Empower your practice with Xero client insights

Client insights make it fast and easy to identify which Xero clients would benefit from a timely conversation, and support or advice from you, helping you to grow your advisory services.

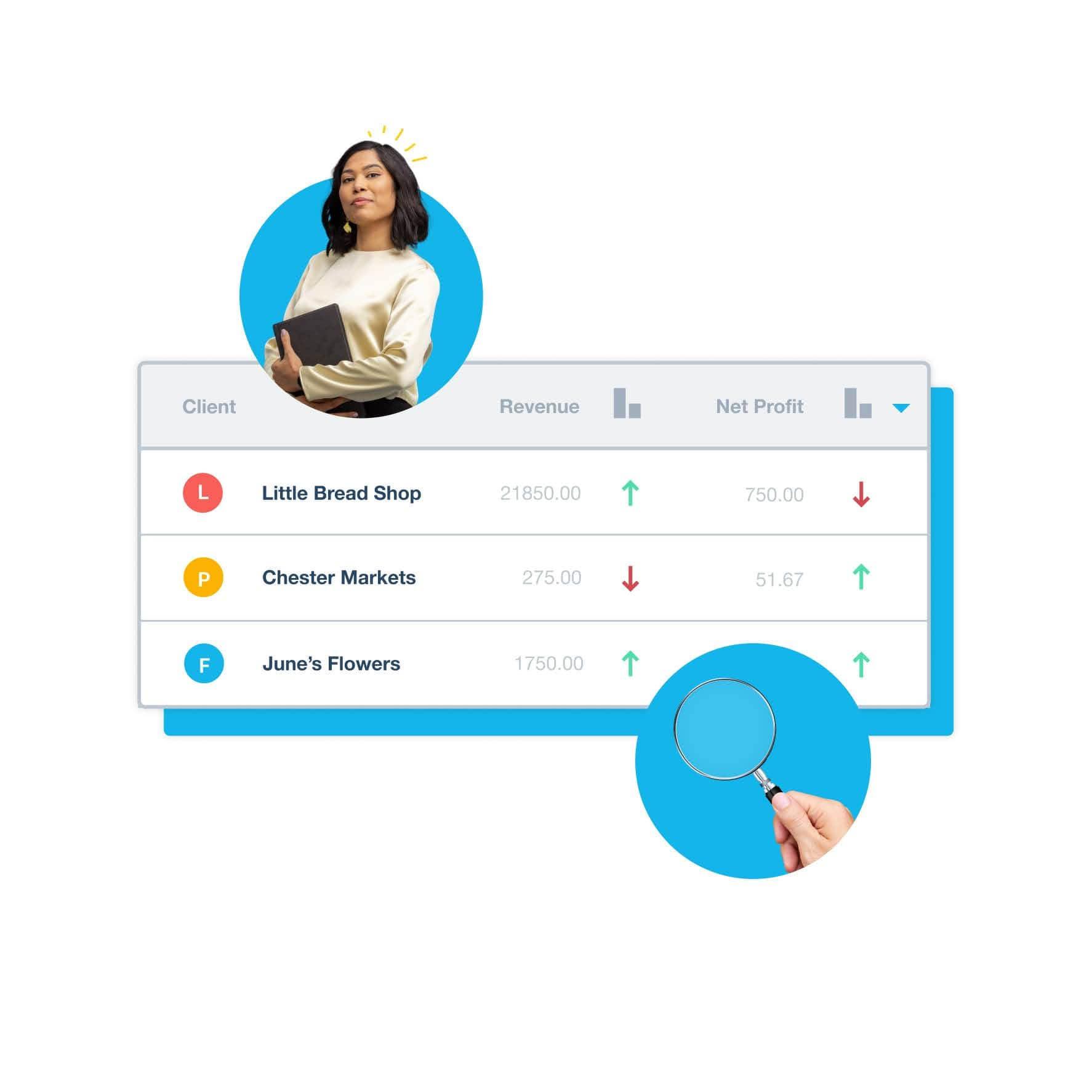

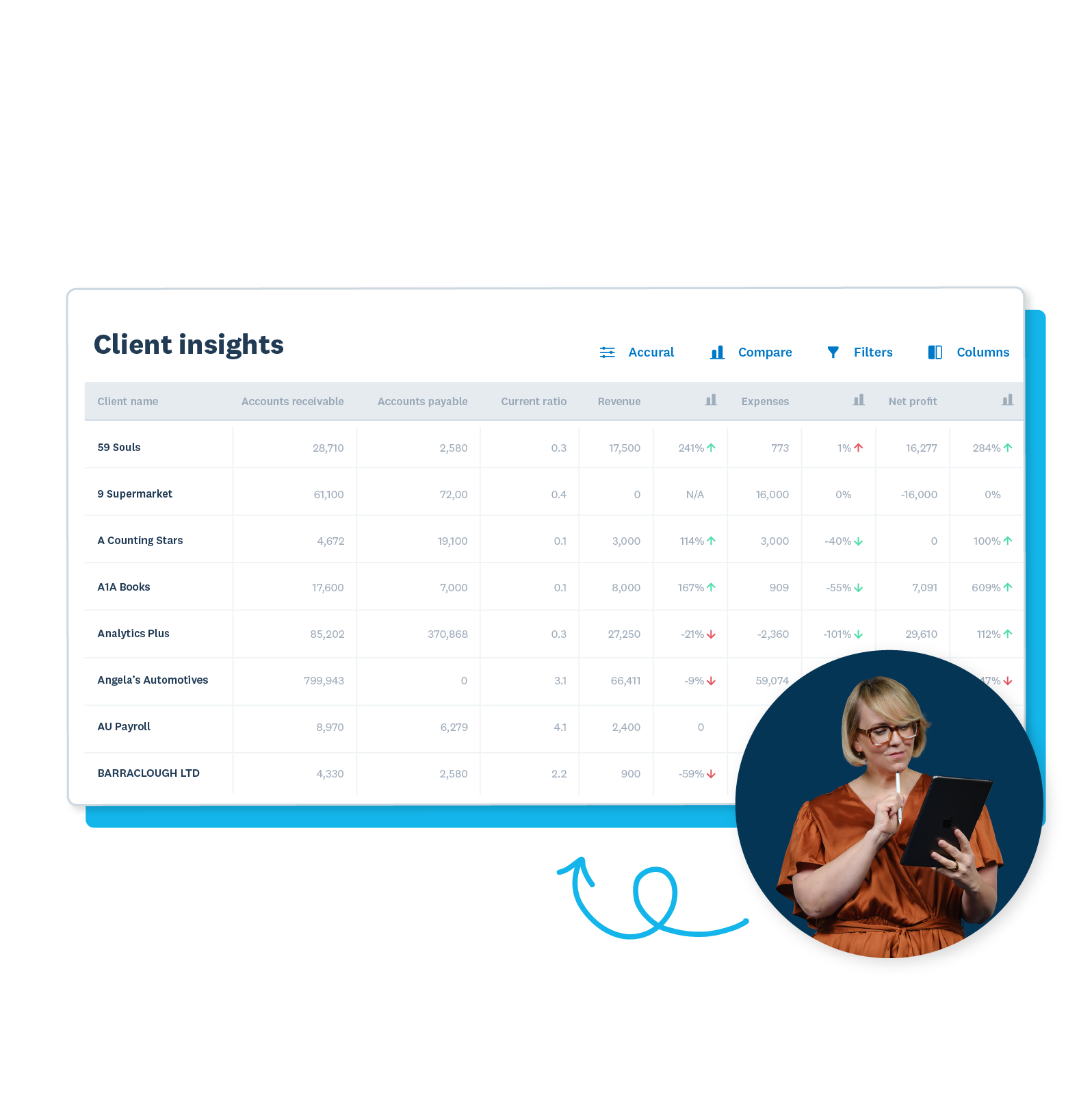

Identify concerns and opportunities

Save time running individual client reports, with a view of all your business edition clients’ key financial indicators. Client insights provide a snapshot of financial health to help you identify concerns or opportunities.

- Choose which periods to compare, and compare performance with previous periods

- Sort the client data within any column, or filter by financial metrics and by industry

- Drill down and go straight into any client’s business snapshot in their Xero accounts to visualise their finance in more detail

See metrics for all clients in one place

View data for all your Xero clients on business subscriptions on the client insights screen so it’s easier to identify which clients are most in need of support or advice. You’ll be able to work efficiently with all the data within Xero.

- View overall cash balance (in Xero), accounts receivable, accounts payable and current ratio for each client

- See their revenue, expenses, net profit, and industry too

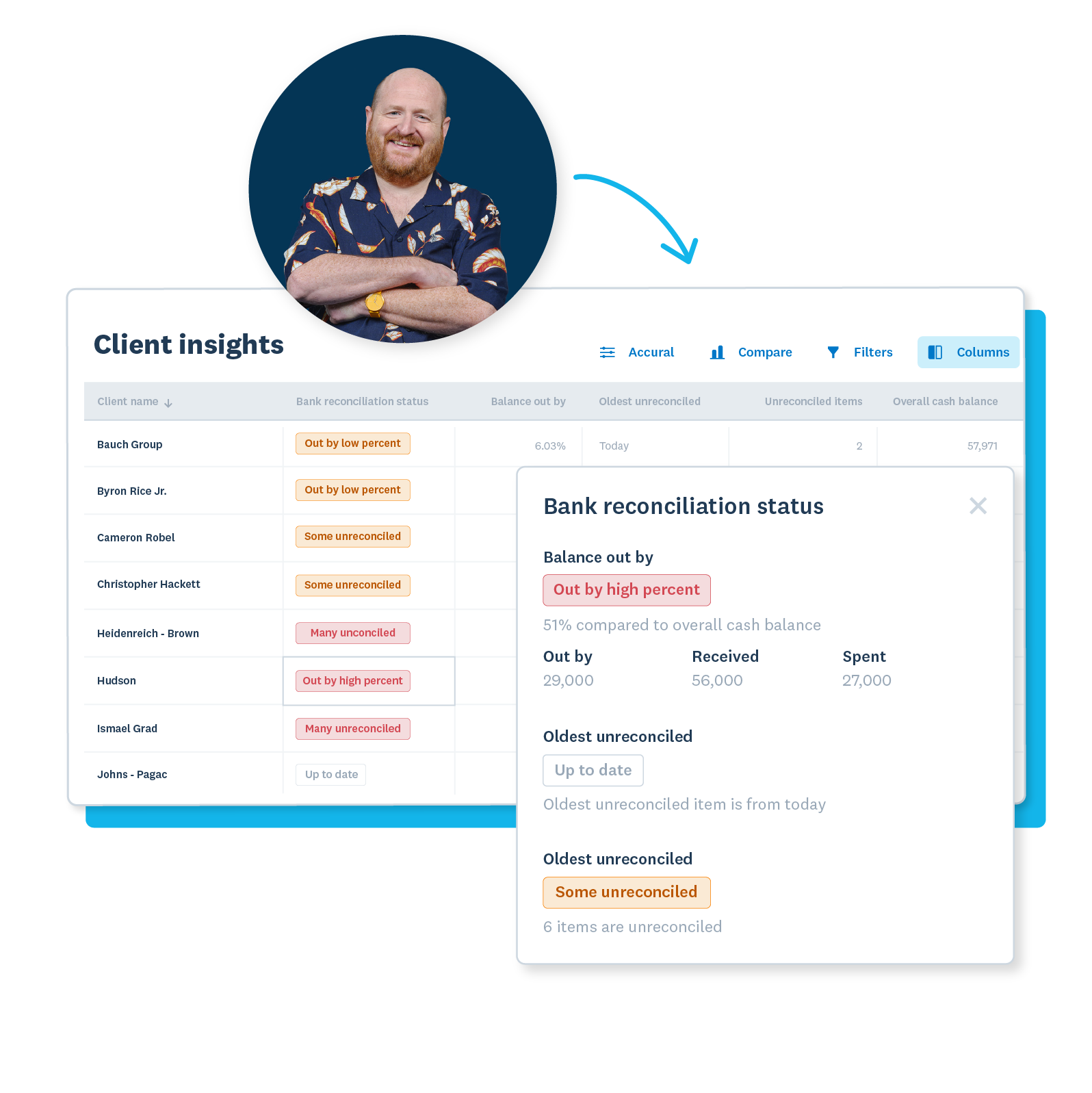

Have confidence in the numbers

With automated bank feeds, you can see whether bank reconciliation is up to date and be confident your clients’ Xero accounts are recent if it is.

- Data flows from your clients’ organisation to your insights dashboard. You can refresh the screen to update the dashboard with the latest client data every hour

- You can see how many unreconciled transactions a client has, their value and date, and judge whether the unreconciled transactions are likely to make a material difference to what you see on the insights dashboard

Encourage client engagement and curiosity

With Xero, you and your clients share access to the same information and analytics, so clients can monitor key financial metrics themselves.

- Use the business snapshot in Xero when you’re having conversations with your client for an overview of financial performance

- Show clients how they can see a simple visualisation of future cash flow with the short-term cash flow projection in Xero

- Once you’ve set goals together, clients can keep an eye on their progress

More about client insights

Xero partners gain free access to Xero HQ and client insights. You can access client insights from the Insights tab in Xero HQ and in Xero Practice Manager, provided the client is on a Xero business plan and you have adviser access to their Xero organisation. (If you use both Xero HQ and Xero Practice Manager, you’ll see the clients you have access to in Xero HQ, so the client list may differ in each tool.)

Learn how to access and use client insightsXero partners gain free access to Xero HQ and client insights. You can access client insights from the Insights tab in Xero HQ and in Xero Practice Manager, provided the client is on a Xero business plan and you have adviser access to their Xero organisation. (If you use both Xero HQ and Xero Practice Manager, you’ll see the clients you have access to in Xero HQ, so the client list may differ in each tool.)

Learn how to access and use client insightsClient insights in Xero HQ and Xero Practice Manager (XPM) help you be proactive and offer a better client experience. The Insights screen lets you quickly and easily understand how your clients’ businesses are performing, so you can identify who may need help. It enables you to communicate with them and provide timely advice, offer ongoing advisory services, and build your advisory revenue.

Client insights in Xero HQ and Xero Practice Manager (XPM) help you be proactive and offer a better client experience. The Insights screen lets you quickly and easily understand how your clients’ businesses are performing, so you can identify who may need help. It enables you to communicate with them and provide timely advice, offer ongoing advisory services, and build your advisory revenue.

Client insights help solve some of the problems that accountants and bookkeepers face when offering and charging effectively for advisory services, including having up to date information, analysing performance taking too much time, knowing which clients need help and what actions to suggest, assessing how each client should be performing.

Client insights help solve some of the problems that accountants and bookkeepers face when offering and charging effectively for advisory services, including having up to date information, analysing performance taking too much time, knowing which clients need help and what actions to suggest, assessing how each client should be performing.