Profit Margin: What It Is, Types, and How to Improve Yours

Learn how to calculate profit margin. Use it to price smarter and grow profit.

Written by Jotika Teli—Certified Public Accountant with 24 years of experience. Read Jotika's full bio

Published Friday 6 February 2026

Table of contents

Key takeaways

- Calculate all three profit margin types regularly to get a complete financial picture: gross margin for pricing decisions, operating margin for business efficiency, and net margin for overall financial health.

- Benchmark your profit margins against industry standards quarterly to identify performance gaps and set realistic improvement targets based on your sector's typical ranges.

- Improve your profit margins by focusing on three key areas: reducing costs through supplier negotiations and expense audits, increasing operational efficiency through automation and staff training, and optimising pricing strategies with regular reviews and premium service tiers.

- Use profit margin data to guide critical business decisions by prioritising high-margin products for promotion, allocating resources to profitable areas, and setting minimum margin thresholds for new offerings.

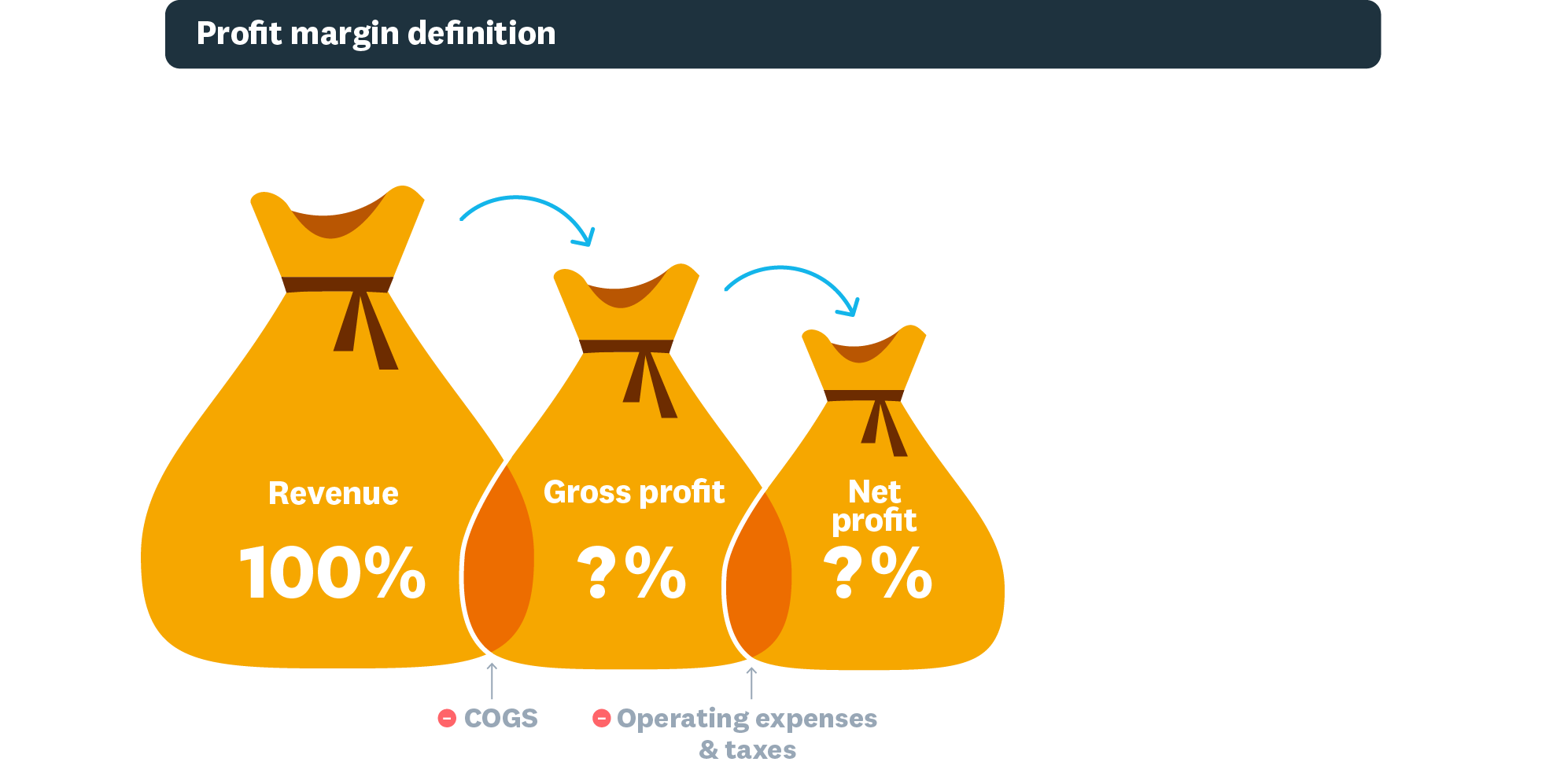

What is a profit margin?

Profit margin is the percentage of revenue remaining after you pay business expenses. The higher your percentage, the more profit you keep from each sale. This metric shows whether your business earns enough to cover costs and grow.

A strong profit margin indicates your business:

- generates enough revenue to cover all costs

- has areas of strong performance

- has opportunities to cut expenses

Profit margins vs net profit

Net profit is the dollar amount left after deducting all expenses from revenue. Profit margin expresses that profit as a percentage of revenue.

The key difference: net profit tells you how much money you made, while profit margin shows how efficiently you made it. A business earning $50,000 net profit on $500,000 revenue has a 10% margin, but the same $50,000 on $1,000,000 revenue is only 5%.

Profit margin vs markup

Profit margin and markup both measure profitability, but they calculate it differently.

- Profit margin: Profit as a percentage of the selling price

Example: You buy a product for $60 and sell it for $100.

- Markup: $40 profit ÷ $60 cost = 67% markup

- Profit margin: $40 profit ÷ $100 selling price = 40% margin

Use markup when setting prices based on cost. Use profit margin when analysing overall business performance and comparing against competitors.

Types of profit margins

Three main types of profit margins help you understand different aspects of your business performance.

Gross profit margin

Gross profit margin measures revenue remaining after paying for the goods and services you sell.

- Formula: (Revenue - Cost of goods sold) ÷ Revenue × 100

- Includes: Direct costs of production or service delivery

- Excludes: Operating expenses, taxes, and interest

- Use it to: Set pricing, identify improvement areas, and compare performance across periods

Learn more about gross profit margin.

Operating profit margin

Operating profit margin shows profit after paying variable production costs but before taxes and interest.

- Formula: Operating income ÷ Revenue × 100

- Includes: Wages, operational costs, materials, and overhead

- Excludes: Taxes and interest payments

- Use it to: Assess core business profitability and attract investors or lenders

Net profit margin

Net profit margin reveals the percentage of revenue remaining after paying all costs and taxes.

- Formula: Net income ÷ Revenue × 100

- Includes: All expenses, taxes, and interest

- Excludes: Nothing

- Use it to: Evaluate overall financial health and compare against competitors

Learn more about net profit margin.

Key differences between margin types

Each margin type serves a different purpose in understanding your business.

Gross

- What it measures: Revenue minus direct costs

- Best used for: Pricing decisions, product profitability

Operating

- What it measures: Revenue minus direct and operating costs

- Best used for: Core business efficiency, investor analysis

Net

- What it measures: Revenue minus all costs and taxes

- Best used for: Overall financial health, business valuation

Which margin should you track?

Here's when to use each type:

- Track gross margin to evaluate individual products or services

- Track operating margin to assess business efficiency

- Track net margin to understand true profitability

Most small businesses should monitor all three to get a complete financial picture.

How to calculate profit margins

To calculate profit margin, divide your profit by your revenue, then multiply by 100 to get a percentage.

Universal formula: (Profit ÷ Revenue) × 100 = Profit margin %

Expressing margin as a percentage makes it easier to compare performance across different time periods or against other businesses.

Gross profit margin calculation

Example: Your office cleaning business earns $20,000 in revenue. It costs $8,000 to provide those services, leaving $12,000 gross profit.

Calculation: $12,000 ÷ $20,000 × 100 = 60% gross profit margin

This means you keep 60 cents of every dollar earned after covering direct service costs.

Try our gross profit margin calculator.

Operating profit margin calculation

Example: Your office cleaning business also has $3,000 in operating expenses (rent, utilities, admin). After deducting these from gross profit, your operating profit is $9,000.

Calculation: $9,000 ÷ $20,000 × 100 = 45% operating profit margin

This means you keep 45 cents of every dollar after direct costs and operating expenses, but before taxes.

Net profit margin calculation

Example: Using the same office cleaning business, you also pay $4,000 in taxes. Your net profit is $5,000.

Calculation: $5,000 ÷ $20,000 × 100 = 25% net profit margin

This means you keep 25 cents of every dollar after all expenses and taxes.

Try our net profit margin calculator.

What is a good profit margin?

A good profit margin varies by industry, but the average profit margin recommended for small businesses ranges between 7% and 10%. Your target depends on your sector, business model, and growth stage.

Here are general benchmarks by margin type:

- Gross profit margin: 50–70% for service businesses, 20–50% for retail

- Operating profit margin: 10–20% for most industries

- Net profit margin: 5–10% is average, 10–20% is strong, 20%+ is excellent

Your gross margin will always be higher than your net margin because it excludes operating costs and taxes. Operating and net margins give you the clearest picture of overall financial health.

Industry benchmarks for profit margins

Profit margins vary significantly by industry. Here are typical ranges:

- Software and tech: 20–40% net margins due to low variable costs, with one report identifying entertainment software (27.43%) as one of the most profitable small business industries by net margin

- Professional services: 15–25% net margins with minimal overhead

- Retail: 2–5% net margins with high volume, low margin model

- Restaurants: 3–9% net margins due to high food and labour costs, with the industry average reported to be hovering around 3–5%

- Manufacturing: 5–10% net margins depending on automation level

How to benchmark your profit margin

Benchmarking compares your margins against industry standards and competitors to assess performance.

Follow these steps to benchmark effectively:

- Calculate your current gross, operating, and net margins

- Research industry averages through trade associations or financial databases

- Identify three to five competitors of similar size and compare publicly available data

- Note where you exceed or fall short of benchmarks

- Set improvement targets based on the gap

You can find benchmark data from several sources:

- Industry association reports

- Government statistics (Australian Bureau of Statistics, Statistics New Zealand)

- Accounting software reports

- Your accountant or bookkeeper

Review benchmarks quarterly and adjust your targets as your business grows or market conditions change.

Why profit margins matter

Profit margins matter because they reveal your business's financial health at a glance. They show how efficiently you convert revenue into actual profit.

Tracking profit margins helps you:

- Set prices confidently: Ensure each sale covers costs and delivers profit

- Control expenses: Identify where costs eat into your earnings

- Plan budgets: Allocate resources to high-performing areas

- Attract funding: Banks and investors examine margins before lending or investing, as gross margin has been shown to be a key valuation driver, with high-margin companies trading at a significant premium

- Benchmark performance: Compare your results against competitors and industry standards

Benefits of tracking profit margins

High profit margins typically indicate your business:

- attracts investment more easily due to demonstrated financial health

- has capital available to reinvest in growth

- can experiment with pricing strategies and innovation

- maintains a competitive edge in your market

Review your margins regularly to spot trends and opportunities. Benchmark against competitors to understand your market position.

What profit margin trends reveal

Profit margin trends show patterns in your margins over time and indicate the direction of your financial health.

Here's what different trends mean:

- Rising margins: Improving efficiency, successful price increases, or better cost control

- Declining margins: Rising costs, pricing pressure, or operational inefficiencies

- Stable margins: Consistent performance, but watch for missed improvement opportunities

- Volatile margins: Seasonal factors, inconsistent pricing, or unpredictable costs

Compare your trends against competitors and industry benchmarks to understand your market position. A declining margin in a growing market signals a problem, while stable margins during industry-wide pressure shows resilience.

Factors affecting profit margins

Several factors influence your profit margins, some within your control and others external.

Several industry factors affect margins:

- Retail and hospitality typically have higher overheads and tighter margins

- Service businesses and consultancies often achieve higher margins

- Seasonal businesses may see significant margin fluctuations

Economic conditions also play a role:

- Inflation increases your costs without automatic revenue increases

- Rising interest rates affect businesses with loans or credit lines

- Supply chain disruptions can spike material costs

Your location affects margins too:

- Rent varies significantly by region and neighbourhood

- Local tax rates affect your net margin

- Labour costs differ by market

Consider these factors when setting prices and evaluating your margin performance.

How to improve your profit margins

To improve your profit margins, focus on three key areas: reduce costs, increase operational efficiency, and optimise your pricing strategy. Small improvements in each area compound to create significant margin gains.

Control your costs

Reducing expenses directly increases your profit margin. Start by:

- auditing subscriptions and cancelling unused services

- negotiating better rates with suppliers

- reviewing labour costs and scheduling efficiency

- reducing waste in materials and inventory

- comparing insurance and utility providers annually

Improve operational efficiency

Streamlining operations lets you generate more revenue without proportionally increasing costs.

- Automate repetitive tasks: Use software for invoicing, scheduling, and inventory tracking

- Train your team: Well-trained staff work faster and make fewer costly errors. In fact, over half of companies planning price increases say they will use more frontline training to help staff articulate the value that justifies a higher price.

- Improve customer service: Satisfied customers return and refer others, reducing acquisition costs

- Review workflows: Identify bottlenecks that slow production or service delivery

- Track time and resources: Measure where hours and money go to find inefficiencies

Optimise your pricing strategy

Strategic pricing directly impacts your profit margin without requiring cost cuts.

- Review your prices regularly: Ensure they reflect current costs and market rates

- Use dynamic pricing: Adjust prices based on demand, season, or capacity

- Create premium tiers: Offer enhanced packages for customers willing to pay more

- Bundle products or services: Increase average transaction value

- Analyse competitor pricing: Position your prices competitively without undervaluing your work

Here's more about pricing strategies.

How to use profit margin data for business decisions

Your profit margin data guides smarter business decisions across pricing, budgeting, and investment, as research shows organisations that use data-driven guidance win more deals at a 12% higher rate.

Pricing decisions

Profit margins reveal which products or services deliver the best return. Use this data to:

- identify high-margin offerings to promote more heavily

- spot low-margin items that may need price increases

- evaluate whether discounts are sustainable

- set minimum margin thresholds for new products

Budget planning

Margin data helps you allocate resources effectively.

- Prioritise spending on high-margin products or services

- Reduce investment in consistently low-margin areas

- Plan for seasonal margin fluctuations

- Set realistic revenue and profit targets

Investment priorities

Your margins show where to focus growth efforts.

- Expand high-margin product lines or services

- Invest in efficiency improvements for low-margin areas

- Evaluate new opportunities against current margin performance

- Decide when to discontinue underperforming offerings

Track your profit margins with Xero

Xero helps you monitor profit margins in real time, so you can make informed decisions without manual calculations.

With Xero, you can:

- view profit and loss reports instantly from any device

- track margins by product, service, or customer

- spot trends with automated financial dashboards

- integrate with your bank for accurate, up-to-date figures

Get one month free when you try Xero today, or explore Xero accounting software to see how it fits your business.

FAQs on profit margin

Here are answers to common questions about profit margins.

What does a 20% profit margin mean?

A 20% profit margin means you keep 20 cents of every dollar in revenue as profit. If your business earns $100,000, your profit is $20,000 after expenses.

What does a profit margin of 30% mean?

A 30% profit margin means you retain 30 cents of every dollar earned. This is considered strong for most industries and indicates efficient cost management.

Can profit margin be negative?

Yes, a negative profit margin means your expenses exceed your revenue. This indicates a loss rather than a profit and signals the need for immediate cost reduction or revenue increases.

How often should I calculate my profit margin?

Calculate your profit margin at least monthly. Review it quarterly to spot trends and annually for strategic planning. Accounting software like Xero calculates margins automatically with each transaction.

What's the difference between profit margin and markup?

Profit margin is profit as a percentage of the selling price. Markup is profit as a percentage of the cost. For example, if you buy an item for $60 and sell it for $100, your markup is 67% ($40 ÷ $60), but your profit margin is 40% ($40 ÷ $100).

Disclaimer

Xero does not provide accounting, tax, business or legal advice. This guide has been provided for information purposes only. You should consult your own professional advisors for advice directly relating to your business or before taking action in relation to any of the content provided.