Nailing the invoicing process

Sending a bill is just one part of the invoicing process. Find out what else it takes to get paid.

Published Tuesday 24 August 2021

Invoice payments take time

Time seems to run at a different speed when you’re waiting for payment, especially if your cash flow is tight. Xero records the actual time between when invoices are issued and when they’re paid, so we can tell you the average wait time for New Zealand is 23.7 days (data refreshed monthly).

But there are things you can do to speed things up.

How to shrink your wait

Accounts receivable professionals send and chase invoices for a living. We asked for their tips on shortening the wait for payment. Their advice comes in three parts: what to do before, when, and after invoicing.

Before sending invoices

The most important part of your invoicing process is to set payment terms. This is a policy stating when and how you expect to be paid. It’s common to share these terms with your customer before agreeing a sale. Payment terms are also repeated on your invoice and they can have a big effect on how swiftly you’re paid.

Save a week or two by giving customers less time

Your most powerful payment term is your due date. While invoices have historically given customers weeks to pay, that’s not necessary anymore. It’s increasingly common to ask for payment within seven days. A 2018 Xero study found that invoices with one-week payment terms are paid in about two weeks – that’s a week late but still better than voluntarily waiting three or four weeks. Just be aware that if your client is a big company, you may be expected to accept their payment terms rather than the other way around.

Halve wait times by accepting online payments

With online payments, you get to choose what online payment options you offer and that's another powerful tool for speeding things up. Xero’s data shows that invoices offering convenient online payment options get settled up to twice as fast. Online payment options include things like cards, digital wallets, and ACH (such as PayPal, Stripe and GoCardless). Be aware there are fees associated with those forms of payment.

Schedule interim payments for big jobs

Some jobs drag on and on. But you don’t have to wait till a job is finished before sending a bill. You can agree to send invoices when certain milestones are complete. Or you might send invoices at regular intervals for the work performed during the period. Some customers may be reluctant to pay for unfinished work so it’s worth setting expectations during negotiations.

Create incentives for early payment

Many businesses offer discounts for early payment, or apply penalties for late payments. This could be another option for you if it’s legal in your country. But again, it needs to be clearly stated in your payment terms.

Sample payment terms

Write your payment terms in plain English on your invoice and make it clear how you prefer to get paid. Here’s an example:

When sending invoices

The secret to invoicing is to do it regularly and do it right. Your invoicing process is critical to business cash flow, so give it the priority it deserves.

Actually send the invoice

Send invoices straight after completing work, or make time each day or week to do it. If you delay sending them, then you’re volunteering to wait for payment.

Nail the details

Check you have all the details correct - invoice number, product and service descriptions, amounts owed, and payment terms (including due date). If your customer is a business, ask if you need to include a purchase order (PO) number. Their accounts team may not be able to pay you without one. A mistake with any of these things could delay your payment.

Send it to the right person or place

Ask where to send the invoice. If your customer is a business, the invoice probably needs to go to an accounts department rather than to the person who placed the order with you. After sending, it’s not a bad idea to check they’ve received it, especially if it's the first time you’ve dealt with them. While on the call, you can make sure it has all the details they expected. It’s better to replace a wrong invoice immediately than wait for it to be overdue.

After sending invoices (the accounts receivable process)

Accounts receivable is the name given to the money you’re owed by customers. Successful businesses have accounts receivable processes to get that money in the door as soon as possible. Here’s roughly how they’re structured.

Check what’s been paid (invoice reconciliation)

Check your bank account regularly to see which invoices have been paid and which haven’t. Keep a list of unpaid invoices. As they go past due, you can flag them for special attention.

Tip: Online invoicing software can do this for you.

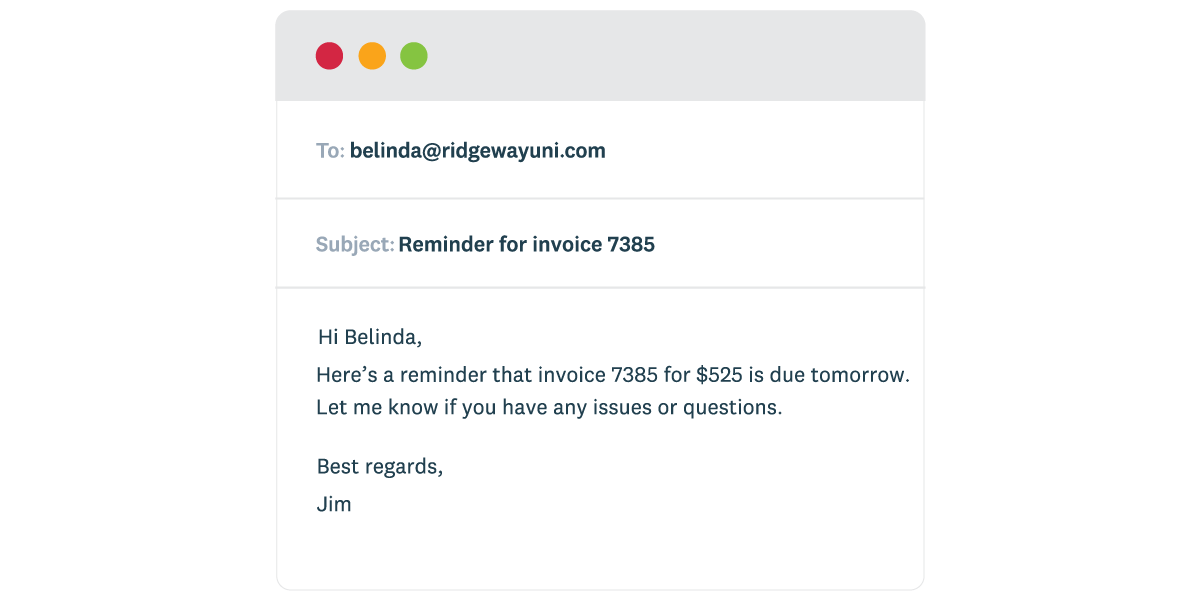

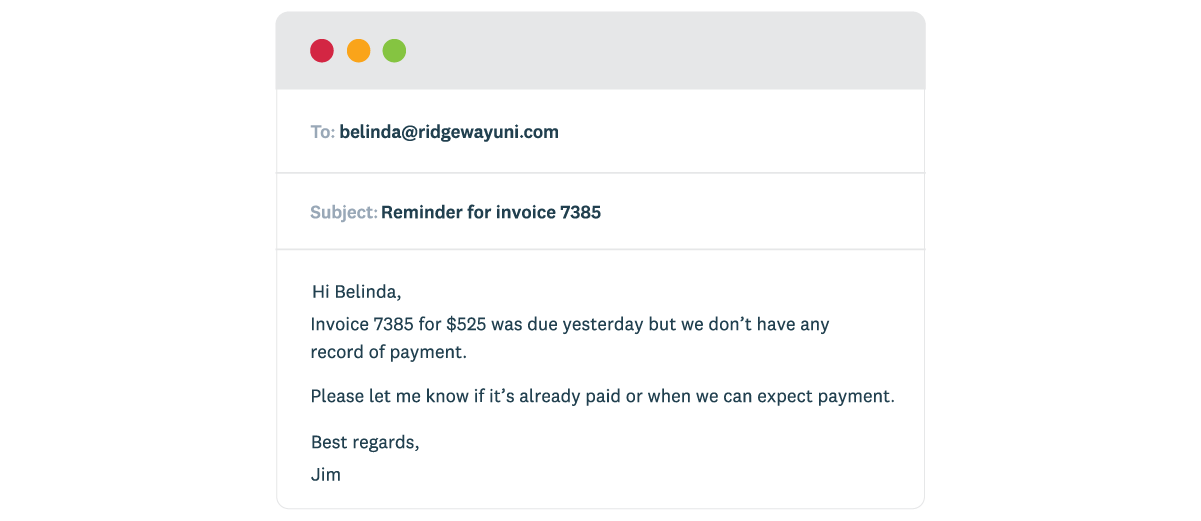

Chase payments

Check your list of unpaid invoices and send a reminder as the due date approaches. If the invoice goes past due, send another email. Keep it short, warm, and to the point. There are many legitimate and understandable reasons why a customer might miss a payment deadline.

Tip: Online invoicing software can send automated reminder emails for you.

Have an escalation process

Lots of late invoices will be paid after you’ve sent a reminder but some won’t. You’ll need a separate strategy for those. You might call for an in-person chat. Perhaps you’ll offer a payment plan if they’re strapped for cash. Or you may have to turn the debt over to a debt collector.

Have help

Train more than one staff member on the invoicing process so you’re not held up by someone being absent. Or consider getting a bookkeeper or accountant to assist with your accounts receivable process. They can really help if you find it hard to talk to customers about money.

Tips for following up an overdue invoice

Dealing with late payments isn’t comfortable but it’s essential to the invoicing process. Just remember that you’re not asking for a favour: the customer has accepted something from you and they need to keep their side of the bargain. Here are your options for overdue invoices.

1. Write a payment request letter or email

Be polite, quote the invoice number, say when it was due, and ask when you can expect payment. Attach the invoice again with your message. Ask if they need anything more from you to process payment, such as more details or maybe a purchase order (PO) number.

2. Send a statement

A statement differs from an invoice in that it shows all the customer’s unpaid invoices – or summarises all their invoices and payments – between two dates. Statements aren’t commonly sent anymore but they can still be a useful form of payment request when a customer has more than one unpaid invoice.

3. Pick up the phone

A phone call is powerful – uncomfortable to make, but effective. It’s awkward for the customer too and that’s why it works. You don’t need to say much. Just be polite and friendly and tell them what invoice is late. Then let them do the talking. Keep notes of your phone calls so that you have a reminder of the commitments your customer has made.

4. Charge a late payment fee

You can charge a fee for late invoices, but only if customers know you have a penalty policy. Write late fees into your quote or service agreement, and get customers to sign it before you start doing business. Then you can mention that penalties may kick in when you’re sending payment requests.

5. Agree on a payment plan

If your customer isn’t paying because they’re low on cash, you could suggest they make part payments over several weeks or months. Remember to ask the customer to quote the invoice number in each part payment they make, so it’s easy for you to keep track of them.

6. Stop supplying them until the outstanding invoice is paid

Refusing to supply a customer, may motivate them to pay if they need more goods or services from you in the future. Just bear in mind that cutting them off could signal the end of the relationship.

7. Get a debt collector to chase the overdue invoice

Debt collectors have a knack for getting overdue invoices paid out. But they may take 25% or more of the money as payment for their services. Check their terms before signing up. This step can also dent your customer’s credit rating. It might be a good idea to write a final warning letter to them before taking this step.

8. Write off the invoice as a bad debt

You may decide these steps are too drastic for a small outstanding invoice. Or perhaps you’ll try them and get nowhere. Either way, there’s a chance you’ll sometimes be left with an unpaid bill at the end of your invoicing process which you’ll need to write off as a bad debt. This step is important as it allows your books to reflect the lost income and allows you to claim back any tax you’ve already paid on the expected income.

How invoicing software can help

When it comes to the invoicing process, online invoicing software can:

- create and send invoices to a set schedule, including repeating invoices

- send automated reminders when payment is due or overdue

- match your bank deposits to payments if banking is integrated with your accounting software

- integrate with government-endorsed, e-invoicing networks to send invoices directly to a customer’s accounting software

Disclaimer

Xero does not provide accounting, tax, business or legal advice. This guide has been provided for information purposes only. You should consult your own professional advisors for advice directly relating to your business or before taking action in relation to any of the content provided.

How to invoice

Looking for help on making and sending invoices and getting them paid? Check out these tips on the art of invoicing.

Now that you have your guide

Managing finances can feel overwhelming. With Xero’s powerful tools, small businesses can stay organised and confident.