7. So long as you signal your shorter payment terms up front, data shows customers tend to pay sooner.

You don’t have to give customers 30 days to pay. Try 14 or even 7. So long as you signal your shorter payment terms up front, data shows customers tend to pay sooner.

Businesses often use PO numbers to ensure incoming bills are charged to the correct project. Your invoice may be rejected without one. And what’s worse, a customer may not even tell you it’s been rejected until you ask why it hasn’t been paid yet. You’re better off to ask if you need one at the outset.

Businesses often use PO numbers to ensure incoming bills are charged to the correct project. Your invoice may be rejected without one. And what’s worse, a customer may not even tell you it’s been rejected until you ask why it hasn’t been paid yet. You’re better off to ask if you need one at the outset.

Your point of contact is probably not the person who pays the bills. Ask where to send your invoice. If it’s a business, they may have an accounts payable department for that sort of thing so ask for their email address.

Your point of contact is probably not the person who pays the bills. Ask where to send your invoice. If it’s a business, they may have an accounts payable department for that sort of thing so ask for their email address.

It never hurts to send a polite reminder when your invoice is coming due. This probably doesn’t apply if you only gave them 7 days to pay in the first place, but if your payment terms are any longer then a well-timed heads up can inspire action. And it lets your customer know that you care about getting paid on time.

It never hurts to send a polite reminder when your invoice is coming due. This probably doesn’t apply if you only gave them 7 days to pay in the first place, but if your payment terms are any longer then a well-timed heads up can inspire action. And it lets your customer know that you care about getting paid on time.

What if your customer doesn’t pay?

Invoices go past due all the time. You’ve probably missed a few bills yourself. That doesn’t mean you just quietly accept it. Tell your customer it’s now overdue and ask (in your nicest possible voice) when you can expect payment.

Invoices go past due all the time. You’ve probably missed a few bills yourself. That doesn’t mean you just quietly accept it. Tell your customer it’s now overdue and ask (in your nicest possible voice) when you can expect payment.

You can avoid a lot of back and forth by quoting the unique invoice number, the due date and the date sent. Also attach a copy if you’re communicating via email. It helps get everyone on the same page quicker.

You can avoid a lot of back and forth by quoting the unique invoice number, the due date and the date sent. Also attach a copy if you’re communicating via email. It helps get everyone on the same page quicker.

Make sure the delay isn’t caused by a disagreement. If there’s a dispute coming, you’re better off getting to the bottom of it now. So take some time to confirm they’re satisfied with the work and that the invoice was what they expected. If they agree they’re happy with everything then it’s hard for them not to pay.

Make sure the delay isn’t caused by a disagreement. If there’s a dispute coming, you’re better off getting to the bottom of it now. So take some time to confirm they’re satisfied with the work and that the invoice was what they expected. If they agree they’re happy with everything then it’s hard for them not to pay.

Perhaps they’ve lost your bank details. Or they need you to attach a PO number. Or maybe they need your point of contact to sign off on something. Ask if there’s anything else they need to process the payment.

Perhaps they’ve lost your bank details. Or they need you to attach a PO number. Or maybe they need your point of contact to sign off on something. Ask if there’s anything else they need to process the payment.

If you’re being ghosted on email, pick up the phone. An in-person chat can clear up a lot of confusion quickly.

If you’re being ghosted on email, pick up the phone. An in-person chat can clear up a lot of confusion quickly.

Your customisable PDF invoice template

Tailor this simple electronic invoice template to suit you:

- Upload your business name to make the invoice template your own

- Add your business address to the invoice layout (so you don’t need to type it in each time)

- Update the free sample invoice with your unique purchase order and invoice numbers

- Send the invoice by email as a PDF, or print it and post a paper copy to customers

Free invoice templates for your industry

Easily manage and bill your construction projects with our detailed construction invoice template.

Download and use our construction invoice templateEasily manage and bill your construction projects with our detailed construction invoice template.

Download and use our construction invoice templateSimplify your billing process with our customisable consulting invoice template.

Download and use our consulting invoice templateSimplify your billing process with our customisable consulting invoice template.

Download and use our consulting invoice templateGet paid faster with our professional and easy-to-use freelancer invoice template.

Download and use our freelancer invoice templateGet paid faster with our professional and easy-to-use freelancer invoice template.

Download and use our freelancer invoice templateStreamline your invoicing with our comprehensive contracting invoice template.

Download and use our contractor invoice templateStreamline your invoicing with our comprehensive contracting invoice template.

Download and use our contractor invoice templateKeep track of rental payments effortlessly with our user-friendly rental invoice template.

Download and use our rental invoice templateKeep track of rental payments effortlessly with our user-friendly rental invoice template.

Download and use our rental invoice templateEnsure accurate billing with our precise and straightforward medical invoice template.

Download and use our medical invoice templateEnsure accurate billing with our precise and straightforward medical invoice template.

Download and use our medical invoice templateSimplify your transportation billing with our efficient transportation invoice template.

Download and use our tranportation templateSimplify your transportation billing with our efficient transportation invoice template.

Download and use our tranportation templateProfessionally bill your photography services with our sleek photography invoice template.

Download and use our photography templateProfessionally bill your photography services with our sleek photography invoice template.

Download and use our photography templateImpress clients and get paid promptly with our graphic design invoice template.

Download and use our graphic design templateImpress clients and get paid promptly with our graphic design invoice template.

Download and use our graphic design templateEnhance your sales transactions with our versatile sales invoice template.

Download and use our sales invoice templateEnhance your sales transactions with our versatile sales invoice template.

Download and use our sales invoice templateEnsure smooth business transactions with our detailed commercial invoice template.

Download and use our commercial invoice templateEnsure smooth business transactions with our detailed commercial invoice template.

Download and use our commercial invoice templateIf you're self-employed there's already plenty on your to-do list, without having to create profressional invoices from scratch. Our free invoice template is simple and versatile - so you can prioritise getting paid.

Download and use our self-employed invoice templateIf you're self-employed there's already plenty on your to-do list, without having to create profressional invoices from scratch. Our free invoice template is simple and versatile - so you can prioritise getting paid.

Download and use our self-employed invoice template

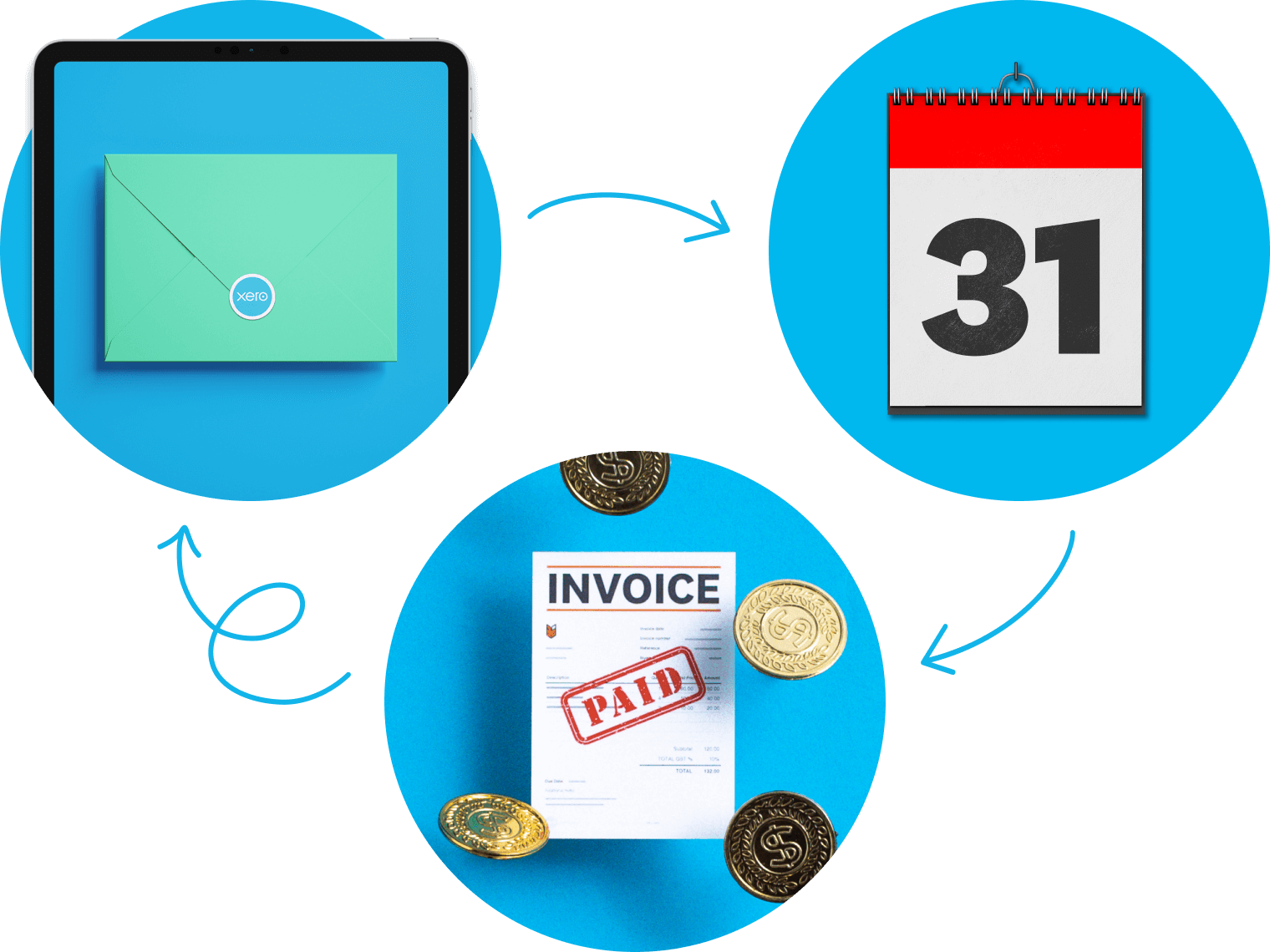

Using the free invoice template

Download invoice

Fill in the form and get your sample invoice template free, delivered by email. Save a copy to your device.

Send as a PDF

After some invoice customisation, deliver your customer’s bill digitally by sending it as a PDF.

Get paid sooner

The sooner you send a complete, accurate invoice, the sooner you get paid.

Your multi-purpose template solution

Fill out this invoice template and save it to your drive. On the next billing cycle, you’ll only need to change the date and invoice number.

Interim invoice template

This template is perfect for charging progress payments. Save it on your drive and change the details for each subsequent invoice.

Download and use template for interim invoicesFinal invoice template

When requesting the last in a series of payments, simply flag it as the final invoice in the ‘additional notes’ section of this template.

Download and use template for final invoicesInvoice generator template

If you’re looking to generate invoices instantly, check out our free invoice generator to quickly create ready-to-send invoices.

Download and use our invoice generator

Craft your own!

Ready to make an invoice that looks and sounds just like your business? Check out our video guide on how to make an invoice.

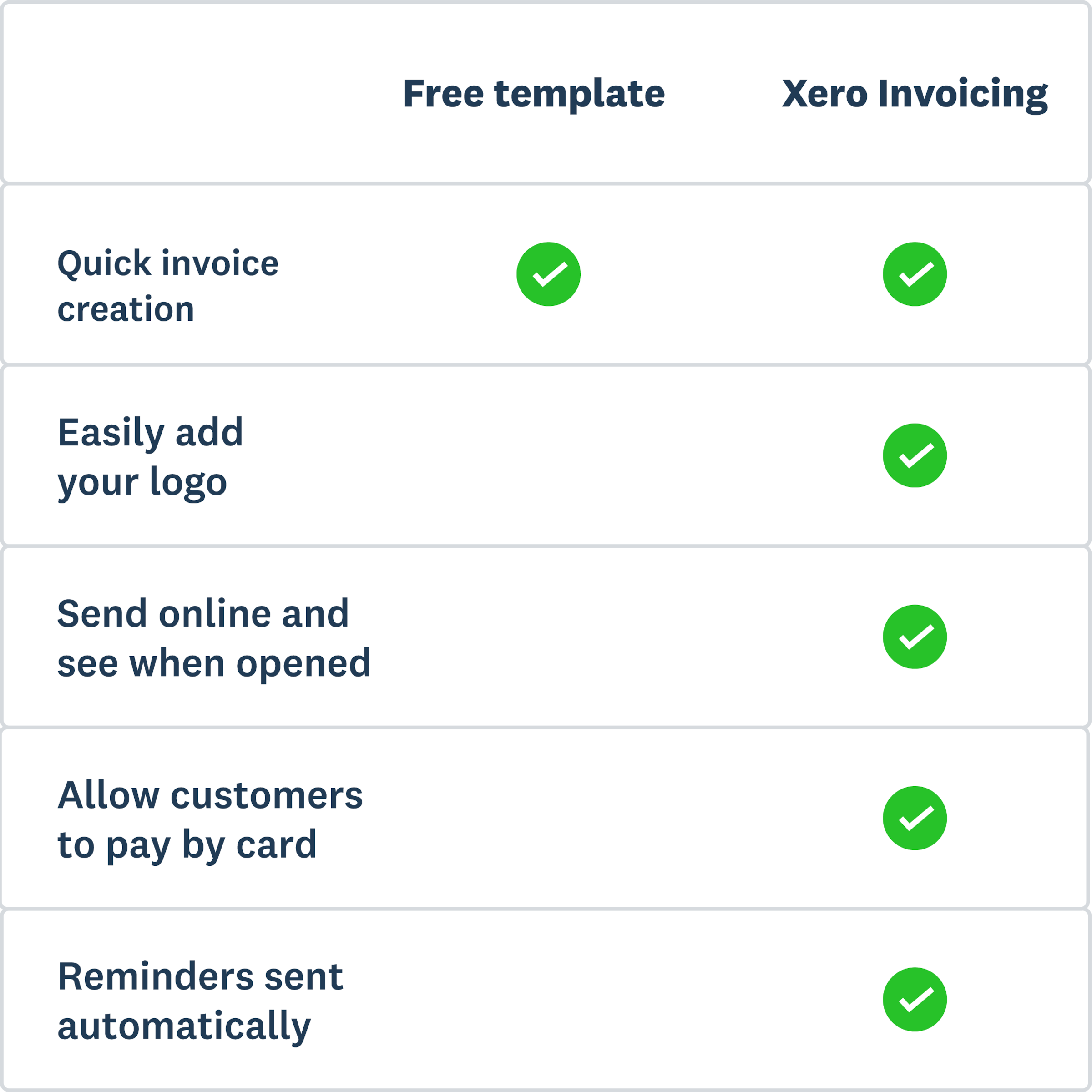

Software solution for invoicing

Leave customer bill templates and messy paperwork in the past. With Xero invoicing software, the processes to get you paid are fast and simple. Automate tasks to save time and keep all your invoice information in one secure place.

- Invoice for partial payments like deposits

- Send smarter, automated invoice reminders

- Add previously invoiced items to your invoice with one click

- See the effects of payments on your cash flow with invoice tracking

- Set recurring invoices using pre-designed templates, including draft invoices

- Experience a simplified payment process with fewer steps for your customers

- Send professional invoices faster with new email tools and live preview features

93% of customers agree Xero is easy to use

*Source: survey conducted by Xero of 1505 small businesses in Australia using Xero, May 2024

Disclaimer

Xero does not provide accounting, tax, business or legal advice. This template has been provided for information purposes only. You should consult your own professional advisors for advice directly relating to your business.