Gross Profit Margin: What It Is and How to Calculate It

Learn how gross profit margin helps you price well, cut waste, and grow profit.

Written by Lena Hanna—Trusted CPA Guidance on Accounting and Tax. Read Lena's full bio

Published Thursday 5 February 2026

Table of contents

Key takeaways

- Calculate your gross profit margin by dividing gross profit by revenue and multiplying by 100 to understand what percentage of each sale you keep after covering direct production costs.

- Benchmark your margin against industry standards, as good margins vary widely from below 45% in electronics to over 55% in jewellery and cosmetics, with an overall average of about 36.56% across industries.

- Track your margins monthly to spot trends and identify problem areas, as regular monitoring helps you catch rising costs or pricing issues before they impact your bottom line.

- Improve your margin by strategically adjusting prices, negotiating better rates with suppliers, reducing waste, and streamlining operations to lower your cost of goods sold.

Key takeaways

- Gross profit margin measures the percentage of revenue remaining after covering direct costs, showing how efficiently your business produces goods or services.

- Calculate it by dividing gross profit by revenue, then multiplying by 100.

- A "good" margin varies by industry, with benchmarks ranging from below 45% in electronics to over 55% in jewellery and cosmetics.

- Track your margins regularly to spot trends, identify problem areas, and make informed pricing decisions.

- Improve your margin by adjusting prices, reducing costs, or streamlining operations.

What is gross profit margin?

Gross profit margin is the percentage of your sales revenue that remains after subtracting the direct costs of producing your goods or services. It shows how efficiently your business turns sales into profit before accounting for operating expenses like rent and utilities.

A higher gross profit margin means you keep more money from each sale. A lower margin signals that costs are eating into your revenue, making it harder to cover expenses like rent and energy and turn a net profit.

Your gross profit margin shows what proportion of sales income you can keep in the business after covering your direct costs. Gross margins can also show areas where your business is profitable, and where it might be struggling.

Gross profit margin vs gross profit

Gross profit is a currency amount, while gross profit margin is a percentage. Gross profit tells you how much money you have left after direct costs. Gross profit margin tells you what proportion of your revenue that represents.

The term "gross margin" means the same thing as gross profit margin and is often used interchangeably.

How to calculate gross profit margin

Gross profit margin formula

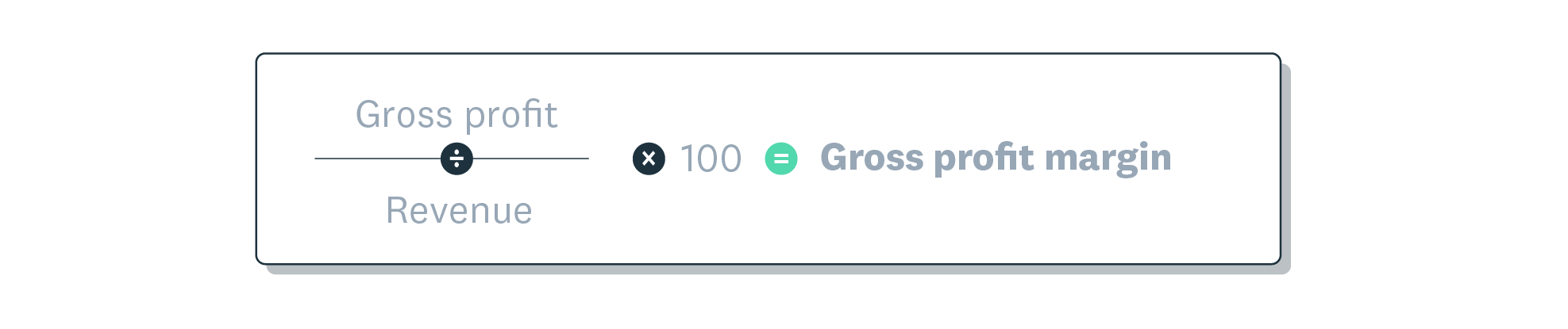

Use this formula to calculate your gross profit margin:

Gross profit margin = (Gross profit ÷ Revenue) × 100

The result is a percentage that shows how much of each unit of currency in sales you keep after covering direct costs.

Gross profit margin formula explained

Follow these steps to calculate your gross profit margin:

- Find your gross profit: Subtract your cost of goods sold (COGS) from your total revenue.

- Apply the formula: Divide your gross profit by your total revenue.

- Convert to a percentage: Multiply the result by 100.

Gross profit margin example calculation

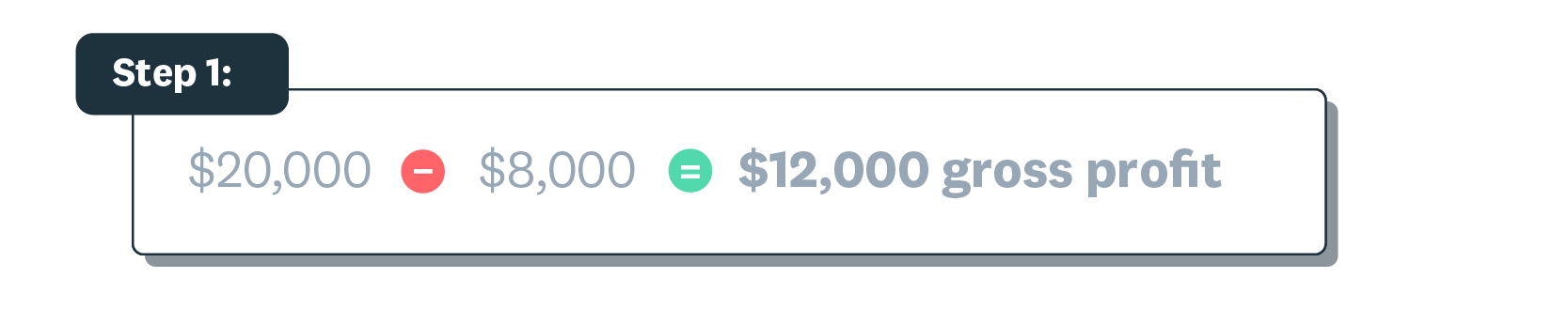

Here's how a cleaning business might calculate its gross profit margin:

- Revenue: $20,000

- Cost of goods sold: $8,000

- Gross profit: $20,000 − $8,000 = $12,000

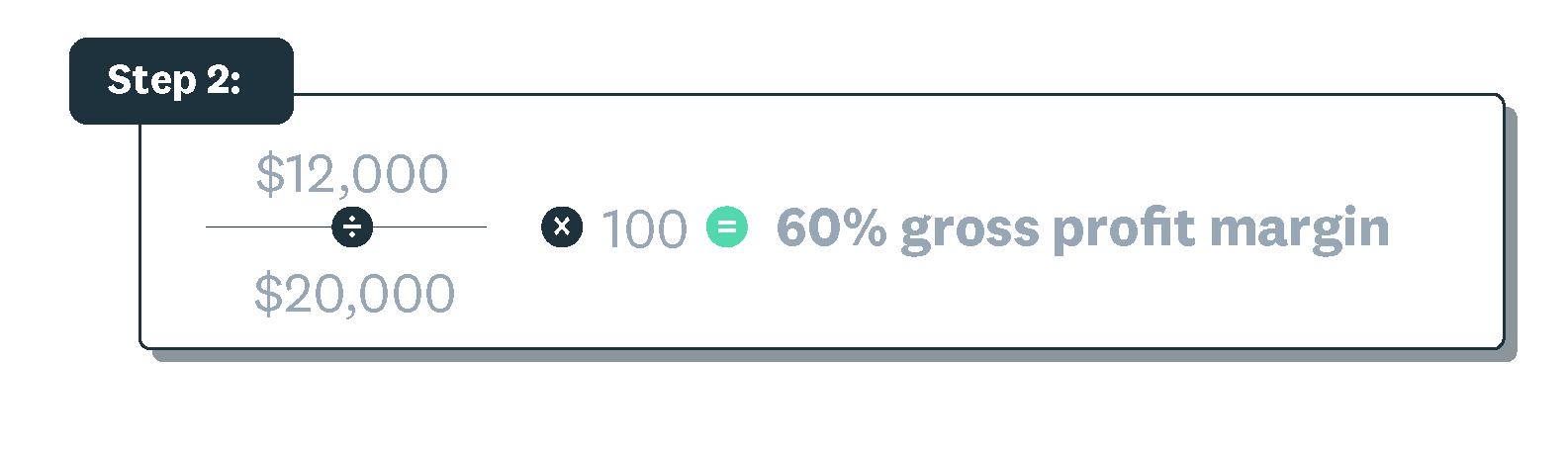

- Gross profit margin: ($12,000 ÷ $20,000) × 100 = 60%

This means the business keeps 60% of every unit of currency earned after covering direct costs.

Avoid common calculation mistakes

Make sure you estimate your COGS correctly, as it strongly affects the gross profit margin calculation.

What is a good gross profit margin?

While a good gross profit margin typically ranges from 25%–55%, the average gross profit margin across all industries is about 36.56%, so the right target depends heavily on your industry, business size, and market conditions.

Factors affecting your margins

Several factors influence what counts as a good gross profit margin for your business:

- Industry: Different sectors have different cost structures. Hospitality has high overhead and low product costs, while financial services have lower overhead and higher fees.

- Region: Costs, taxes, and market demand vary by location. A city shop faces different economics than a rural one.

- Business type: Ecommerce stores typically have lower overhead than physical retailers, allowing for higher potential margins.

- Market competition: Competitive industries like electronics retail often see squeezed margins as businesses compete on price.

- Changes in demand: Falling demand may force you to lower prices to attract customers.

- Rising input costs: Increases in materials or labour costs narrow your margins. For some airlines, for example, fuel and labour can account for over 50% of revenues.

- Customer spending power: When customers have less to spend, your revenue and margins may suffer.

Benchmarking your gross profit margin

For a realistic picture of how your business is performing, benchmark your gross profit margin against similar-sized businesses in your industry, market, or region.

Industry benchmarks for gross profit margin

Gross profit margins vary widely by sector:

- Higher margins (55%+): Jewellery, cosmetics, and software, with the system and application software sector boasting an average gross profit margin of 71.52%.

- Mid-range margins (45–55%): Professional services, food and beverage, and apparel, as the apparel industry boasts an average gross margin of 51.93%.

- Lower margins (below 45%): Electronics, alcoholic beverages, and grocery retail. For comparison, the auto and truck industry has one of the lowest average gross profit margins at just 12.45%.

Your accountant or bookkeeper can help you find benchmarks for similar-sized businesses in your industry and set realistic targets.

When to reassess your gross profit margin

Evaluate and monitor your gross profit margins regularly, especially in a changing market. Research shows 36% of CFOs report their teams alter their forecasts at least weekly. It's also good to look at them when conducting a financial performance analysis, for example, if you've missed your growth targets.

Your gross profit margin needs to cover your cost of goods sold (COGS) and other costs like operating expenses and taxes. Your accountant can help you pinpoint a gross margin for your business.

Xero's accounting software and financial reports make it easy to gauge your business's performance.

Analysing gross profit margin for business insights

Analysing your gross profit margin reveals which parts of your business are profitable and which need attention. By tracking your margins over time and across product lines, you can spot trends, identify problem areas, and make data-driven decisions about pricing and costs.

Interpreting gross profit margin trends

Monitor your gross margin trends over time to reveal patterns in your business's performance: where your revenue is strong (and where it isn't), and how your costs change by product and time of year. Regular tracking helps you identify seasonal patterns, rising costs, and pricing opportunities. Compare your margins month over month and year over year to understand whether your business is becoming more or less efficient.

Gross profit margin compared with other metrics

Understanding different profit margins helps you see your business's financial health from multiple angles. Gross profit margin shows production efficiency, operating profit margin adds overhead costs, and net profit margin reveals your bottom line after all expenses.

Here's how each metric differs and when to use it.

Gross profit margin vs operating profit margin

Operating profit margin includes both COGS and operating expenses like rent, utilities, and salaries. It shows how much profit you keep after running your day-to-day business, not just producing your products.

Use operating profit margin to evaluate your overall operational efficiency.

Gross profit margin vs net profit margin

Net profit margin accounts for all expenses: COGS, operating costs, interest, and taxes. It shows your true bottom-line profit as a percentage of revenue, which can vary dramatically by industry; for instance, real estate development has the lowest average net profit margin at -16.35%.

Use net profit margin to assess your overall financial health and long-term sustainability.

How to use each metric

- Gross profit margin: Analyse your COGS and guide pricing decisions.

- Operating profit margin: Evaluate operational efficiency and inform budgeting.

- Net profit margin: Assess overall financial health and plan for long-term growth.

How to improve gross profit margin

Improving your gross profit margin puts more money in your pocket from every sale. Focus on three key areas: pricing, costs, and efficiency.

Adjust your prices

Review your pricing regularly to reflect market conditions and your costs. Consider these approaches:

- Raise prices strategically: If you offer unique value, customers may accept modest increases.

- Add premium options: Offer upgraded products or services at higher price points.

- Bundle products: Combine items to increase average transaction value.

- Monitor competitors: Adjust pricing to stay competitive without racing to the bottom.

Reduce your cost of goods sold

Lower direct costs to keep more of each sale. Try these strategies:

- Negotiate with suppliers: Build relationships to secure bulk discounts and better rates.

- Compare vendors regularly: Shop around to ensure you're getting competitive pricing.

- Reduce waste: Track materials closely to minimise spoilage and excess.

- Optimise purchasing: Order strategically to avoid rush fees and take advantage of discounts.

Streamline your operations

Efficient operations reduce costs and improve margins. Focus on these areas:

- Automate routine tasks: Use accounting software to reduce manual work and errors.

- Improve inventory management: Minimise excess stock to lower storage costs.

- Train your team: Skilled staff work faster and make fewer costly mistakes.

- Review processes regularly: Identify bottlenecks and eliminate unnecessary steps. For example, some airlines saw their margins dip partly because they relied on older aircraft that were relatively inefficient compared to newer models, making them more vulnerable to rising fuel costs.

Use Xero to track your gross profit margin

Tracking your gross profit margin regularly helps you spot trends and make smarter business decisions. Xero makes it easy with built-in financial reports that show your margins at a glance.

With Xero, you can:

- View real-time reports: See your gross profit margin alongside other key metrics.

- Track trends over time: Monitor how your margins change month to month.

- Make informed decisions: Use clear data to guide pricing and cost management.

Spend less time on bookkeeping and more time growing your business. Get one month free.

FAQs on gross profit margin

Here are answers to common questions about gross profit margin.

What does a 40% gross profit margin mean?

A 40% gross profit margin means your business keeps 40% of every unit of currency in sales after covering direct costs. The remaining 60% goes toward producing your goods or services.

What does a 20% gross margin mean?

A 20% gross margin means you keep 20% of every unit of currency in revenue after direct costs. This is relatively low for most industries and may make it difficult to cover operating expenses and turn a net profit.

What does gross profit margin tell you about business health?

Gross profit margin shows how efficiently you produce goods or services. A healthy margin means you have room to cover operating costs and invest in growth. A declining margin signals rising costs or pricing pressure that needs attention.

How often should I calculate my gross profit margin?

Calculate your gross profit margin monthly at minimum. Review it quarterly to spot trends and annually to compare against industry benchmarks. More frequent tracking helps you catch problems early.

Can gross profit margin be too high?

Yes, an unusually high margin might indicate you're pricing too high and losing potential customers, or that you're underinvesting in quality. Compare your margin to industry benchmarks to ensure you're competitive while remaining profitable.

Disclaimer

Xero does not provide accounting, tax, business or legal advice. This guide has been provided for information purposes only. You should consult your own professional advisors for advice directly relating to your business or before taking action in relation to any of the content provided.