Kiwi small business sector bounces back in October

Sales and job figures for small businesses begin recovery as lockdown restrictions lift

Wellington — 25 November, 2021 — Xero, the global small business platform, today released its Xero Small Business Index for October 2021, which showed improvements in sales, jobs and time to be paid.

Small business sales rose 6.4 percent year-on-year (y/y) nationally in October after two months in decline, while jobs increased 4.4 percent y/y - an increase from 3.6 percent y/y recorded in September.

Xero’s Managing Director for New Zealand & Pacific Islands, Craig Hudson, says this recovery appears to reflect the easing lockdown restrictions and the small business community’s ability to find a way during uncertain times.

“While the numbers are promising, it’s important to remember our data breaks down the averages in the small business sector. There are still businesses in each industry that are really struggling, and this is particularly true in hospitality and tourism where lockdown has hit the hardest.

“The feedback I’m getting directly from small businesses is that they're struggling right now. Even those who are generating good numbers seem to be working a lot harder to get the job done. It’s also important we don’t underestimate the mental toll the ongoing lockdown restrictions and uncertainty are having on the small business community.

“But overall, the data shows how the small business sector was better prepared for this wave of lockdowns, taking on the lessons learnt last year. All were disrupted in September, but with digital tools and perseverance many have managed to turn things around quickly in October to head back in the right direction,” says Hudson.

Improved sales figures across the country

After easing to Alert Level Three on 21 September, Auckland led the strong October turnaround with sales growth of 6.7 percent y/y, following a sharp fall of 20.7 percent y/y in September.

Across the country, all other regions experienced improvements in sales growth apart from Waikato which, after moving from Alert Level 2 to 3 early in the month, saw sales growth slow from 5.6 percent y/y in September to 2.2 percent y/y in October.

Most industries saw a strong bounceback in sales, led by construction (+10.4% y/y after -14.0% y/y in September), manufacturing (+6.3% y/y after -4.3% y/y) and retail trade (+4.6% y/y after -2.9% y/y).

And while improving on September’s results, the hospitality sector was still down 7.6 percent y/y in October as the sector grapples with trading restrictions under lockdown.

“It appears that small businesses have their cashflow back under control in October after a couple of uncertain months, especially in Auckland,” says Hudson.

“This has a flow on effect to payment times, with Kiwi businesses waiting less time to get paid in October than September where it rose to at its highest level since June 2020.”

Small business owners waited an average of 23.8 days to be paid in October. The late payments measure, which tracks the average number of days late that invoices are paid, also declined by 2.6 days to 5.8 days.

In Auckland specifically, time to be paid improved by 3.7 days in October and now sits at 26.1 days, but remains higher than all other regions.

“This shift suggests an overall improvement in small businesses being paid on time, rather than any shift to shorter payment terms,” says Hudson.

Nationwide small business job growth

Furthermore, in October jobs rose 4.4 percent y/y in October, up from 3.6 percent y/y in September. This performance, amid ongoing trading restrictions for most service-based Auckland businesses, is a strong outcome.

Due to the extended Alert Level Three lockdown, Auckland was the softest region for the second month in a row, with jobs rising 3.4 percent y/y.

In contrast, other regions continued to record above average rises: Wellington (+6.9% y/y), Canterbury (+6.9% y/y), Otago (+6.4% y/y) and Waikato (+5.1% y/y).

Across industries, there was strong growth recorded for professional services (+9.6% y/y), manufacturing (+9.4% y/y) and construction (+7.8% y/y).

“Unfortunately, hospitality continues to bear the brunt of ongoing lockdowns, with jobs falling 8.0 percent y/y in October - the only industry in negative territory,” says Hudson.

“One potential side effect of the ongoing lockdown restrictions is Kiwis being turned off working in hospitality due to uncertainty around their employment and are instead opting for more ‘steady’ employment in retail and other sectors.

“Despite this, the growth across other industries shows resilience in Kiwi small businesses. With restrictions lower outside of Auckland, it’s a positive sign to see above average year on year growth across the country.”

Small Business Index climbs again

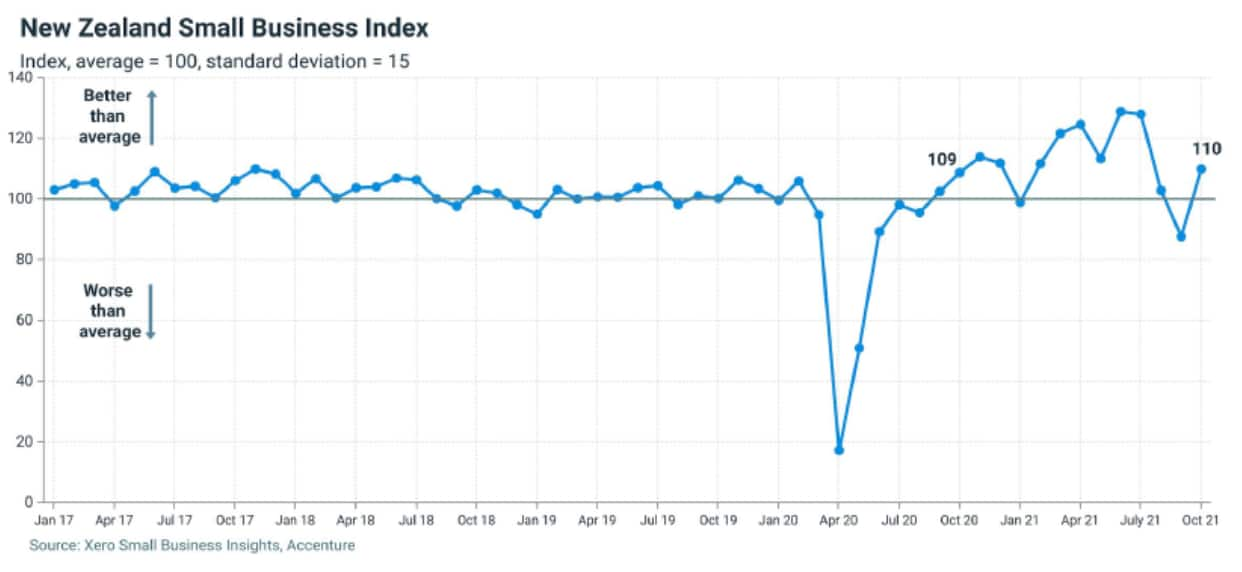

The New Zealand Small Business Index rose 22 points in October to 110 points, after Auckland moved from Alert Level Four to Alert Level Three in late September.

Apart from Waikato, the majority of New Zealand remained at Alert Level Two throughout October, where businesses are able to operate with minimal restrictions.

Despite the ongoing restrictions, it appears New Zealand small businesses have continued to remain productive.

Looking overseas, both Australia and the UK have seen below-average Indexes readings despite having fewer restrictions. Australia’s index scored 94 points in October and the UK was at 95 points.

“It’s encouraging to see the Small Business Index climbing after falling over the last few months due to the snap Alert Level Four lockdown and ongoing restrictions in Tāmaki Makaurau and other parts of Aotearoa,” says Hudson.

“As we begin preparing for a well-deserved summer holiday, it’s important we remain cognisant of the challenging few months our small business community has faced.

“Many have missed out on key months to prepare for the summer shutdown and will be hoping to make up for this in the coming weeks. Where possible, shopping local will aid this recovery and help ensure we can all enjoy this summer as much as possible.”

For further information on the Xero Small Business Insights October metrics please refer to the XSBI Update for New Zealand.

ENDS

Media Contact

Natalie Benning | natalie.benning@xero.com | 021 026 19604

About Xero

Xero is a cloud-based accounting software platform for small businesses with over 3 million subscribers globally. Through Xero, small business owners and their advisors have access to real-time financial data any time, anywhere and on any device. Xero offers an ecosystem of over 1,000 third-party apps and 300 plus connections to banks and other financial partners. In 2021, Xero was included in the Dow Jones Sustainability Index (DJSI), powered by the S&P Global Corporate Sustainability Assessment. In 2020 and 2021, Xero was included in the Bloomberg Gender-Equality Index and in 2020, Xero was recognised by IDC MarketScape as a leader in its worldwide SaaS and cloud-enabled small business finance and accounting applications vendor assessment.

About Accenture

Accenture is a leading global professional services company, providing a broad range of services and solutions in strategy, consulting, digital, technology and operations. Combining unmatched experience and specialised skills across more than 40 industries and all business functions — underpinned by the world’s largest delivery network — Accenture works at the intersection of business and technology to help clients improve their performance and create sustainable value for their stakeholders.

Note to the editor

Previous iterations of the XSBI data have listed snapshots of data from the time it was captured. Some of these historical data points change as bookkeepers and accountants finalise their clients’ accounts, which can impact the specifics of the percentages.

Related media and enquiries

For all media enquiries, please contact the Xero media team.

- Media release

Digital hesitance holding New Zealand small businesses back

Behavioural research discovers barriers to Kiwi small business success

- Media release

Market Release H1 FY22

Xero Limited (ASX: XRO) reports its half year earnings to 30 September 2021 (H1 FY22)

- Media release

More than two in three Aussies set to shop in-store this festive season

Gen X and Millennials will lead the festive spending spree as businesses prepare for their busiest weeks

Start using Xero for free

Access Xero features for 30 days, then decide which plan best suits your business.