Profit Margin: What It Is, Formulas, and How to Improve Yours

Learn how to calculate profit margin and use it to set your prices, trim costs, and grow profit.

Written by Jotika Teli—Certified Public Accountant with 24 years of experience. Read Jotika's full bio

Published Thursday 5 February 2026

Table of contents

Key takeaways

- Calculate all three profit margin types regularly to get a complete picture of your business health: gross profit margin shows pricing efficiency, operating profit margin reveals core business performance, and net profit margin provides the most comprehensive view after all expenses.

- Focus on three key strategies to improve your margins: control costs by auditing subscriptions and negotiating with suppliers, boost efficiency through automation and staff training, and adjust pricing using value-based approaches rather than just covering costs.

- Compare your margins against industry benchmarks rather than general standards, as what counts as good varies significantly by sector—a 3% net margin might be excellent for retail but concerning for consulting services.

- Track margin trends over time rather than relying on single snapshots, as rising margins indicate improving efficiency while declining margins signal potential cost control or pricing issues that need immediate attention.

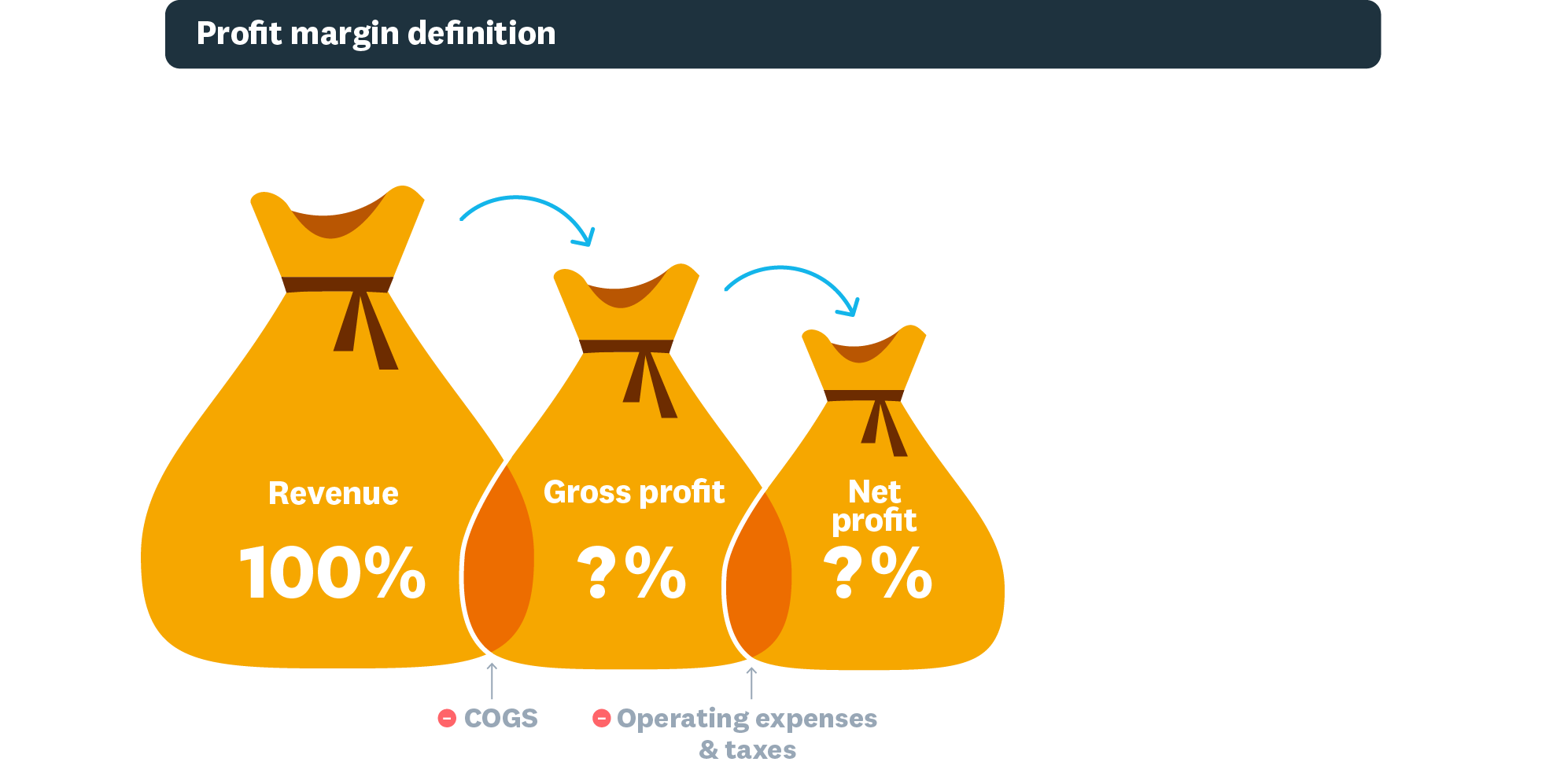

What is a profit margin?

Profit margin is the percentage of revenue your business keeps after paying expenses. The higher the percentage, the more profit you retain from each saleA strong profit margin signals your business earns enough to cover costs and fund growth. It also reveals which areas perform well and where you may need to cut expenses.

Profit margins vs net profit

Net profit is the dollar amount remaining after you subtract all expenses from revenue. Profit margin expresses that profit as a percentage of your total revenue.

The key difference: net profit tells you how much money you made, while profit margin shows how efficiently you made it relative to your sales.

Types of profit margins

Businesses track three main types of profit margins, each measuring profitability at a different level.

- Gross profit margin: The percentage of revenue remaining after subtracting the cost of goods sold (COGS). Use it to set pricing, spot inefficiencies, and compare performance across periods. Try our gross profit margin calculator.

- Operating profit margin: The percentage of revenue left after paying variable production costs (wages, materials, operations) but before taxes and interest. It shows how profitable your core business operations are. Investors and lenders use this metric to assess business viability.

- Net profit margin: The percentage of revenue remaining after all costs, expenses, and taxes. It's the most comprehensive measure of your business's financial health because it accounts for everything.

Learn more about net profit margin.

How to calculate profit margins

Profit margin formula: (Profit ÷ Revenue) × 100 = Profit margin %

This formula works for all three margin types. Expressing profit as a percentage makes it easier to compare your performance across different time periods, track trends, and benchmark against competitors.

Gross profit margin calculation

Here's an example using an office cleaning business:

- Revenue: $20,000

- Cost of goods sold: $8,000

- Gross profit: $12,000

Calculation: $12,000 ÷ $20,000 × 100 = 60% gross profit margin

This means you keep 60 cents of every dollar earned before paying operating expenses and taxes.

Try our gross profit margin calculator.

Operating profit margin calculation

Adding operating expenses to the example:

- Gross profit: $12,000

- Operating expenses: $3,000

- Operating profit: $9,000

Calculation: $9,000 ÷ $20,000 × 100 = 45% operating profit margin

This shows how much you earn from core operations before taxes and interest.

Net profit margin calculation

Continuing the example above, you also pay $4,000 in taxes:

- Gross profit: $12,000

- Taxes: $4,000

- Net profit: $8,000

Calculation: $8,000 ÷ $20,000 × 100 = 40% net profit margin

This means you keep 40 cents of every dollar earned after all expenses and taxes.

Try our net profit margin calculator.

What is a good profit margin?

What counts as good varies by industry, business model, and margin type. As a general benchmark:

- 5% net profit margin: Low but acceptable for high-volume industries like grocery or retail

- 10% net profit margin: Average for most industries

- 20%+ net profit margin: Strong performance, common in software, consulting, and luxury goods. For service industries like consulting, experts consider a net margin above 20% a key indicator of a financially robust firm.

Your gross margin will always be higher than your net margin because it doesn't include all costs. Focus on your operating and net margins for the clearest picture of financial health.

Industry matters significantly. A 3% net margin might be excellent for a supermarket but concerning for a consulting firm. Compare your margins against businesses in your sector, not across all industries.

Why profit margins matter for your business

They reveal your business's financial health at a glance. They show how efficiently you convert revenue into profit.

Use your profit margins to:

- Set pricing: Determine if your prices cover costs and generate adequate profit.

- Control costs: Identify where expenses eat into your earnings.

- Allocate resources: Direct investment toward your most profitable products or services.

- Secure funding: Demonstrate financial viability to banks and investors.

When you apply for a loan or seek investment, lenders and investors examine your margins closely. Strong margins signal a sustainable, well-managed business.

Benefits of high profit margins for growth

High profit margins typically mean your business:

- Attracts investment more easily because it demonstrates financial stability.

- Reinvests in growth with surplus funds for expansion, hiring, or equipment.

- Experiments with pricing and innovation without risking viability.

Review your margins regularly to spot trends and opportunities. Benchmark against competitors in your industry to gauge your position.

High margins don't guarantee growth. A comprehensive Yale study of public and private firms found that, contrary to popular belief, companies often fail to improve their margins over time, even as they grow. Rapid expansion can temporarily compress margins if short-term costs spike. Focus on growing sustainably rather than chasing the highest possible margin.

Factors affecting profit margins

Several factors influence your profit margins, some within your control and others not:

- Industry: Retail and hospitality typically have tighter margins due to higher overheads. Consulting and software often enjoy wider margins.

- Economic conditions: Inflation raises supply costs. High interest rates increase borrowing expenses. Both compress margins.

- Location: Rent, local taxes, and labour costs vary significantly by region and directly affect your bottom line.

- Business model: Online businesses often achieve higher net margins than physical stores due to lower overhead.

- Scale: Larger operations may benefit from bulk purchasing, but rapid growth can temporarily squeeze margins.

Factor these variables into your pricing strategy and margin expectations.

How to increase your profit margins

It comes down to three levers: reducing costs, increasing efficiency, and adjusting pricing. Most businesses can make meaningful gains by addressing all three.

Control your costs

Reduce operational expenses by targeting common cost drains:

- Audit subscriptions: Cancel software, services, or memberships you no longer use.

- Negotiate with suppliers: Request volume discounts or better payment terms.

- Manage labour costs: Align staffing levels with demand and reduce overtime where possible.

- Review recurring expenses: Question every line item on your monthly outgoings.

Small savings across multiple categories add up to meaningful margin improvements.

Make your operations more efficient

Boost operational efficiency to get more output from the same resources:

- Automate repetitive tasks: Use software to handle invoicing, scheduling, and data entry.

- Streamline workflows: Identify bottlenecks and eliminate unnecessary steps.

- Train your team: Skilled staff work faster and make fewer costly errors, and retaining them is a key factor in profitability. For example, high-performing consulting firms often maintain an employee turnover below 10%.

- Improve customer retention: Keeping existing customers costs less than acquiring new ones.

Greater efficiency means lower costs per unit of revenue, which directly improves your margins.

Adjust your pricing

A strong pricing strategy directly impacts your margins. Consider these approaches:

- Value-based pricing: Charge based on the value you deliver, not just your costs.

- Dynamic pricing: Adjust prices to match demand, seasonality, or market conditions.

- Premium packages: Bundle products or services to increase average transaction value.

- Price increases: Raise prices gradually if your costs have risen or your value has improved.

Test different strategies to find what your market will bear without losing customers.

Learn from high-profit-margin businesses

Some industries consistently achieve higher profit margins due to lower overhead, strong demand, or unique value propositions.

Industries known for high margins include:

- Software and software as a service (SaaS): While elite companies can achieve gross margins of 70–90%, industry benchmarks define high performers as having a gross profit margin (GPM) higher than 45% due to low marginal costs.

- Consulting and professional services: 15–25% net margins with minimal inventory.

- Financial services: Strong margins from fee-based revenue.

- Luxury goods: Premium pricing supports margins of 10–20%+.

What these businesses have in common:

- Clear value proposition: Customers understand why they're paying premium prices.

- Operational efficiency: Streamlined processes minimise waste.

- Customer loyalty: Repeat business reduces acquisition costs.

Tips for maintaining high profit margins

Apply these practices from high-margin businesses, regardless of your industry:

- Communicate your value clearly: Help customers understand why you're worth the price. A strong value proposition builds trust and justifies premium pricing.

- Eliminate operational waste: Review processes regularly and cut steps that don't add value. Efficiency gains flow directly to your margins.

- Build customer loyalty: Repeat customers cost less to serve than new ones. As a benchmark, successful consulting firms aim to retain over 80% of clients over three years to ensure stability. Use loyalty programmes, excellent service, and consistent quality to keep them coming back.

Analyse your profit margins for better business decisions

Use your profit margin data to make smarter business decisions:

- Adjust pricing: Identify which products or services deliver healthy margins and which need price increases or cost reductions.

- Allocate budget: Direct resources toward high-margin offerings that provide better returns on investment.

- Guide investments: Focus expansion efforts on the most profitable areas of your business.

- Spot problems early: Declining margins signal issues before they become critical.

What profit margin trends reveal

These trends reveal whether your business is becoming more or less efficient over time. A single margin snapshot tells you where you stand; trends tell you where you're heading.

Watch for these patterns:

- Rising margins: Your efficiency is improving, costs are under control, or pricing power is increasing.

- Stable margins: Your business is maintaining performance, which may be positive or signal missed opportunities.

- Declining margins: Costs may be rising faster than revenue, competition may be intensifying, or pricing may need adjustment.

Compare your trends against industry benchmarks and direct competitors. A 10% margin might be excellent if competitors average 5%, or concerning if they average 15%.

Track your profit margins with Xero

Tracking your profit margins is easier when your financial data is accurate and up to date. Xero accounting software helps you:

- See margins in real time: Access dashboards and reports that show profitability at a glance.

- Track trends over time: Compare margins across periods to spot patterns and issues early.

- Make confident decisions: Use accurate data to guide pricing, budgeting, and investment choices.

Ready to see how your business performs more clearly? Get one month free and start tracking your profit margins with confidence.

FAQs on profit margin

Here are answers to common questions about profit margins.

What does a 20% profit margin mean?

A 20% profit margin means you keep 20 cents of every dollar in revenue after expenses. If your business earns $100,000 in revenue with a 20% net margin, your profit is $20,000.

What does a 30% profit margin mean?

Most industries consider this strong performance, and it indicates efficient cost management relative to revenue. A 30% profit margin means you retain 30 cents of every dollar earned.

How often should I calculate my profit margins?

Calculate your profit margins monthly at minimum to catch trends early. Review them quarterly for strategic planning and annually for year-over-year comparisons and goal setting.

What's the difference between markup and profit margin?

Markup is the percentage you add to your cost to set a selling price. Profit margin is the percentage of the selling price that becomes profit. A 50% markup on a $10 item creates a $15 price, but the profit margin is 33% ($5 profit ÷ $15 price).

Disclaimer

Xero does not provide accounting, tax, business or legal advice. This guide has been provided for information purposes only. You should consult your own professional advisors for advice directly relating to your business or before taking action in relation to any of the content provided.