Calculating GST and issuing tax invoice

If you’re a GST-registered business you must add GST to your prices. You also need to issue GST invoices. Find out how.

Published Thursday 23 September 2021

Calculating GST and issuing tax invoices

If you’re a GST-registered business you must add GST to your prices. You also need to issue GST invoices to customers. Let’s take a look at the maths and the requirements of both.

How to add GST to prices

Once you’re GST registered, you’ll need to put prices up by 8%. There’s a very simple formula for doing that:

What are tax invoices?

A tax invoice tells a customer how much GST they paid on a purchase. You must issue a tax invoice when you sell to GST-registered customers.

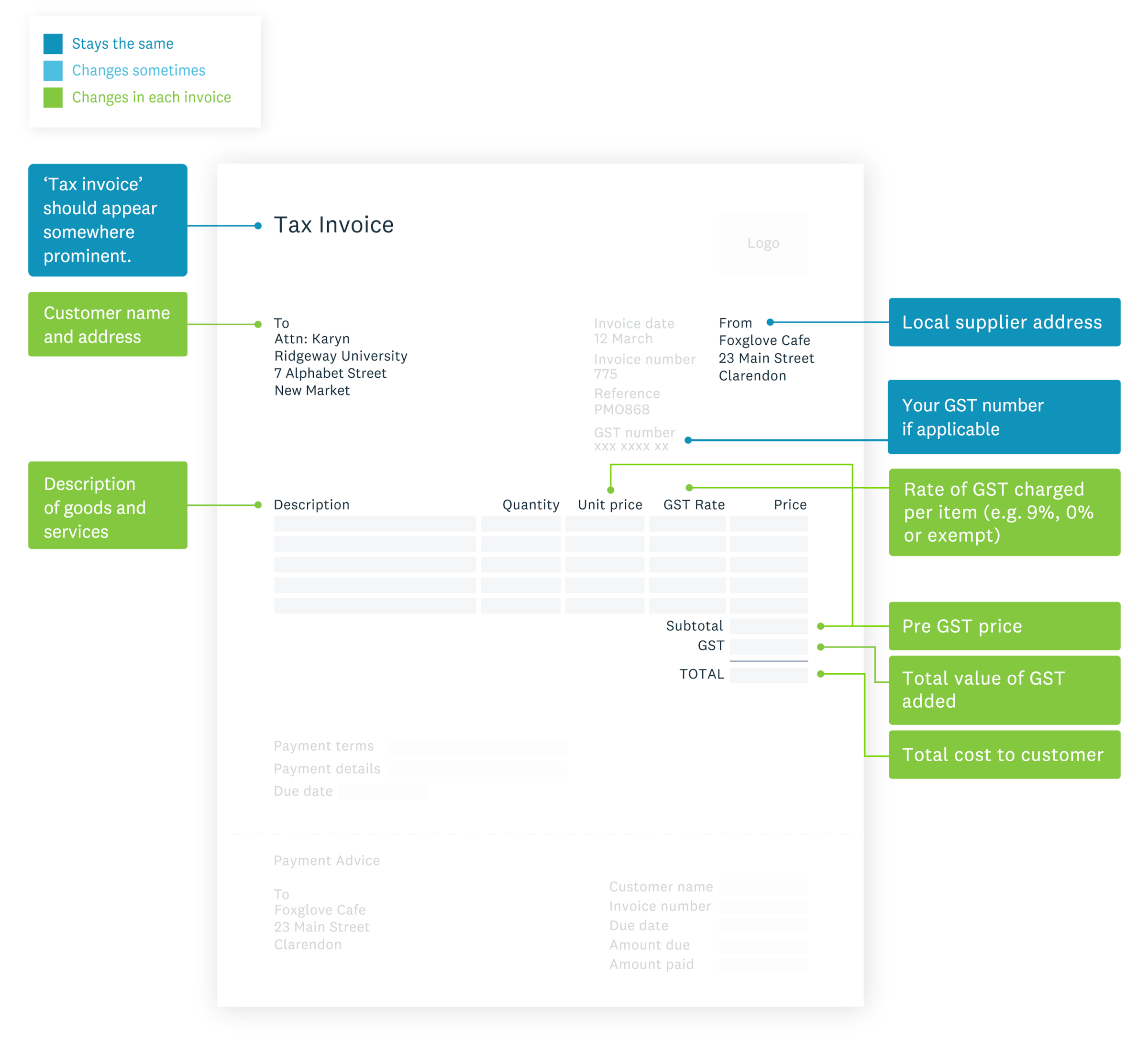

Tax invoice example

Here’s what you need to put on a tax invoice.

A simplified tax invoice can also be used for invoice amounts less than $1000 inclusive of GST. You can get more information on invoicing customers here.

Receipts versus tax invoices

A receipt printed at point of sale is called a tax invoice if it has all of this information on it. But it must contain the words ‘Tax invoice’.

Disclaimer

Xero does not provide accounting, tax, business or legal advice. This guide has been provided for information purposes only. You should consult your own professional advisors for advice directly relating to your business or before taking action in relation to any of the content provided.

GST Guide For Business

Making a start with GST? Don’t worry. It’s a little extra admin, but this guide will help you get sorted.

- What is GST?

You’ve probably heard about GST before – it stands for goods and services tax and is added onto prices in Singapore.

- Registering for GST

Find out if your business needs to register for GST. If so, learn how to do it and find out what happens next.

- Calculating GST and issuing tax invoices

If you’re a GST-registered business you must add GST to your prices. You also need to issue GST invoices. Find out how.

- Claiming back GST

GST-registered businesses can claim back the GST they pay on business expenses. Learn when and how.

- Working out your GST refund or payment

Working out GST is simple maths. Keeping track of all your transactions is the tricky part. Let’s learn the process.

- GST returns and due dates

GST-registered businesses must declare how much they’ve collected and paid. You do this by filing GST returns (GST F5).

- Tools and guides for your business

Now you know the ins and outs of GST, but it can be tough to keep on top of it all. Xero’s got the resources to help.

Download the GST Guide for Business

Get your GST sorted. Fill out the form to receive this guide as a PDF.

Now that you have your guide

Managing finances can feel overwhelming. With Xero’s powerful tools, small businesses can stay organised and confident.